MH Daily Bulletin: July 6

News relevant to the plastics industry:

At M. Holland

- We are numb with grief over this weekend’s mass shooting in Highland Park, Illinois, a neighboring community to M. Holland’s headquarters and home to many Mployees. Fortunately, all Mployees are safe and accounted for, but our hearts and thoughts are with the community after this tragic attack. Our President and CEO Ed Holland shared this message with Mployees this week.

Supply

- Oil plummeted 9% Tuesday in the biggest daily drop since March on growing fears of a global recession. WTI closed below $100/bbl, while U.S. natural gas prices fell almost 5%.

- In mid-morning trading today, WTI futures were off 4.1% at $95.38/bbl, Brent was down 3.9% at $98.79/bbl, and U.S. natural gas was down 1.3% at $5.45/MMBtu.

- U.S. refiners sent over 5 million barrels of emergency crude stock to Europe and Asia in June, blunting White House efforts to bring down fuel prices by releasing more of the reserves.

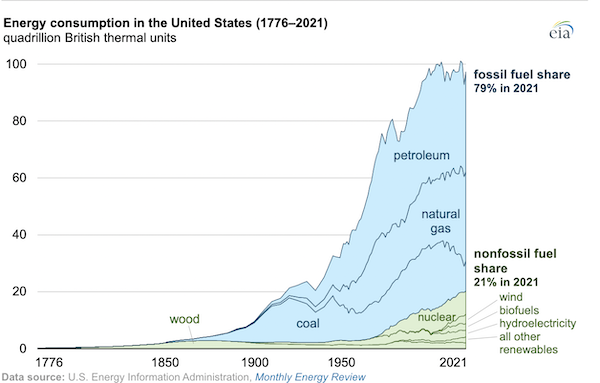

- Last year, the U.S. saw its first increase in coal consumption since 2013:

- Shell joined other Western oil majors in taking a stake in the world’s largest LNG project in Qatar.

- Norway’s petroleum output will remain stable after the government reached a deal with striking oil and gas workers Monday.

- Saudi Arabia raised crude selling prices to Asian buyers by $2.80/bbl to a near-record premium over Oman/Dubai quotes.

- Sri Lanka closed schools, imposed power rationing and halted more fuel sales as the island’s fuel supplies completely dry up.

- More oil news related to the war in Europe:

- Concerns are growing that Russia will not resume gas flows to Europe once maintenance is completed on the key Nord Stream 1 pipeline later this month.

- Germany’s government is moving forward with plans to unlock funding for bailing out private energy firms.

- Unexploded bombs from WWII are slowing the construction of much-needed LNG terminals on Germany’s northern coast.

- Russian lawmakers approved a temporary windfall tax on Gazprom in a bid to quickly raise $20 billion in tax revenue.

- Drought conditions could lower France’s nuclear output this summer, worsening Europe’s energy shortage.

- The International Energy Agency cut its three-year forecast for growth in global LNG demand by 60% due to fallout from Russia’s invasion.

- Australia’s government extended emergency measures allowing it to divert foreign-bound LNG to domestic markets through 2030.

- Greece will spend over $715 million to extend energy subsidies through July.

- Japan’s largest power utility is eyeing a takeover of Toshiba’s nuclear business.

- Over 40% of U.S. energy sector jobs are now in areas aligned to net-zero goals such as renewables, grid technology and storage.

- Renewables provided 49% of power used in Germany in the first half of 2022.

- A massive new electric vehicle charging station in Oxford, U.K., will begin sending power back to the national grid.

Supply Chain

- A Fourth of July barbecue likely sparked northern California’s fast-spreading Electra Fire, which tripled in size from Monday to Tuesday.

- Italy declared a state of emergency in five northern and central regions where drought is killing crops and threatening power supplies.

- Extreme heat waves in Europe have increased three to four times faster than other parts of the world, new research suggests.

- “Go-slow” convoys disrupted British roadway travel yesterday in protest over record-high fuel prices.

- Manufacturers across the globe are seeing a sharp increase in inventory as consumer demand weakens.

- U.S. wholesale inventories reached $880.6 billion in May, up 25% from a year ago.

- Logistics firms report U.S. orders with Chinese manufacturers have fallen as much as 30% as consumers shift spending from goods to services.

- Container lines are beginning to assess penalties on shippers who incorrectly declare the weight of boxes on Asia-to-Europe services.

- References to “onshoring,” “reshoring” and “nearshoring” are up 1,000% in first-half earnings calls compared to 2020, a Bloomberg survey shows.

- Sales for three- to five-year-old trucks were up nearly 83% in the first five months of 2022 compared to a year ago.

- Walmart will charge suppliers new fuel and pickup fees starting Aug. 1 in response to higher transportation costs.

- Old Dominion Freight Line is testing a simplified “One Rate, One Time” pricing system that provides a single invoice to less-than-truckload shippers before their freight is picked up.

- Supply bottlenecks reduced orders for LNG-fueled commercial ships to just two in June, according to classification society DNV. Overall vessel orders are down 45% this year even as demand for cargo and LNG ships remains strong, according to Clarksons Research.

- Singaporean shipper Pacific International Lines has placed orders for eight new container ships in the past four months that will be capable of running on ammonia.

- In the latest auto market news:

- Ford vastly outperformed the industry with a 1.8% rise in second-quarter sales from a year ago, boosted by a surge of F-series truck sales in June.

- Computer chip shortages could cost Stellantis up to 220,000 vehicles this year from lost production in Italy.

- Chinese automaker BYD surpassed Tesla as the world’s leading electric vehicle seller with 638,157 vehicle sales in the first half of 2022.

- Volkswagen’s chief executive believes the automaker can overtake Tesla in the electric vehicle market by 2025 due to Tesla’s production difficulties.

- U.S.-based Mars Inc. joined Kraft Heinz in pulling products from Britain’s largest grocery chain after the grocer refused to raise product prices to meet inflation.

- Singapore’s second-largest airfield is positioning itself as a future hub for flying taxis.

- Britain’s national health service is piloting the use of drones to provide same-day delivery for drugs and medical equipment.

Domestic Markets

- The U.S. reported 179,507 new COVID-19 infections and 434 virus fatalities Tuesday. An accurate picture of the nation’s virus data is increasingly blurry as more cities stop daily reporting.

- Between March 2020 and October 2021, COVID-19 was the leading cause of death for Americans aged 45-54 and the third leading cause of death overall.

- The fast-spreading BA.5 subvariant of Omicron is now the dominant U.S. strain with 53.6% of total infections, the CDC said.

- Los Angeles County’s COVID-19 positivity rate is steadily rising and surpassed 13.5% over the holiday weekend.

- The CDC recommends people in 15 Washington counties return to mask-wearing amid rising COVID-19 infections.

- New research suggests reinfections with COVID-19 could lead to more damaging health impacts regardless of infection strain.

- Pfizer announced promising trial data for the updated COVID-19 vaccine it plans to introduce this fall.

- A chronic COVID-19 patient in Connecticut developed three distinct lineages of coronavirus during 471 straight days of infection, highlighting how new strains can germinate with long-COVID symptoms.

- The job market remained robust in May, according to the Labor Department, with employers posting 11.3 million job openings.

- Over half of Americans surveyed say they will stop using virtual services in healthcare, grocery delivery and curbside pickup once the pandemic subsides.

- The U.S. personal savings rate hit 5.4% in May, dipping below the average of the past decade.

- U.S. and Chinese trade officials met virtually Tuesday as a deal nears to remove billions of dollars of American tariffs on Chinese goods.

- New orders for U.S.-manufactured goods rose a larger-than-expected 1.6% in May, new data shows.

- Some of the largest U.S. firms are offering midyear raises to retain employees and keep up with the cost of inflation.

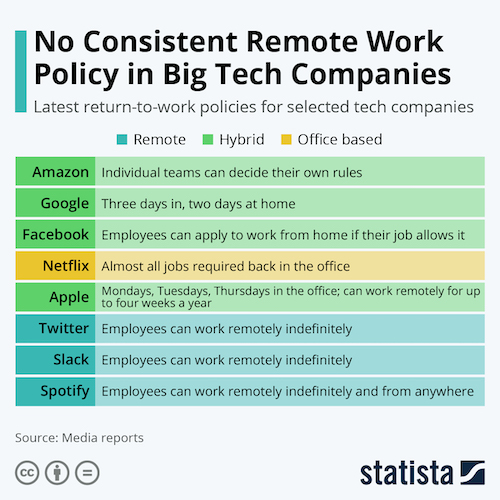

- Remote work coupled with higher interest rates drove down shares of public office owners much faster than the broader stock selloff this year, new data shows.

- Nearly 2.5 million people passed through U.S. airports on Friday, a pandemic record. The weekend’s total 9 million air travelers was just shy of 2019 levels, as disruptions eased substantially compared to Memorial Day weekend in May.

International Markets

- A spate of COVID-19 flareups in China prompted fresh mass testing in Shanghai, movement curbs in Xian and tightened lockdowns in the eastern province of Anhui.

- New COVID-19 cases in South Korea nearly tripled from Monday to Tuesday.

- Italy reported over 100,000 new COVID-19 cases on Tuesday for the first time since February.

- COVID-19 cases are on the rise in New Zealand.

- COVID-19 infections doubled last week in Romania, the EU’s least-vaccinated member state.

- Canadian officials are considering making COVID-19 booster shots mandatory every nine months for the foreseeable future.

- More news related to the war in Europe:

- Ukrainian officials said the nation will need at least $750 billion to rebuild after its war with Russia is over.

- Yum Brands, owner of Pizza Hut and KFC, announced plans to exit Russia completely following a smaller pullback in May.

- Truck maker AB Volvo is laying off its Russian staff in preparation of a possible exit from the nation.

- IKEA will completely shutter operations in Russia this week.

- The euro fell to its lowest level against the dollar in two decades Tuesday, suppressed by growing fears of a recession caused by energy shortages. Meanwhile, S&P Global’s index of business growth in the euro zone fell to a 16-month low in June.

- South Korean consumer prices rose a larger-than-expected 6% in June from a year ago, the fastest pace since 1998.

- European lawmakers approved two sweeping pieces of digital regulation Tuesday, setting the stage for legal battles with the world’s largest tech firms.

- Mexico’s president submitted a bill to eliminate daylight savings time.

- Shareholders of LATAM Airlines, Latin America’s largest air transport group, approved an $8 billion bankruptcy reorganization plan Tuesday.

- Another A350 jet order was canceled by Airbus in the plane maker’s escalating dispute with Qatar Airways over surface scars on jets. Airbus’ first-half jet deliveries were on pace with last year.

- South Korea’s LG Energy Solution plans to supply over $760 million worth of batteries to Isuzu Motors as the Japanese automaker ramps up production of electric vehicles.

- Lamborghini will spend almost $2 billion developing a hybrid lineup of vehicles by 2024, executives said.

- German regulators signaled antitrust concerns will not hinder Volkswagen’s plans to jointly develop autonomous driving technology with Germany’s Bosch.

Some sources linked are subscription services.