MH Daily Bulletin: January 26

News relevant to the plastics industry:

At M. Holland

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

- M. Holland announced leadership changes to support accelerated growth and the next phase of the company’s evolution. Click here to read the full press release and read more in Plastics News.

- Every year, M. Holland’s market managers take time to reflect on the major trends of the past 12 months. Click here to read M. Holland’s 2023 Plastics Industry Trends & Predictions, including business insight and recommendations for the 3D printing, automotive, color and compounding, electrical and electronics, healthcare, packaging, rotational molding, sustainability, and wire and cable markets.

- Supply chain disruptions and balancing customer demand with available materials proved to be challenging across healthcare, packaging and sustainability in 2022. Click here to read 2023 predictions from our market managers for these three markets.

Supply

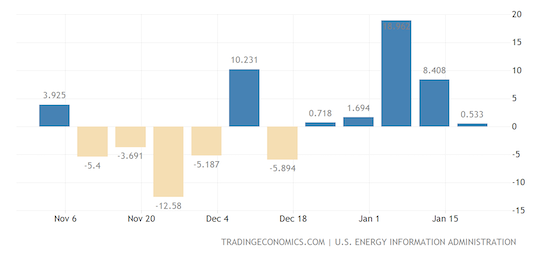

- Oil settled flat Wednesday after data showed a smaller-than-expected build in U.S. crude stocks of 533,000 barrels last week.

- In mid-morning trading today, WTI futures were up 0.3% at $80.39/bbl, Brent was up 0.4% at $86.44/bbl, and U.S. natural gas was down 8.2% at $2.82/MMBtu.

- Chevron plans to buy back $75 billion in shares and increase dividend payouts after a year of record profits.

- U.S. energy company Hess Corp soundly beat fourth-quarter earnings estimates after a 10% gain in production last year.

- Sempra Energy’s Port Arthur LNG project on the U.S. Gulf Coast is now fully subscribed with long-term supply agreements.

- Equinor launched the sale of its stake in an offshore Nigerian oil field, joining a broader retreat from the country by Western energy firms focusing on newer and more profitable operations.

- Los Angeles County followed the City of Los Angeles in banning new oil and gas drilling starting in 30 days.

- M&A deals in the upstream sector fell to their lowest number since 2005 in 2022, while the value of deals fell 13% from the prior year.

- French bank BNP Paribas pledged to cut lending to the oil and gas industry by 80% by 2030 as part of a deep decarbonization drive.

- More news related to the war in Ukraine:

- European natural gas prices are down 25% this month amid substantial inventories and milder weather in the forecasts.

- Russia’s Far East Sakhalin-2 LNG project could see revenues double this year amid generally higher LNG prices and strong demand from Asia.

- Building a U.S. offshore wind supply chain to meet the White House’s goals would cost at least $22.4 billion, research shows.

- Freeport-McMoRan warned that its struggle to find workers in the U.S. is limiting the amount of copper it can produce for the green energy transition.

- NextEra, the U.S.’s largest generator of renewable energy, fell short of quarterly revenue projections but said recent U.S. legislation should cause renewables activity to surge in coming years.

- Mitsubishi is considering a partnership with Exxon Mobil and Nippon Steel to launch a carbon capture and storage project in Japan.

- Dow Chemical missed revenue and earnings targets in the fourth quarter and said it will cut 2,000 jobs, or 5% of its workforce.

Supply Chain

- Long-stalled West Coast labor talks are showing no signs of progress, extending uncertainty for U.S. retailers who rely on the coast to import goods from Asia.

- Amazon’s British unit saw its first-ever strike among hundreds of employees Thursday.

- Maersk and MSC, the world’s two biggest shipping lines, plan to end their vessel-sharing partnership in 2025 as demand for trade is forecast to weaken.

- The American Trucking Associations’ for-hire truck tonnage index hit 115.2 in December, a 0.4% rise from the previous month and up 3.4% overall last year in the largest annual gain since 2018.

- The global orderbook for new car carriers has swelled to 130 vessels with capacity of 27% of the existing fleet.

- Italy’s Grimaldi Lines ordered five car carriers capable of being powered by ammonia.

- Slowing airfreight demand could lead to lower rates and greater capacity this year, analysts say.

- Singapore-based airport services provider SATS is on track to complete a $1.29 billion purchase of air cargo handler Worldwide Flight Services as early as March.

- Norfolk Southern posted lower-than-expected fourth quarter profit in a sign that railroad operators continue to struggle with labor shortages, service problems and high fuel prices.

- Major U.S. railroads are considering offering paid sick days to retain workers.

- French train-maker Alstom posted an 8% rise in quarterly sales following its acquisition of Bombardier’s rail business and rebounding train ridership.

- Some countries are reviving COVID-19 restrictions and testing requirements on seafarers since China ended its COVID-zero policy.

- Airbus is slowing its pace of production increases due partly to the limited availability of engines for new aircraft, according to reports.

- The British government is considering imposing an emissions levy on steel imports to help shield the nation’s manufacturers from slumping demand and high energy prices.

- In the latest news from the auto industry:

- Tesla reported fourth-quarter profit of nearly $3.7 billion, up 59% from a year earlier despite a sharp decline in profit margins.

- Mining companies have largely left out key battery component graphite from plans to expand production, raising the possibility of supply snarls for electric vehicles.

- Jaguar Land Rover returned to profitability in the fourth quarter after improved availability of semiconductors boosted output of new high-end models.

Domestic Markets

- The U.S. reported 95,468 new COVID-19 infections and 1,266 virus fatalities Wednesday.

- New research shows updated booster shots from Moderna and Pfizer helped prevent symptomatic infections from the new XBB strain of COVID-19, the CDC said.

- The U.S. economy grew at a healthy 2.9% annual pace in the fourth quarter of 2022.

- First-time jobless claims shrank by 6,000 to last week to 186,000, the lowest level since April.

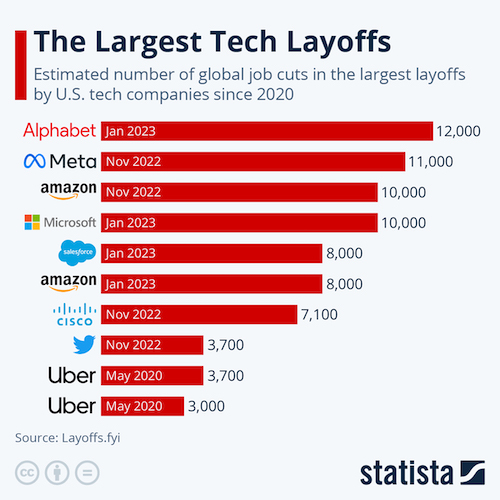

- Software giant SAP and IBM joined the wave of tech companies making layoffs, with the former announcing 3,000 job cuts and the latter saying it would cut about 3,900 jobs.

- A surge in hiring by American small businesses could slow the Federal Reserve’s efforts to cool inflation, with small companies responsible for all the net job growth in the U.S. since the onset of COVID-19.

- U.S. companies borrowed 9% more in December to finance equipment investments compared with a year earlier.

- Pending U.S. home sales rose 2.9% in December, the first increase in more than a year as housing demand is starting to show signs of recovery.

- In the latest news from quarterly earnings season:

- Losses at Boeing widened in 2022 as it warned of further supply chain issues, despite the plane-maker reporting its first yearly positive cash flow since 2018.

- Kleenex-maker Kimberly-Clark saw no change in sales from the previous quarter, continuing a soft streak for makers of everyday household goods.

- Abbott Laboratories reported disappointing medical device sales as COVID-19 curbs in China and supply-chain issues hit its international operations.

- Exchange operator Nasdaq posted weaker-than-expected results as global economic uncertainty weighed on indexing and initial public offering revenues.

- Cessna jet-maker Textron saw better-than-expected revenue as the pandemic-driven demand for private jets shows little signs of cooling.

- Shares of Levi Strauss surged after it topped fourth-quarter sales projections even as higher costs and currency pressures cloud its near-term outlook.

International Markets

- The CDC says that critical cases of COVID-19 in China are down 72% from a peak early this month, while daily deaths have dropped 79%.

- Japan cut its view on the overall economy for the first time in 11 months in January as a slowdown in global demand for tech and semiconductors hurts exports, especially to Asia.

- The Bank of Canada hiked its key interest rate to 4.5% Wednesday, the highest level in 15 years, and became the first major central bank to say it would likely hold off on further increases for now.

- Mexico’s same-store retail sales rose by 10.6% last year as the highest inflation in over two decades sent prices soaring.

- Quarterly earnings from ASML exceeded expectations as the Dutch tech company, Europe’s largest, forecast a rise of more than 25% this year despite possible curbs on exports to China.

- Britain’s competition regulator started the first phase of an investigation into U.S. chipmaker Broadcom’s $61 billion acquisition of cloud-computing firm VMware.

- Natural disasters caused global losses of $313 billion last year, much of it due to Hurricane Ian in the U.S., which ranked as the second-costliest natural disaster the insurance sector has ever faced.

Some sources linked are subscription services.