MH Daily Bulletin: July 18

News relevant to the plastics industry:

At M. Holland

- M. Holland has launched a new Healthcare Packaging line card to help manufacturers solve industry challenges and meet regulatory and supply chain demands.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose 2.5% Friday on signals that Saudi Arabia will do little to boost output in the short term.

- In mid-morning trading today, WTI futures were up 4.1% at $101.60/bbl, Brent was up 4.4% at $105.60/bbl, and U.S. natural gas up 7.4% at $7.53/MMBtu.

- Active U.S. oil rigs rose by two to 599 last week, the most since March 2020, according to Baker Hughes.

- Libya is expected to boost crude output following a series of meetings between the government and protesters who have blockaded the nation’s oil facilities for months.

- China’s June refinery throughput shrank by 10% from a year ago, capping the nation’s first half-year output decline in over a decade.

- TotalEnergies says it is preparing to release “exceptional” earnings after European refining margins tripled from the first to the second quarter.

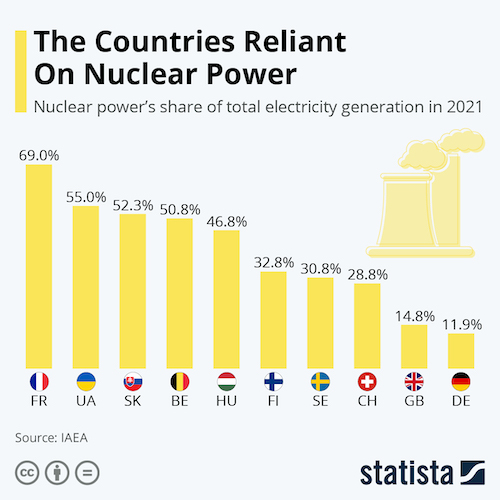

- Nuclear now makes up more than 50% of electricity generation in four European nations and could play a significant role in the continent’s transition to cleaner energy.

- Consumers are pivoting back to remote work to blunt the impact of high gasoline prices. The average price fell to $4.52 over the weekend, down 16 cents in the past week.

- More oil news related to the war in Europe:

- European LNG prices are now 1,900% higher than two years ago at the trough of the pandemic and roughly equal to buying oil at $230/bbl.

- High demand for oil has pushed freight rates for medium-sized tankers to $40,000, up four-fold since January, brokers say.

- German power supplier Uniper SE, the nation’s largest purchaser of Russian gas, says it is “days away” from insolvency.

- S&P Global predicts Germany will only be able to access 65% of its coal supply in the coming months as drought lowers water levels of major transport rivers.

- British chemical firm Ineos Group predicts Europe will be forced to ration natural gas this winter if Russia abruptly halts deliveries in the coming weeks.

- Europe may ban the import and transit of some fuel oil from Russia six months ahead of plans, officials signaled.

- Saudi Arabia more than doubled Russian fuel imports last quarter as it worked to feed domestic power stations and keep its world-leading exports flowing.

- Algeria is turning into a major source of gas for European countries looking to replace Russian supplies.

- The Japanese government plans to support Mitsui and Mitsubishi in their attempts to stay in Russia’s massive Sakhalin-2 oil and gas project under development, which Moscow is attempting to nationalize.

- Canada is scrapping some sanctions for two years to allow the transport of pipeline parts to Russia, a bid to keep fuel deliveries flowing to Europe.

Supply Chain

- Hundreds were evacuated in France, Spain and Portugal over the weekend as a blistering heatwave sparked more wildfires.

- Italy’s worst drought in 70 years has reduced its longest river, the Po, to a trickle in some places.

- The U.S. administration named a new emergency board aimed at helping railroads and labor unions reach agreement on new contracts.

- Construction of new U.S. manufacturing sites has more than doubled over the past year as more companies work to return production from overseas.

- Failures of trucking fleets picked up sharply in June following months of surging diesel prices.

- The New York and New Jersey port authority ended talks with Amazon over a deal to develop air cargo facilities at Newark Liberty International Airport.

- South Korean shipbuilder Daewoo is in severe financial difficulties partly due to rising labor issues with subcontractors.

- China’s Cosco Shipping expects its earnings to grow 74% to $9.6 billion in the first half of the year.

- U.S. Congress’ stalled effort to advance billions in computer-chip subsidies is throwing plans for massive new domestic factories into doubt.

- The average price of DRAM memory chips, one of the most common types, fell 10.6% in the latest quarter from a year ago, suggesting the computer-chip boom period may be ending.

- Boeing is reducing monthly output targets for its 737 MAX jet due to parts shortages for engines and electronics. Brazilian plane maker Embraer is also struggling with the aviation supply chain, the firm said.

- Industrial supplier Fastenal slightly missed Q2 forecasts while warning that demand could soften after it hiked prices to manage inflation.

- Abbott Laboratories, a major cause of the recent U.S. baby-formula shortage, will soon resume product shipments from its long-shuttered factory in Sturgis, Michigan, the firm said.

- In the latest news from the auto industry:

- Volkswagen’s second-quarter losses were fueled by a 49% sales decline in central and eastern Europe. The automaker also is on pace to widely miss its 2022 sales targets in China.

- Tesla vehicles are thousands of dollars more expensive than several months ago as the automaker repeatedly raises prices to reflect higher material and battery costs.

- Most of the past decade’s 3.3 million “park-outside” car recalls occurred in the past two years due to problems with emerging battery technology, especially in electric vehicles.

- China’s steelmaking hub of Wugang imposed a three-day lockdown over a single COVID-19 case last week.

- Shanghai and Tianjin, two of China’s main port cities, ordered testing of residents after recent infections were detected, creating fears of possible lockdowns that could disrupt global supply chains.

- Copper prices are down to their lowest level in nearly two years amid recessionary concerns.

- South Africa will impose rolling power cuts this week due to a lack of generating capacity.

Domestic Markets

- The U.S. reported 126,023 new COVID-19 infections and 348 virus fatalities Sunday. New cases rose in 38 states last week while average daily hospitalizations have doubled since May to a three-month high.

- The U.S. administration extended the nation’s COVID-19 public health emergency for another three months.

- The fast-spreading BA.5 subvariant of Omicron is four times more resistant to vaccines than earlier strains, new research suggests.

- U.S. health officials are soon expected to announce protocol allowing all adults to get a second COVID-19 booster dose.

- COVID-19 hospitalizations in Los Angeles have doubled from a month ago.

- The CDC is recommending a return to mask-wearing in Dallas and surrounding counties amid rising COVID-19 infections.

- Tens of millions of people continue to suffer the effects of “long COVID,” which is undiagnosable, months and years after recovering from initial infection.

- More Federal Reserve officials signaled their support for a 75-basis-point interest-rate hike later this month, what would be the second in a row.

- Private-sector payrolls surpassed pre-pandemic levels for the first time in June, led by transportation and warehousing jobs.

- Inflation-adjusted U.S. wages have failed to log a single month of year-over-year growth since March of 2021, new data shows.

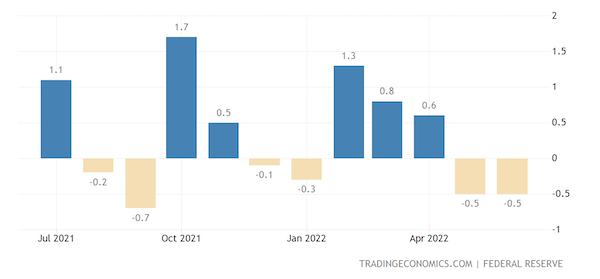

- U.S. consumer sentiment picked up in July from an all-time low last month, according to a widely tracked index from the University of Michigan:

- Fewer S&P 500 companies are beating earnings expectations in their latest quarterly reports than in years past.

- U.S. factory output dropped 0.5% in June, the second month of declines due in large part to rising inventories and recession fears.

- Manufacturing activity in New York state unexpectedly rose in July for the first time in three months, according to the Federal Reserve.

- A growing number of U.S. localities are handing out cash grants and other perks aimed at drawing skilled employees from out of-state to work remotely.

- An outlier among big banks, Citigroup’s second-quarter profit surged past expectations on large gains from currency and commodity trading.

- Wells Fargo reported a 48% profit decline in Q2 as it set aside bad-debt reserves in the event of a recession.

- Amazon is pausing the construction of six new office buildings in Washington state and Tennessee as the firm reevaluates its hybrid work policy.

- The White House pledged to boost involvement in emissions policy on news that Congressional lawmakers are stalling on climate-related tax and incentive bills.

International Markets

- Over 3.5 million people contracted COVID-19 in the U.K. last week, a 30% increase from the week prior.

- China reported 450 COVID-19 infections Saturday, the most since May, with fresh lockdowns imposed on millions of people in the country’s northwest and south.

- Macau, an administrative region of China, will remain locked down through the end of the week as COVID-19 cases remain high.

- Japan reported a record 110,600 new COVID-19 cases on Saturday, surpassing February’s high.

- South Korea saw more than 41,000 new COVID-19 cases on Saturday, the most in two months.

- Daily COVID-19 infections in India surpassed 20,000 for the first time in four months as total infections during the pandemic topped 2 billion.

- COVID-19 hospitalizations are at all-time highs in Australia, prompting the nation to resume support payments for infected workers.

- More news related to the war in Europe:

- The European Commission, executive branch of the EU, formally proposed its seventh package of sanctions against Russia Friday, including an import ban on gold and updated measures to free up food shipments.

- Russia’s war in Ukraine could cost the global economy up to $1 trillion in output this year, with the largest losses in Italy, Germany and France.

- Boeing trimmed its 20-year industrywide demand forecast for planes primarily due to lower orders from the sanctioned Russian market.

- The global economic outlook is “exceptionally uncertain” amid soaring inflation, the IMF’s chief said.

- Chile’s central bank launched a $25 billion intervention in foreign exchange markets to support the peso after it fell to a record low late last week.

- Sri Lanka’s economy will likely contract more than 6% this year due to political instability and social unrest, the country’s central bank said.

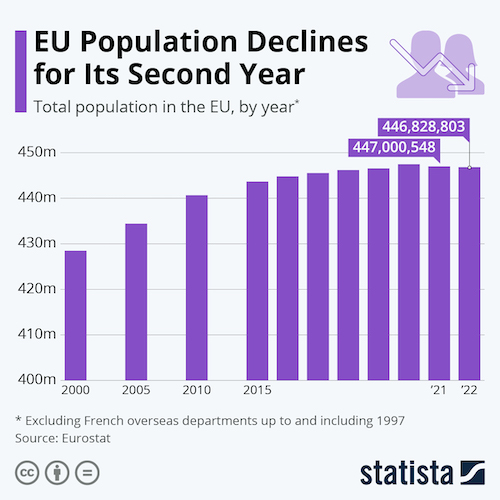

- The EU’s population fell in 2021 for the second year in a row, with COVID-19 likely the main contributor:

- Higher interest rates are pinching the Canadian housing market, with prices down 18.5% since a February peak.

- Scandinavia’s main airline SAS continues to suffer from a massive walkout of pilots, with negotiations stretching into their third week today.

- Amazon will be one of Britain’s 10 largest private employers after the addition of 4,000 workers this year.

Some sources linked are subscription services.