MH Daily Bulletin: February 27

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil edged higher Friday but was flat for the week, with prices supported by lower Russian exports and pressured by rising U.S. inventories.

- In mid-morning trading today, WTI futures were down 0.6% at $75.83/bbl, Brent was down 0.7% at $82.62/bbl, and U.S. natural gas was up 4.6% at $2.67/MMBtu.

- Active U.S. drilling rigs fell by seven last week to a total of 753, according to Baker Hughes.

- U.S. LNG exporter Cheniere Energy reported a higher-than-expected quarterly profit.

- Germany is on pace to become the world’s fourth-largest LNG importer by 2030 by building 70.7 million tonnes per year of import capacity, according to the nation’s economy ministry.

- Mexico’s state-owned oil company Pemex saw three fires at separate facilities that it operates in Mexico and the U.S. last week.

- Ecuador declared force majeure for its oil industry last week following a bridge collapse that triggered the closure of crude and gas pipelines.

- Venezuelan crude production is down 75% over the past decade.

- Crude exports from the U.S. to Europe are up 38% in the year since Russia invaded Ukraine, as shipments to the continent exceed those to Asia.

- Europe is on track to import a seven-year high of diesel from the Middle East and Asia this month after an embargo on Russian imports took effect Feb. 5.

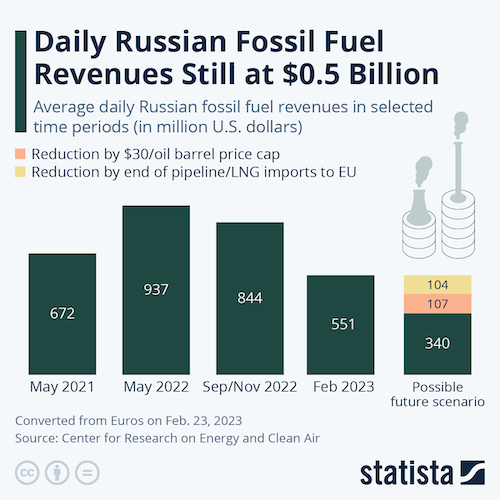

- Early data suggests a G7 price cap on Russian petroleum products and EU bans on Russian oil imports have curbed Moscow’s energy revenues without creating oil shortages.

- Approvals for new coal-powered electrical facilities in China surged four-fold in 2022 from the prior year and were at a seven-year high.

- Russia halted supplies of oil to Poland on a key pipeline over the weekend.

- Exxon Mobil plans to export blue ammonia from a Texas plant to Asia in anticipation of demand from Japan and South Korea.

- Europe’s existing incentives for clean-energy development are probably already larger than those in the U.S.’s newly passed Inflation Reduction Act, new research shows.

- U.S. power plant emissions fell last year as the industry continued a switch from coal to natural gas, according to the EPA.

- An international research team reports that it discovered a method for recycling LDPE and PP plastic resins into fuel at low temperatures and with minimal byproducts.

- Dow Chemical said it is investigating why discarded tennis shoes collected for a program to recycle them into playgrounds and running tracks in Singapore were instead exported to Indonesia.

Supply Chain

- Winter storms in California and Michigan left hundreds of thousands without power over the weekend.

- The shipping industry is expected to face a flood of new containerships entering service in the coming years, potentially leading to overcapacity.

- Trucking demand is 25% below its 2021 peak and falling, suggesting the industry will be plagued with overcapacity until 2025.

- Insurers are facing half a billion dollars in claims for up to 60 commercial ships still stuck in Ukraine a year after Russia’s invasion.

- Amazon is expanding ultrafast delivery options even as it scales back plans and spending in other areas.

- Logistics software provider BlueCargo has raised $11 million to expand its container-tracking platform across the U.S.

- Chipmaker Nvidia reported a sharp fall in quarterly profit but forecast a recovery in its video-game-related business.

- HMD Global Oy, licensee of Nokia smartphones, plans to establish 5G device manufacturing in Europe this year, a move away from Asia where most device manufacturing resides.

- Artificial-intelligence tools that generate text with minimal prompting could become a new revenue stream for semiconductor makers.

- A bipartisan group of U.S. lawmakers are calling for a return of higher tariffs on imported steel amid surging imports, particularly from Mexico.

- The U.S. will impose a 200% tariff on aluminum and derivatives produced in Russia starting March 10, establishing an effective ban.

- In the latest news from the auto industry:

- Ford will halt production of its electric F-150 Lightning pickup for another week following a battery issue that caused a truck to catch fire earlier this month.

- GM’s decision to cut production of large pickup trucks at a U.S. plant points to new challenges for Detroit automakers as they contend with growing inventories of unsold vehicles.

- Electric truck-maker Nikola warned in an SEC filing that it may cease to exist in the next 12 months after missing revenue targets in the fourth quarter.

- British electric-vehicle production surged nearly 50% in January from a year ago, helping to keep the nation’s auto production market stable.

- Volkswagen will build its own production plant in the U.S. for its new Scout off-road brand rather than collaborating with a partner.

- Audi may build a factory in the U.S. to take advantage of the country’s new incentives for clean-energy development.

- Mexico is continuing to warn that Tesla may be unable to build a factory in the northern state of Nuevo Leon due to water shortages.

- A growing number of retailers, including Subway and BP, are adding electric vehicle chargers to their locations to attract new customers.

Domestic Markets

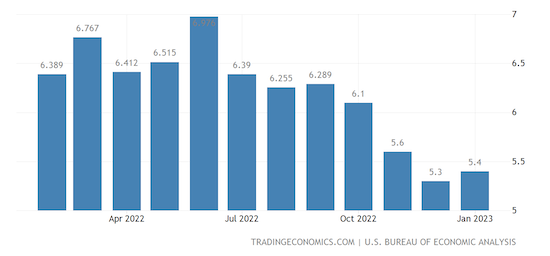

- Global stock markets slid Friday after the personal-consumption expenditures price index — the Federal Reserve’s preferred inflation gauge — rose a higher-than-expected 5.4% in January.

- U.S. securities traders are hedging at the fastest clip since the start of the pandemic as fear creeps back into the stock market.

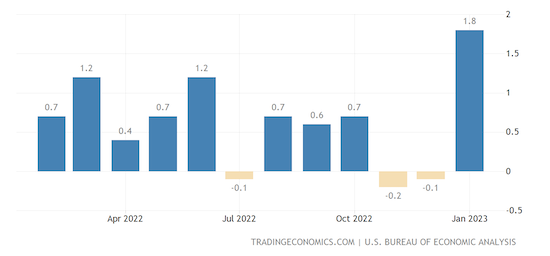

- U.S. consumer spending jumped 1.8% in January from the prior month, the largest increase in nearly two years.

- U.S. companies borrowed 6% more in January than a year earlier to finance equipment investments, according to the Equipment Leasing and Finance Association.

- The number of Americans working part time is surging, a reflection of changes in the U.S. economy since the start of the pandemic.

- American millennials have racked up debt at a historic pace since the pandemic, with 30-somethings owing $3.8 trillion in the fourth quarter, up 27% from pre-pandemic levels.

- The pandemic-fueled embrace of remote work has pushed employment among Americans with disabilities to an all-time high of 21.3%.

- Used car retailer American Car Center, which primarily sold in the subprime market, shuttered its business as more Americans fall behind on auto loans.

- Several big names in the U.S. travel and leisure industry are reporting faster rates of bookings this year than in pre-pandemic times.

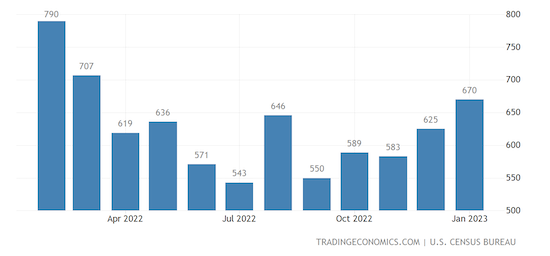

- Sales of new U.S. single-family homes jumped to a 10-month high in January as prices declined.

- Major consumer companies including Kraft Heinz and Conagra Brands are culling product lines to combat still-high costs and falling consumer demand, executives said last week.

- Apple is reportedly making major progress on a no-prick blood glucose monitor built into its wearable devices, a potential milestone for the healthcare industry.

International Markets

- China’s central bank expects the nation’s economy to rebound this year as it plans more “precise and forceful” monetary stimulus.

- The EU vowed to increase pressure on Moscow over its invasion of Ukraine as it adopted a 10th sanctions package against Russia Saturday.

- India is starting to emerge as a global economic power, according to the Wall Street Journal.

- Brazilian consumer prices rose by a higher-than-expected 0.76% this month as annual inflation remains well above targets.

- British Airways-owner IAG posted its first annual profit of the pandemic and said earnings could jump 90% this year as business rebounds.

Some sources linked are subscription services.