MH Daily Bulletin: February 23

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell over 3% to their lowest level in two weeks Wednesday amid growing concerns that persistent inflation will prompt more central bank interest rate hikes and data from the American Petroleum Institute showing a 9.9 million barrel increase in U.S. crude inventories last week.

- In mid-morning trading today, WTI futures were up 2.2% at $75.59/bbl, and Brent was up 2.1% at $82.26/bbl.

- Low gas prices prompted Chesapeake Energy to pull three rigs, with other shale gas producers following suit. In mid-morning trading today, U.S. natural gas was up 2.8% at $2.23/MMBtu.

- Morgan Stanley increased its forecast for oil demand this year, raising its growth estimate from 1.4 million bpd to 1.9 million bpd, citing China’s reopening.

- Gasoline prices, down since summer with the price of crude, could rise again due to a sanction-driven drop in Russian exports of vacuum gas oil (VGO), a sludge from the refining process for other distillates used by some refiners to produce gasoline.

- The U.K. secured 43.7 GW of power capacity in the nation’s recent capacity auction, enough to secure its electricity needs for the next four years but at steeply higher costs.

- India’s state-owned oil refiner HPCL is struggling to find western banks willing to process its payments for Russian crude because of the firm’s refusal to declare the price it paid for the commodity.

- Iberdrola, Spain’s largest utility, saw its net profit rise 11.7% to $4.63 billion in 2022 and expects that strong performance in the U.S. and Brazil will help boost its net profit by as much as 10% in 2023.

- South Africa is offering tax incentives worth $710 million to businesses and individuals to spur investment in renewable energy projects and offset the impact of higher fuel and food prices.

- The U.S. proposed its first sale of offshore wind power development rights in the Gulf of Mexico as part of an effort to add 30 GW of wind energy by 2030.

- Three environmental groups are suing BNP Paribas, the euro zone’s largest bank, for its lending to fossil fuel companies.

- Thailand will ban plastic waste imports in 2025.

Supply Chain

- More than 1,500 flights were canceled in the U.S. Wednesday due to a massive winter storm that stretched across the country. Blizzard warnings were issued in several states, with two feet of snow forecast for Minneapolis, the most in 30 years.

- Strong winds in Northern and Southern California left more than 172,000 customers of utility PG&E without power Tuesday night.

- The Vancouver Fraser Port Authority completed an expansion project that increases its container handling capacity by 66% to 1.5 million TEUs per year.

- Japanese chipmaker Rapidus announced plans to invest $15 billion to establish a prototype production line for advanced 2-nanometer semiconductors by the first half of 2025.

- In the latest news from the auto industry:

- General Motors will idle a pickup truck plant in Indiana for two weeks in March to adjust inventories and a Corvette plant in Kentucky this week due to a part shortage.

- New car registrations in Europe rose for their sixth straight month in January, jumping 11% to 911,064 vehicles, with the biggest increases in Spain and Italy.

- South Africa’s domestic vehicle sales are forecast to rise just 3% this year amid high interest rates and low consumer confidence, while vehicle exports are expected to jump 8% and reach a record in 2024.

- Stellantis, after reporting a 29% jump in annual profits and outperforming its major global competitors, said it will spread the prosperity with a dividend payout and share repurchase for shareholders and generous bonuses for employees.

- Mercedes-Benz and Google are partnering to advance the performance and navigation systems in the carmakers electric-vehicles.

- Bentley Motors will stop producing hand-built 12-cylinder engines next year so that it can focus on building out a fully electric vehicle lineup by the beginning of the next decade.

- After announcing in 2021 that it is moving its corporate headquarters to Texas, Tesla said yesterday it will maintain its global engineering headquarters in California.

- Australian miner Rio Tinto inked a deal with BMW to supply hydroelectric-powered aluminum from its Canadian operations, which could lead to a 70% reduction in the automaker’s aluminum CO2 emissions.

- U.S. electric truck-maker Nikola will begin testing new autonomous driving software on its battery- and fuel cell-electric trucks later this year with plans to make it standard in 2024.

- Target is investing $100 million to add six new package-sorting centers to help expand its next-day delivery capabilities.

Domestic Markets

- The Commerce Department revised downward its reading of GDP growth in the fourth quarter from 2.9% to 2.7%.

- Initial jobless claims fell by 3,000 last week to 192,000, the sixth consecutive week below 200,000, indicating the labor market remains robust.

- The average price for a 30–year fixed mortgage jumped to 6.62% for the week ended Feb. 17, the highest level since November 2022.

- Roughly 1 in 4 adults aged 25 to 34 are living in multigenerational households in the U.S. due to rising housing and childcare costs, with a large increase in older adults moving in with millennials, a trend known as the reverse-boomerang effect.

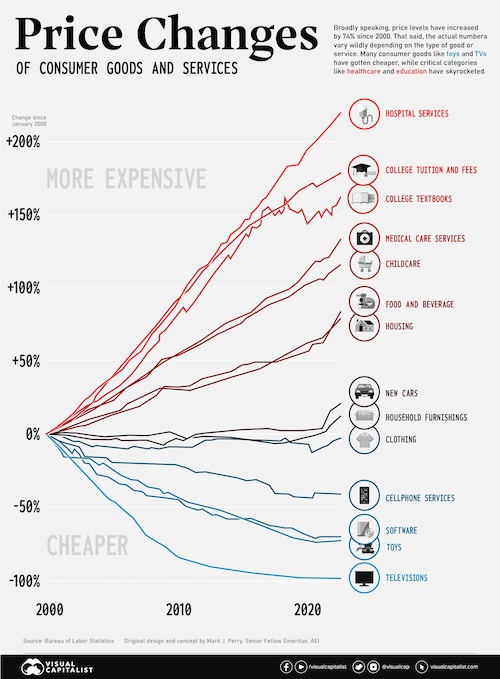

- Inflation in hospital services costs has been the highest among sectors over the past two decades, up over 200%:

- A growing number of Americans are taking on second jobs to make the most of their flexible working arrangements and earn extra cash, with the number of multiple job holders topping eight million at the end of 2022.

- Amid the ongoing shift to hybrid work, architects and real–estate developers are introducing flexible, multi-use spaces, outdoor access and residential-commercial design concepts to create an at-home vibe in the workplace.

- Management consulting company McKinsey & Co. plans to cut 2,000 workers in one of its largest headcount reductions as part of a restructuring to help preserve the compensation pool for its partners.

- Online furniture retailer Wayfair lost five million customers last year and suffered a $1.3 billion loss as consumers shifted spending from household goods to food and services.

- Intel, the world’s largest maker of computer processors, is cutting its dividend payment by 66% to its lowest level in 16 years in a bid to preserve cash and fund its turnaround plan.

- Spice-maker McCormick & Co is facing pushback from retailers on its plans to increase prices on its spices and hot sauces.

- Sportswear apparel company Under Armour reported higher revenue in the fourth quarter and said its inventory was up 50% year over year, but it expects to quickly work through excess stock amid an easing of supply chain disruptions.

- Unilever is reformulating its ice creams to stay firm in warmer, energy efficient freezers, hoping to boost sales by appealing to sustainably-minded consumers.

- Lingerie company Victoria’s Secret launched a new bra made with plant-based fabric pads that are easier to recycle than synthetics and can be returned to any U.S. store for recycling.

International Markets

- Drivers working for London’s Tube system are planning a 24-hour strike March 15 to be followed by several days of industrial action on the U.K.’s wider rail network amid ongoing disputes over pay, working conditions and pensions.

- Malaysian low-cost air carrier AirAsia is struggling to sell tickets from China, only selling about half of those available amid ongoing uncertainty regarding return flights and inbound entry rules.

- After years of underperformance, jet engine-maker Rolls Royce soundly beat earnings estimates in 2022 with a 57% increase in operating profits.

- Retail sales in Canada jumped 0.5% from November to December to $46.19 billion, led by increased sales at auto dealerships, parts dealers and general merchandise stores.

- British consumer goods company Reckitt issued a recall for two batches of its plant-based infant formula over concerns about possible contamination.

- The head of the U.K. National Farmers Union is calling for additional support for farmers growing salad ingredients as rising energy costs are expected to lead to the lowest levels of production on record.

Some sources linked are subscription services.