MH Daily Bulletin: January 5

News relevant to the plastics industry:

At M. Holland

- The U.S. Inflation Reduction Act (IRA) includes nearly $500 billion in new spending and tax breaks that will catalyze the clean energy transition, increase tax revenues and reduce healthcare costs. Dwight Morgan, Executive Vice President of Corporate Development at M. Holland, recently provided insight on what the IRA includes and key considerations for the plastics industry. Click here to read the full post.

Supply

- Oil fell more than 5% Wednesday, marking the steepest percentage loss in the first two trading days of any year for over three decades.

- In mid-morning trading today, WTI futures were up 0.8% at $73.43/bbl and Brent was up 0.9% at $78.52/bbl.

- U.S. natural gas prices are down 57% from summer highs. Futures were down 9.2% at $3.79/MMBtu in morning trading today.

- U.S. crude stocks rose by 3.3 million barrels last week after 1 million bpd in refining capacity was shuttered by Winter Storm Elliott, according to the American Petroleum Institute. Government data is due today.

- Already set at a 10-month low, Saudi Arabia may further cut prices for its flagship Arab Light crude grade to Asia in February as concerns about oversupply continue to cloud the market.

- The 120,000 bpd rise in OPEC’s oil output in December ran counter to the agreement by the wider OPEC+ alliance to cut production targets to support the market.

- The U.S. is on track to become the world’s biggest exporter of LNG in 2023, beating out market leader Australia once Freeport’s fire-idled plant in Texas is restarted.

- Dredging issues are slowing Chevron’s efforts to load tankers at one of its four Venezuelan joint ventures to bring heavy crude to the U.S. for the first time in years.

- BP plans to boost investment in its U.S. onshore oil and gas business, mostly in Texas, by 41% to a total of $2.4 billion this year. The producer also said it would raise annual spending in the Gulf of Mexico through 2025.

- Exxon Mobil signaled another strong operational profit of about $15.4 billion in the fourth quarter, pushing it toward record annual profit in 2022.

- OPEC member Libya’s production capacity is expected to top out at 1.8 million bpd by 2024, up from around 1.1 million currently, officials say.

- India’s power regulator said providers that rely on imported coal should be fully compensated for losses suffered when they were mandated to generate power during 2022.

- More oil news related to the war in Europe:

- Natural gas prices in Europe plummeted 11% Wednesday to the lowest level since November 2021 as a warm spell curbs heating demand and wind generation rises.

- German power exports to France jumped to a three-decade high in 2022 due to prolonged outages at French nuclear reactors.

- The number of so-called dark fleet tankers calling at key Russian oil export ports is rising.

- Ukrainian officials say efforts are failing to build a security zone around the Zaporizhzhia nuclear plant, Europe’s largest, as Russian occupation poses risks for an incident.

Supply Chain

- A powerful storm unleashed heavy rain and strong winds across Northern California Wednesday, triggering evacuations, power outages and widespread flooding just days after another system brought record-setting rain. California’s governor declared a state of emergency.

- The U.S.’s first major winter storm of 2023 dumped snow and freezing rain from the Northern Plains to the Upper Great Lakes on Tuesday and Wednesday.

- Crippling strikes among British rail workers are expected to continue until at least Monday when labor negotiations resume, officials said.

- Workers at a CNH Industrial plant in Wisconsin are expected to reject the latest contract offer, possibly extending an eight-month-long strike.

- The gap between spot and contract rates in the U.S. truckload market is narrowing after contract rates spent the latter half of 2022 on a slide.

- Container lines are offering increasingly flexible terms in a bid to sign shippers to long-term contracts.

- Reports suggest China is pausing big spending on building its domestic chip industry amid disappointing returns on investment and the fallout from rising COVID-19 cases.

- Samsung’s quarterly profit will likely plunge 58% to its lowest in six years as a global economic downturn saps demand for electronic devices and memory chips. Demand could remain depressed throughout 2023, an executive warned.

- Apple is expected to enlist Luxshare Precision, a Chinese competitor to Foxconn and Pegatron, to produce its premium iPhone models after worker protests erupted at Foxconn’s megafactory in Zhengzhou last year, disrupting production.

- U.S. semiconductor maker Advanced Micro Devices plans to move its main logistics center from Hong Kong to Taiwan.

- Online pet retailer Chewy plans to open two more automated fulfillment centers this year.

- In the latest news from the auto industry:

- GM’s 2022 sales rose 3% to 2.3 million, allowing it to retake its position as the U.S.’s top sales leader from Toyota, whose sales fell 9.6% for the year due to persistent semiconductor and parts shortages.

- At 2.4 million in sales, BMW sold about 100,000 fewer cars in 2022 than the previous year but more than doubled its share of fully electric cars sold to almost 10% of total electric vehicle sales.

- Seven in 10 U.S. consumers are looking to pay less than $50,000 for an electric vehicle, with lack of affordability seen as the biggest barrier to wider adoption, according to surveys.

- U.S. auto sales likely fell 8% to a total of 13.7 million units last year, which would be the lowest sales figure in more than a decade.

- Automakers had their worst year in Britain in three decades, with total sales falling 2% to a total of 1.61 million. Notably, electric vehicles overtook diesel cars with around 17% of new registrations.

- CATL and BYD, China’s top two battery manufacturers, now control some 50% of the global supply of electric-vehicle batteries, leaving South Korean and Japanese rivals lagging behind.

- Stellantis will cut about one in five retail outlets in France, part of an effort to restructure its distribution network and bring down costs, the automaker said.

- Stellantis is partnering with Archer Aviation to start building an electric air taxi in Georgia by 2024.

- Microsoft is reportedly in talks to invest over $10 million in autonomous trucking startup Gatik.

- Qualcomm unveiled a new processor chip for the auto industry that promises to integrate entertainment and self-driving functions, potentially saving carmakers substantial costs.

- German auto supplier Continental has teamed up with California chipmaker Ambarella to make software and hardware systems for autonomous driving.

- British chip designer Arm has more than doubled revenue at its automotive business since 2020, the firm said.

Domestic Markets

- The U.S. reported 187,870 new COVID-19 infections and 1,232 virus fatalities Wednesday.

- XBB.1.5, a new and highly infectious strain of Omicron, could be responsible for up to 75% of all new cases in the U.S. Northeast, the CDC says.

- Initial unemployment claims plunged by 19,000 the last week of 2022 to 204,000, far below the 220,000 expected by analysts and the lowest since September. Separately, private payrolls grew by 235,000 jobs in December according to ADP, far above the 153,000 expected, further confirming the continuing strength of labor markets.

- Officials at the Federal Reserve’s December policy meeting agreed that the U.S. central bank should continue raising interest rates to control the pace of price increases but at a more gradual pace than in 2022, newly released minutes show.

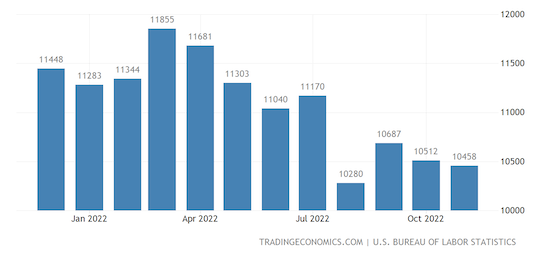

- U.S. job openings, a measure of labor demand, fell by a surprisingly low 54,000 to a total of 10.46 million in November, raising concerns that the Federal Reserve will use the tight labor market as a reason to keep interest rates higher for longer.

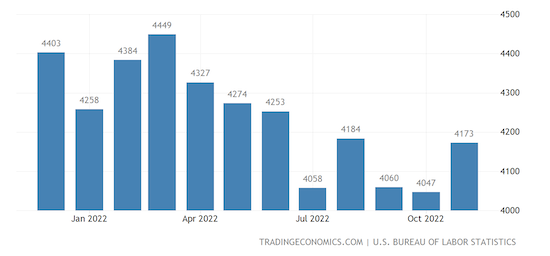

- About 4.17 million employees resigned from their jobs in November, a historically high level which could force businesses to pay more to keep their workers.

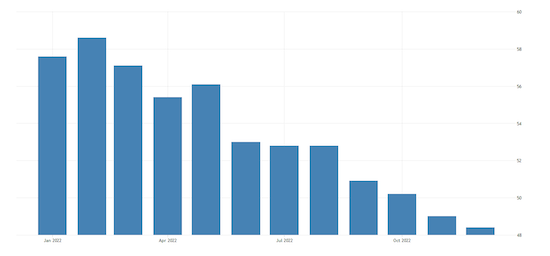

- U.S. manufacturing contracted further in December, dropping for a second straight month to 48.4 on the Institute for Supply Management’s purchasing managers’ index.

- The Institute for Supply Management’s forward-looking new orders sub-index tumbled to 45.2 in December, the lowest reading since May 2020, signaling that deflation for goods is underway.

- New reports suggest Amazon will lay off more than 17,000 employees as part of its latest round of job cuts, significantly more than the 10,000 reported in November.

- Salesforce announced plans to cut about 10% of its workforce and reduce real estate holdings after the enterprise software firm said it hired too many people during the pandemic-fueled boom.

- U.S. mortgage applications ended 2022 at the lowest level in more than two decades, new data shows.

- Manhattan home prices were 5.5% lower in the fourth quarter of 2022 compared to a year earlier, the first annual decrease since the beginning of the pandemic.

- Online searches for new U.S. office space fell significantly in 2022 from previous years, new research shows. The corporate office market is poised to continue worsening this year as companies look to shed real estate as a primary way to reduce expenses.

- Building owners in New York City are racing to develop renewables capacity ahead of new penalties that take effect in 2024 on owners of inefficient properties.

- Johnson & Johnson submitted its plan to spin off its consumer health business Kenvue in the first significant U.S. IPO filing of the new year.

- At about $580 billion, more venture funding was raised for climate-friendly projects than for fossil-fuel companies for the first time ever last year, according to Bloomberg.

International Markets

- In the latest China news:

- EU policymakers recommended that member nations impose pre-departure COVID-19 testing on all passengers from China.

- The World Health Organization says that although China’s recent wave of COVID-19 has not produced a new variant, the country is vastly under-representing how many people have died from the virus. International health experts project the nation’s virus death toll above 1 million for the full year.

- Japan will toughen its COVID-19 border control measures for travelers from China this weekend.

- China’s services activity shrank for a fourth straight month in December, albeit at a slower pace than previously, new business surveys show.

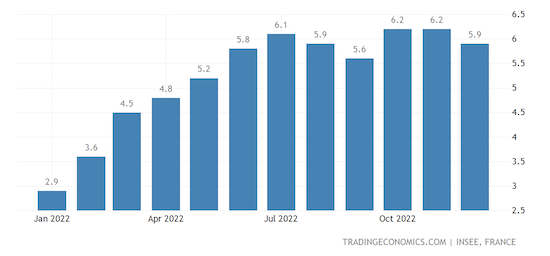

- French inflation unexpectedly dropped to 5.9% in December from a record-high a month earlier, the latest sign that easing energy prices are helping Europe overcome its worst inflation in decades.

- Shopper numbers across Britain rose almost 10% in December from a year ago, staying resilient despite a growing cost-of-living crisis and a national rail strike.

- About 36% of British businesses surveyed expect lower profits this year.

- Credit defaults are set to more than double in Europe this year as companies struggle with rising costs and cash-strapped consumers, S&P Global says.

- Ryanair hiked its forecast for full-year profit by up to 325 million euros Wednesday, citing pent-up travel demand that unleashed in the fourth quarter.

- Germany’s CO2 emissions held steady last year as higher use of oil and coal offset lower energy consumption and record renewables output.

- Global mergers and acquisitions values slumped 36% to $3.78 trillion in 2022, well short of a record $5.91 trillion the previous year.

Some sources linked are subscription services.