MH Daily Bulletin: July 19

News relevant to the plastics industry:

At M. Holland

- M. Holland has launched a new Healthcare Packaging line card to help manufacturers solve industry challenges and meet regulatory and supply chain demands.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose 5% Monday, rebounding from last week’s biggest decline in over a month.

- In mid-morning trading today, WTI futures were down 0.3% at $102.40/bbl and Brent was down 0.2% at $106.10/bbl.

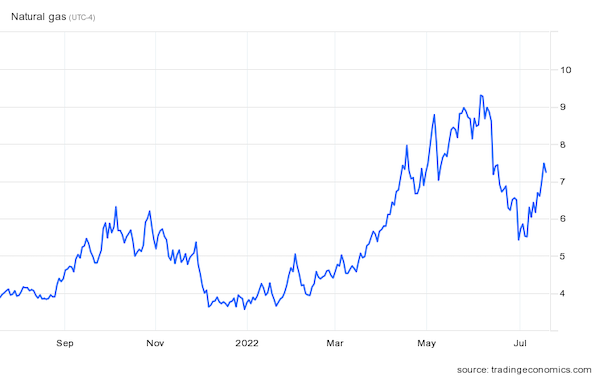

- U.S. natural gas futures topped $7.50/MMBtu for the first time in a month yesterday but fell by 1.4% in morning trading to $7.38/MMBtu.

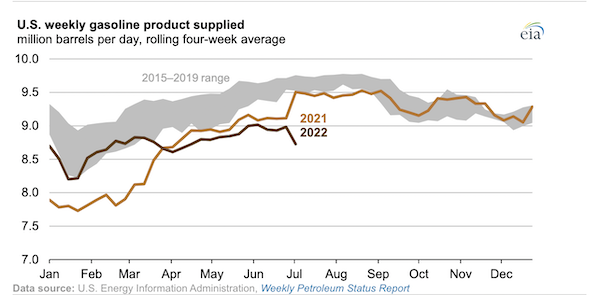

- The average U.S. gasoline price is below $4.50 a gallon for the first time in two months, according to AAA. Gasoline consumption remains lower than last year, however:

- The U.S. is currently exporting as much as 1.39 million bpd of diesel, about 10% more than the previous July record from five years ago.

- Tightened export quotas on Chinese refiners are causing major declines in the nation’s exports of gasoline (-42%) and diesel (-84%) this year.

- Saudi Arabian officials said the nation will likely max out its crude production capacity at 13 million bpd in 2027.

- More oil news related to the war in Europe:

- Russia’s Gazprom declared force majeure on gas shipments to several European buyers over the past month, a warning sign of more substantial cuts ahead.

- The European Commission does not expect Russia to restart a key natural gas pipeline to Germany when maintenance ends this week, officials said Monday.

- The French government offered to nationalize power company EDF for almost $10 billion, a bid to manage the nation’s energy crisis through state intervention.

- German power supplier Uniper is borrowing billions of dollars to manage fallout from rising energy prices, the firm said.

- Europe must take immediate steps to conserve gas and prevent rationing this winter, the IEA says. More EU nations are scrambling to secure supplies from Algeria and Azerbaijan.

- Russia again failed to book extra capacity on gas pipelines through Ukraine next month, adding to uncertainty over deliveries to Europe.

- Russian crude shipments to China and India are down almost 30% from their post-invasion peak, according to the latest figures.

- In a rare move, Poland, the EU’s top coal producer, ordered over 4.5 million tons of imported fuel as fears grow of an energy shortage this winter.

- Canada began shipping sanctioned pipeline parts to Germany over the weekend, despite doubts that the equipment will keep supplies flowing from Russia.

- Germany may extend the lives of its last three nuclear plants ahead of expected supply cuts from Russia.

- South Africa’s largest fuel producer declared force majeure on petroleum products amid delays in crude deliveries to its refineries.

- Brazil’s two largest states cut taxes on ethanol in a bid to make the biofuel more competitive and free up gasoline supplies.

- Canada is in early talks on a plan to cap and cut greenhouse gas emissions from the oil and gas sector, the nation’s largest and fastest-growing source of emissions.

Supply Chain

- Britain declared a national emergency Monday as a sweltering heatwave pushed temperatures to all-time highs, forcing schools and some businesses to close. Extreme heat is also covering France and Spain.

- The Port of Los Angeles handled nearly 877,000 TEUs last month, eclipsing 2021 as the busiest June on record.

- The Brownsville Ship Channel will undergo a $68 million expansion to accommodate bigger cargo ships in the only deep-water port between Texas and Mexico, a key trade route.

- The U.S. Department of Transportation is seeking approval to start a new, voluntary platform for the exchange of container data, a bid to improve cargo flow through domestic freight networks.

- Auction prices for used heavy-duty trucks are starting to decline after 18 consecutive months of increases, according to J.D. Power.

- Shipping congestion is keeping nearly half the world’s chemical tanker capacity stuck at ports, Clarksons Research says.

- A trimmed-down bill to spur U.S. semiconductor production with $52 billion in incentives could start moving in the Senate today. The finished bill will likely restrict firms from taking funds if they also are building or expanding advanced chip manufacturing in China.

- Last-mile delivery revenue could jump from $70 million this year to over $670 million by 2030, ABI Research predicts.

- In the latest news from the auto industry:

- BMW will resume production at its Dingolfing site in Germany today following a brief shutdown caused by rail disruption on Monday.

- Volkswagen says problems with its software development could delay new electric vehicle models from Audi, Porsche and Bentley.

- Volkswagen sold 27% more battery-electric vehicles in the first half of 2022 compared to a year ago, a bright spot in the automaker’s otherwise disappointing financial report.

- Porsche says supply chain challenges led to a 5% drop in global first-half deliveries, with the largest decline coming from China.

- Stellantis will return to selling imported vehicles in the Chinese market after plans to ramp up production within the country failed to boost sales.

- The first U.S.-made Great Lakes bulk carrier in 35 years completed its initial sea trials.

- GXO Logistics, one of three recent spinoffs of XPO Logistics, is laying off over 140 workers in Wisconsin as it moves its warehousing operations to Kentucky.

- Amazon will begin making drone deliveries in Texas later this year as part of its “Prime Air” service, the firm said.

- DHL announced plans for a large hub near Birmingham, U.K., as part of an $850 million investment in British e-commerce.

- The Russia-occupied Port of Mariupol is reopening even as ship owners say they haven’t been told about the status of their vessels.

Domestic Markets

- The U.S. reported 122,639 new COVID-19 infections and 336 virus fatalities Monday. Cases are rising in 40 states — primarily in the Great Plains, West and South — while hospitalizations surged 20% the past two weeks.

- COVID-19 cases in New York rose 21% last week.

- The CDC will meet this week to potentially approve Novavax’s COVID-19 vaccine, what would be the fourth shot available to adult Americans.

- The CDC ended its COVID-19 Program for Cruise Ships yesterday after two years.

- The U.S. dollar is at its strongest in two decades, driving down prices for dollar-denominated commodities and muting the earnings outlook for many international corporations.

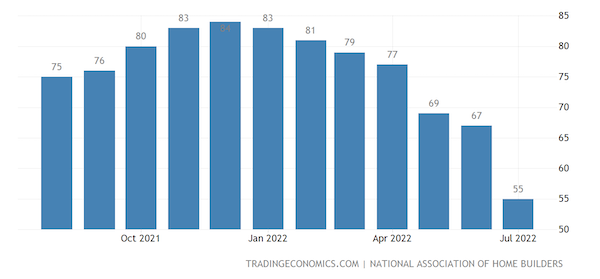

- U.S. homebuilder sentiment fell this month to the lowest level since May 2020 amid high inflation and rising interest rates.

- Rent prices in Austin, Texas, rose 108% over the past year, the largest year over year increase in the nation.

- U.S. home sales to foreign buyers fell 7.9% for the year ending in March, the fifth straight annual decline, even as rising prices pushed the dollar volume of sales up 9%.

- U.S. airline bookings fell 2.8% from May to June, likely a reflection of soaring ticket costs.

- The price for a pound of white bread in the U.S. hit a record $1.69 in June, up 12% from a year ago.

- Amazon and Facebook parent Meta are scaling back office expansions planned for New York in a reconsideration of permanent hybrid work policies.

- While private sector employment in the U.S. surpassed pre-pandemic levels in June, overall employment remains 524,000 lower as state and local governments struggle to attract and retain workers in the tight labor market.

- U.S. employers added 884,000 jobs for workers aged 16 to 19 in June, a 41% increase from last year in one of the highest labor participation rates for the demographic in over a decade.

- Workforce participation among older workers aged 55-64 fell by 400,000 early in the pandemic before returning to pre-pandemic levels this year. Fears are growing that resurging COVID-19 infections could again force them into early retirement.

- Apple joined many other large firms, particularly in technology and real estate, that are reining in hiring and spending plans due to recessionary fears.

- IBM posted better-than-expected sales growth of 9% in the second quarter but warned of rising costs weighing on future earnings.

- Goldman Sachs (-47%) and Bank of America (-32%) reported sharp declines in second-quarter profits after volatile markets slashed investment banking revenue across the industry.

- Delta Air Lines ordered 100 Boeing 737 MAX 10 jets, a needed boost for the plane maker after months of ceding ground to Airbus. Boeing also expects to soon resume production of its 787 Dreamliner after a two-year stall.

International Markets

- Shanghai and several other large cities are imposing fresh mass testing or extending lockdowns on millions of people after new COVID-19 cases in China neared 700 Monday, a two-month high.

- Hong Kong stepped up its pandemic restrictions with a new requirement that quarantined people start wearing tracking bracelets, a measure resembling COVID surveillance in China.

- COVID-19 cases have tripled in Europe over the past six weeks while hospitalizations have doubled, according to the World Health Organization.

- Despite saving an estimated 20 million lives globally in their first year of use, injected COVID-19 vaccines have not stopped the virus’s spread or mutation, leading researchers to focus on versions that can be swallowed or inhaled closer to the point of incubation.

- More news related to the war in Europe:

- H&M, the world’s second largest apparel retailer, announced plans to fully exit the Russian market at a cost of roughly $200 million and 6,000 staff.

- Europe’s GDP could fall up to 1.5% this year if the EU fails to take preventive measures to save energy this winter, according to bloc estimates.

- Broadly rising interest rates are pushing down home prices in some of the world’s hottest housing markets for the first time in the pandemic.

- Chinese officials are discussing a plan to halt mortgage payments on stalled real estate projects to avoid further crisis in the nation’s roiling property sector.

- With up to 60% of flights delayed and roughly 8% canceled at some of Europe’s busiest travel hubs, rental car prices are up three- and four-fold as travelers avoid air travel chaos. Lost luggage claims at Europe’s airports are 30% higher than in 2019.

- Airline SAS reached a tentative contract with its pilot union. The two-week strike has cost the Scandinavian airline over $10 million per day.

- Flights were disrupted from London’s Luton airport on Monday after soaring temperatures melted runway pavement.

- Virgin Atlantic Airways plans to launch a flying taxi service out of Heathrow Airport for domestic travel in England by 2025.

Some sources linked are subscription services.