MH Daily Bulletin: January 10

News relevant to the plastics industry:

At M. Holland

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates in Orlando on Jan. 24-26. Stop by Booth #16 to speak with our experts and attend a talk on regulatory compliance changes by Christopher Thelen, M. Holland’s Senior Regulatory Specialist, on Jan. 24 at 4:20 pm.

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

- The U.S. Inflation Reduction Act (IRA) includes nearly $500 billion in new spending and tax breaks that will catalyze the clean energy transition, increase tax revenues and reduce healthcare costs. Dwight Morgan, Executive Vice President of Corporate Development at M. Holland, recently provided insight on what the IRA includes and key considerations for the plastics industry. Click here to read the full post.

Supply

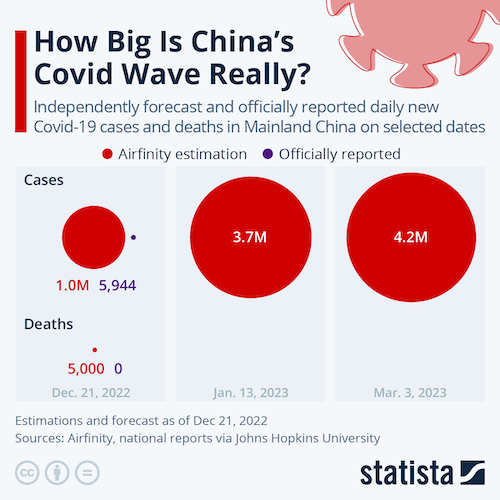

- Oil rose 1% Monday as China’s borders opening boosted the outlook for fuel demand.

- In mid-morning trading today, WTI futures were down 0.2% at $74.47/bbl, Brent was down 0.3% at $49.41/bbl, and U.S. natural gas was down 8.0% at $3.60/MMBtu.

- The average U.S. gasoline price hit $3.25 per gallon this week, the second weekly gain on impacts from refinery closures during Winter Storm Elliott.

- China announced stricter crude import quotas for independent refiners, signaling authorities expect a sharp rebound in oil demand.

- China allowed several large coal importers to resume purchases of Australian coal for the first time in two years this week.

- Frontline terminated plans to combine with Euronav in a deal that would have created the world’s largest publicly-listed oil tanker owner and operator with a market capitalization of more than $6 billion and 146 vessels.

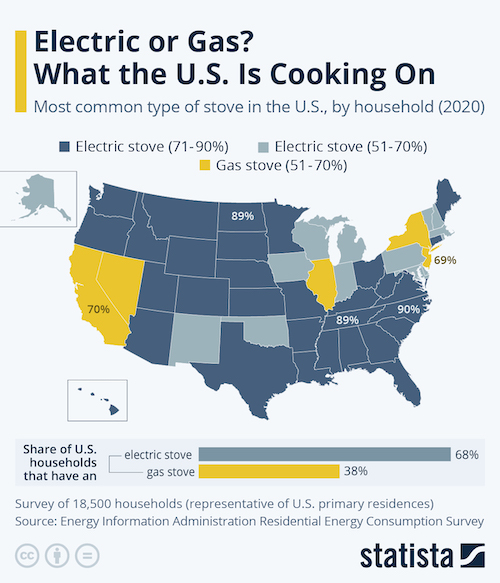

- U.S. regulators are weighing a ban on natural gas stoves, which are used in about 40% of homes, following new research suggesting the appliances emit health-threatening air pollutants.

- More oil news related to the war in Europe:

- In the rush to replace Russian natural gas, Europe imported nearly a quarter of all LNG traded globally last year, new figures show.

- Europe’s recent ban on seaborne crude imports from Russia is believed to be behind a sharp drop in prices for Russia’s flagship oil, which now trades at around $37.70/bbl, well below the $60/bbl price cap imposed by G7 nations.

- Russia has nearly returned the Far East Sakhalin-1 oil and gas project to full capacity after Exxon Mobil, the project’s previous operator, quit its Russian operations last year.

- Russian oil giant Rosneft is seeking a slot to export more gas to China through a Siberian pipeline.

- Lukoil, Russia’s second-largest oil firm, agreed to sell an Italian refinery in its first major overseas asset sale since the invasion of Ukraine.

- Norwegian producers have committed $30 billion to develop and upgrade gas fields to keep output high for at least the next five years.

- Kuwait expects to raise diesel shipments to Europe fivefold this year to help the continent make up for a drop in imports from Russia.

- Spain and Portugal are looking for European approval to keep subsidizing fossil-fuel plant power costs through 2024 in order to keep prices down for consumers.

- Germany is preparing to upgrade thousands of miles of its power network to boost the transmission of renewably sourced electricity.

Supply Chain

- Over 120,000 California homes and businesses were still without power Monday as the state moves into its second week of severe weather, including torrential rains that have caused widespread flooding.

- Insured losses from global natural disasters hit about $120 billion last year, with about half coming from Hurricane Ian’s September landing in Florida.

- New Zealand started rationing CO2 for medical and water needs following the recent closure of the country’s only food-grade CO2 production facility.

- A bulk carrier transporting Ukrainian grain briefly ran aground in the Suez Canal Monday, with minimal disruption reported.

- Significant air cargo disruption at Chicago O’Hare was temporarily averted after cargo service provider Alliance Ground International agreed to terms allowing unions. Swissport, another major cargo handler, has yet to comply with a city mandate requiring cargo contractors to allow organizing efforts to keep their operating licenses.

- U.S. truckload tender rejection rates stayed historically low through the holiday season, signaling a loose sourcing environment with ample transport capacity.

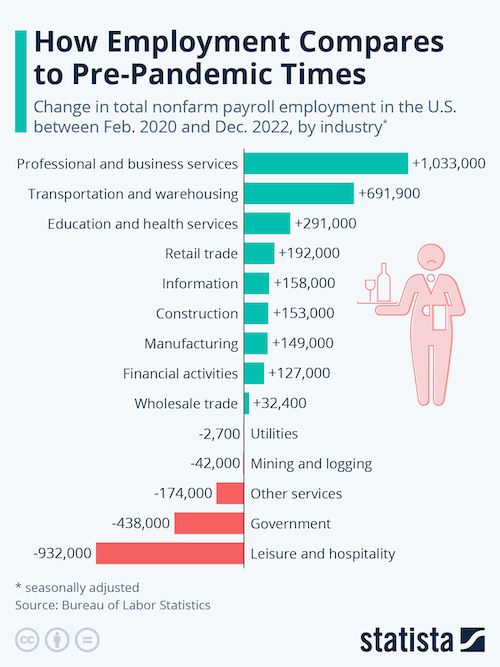

- The U.S. trucking industry added 2,100 jobs in December, while warehouse jobs declined but at a slower pace than in recent months, according to the latest jobs data.

- There were at least 38 instances of protests or strikes affecting port operations in 2022, more than four times the previous year.

- Container spot rates from Asia to the U.S. have tumbled over 80% since September peaks of around $20,000 per FEU, according to Freightos. Major retailers won’t see significant relief until the spring contract renegotiation season, however.

- Container imports into major U.S. ports have fallen below the 2-million-TEU-per-month mark, signaling an end to container shipping’s pandemic-driven surge, the National Retail Federation says.

- German logistics firm HHLA is nearing a deal for Chinese shipping giant Cosco to take a terminal stake at the Port of Hamburg.

- Taiwan’s Evergreen Marine Corp. is using bumper 2022 earnings to pay bonuses equal to four years’ worth of salaries to many employees.

- Maryland banned the use of personal cell phones by ship pilots following the Ever Forward’s disruptive grounding in the Chesapeake Bay in March 2021.

- Walmart surpassed 6,000 drone deliveries last year, with the service now extended to 36 stores in seven states.

- Apple’s push to replace purchased computer chips with homegrown components will include dropping a key Broadcom part in 2025, dealing a blow to one of its biggest suppliers.

- Apple exported some $2.5 billion of iPhones from India between April and December, nearly twice the previous fiscal year’s total as the tech giant continues its shift away from China. Separately, India’s Tata Group is close to taking over a major plant in southern India to give the country its first homegrown iPhone maker.

- Canada ranked as the U.S.’s top trading partner for the second consecutive month in November, led by oil exports, topping Mexico and China.

- In the latest news from the auto industry:

- Sales of electric and hybrid passenger cars nearly doubled in China in 2022, while sales of typical internal combustion vehicles fell 13%.

- U.S. and European trade representatives started talks on issues related to electric-vehicle subsidies for cars sold in the North American market.

- Some 2.7 million vehicles could be cut from production schedules this year due to persistent chip shortages, according to AutoForecast Solutions.

- Tesla’s steep price cuts in China — up to 24% for some models — continue to spur protests at the automaker’s Chinese showrooms and distribution centers. Separately, the automaker began discounting cars in Singapore.

- Vietnamese electric-vehicle-maker VinFast delayed December deliveries to its first U.S. customers due to supply-chain issues.

- Trailing China and the U.S., India surpassed Japan last year to become the world’s third-largest car market for the first time.

- Rolls-Royce sold a record 6,021 cars in 2022, led by sales in the U.S.

- South Korea’s SK On indicated it is reconsidering a Turkish battery cell venture planned with Ford.

- Stellantis signed a deal with Australian miner Element 25 for the supply of key electric-vehicle battery materials.

- Chinese automaker Guangzhou Automobile Group says its joint venture with Honda will no longer produce or sell cars under the Japanese firm’s Acura brand due to poor sales.

Domestic Markets

- The U.S. reported 41,026 new COVID-19 infections and 248 virus fatalities Monday.

- New York’s COVID-19 fatalities jumped 30% in December as the highly infectious XBB.1.5 variant surged to account for over half of new cases.

- More U.S. airports are adding on-site COVID-19 testing centers to better monitor incoming viral strains, especially from China.

- Moderna is considering selling its COVID-19 vaccine for up to $130 a dose when it shifts to commercial distribution of the shots this year, up from $26 a dose in federal supply contracts.

- Over 7,000 nurses at two New York City hospitals went on strike Monday after contract talks broke down over wages and staffing levels.

- U.S. households lowered their near-term inflation forecasts last month, according to the New York Fed.

- The U.S. dollar slid to a seven-month low against the euro Monday as traders bet recent economic data will prompt the Federal Reserve to slow its pace of rate hikes.

- U.S. consumer borrowing climbed by the sharpest pace in three months in November, new data shows.

- Optimism among small businesses fell to a six-month low in December.

- Goldman Sachs plans to cut 3,200 jobs starting this week, part of a wave of cost-cutting on Wall Street after a big slump in dealmaking.

- U.S. investment bank Jefferies saw a 57% decline in fourth-quarter profit, potentially offering an early snapshot of results across Wall Street.

- Hedge funds posted their worst performance since 2018 last year, mainly dragged down by deflated equity prices.

- Moderna says it generated about $18.4 billion in COVID-19 vaccine sales in 2022, meeting its yearly forecasts.

- Disney is asking employees to return to the office at least four days a week, becoming the latest big firm to cut back on work-from-home allowances during the pandemic.

- Abercrombie & Fitch and American Eagle Outfitters raised their sales forecasts for the holiday quarter, while Lululemon, maker of athletic wear, expects sales to decline.

- Johnson & Johnson says it is looking for merger opportunities as it works to spin off its consumer healthcare business to focus on pharmaceuticals and medical devices.

- Helen of Troy, owner of popular brands including Hydro Flask, Drybar and Vicks, saw third-quarter sales fall 10.6% as well-stocked retail customers dropped orders.

- U.S. aviation regulators are readying a proposal to require passenger and cargo aircraft to install certain 5G-resistant parts by early 2024.

International Markets

- China’s top health official says some of the most populous provinces have passed peak COVID-19 cases in the country’s recent wave.

- Investor morale in the euro zone picked up for a third straight month in January but remained in negative territory, signaling persistent concerns about the global economic situation, according to surveys.

- Euro zone unemployment was unchanged at a record-low 6.5% in November, in line with expectations.

- Four out of ten German companies expect business to shrink this year due to high energy costs and supply-chain issues, according to a new survey.

- Mexico’s headline inflation hit 7.82% in December, up slightly from the previous month. Core inflation, stripping out food and energy, dropped for the first time in almost two years.

- Inflation in Tokyo rose a faster-than-expected 4% in December, exceeding the central bank’s target for a seventh straight month in a sign of broadening inflationary pressure.

- Chile, the world’s top copper producer, saw exports of the metal fall 13.2% to a total of $4.28 billion in December.

- Ukraine has exported about 23.6 million tonnes of grain in the latest season, down almost 30% from the prior year after Russia blockaded Black Sea ports for six months.

- England plans to join Scotland and Wales in banning single-use plastic dinnerware, such as polystyrene cutlery and plates.

- Global cuts in the use of chlorofluorocarbons and related chemicals are succeeding in restoring the earth’s protective ozone layer, which is expected to return to 1980 health by 2040.

Some sources linked are subscription services.