MH Daily Bulletin: January 27

News relevant to the plastics industry:

At M. Holland

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

- M. Holland announced leadership changes to support accelerated growth and the next phase of the company’s evolution. Click here to read the full press release and read more in Plastics News.

- Every year, M. Holland’s market managers take time to reflect on the major trends of the past 12 months. Click here to read M. Holland’s 2023 Plastics Industry Trends & Predictions, including business insight and recommendations for the 3D printing, automotive, color and compounding, electrical and electronics, healthcare, packaging, rotational molding, sustainability, and wire and cable markets.

- Supply chain disruptions and balancing customer demand with available materials proved to be challenging across healthcare, packaging and sustainability in 2022. Click here to read 2023 predictions from our market managers for these three markets.

Supply

- Oil rose about 2% Thursday on expectations that global demand will strengthen due to China’s reopening and positive U.S. economic growth.

- In mid-morning trading today, WTI futures were down 0.4% at $80.69/bbl and Brent was off 0.2% at $87.12/bbl.

- U.S. natural gas fell below $3.00/MMBtu for the first time in two years Thursday amid continuing warm weather that sparked a commodity selloff. Futures were down 2.2% at $2.88/MMBtu in morning trading today.

- U.S. regulators granted Freeport LNG permission to restart some operations at its fire-damaged export terminal on the Gulf Coast.

- A 48-hour strike among French energy workers Thursday lowered the country’s hydropower output and curbed some refinery deliveries, although the overall impact was softer than expected.

- Norway expects to receive a record $89.5 billion in oil and gas tax revenue from last year, triple the previous record set in 2021.

- Chevron earned nearly $8 billion in the fourth quarter, pushing annual profits to a record $36.5 billion, double last year and $10 billion higher than the previous record set in 2011.

- U.S. refiner Valero operated at 97% of capacity in the fourth quarter, the highest since 2018, while refining margins more than doubled to $6.3 billion from a year earlier.

- More news related to the war in Ukraine:

- For a third time this week, the U.K.’s power operator asked reserve coal-fired plants to be warmed up for potential use to support the nation’s grid.

- Shell is looking at a potential exit from its energy retail business across multiple countries, including Britain and Germany, amid tough market conditions.

- Europe is buying more diesel from the U.S. and Saudi Arabia ahead of the EU’s ban on seaborne imports of Russian refined products on Feb. 5.

- RWE, Germany’s biggest electricity provider, saw net income more than double last year on a surge in activity in its short-term power plant deployment.

- The U.S. Department of Energy announced over $100 million in funding to expand U.S. biofuels production, adding to the more than $500 million of investment the past two years.

- Imperial Oil plans to invest over $530 million to build Canada’s largest renewable diesel facility near Edmonton, Alberta.

- Global investment in clean-energy sources soared to a record $1.1 trillion in 2022, equaling the money spent on fossil-fuel investment for the first time.

- Spanish energy firm Iberdrola is looking to sell a portfolio of gas, wind and solar assets in Spain, which could raise over $700 million.

Supply Chain

- The Port of New York and New Jersey moved almost 9.5 million TEUs in 2022, 27% higher than pre-pandemic levels and the first time surpassing the 9 million mark.

- Inbound containers to the 10 largest U.S. ports fell 16.5% in December from a year earlier, the sixth consecutive month of declines.

- The time periods for chartering container ships declined sharply over the past year.

- Canadian National is forecasting weaker-than-expected earnings growth this year even after fourth-quarter revenue rose 21%.

- CSX reported a better-than-expected 9% rise in fourth-quarter profit.

- Union Pacific suspended traffic between Los Angeles and Chicago on a route that uses a damaged bridge in New Mexico.

- Striking ground handlers forced the cancellation of passenger and freighter flights at Berlin Brandenburg Airport.

- Online freight booking platform Freightos started trading shares publicly Thursday, just as the booming shipping demand that helped fuel the digital startup’s growth shows signs of weakening.

- China is considering an export ban on solar technology to help the nation maintain its substantial dominance in solar manufacturing.

- Companies are focusing more efforts on tracking materials across their supply chains ahead of expected new human rights and environmental laws.

- South Korea display panel maker LG Display posted a record quarterly operating loss as global demand for smartphones and other tech remained depressed.

- In the latest news from the auto industry:

- Overseas shipments of cars made in China have tripled since 2020 to reach more than 2.5 million last year, ranking the country slightly behind Germany.

- British car production fell to its lowest level since 1956 last year as output was hit by global shortages of computer chips.

- Volvo reported a 21% rise in fourth-quarter profit, in line with expectations, but said supply-chain issues are set to linger this year.

- Mobileye Global posted surprising revenue gains in the fourth quarter on growing demand for its driver-assistance technology.

- European chipmaker STMicroelectronics beat fourth-quarter sales and earnings estimates on strong demand from automotive and industrial customers.

- Hyundai will invest $8.5 billion this year to electrify more of its fleet amid surging demand for electric vehicles.

- Suzuki will invest almost $35 billion through 2030 in research, development and capital spending on electric vehicles.

- Australian battery-maker Recharge Industries is offering to buy collapsed U.K. supplier Britishvolt.

Domestic Markets

- The U.S. reported 62,323 new COVID-19 infections and 845 virus fatalities Thursday.

- California’s recent deluge of rain will allow the state to boost water deliveries to cities and farming regions after years of drought-induced cutbacks.

- Consumer spending declined 0.2% in December, the second consecutive monthly decline, while core inflation was up 4.4%, the lowest rate since October 2021.

- New orders for U.S.-made capital goods fell 0.2% in December, while shipments declined for a second month, suggesting that higher borrowing costs were pressuring manufacturing.

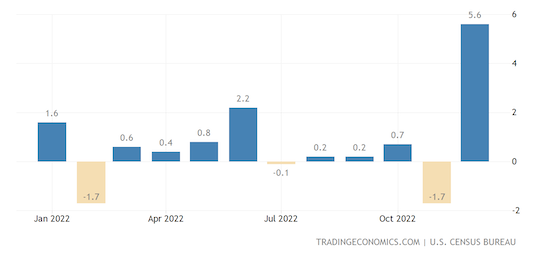

- U.S. durable goods orders soared 5.6% in December, the sharpest gain since July 2020 led by transportation equipment:

- Hasbro said it will eliminate 15% of its global workforce this year in the latest indication that weakening demand is spreading to sectors beyond technology and media.

- Chipotle plans to hire 15,000 people in the U.S. as it opens more restaurants and tries to keep up with an expected boost in demand in coming months.

- Bed Bath & Beyond says it defaulted on its credit lines just weeks after warning it was running low on cash and exploring a bankruptcy filing.

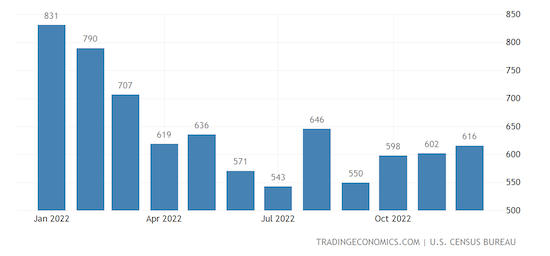

- New single-family home sales rose 2.3% in December, the third month of increases, as mortgage rates continued to decline.

- In the latest news from quarterly earnings season:

- Intel reported a 32% decrease in sales and issued a gloomy outlook for the current quarter.

- Southwest Airlines warned of a loss in the current quarter as passengers shun the carrier in the aftermath of an operational meltdown over the holidays.

- New York-based JetBlue Airways saw a wider-than-expected quarterly loss due to high fuel costs despite the strongest travel demand since the start of the pandemic.

- Visa’s revenues beat expectations in the latest quarter, rising 12%, but it was the slowest gain in seven quarters on ebbing travel demand and slowing consumer spending.

- Mastercard saw net revenue climb 12% but forecast weaker growth for the current quarter as a boost from pent-up travel demand weakens.

- U.S. grains merchant Archer-Daniels-Midland said hefty global demand led to record quarterly profit that will keep driving strong results this year.

- Hospital operators in the U.S. are likely to see a dip in fourth-quarter profits amid ongoing staffing issues.

International Markets

- Global economic growth is forecast to barely clear 2% this year, at odds with widespread optimism in markets since the start of the year, according to Reuters economists.

- The dismantling of China’s COVID-zero restrictions has wealthy citizens leaving the country, which could spur billions in capital outflows this year.

- Business sentiment among South Korea manufacturers has fallen to its lowest level in over two years, according to a central bank index.

- Low-cost European airlines are reporting record bookings for summer holidays, a sign that consumers are still likely to take trips despite fears of a recession.

- Airbus is looking to hire some 13,000 people across the globe this year to support increased production of commercial aircraft.

- Sales for luxury goods group LVMH rose 9% last quarter as U.S. and European shoppers bought more during the crucial holiday season.

- An unusually harsh winter in Asia is contributing to food shortages across the center of the continent, with some countries banning exports in an effort to maintain domestic stock.

Some sources linked are subscription services.