MH Daily Bulletin: June 6

News relevant to the plastics industry:

At M. Holland

- M. Holland is exhibiting during the WAI Operations Summit & Wire Expo on June 7-8 in Dallas, Texas. This event focused on wire and cable manufacturing offers industry forecasts, technical presentations, networking and more. Join us at Booth #621 to learn more about our supply solutions for wire and cable.

- Nick Chodorow has joined M. Holland as Chief Innovation Officer. In this role, Nick will lead efforts to enhance the company’s technology platforms and accelerate its digital journey. Click here to read the full press release.

Supply

- Oil prices rose almost 2% Friday, with WTI notching its sixth weekly gain on tight U.S. supplies.

- Saudi Arabia raised Asia-bound crude prices by more than expected in response to higher demand from China, sending Brent futures above $120/bbl earlier today.

- In mid-morning trading, WTI was down 0.3% at $118.50/bbl, Brent was down 0.2% at $119.50/bbl, and U.S. natural gas was up 9.1% at $9.30/MMBtu.

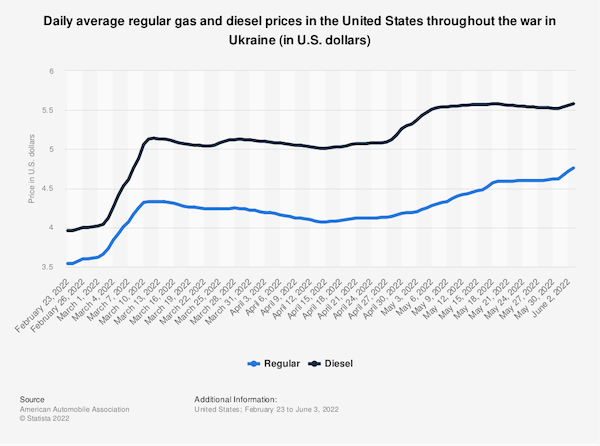

- A California gas station charged $9.60 a gallon for gasoline late last week, the highest in the nation.

- Active U.S. oil and gas rigs were unchanged last week at 727, up 59% from the same time last year.

- Chevron’s chief executive predicts there will never be another new refinery built in the U.S. due to the growing shift toward renewable energy.

- The U.S. may allow more sanctioned Iranian oil onto global markets even without a revived nuclear accord, Vitol predicts.

- Canadian heavy crude is struggling to find export markets as it competes with releases of similar grades from strategic oil reserves, sending its discount to WTI to a seven-month high.

- Some Norwegian oil production could go offline this week if over 600 workers move forward with a threatened strike.

- The EPA issued biofuel blending mandates for 2022 and retroactive mandates for 2020 and 2021 that were delayed due to the pandemic, rejecting requests from oil refiners to be exempted.

- A federal court ruling will make the U.S. administration analyze climate impacts before leasing some 4 million acres of federal land for oil and gas development.

- More oil news related to the war in Europe:

- The U.S. could allow Italy’s Eni and Spain’s Repsol to ship Venezuelan oil to Europe as soon as July to make up for losses of Russian crude.

- Qatari LNG exports dropped this year despite requests from European countries for bigger deliveries.

- France initiated talks with the UAE about potentially boosting the OPEC heavyweight’s exports.

- Although Russian energy exports continue to find markets, industry leaders believe sanctions will degrade the nation’s production capacity over time, similar to Iran and Venezuela.

- Kazakhstan renamed the oil it exports from Russian seaports to dissociate it from sanctioned oil originating in Russia.

Supply Chain

- Tropical Storm Alex, the first named storm of the hurricane season, dumped near-record amounts of rain in southern Florida on Sunday.

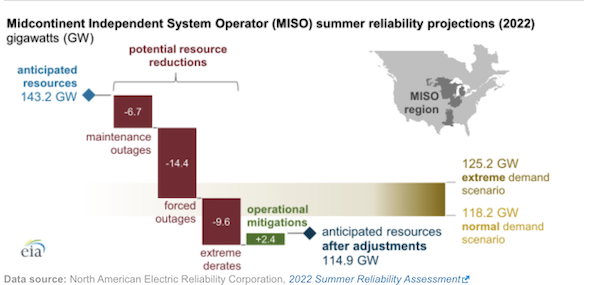

- Officials warn that the U.S. Midwest is in danger of rotating blackouts this summer due to rising power demand and plant retirements.

- A Mexican city in the border state of Nuevo Leon is limiting daily water access to a six-hour window in response to historic drought in the region.

- A 24-hour worker strike will shut down much of London’s sprawling subway network today.

- Abbott Laboratories restarted the problem facility whose closure spurred a U.S. shortage of infant formula months ago. Industry executives say scarcity will continue to at least mid-July, as the national out-of-stock rate hit 73.58% for the week ending May 29.

- United Airlines will donate space on passenger aircraft to ship baby formula from London to the U.S.

- Trucking, warehousing and parcel-delivery companies added 32,900 jobs last month, down from 44,700 in April. Except for March 2022, trucker employment has increased every month since the start of the pandemic.

- California port officials expect imports to rise as Shanghai emerges from its two-month lockdown, which sent Asia-West Coast FEU spot rates down 30%.

- Nineteen of the U.S.’s top 20 ports are seeing record trade this year as consumers tap into savings and credit to keep up spending.

- New long-term container line contracts are hitting all-time highs and sometimes are more expensive than the spot market. Benchmarking firm Xeneta’s index, which measures long-term contract rates, is up 30% this month and 150% the past year.

- Demand for U.S. fuel exports is so strong that rates for foreign-flagged ships carrying fuel are nearing rates for intra-U.S. “Jones Act” vessels, which normally trade at a steep premium.

- Shipyards in South Korea and China are overloaded with container ship orders, hindering output of LNG newbuilds and keeping rates for LNG carriers at all-time highs.

- U.S. regulators have yet to find evidence of collusion over demurrage and detention rates charged by ocean carriers during periods of peak pandemic congestion.

- Supply chain projects in North Carolina, Alaska and Puerto Rico were selected for some $40 million in federal dollars from America’s Marine Highway Program.

- The Port of Houston started work on a $1.1 billion expansion of the Houston Ship Channel to allow more vessels to pass through. The port handled a record 334,493 TEUs in April, up 21% from last year.

- The Port of San Diego is moving forward with an $11.5 million system to control and capture cargo vessel emissions.

- Maersk will expand its air and overland logistics offerings after it closed a $644 million deal to acquire Hamburg-based freight forwarder Senator International.

- CMA CGM reported a first-quarter net profit of $7.2 billion, up from $2.1 billion a year ago.

- Inventory-to-sales ratios are above pre-pandemic levels at U.S. furniture, electronics, appliance and general-merchandise stores, while the ratio for car lots continues to be extremely low.

- Unwanted casual clothing inventories are stacking up at U.S. apparel retailers as restrictions ease and consumer demand takes a U-turn.

- Some automakers, including Mercedes, Daimler Truck and BMW, report that semiconductor shortages are no longer impacting production.

- Harley-Davidson will resume its motorcycle production starting today, ending a 19-day suspension due to a parts shortage.

- Electric vehicle maker Rivian’s efforts to scale up production have been crippled by logistics inexperience.

- Boeing paused production of its 737 MAX jet for about 10 days last month due to logistics problems, new reports show.

- Deere is moving its cab production from Waterloo, Iowa, to Mexico, citing a lack of U.S. workers.

- Commercial fleets make up more than half of Chevrolet’s 140,000 preorders for its electric Silverado truck, to be released next year.

- The U.S. Post Office is testing electric delivery bikes.

- Russia says it will allow Ukraine to export grain from ports if it removes Russia’s underwater mines from coastal areas, while Ukraine is cautious about an offer from Turkey to clear them.

Domestic Markets

- The U.S. reported 13,138 new COVID-19 infections and 18 virus fatalities Sunday.

- The Northeast’s recent surge of COVID-19 is moving West, with California seeing a 30% jump in cases the past week. Upward infection trends continue in at least 21 states.

- Three different highly contagious Omicron subvariants are driving a new surge of COVID-19 infections in Florida, with the seven-day daily average of new cases rising to more than 10,200 Friday.

- U.S. regulators will meet this week to consider approving Novavax’s COVID-19 vaccine after trial data showed 90% effectiveness in virus prevention.

- The White House is looking at lifting some tariffs imposed on China under the previous administration, a bid to combat high inflation.

- Half of business owners expect to be operating in-person all the time a year from now, according to a Nationwide survey. Just 7.4% of American workers are teleworking due to COVID-19, down from a pandemic high around 35%.

- Apple, facing a unionization threat, announced it would create a flexible working environment for retail staff, including extending the minimum time between shifts to 12 hours from 10 hours.

- One in five Americans say inflation has made them reduce retirement savings, according to a survey.

- Despite the hot U.S. housing market, prices in many metro communities have yet to regain their pre-2008 valuations.

- Surging inflation is impacting the wedding industry, with a recent poll showing that nearly 75% of invited guests may be unable to attend due to rising costs of hotel rooms, airfare, clothing and gifts.

- Individual income tax collections are poised to reach $2.6 trillion in the fiscal year ending Sept. 30, a record in data going back over a century.

- New car sales fell to a 12.8 million annualized rate in May, an 11% drop from April.

- With the average new car price near a historic high of $47,000, younger adults have the highest delinquency rates on their auto loans.

- Tesla’s CEO walked back statements about reducing the company’s workforce by 10% this year, now saying the company will add jobs instead but expects salaried positions to remain mostly flat.

- Ford is looking at reducing dealer inventories and selling some electric vehicles directly to consumers in a bid to match Tesla’s innovative success.

- American Airlines predicts second-quarter revenue could swell 13% over 2019 levels, while non-fuel expenses rise a larger-than-expected 11%.

- Boeing says the current state of aircraft technology would not justify launching a new jetliner, despite Airbus’ widening lead in the narrow-body market.

International Markets

- Seven new COVID-19 cases prompted Shanghai authorities to lock down multiple neighborhoods only a day after city-wide restrictions were lifted last week.

- Beijing will further relax COVID-19 restrictions starting today, including dropping traffic bans and allowing indoor dining and normal work to resume.

- Starbucks has reopened 600 of its 940 China-based stores that were closed due to COVID-19 infections and government lockdowns.

- Hong Kong reported 515 new COVID-19 infections Sunday, a six-week high.

- Taiwan is recording record daily COVID-19 fatalities.

- COVID-19 fatalities in Africa should decline over 90% this year due to increased vaccination and natural immunity from prior infection.

- More news related to the war in Ukraine:

- Marriott hotels will pull out of Russia, citing the most recent wave of sanctions.

- Less than 25,000 vehicles were sold in Russia in May, an 84% decline from April and the lowest level since at least 2006, as sanctions and the fallout from the war in Ukraine take a toll on the nation’s auto industry.

- The European Central Bank will take its first steps this week to tighten monetary policy to combat inflation. Bank of America predicts the central bank will hike interest rates by 150 basis points this year.

- Turkey’s inflation rate soared to 73.5% in May, the highest level since 1998.

- Home prices fell for the third straight month in Toronto, an abrupt reversal for one of the world’s hottest housing markets as interest rates rise.

- Airbus delivered 47 planes in May, a 6% drop from the same time last year.

- Global carbon emissions in May were the highest in human history, researchers say.

Some sources linked are subscription services.