MH Daily Bulletin: July 7

News relevant to the plastics industry:

At M. Holland

- We are numb with grief over last weekend’s mass shooting in Highland Park, Illinois, a neighboring community to M. Holland’s headquarters and home to many Mployees. Fortunately, all Mployees are safe and accounted for, but our hearts and thoughts are with the community after this tragic attack. Our President and CEO Ed Holland shared this message with Mployees this week.

Supply

- Oil prices fell 2% to a 12-week low in volatile trading Wednesday, extending steep losses from the prior session.

- In mid-morning trading today, WTI futures were up 5.5% at $103.90/bbl, Brent was up 4.8% at $105.50/bbl, and U.S. natural gas was up 12.0% at $6.17/MMBtu.

- The average U.S. gasoline price fell to $4.779 a gallon yesterday, a 9-cent decrease for the month.

- The American Petroleum Institute says U.S. crude inventories rose by 3.825 million barrels this week, a reversal of expectations for a drawdown. Government data will be released today.

- Prices for frack sand are up 150% year-to-date, hampering American producers’ efforts to turn on the taps at the nation’s largest shale sites.

- Roughly 83% fewer U.S. college students are graduating with petroleum engineering degrees than five years ago as the energy transition clouds industry prospects.

- Equinor said all oil and gas fields affected by a strike in Norway’s petroleum sector will be back in full operation within days.

- China’s fuel export quotas are 39% lower than last year’s, indicating the country will do little to ease the global supply shortage.

- Shell said it will reverse $4.5 billion in write-downs it took on its oil and gas assets due to the improved outlook for energy.

- More oil news related to the war in Europe:

- Germany’s crude oil import bill doubled in the first four months of the year despite volumes only rising 14.6%.

- France’s new prime minister vowed to nationalize the country’s indebted electricity giant EDF in response to the power crisis sparked by Russia.

- TotalEnergies made its first major divestment in Russia since the invasion, selling its stake in an oil field it operated with Norway’s Equinor for over 20 years.

- A Russian court told one of the world’s largest pipelines carrying oil from Kazakhstan to the Black Sea to suspend operations for 30 days over document issues, although exports were still flowing yesterday.

- The U.S. and its allies are discussing methods of capping the price of Russian crude somewhere between $40/bbl and $60/bbl, a bid to limit funding for Moscow’s war effort.

- Austria is preparing to cut some ties with Gazprom over the Russian firm’s continuous failure to deliver gas.

- German gas pipelines are overhauling their grid investment plans for the next decade in the wake of Russia’s invasion.

- OPEC’s Secretary General, a native of Nigeria, died unexpectedly just weeks before the end of his six-year term.

- EU lawmakers approved controversial new rules Wednesday that will label gas and nuclear energy as climate-friendly, potentially boosting investment in them in the energy transition.

- TotalEnergies and Ireland’s Simply Blue Energy are partnering to develop 3 GW of offshore wind power in Oregon by 2023.

- South Korea is restarting production on stalled nuclear projects and extending the life of existing reactors in a new embrace of the energy source for its long-term energy goals.

- Shell announced plans to build Europe’s largest hydrogen plant in the Netherlands by 2025.

- A British bill attempting to overhaul the nation’s energy security could attract almost $120 billion of private-sector investment to renewables by 2030, officials say. The bill scrapped plans for a complete phaseout of coal by 2024.

Supply Chain

- Northern California’s Electra Fire spread to 4,000 acres on Wednesday, forcing over 1,000 people to evacuate and threatening thousands more structures.

- A lingering heatwave in Texas continues to push daily power demand to new records.

- Hundreds more British rail workers voted to strike Wednesday in a dispute over pay.

- The average FEU spot price from Asia to the U.S. West Coast fell 15% in the final week of June to $7,599, according to the Freightos Baltic Index.

- DRAM memory chip prices in the quarter ended June 30 were down 10.6% from the year-ago period, suggesting the semiconductor boom may have peaked.

- Revenue at Samsung Electronics rose a better-than-expected 21% in the second quarter, relaxing fears of a severe inflation-driven slump in global tech demand. The firm’s three-quarter run of record revenues ended, however.

- Polysilicon prices rose for a sixth straight week as plant outages extend a shortage of the key solar-panel material.

- Airfreight rates out of Bangladesh are plummeting as North American apparel demand declines.

- German industrial firms expect supply chain disruptions will continue to hamper output through next year’s first quarter.

- Skinnier and taller 12 oz. aluminum beverage cans are rising in popularity for their differentiation on display and smaller footprint on store shelves and in shipping.

- The FDA could allow overseas makers of baby formula to continue sending product to the U.S. beyond the emergency measure’s current November deadline.

- Medical device supplier Medtronic says some of its supply constraints are easing.

- Walmart patented new technology where autonomous delivery vehicles will automatically release drones to complete deliveries if they encounter roadway obstacles.

- Amazon’s Prime subscription service announced a new partnership with Grubhub just days after the third-party food deliverer signaled it was looking for a new investor to boost its U.S. operations.

- Local officials approved plans for a $300 million, 3-million-square-foot, five-story Amazon warehouse in Niagara, N.Y.

- Vermont-based less-than-truckload carrier LandAir, among the largest carriers in the Northeast with 54 years in business, shuttered its operations this week.

Domestic Markets

- The U.S. reported 197,297 new COVID-19 infections and 734 virus fatalities Wednesday.

- The seven-day average of COVID-19 hospitalizations is up 13% from two weeks ago to its highest level since early March.

- The fast-spreading BA.4 and BA.5 subvariants of Omicron now comprise over 70% of COVID-19 cases in the U.S., the CDC said.

- California’s COVID-19 test positivity rate hit 15% this week, its highest level since January.

- The COVID-19 test positivity rate in parts of Manhattan is above 20% as cases rise to a two-month high.

- The CDC is recommending a return to mask-wearing in 24 Oregon counties with rising COVID-19 infections.

- Louisiana’s latest surge of COVID-19 may be caused by two new subvariants of Omicron that researchers named BE.1 and BF.1.

- Yellowstone became the fourth national park in the nation to reimpose indoor mask mandates due to rising COVID-19 infections.

- The FDA is allowing U.S. pharmacists to prescribe Pfizer’s COVID-19 antiviral treatment.

- Norwegian Cruise Line has ended pre-board COVID-19 testing requirements.

- Over half of U.S. adults say their lives are returning to pre-pandemic normality, according to a survey by the Associated Press.

- Newly released transcripts of the Federal Reserve’s June meeting are solidifying expectations for another 75-basis-point rate hike this month.

- Revised estimates show U.S. economic output contracted 1.6% in the first quarter, more than reported earlier.

- First-time jobless claims rose to 235,000 last week, the highest in almost six months.

- U.S. job openings fell less than expected in May, remaining above 11 million for the sixth consecutive month. The data points to continued strength in the U.S. job market, economists say.

- Growth in the U.S. services sector hit a two-year low in June, according to the Institute for Supply Management.

- U.S. mortgage demand dropped 5.4% last week as average interest rates fell for the second week in a row.

- Rental markets in some of the hottest U.S. cities are showing early signs of a cooldown after prices surged 11.4% over the past year.

- Manhattan homes sold at a median price of $1.25 million in the second quarter, a record high as demand remains strong.

- United Airlines blamed the FAA for 75% of its recent flight disruptions.

- Several food-industry executives say labor pressures are starting to ease for entry-level positions.

- New York City lifeguards will see a 20% pay raise as more than half of positions remain unfilled.

- Electric vehicle maker Rivian reaffirmed its annual production target of 25,000 vehicles after ramping up output in the second quarter.

- Minnesota-based 3M faces the prospect of additional liabilities on top of the $581 million it agreed to pay to the Netherlands over its use of PFAS chemicals in consumer goods.

International Markets

- COVID-19 infections are up 30% globally the past two weeks on rising infections in the U.S. and Europe, the WHO said.

- COVID-19 hospitalizations are set to hit an 18-month high in Britain.

- Beijing and Shanghai ordered new rounds of mass testing as more COVID-19 infections were discovered in connection with illegally operating entertainment venues. Beijing also imposed its first ever COVID-19 vaccine mandate.

- China’s northwestern megacity of Xi’an went under partial lockdown Wednesday after authorities detected the first case of a fast-spreading COVID-19 subvariant of Omicron.

- Hong Kong abandoned its “circuit breaker” rule that severely punished international airlines arriving with COVID-19 infected passengers and virtually shut down the city’s airport.

- Ontario health officials say the fast-spreading BA.5 subvariant of Omicron is causing “exponential growth” in case counts.

- The CDC elevated Sweden, Guatemala and Morocco to Level 3, “High” risk for COVID-19 infection.

- Tens of millions of COVID-19 vaccine doses are being discarded across the globe due to low demand.

- More news related to the war in Europe:

- The IMF said the outlook for the global economy has “darkened significantly” since April and that a global recession could come next year.

- Russia’s invasion of Ukraine will cause global hunger to rise sharply, the United Nations said.

- British bank HSBC is considering a sale of its Russian business to local lenders.

- Euro zone retail sales rose 0.2% year over year in May, new data shows.

- Australia’s central bank raised its interest rate by a half percent for the second straight month, a bid to stem rising inflation in the Asia-Pacific region.

- British Airways cut 10,300 more flights this summer due to staffing shortages, bringing its total reduction in summer capacity to 13%.

- Toronto’s office vacancy rate rose to a record-high 12% in the second quarter.

- New homes hit the British market at their fastest pace since January last month, matching global trends of easing housing markets.

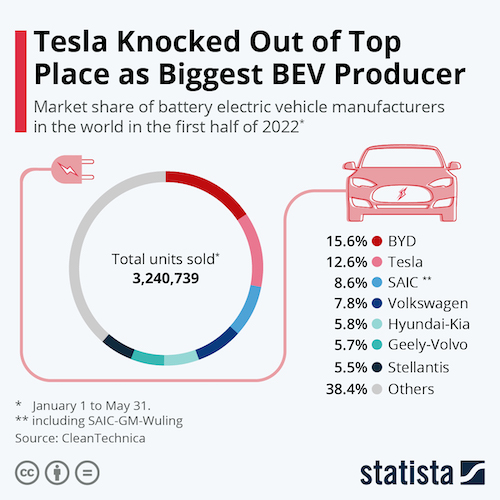

- Tesla sold roughy 78,000 China-made vehicles in June, a 142% increase from May.

Some sources linked are subscription services.