MH Daily Bulletin: June 9

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices jumped 2% to a 13-week high Wednesday on signs of rising demand in the U.S. and China.

- In mid-morning trading today, WTI futures were down 0.2% at $121.90/bbl and Brent was flat at $123.60/bbl.

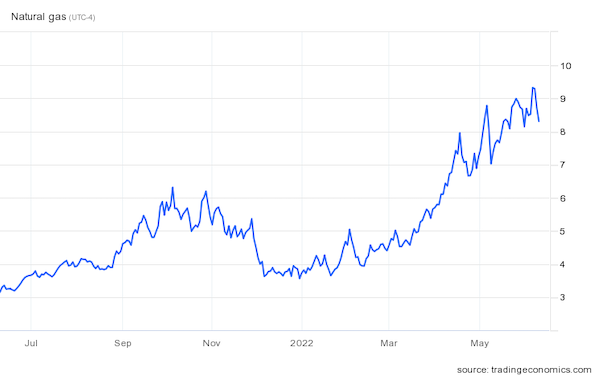

- U.S. natural gas prices fell over 6% Wednesday following an explosion at a Texas export facility operated by Freeport LNG, which could force more supplies to be kept domestically. The facility, which provides around 20% of U.S. LNG processing, will be down for three weeks.

- In mid-morning trading today, U.S. natural gas futures fell another 5.1% to $8.26/MMBtu.

- U.S. crude inventories rose by a surprise 2 million barrels last week, according to the federal government. At 416.8 million barrels, inventories remain some 15% below the five-year average for this time of year, while emergency crude supplies are at a three-decade low.

- U.S. gasoline stocks fell by a surprise 800,000 barrels last week as demand rose despite record-high prices.

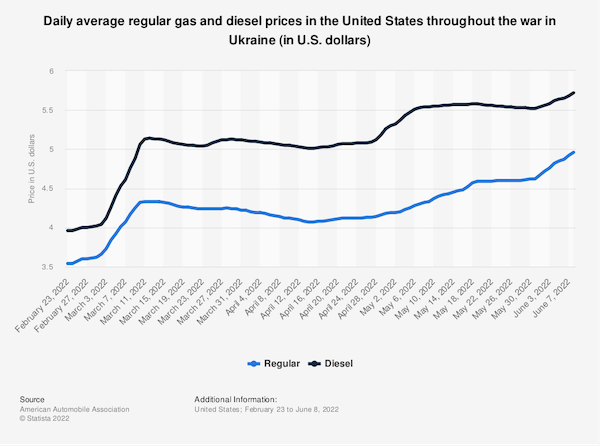

- The average U.S. gasoline price hit a record $4.955 a gallon Wednesday, according to AAA.

- Memorial Day gasoline consumption in the U.S. was 6% below pre-pandemic levels.

- British gasoline prices jumped the most in a day since the early 2000s on Wednesday and are now averaging the U.S. equivalent of about $8.60 a gallon.

- The UAE’s energy minister said efforts by OPEC+ to boost output are “not encouraging,” with the group’s output some 2.6 million bpd short of targets. Crude prices could continue rising as demand rebounds in China, the official said.

- More oil news related to the war in Europe:

- The U.S. is in talks with European allies about forming a buyers’ cartel to set a global cap on the price of Russian oil.

- Europe could face energy rationing amid supply shortages next winter, the International Energy Agency said.

- Reports suggest Russia’s Rosneft is not signing new crude deals with two Indian refiners due to a lack of supply.

- Russia’s oil output could fall 18% by the end of 2023 due to sanctions, according to U.S. forecasts.

- BP is shutting down a key oil pipeline to Georgia’s Black Sea coast this month, citing the safety of oil tankers in the Black Sea.

- Ukraine will halt all exports of coal, natural gas and oil to deal with domestic shortages this winter.

- Chevron’s CEO warned that consumers may start identifying high energy prices with the green energy push, hampering transition efforts.

- EU lawmakers failed to pass a massive overhaul of the bloc’s carbon market, throwing potentially stricter climate goals into jeopardy. Lawmakers did reach agreement to effectively prohibit the sale of new gas- or diesel-powered cars by 2035.

- Environmental groups are criticizing India’s inclusion of coal development in a legislative package aiming to boost renewable energy.

- PG&E, the U.S.’s largest utility, unveiled plans to reach net-zero emissions by 2040 while still using natural gas to produce power.

- A proposed German law would more than double the land available for onshore wind development.

Supply Chain

- Dangerous heat will settle over 22 million people in the Southwestern U.S. for the next several days, with temperatures expected to break records and exceed 110 degrees in some locations.

- The Baltic Exchange Dry Index fell 4.1% Wednesday to the lowest level in over a month, as rates fall for all vessel segments.

- Ocean carriers with strong transpacific operations will see the highest earnings in the second half of 2022, Alphaliner predicts.

- CF Industries is closing one of its two British fertilizer plants and cutting hundreds of jobs due to high energy costs.

- Pakistan is shortening its workweek in an effort to reduce energy and fuel consumption.

- Fuel shortages are hampering logistics activity across the African continent.

- At least a dozen large U.S. battery storage projects have been postponed, canceled or renegotiated as labor and transport bottlenecks crimp supplies.

- An EU proposal to label lithium as dangerous for human health would make it harder to supply the metal to electric-vehicle makers, firms say.

- A major Toyota supplier asked employees to take a day of leave this month to accommodate Toyota’s production shortfalls.

- Intel will receive over $7 billion in subsidies for a new chip factory in Germany, while Taiwan Semiconductor Manufacturing Co. dropped expansion plans for the nation.

- Miami-based Ryder System rejected a takeover bid by an activist shareholder group.

- An Israeli supply chain firm gained its first major customer for stamp-sized tracking tags it attaches to shipments.

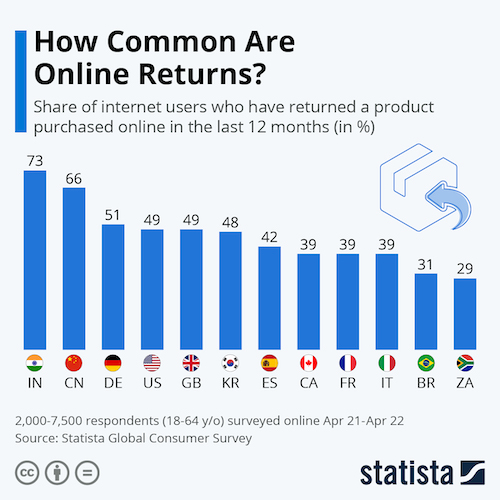

- Some firms are raising fees on costly returns following the pandemic’s burst in online shopping.

- New York-based Plug Power is building a new plant at Belgium’s Port of Antwerp-Bruges to produce 35 tons of green hydrogen per day by 2025.

- Talks to create a safe Black Sea lane for Ukrainian grain exports have stalled.

- Removing underwater mines near key Ukrainian ports could take months, according to the United Nations.

Domestic Markets

- The U.S. reported 210,091 new COVID-19 infections and 1,194 virus fatalities Wednesday.

- COVID-19 cases in Texas are up 31% the past two weeks.

- Alaska will end its COVID-19 state of emergency July 1.

- New York state agencies will no longer require unvaccinated employees to test weekly for COVID-19.

- COVID-19 vaccinations for children under age 5 could roll out as soon as June 21 following FDA approval.

- Fewer than half of fully vaccinated Americans are also boosted against COVID-19, a sharply lower rate than the U.K. and Canada.

- Nearly six times more U.S. children and teenagers died from COVID-19 in one year than from the flu.

- COVID-19 patients may be 25% more likely to develop a psychiatric disorder four months after infection, according to an Ohio State University study.

- First-time jobless claims jumped 27,000 last week to 229,000.

- A widely followed GDP gauge from the Atlanta Federal Reserve suggests the U.S. could head into recession territory as soon as the second quarter.

- Announced M&A deals in the U.S. soared in April and May to almost $80 billion.

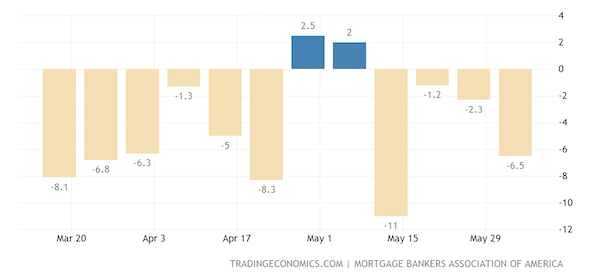

- U.S. mortgage applications, a proxy for demand, fell 6.5% last week to their lowest level in 22 years, according to the Mortgage Bankers Association.

- About 28% of U.S. home sales in March were paid in cash, the highest level since 2014.

- After seeing the highest out-migration among U.S. metro areas during the pandemic, in-migration to Manhattan is now surging past pre-pandemic levels despite soaring home and rent costs.

- More manufacturers are quietly shrinking package sizes without lowering prices, a practice dubbed “shrinkflation.”

- Finance chiefs at major retailers are struggling to forecast quarterly sales as companies navigate ongoing uncertainty over shipping and consumer demand.

- Campbell Soup joined Kellogg and Kraft Heinz in raising its annual sales forecast on expectations of more price hikes and easing logistics constraints.

- Intel joined the string of other tech companies putting a freeze on new hiring as it seeks ways to cut costs.

- Spirit Airlines postponed its Friday stockholder meeting as it courts takeover bids from rivals Frontier Group and JetBlue.

- Used-car prices rose 0.7% in May, the first increase in five months.

- More automakers are backing the U.S. administration’s efforts to restore California’s ability to set its own strict vehicle emissions standards.

- A group of Trader Joe’s employees in Massachusetts will hold a union election, joining a string of U.S. retail workers organizing for higher pay and better benefits.

- The U.S. Interior Department will phase out single-use plastic products on public lands by 2032, including at national parks.

International Markets

- Global COVID-19 cases dropped 12% and fatalities dropped 22% last week, according to the World Health Organization.

- A week after lifting many COVID-19 restrictions, Shanghai will lock down a district with 2.7 million residents for mass testing Saturday.

- Chinese officials are worried that wind gusts will bring COVID-19 into the country across its border with North Korea.

- Aiming to maintain its rigorous COVID-19 controls, major Chinese cities have built tens of thousands of testing sites within a 15-minute walk of each other.

- Taiwan reported a record 159 COVID-19 fatalities Wednesday, while new infections crossed 80,000.

- New COVID-19 cases in Israel are rising as officials consider giving out a fifth vaccine dose.

- Ontario will end most of its remaining mask mandates Saturday.

- Germany will drop COVID-19 vaccination and testing requirements for incoming travelers starting August 31.

- Japan will require that tourists wear face masks and take out medical insurance against COVID-19 as the nation begins reopening its borders this week.

- South Korea lifted quarantine requirements for unvaccinated travelers who test negative for COVID-19 upon arrival.

- More news related to the war in Europe:

- Some Russian airlines are considering relocating to Turkey to avoid crushing Western sanctions.

- A rule change in Britain will allow stricter enforcement of sanctions against firms doing business with Russia.

- Russian consumer inflation hit an annual 17.1% in May, slightly lower than April’s rate.

- The European Central Bank is expected to end a key pandemic bond-buying program and map out its plan to raise interest rates for the first time in more than a decade when it meets today.

- Japan’s beleaguered currency is nearing its weakest level in 24 years after falling for five days straight.

- Poland’s central bank hiked its main interest rate 75 basis points to 6%, a 14-year high.

- Budget European airline Wizz Air says a lack of airport staff is causing higher costs and major disruptions to its flight schedules.

- Cupra, Volkswagen’s Spanish subsidiary, plans to release three new electric vehicle models by 2025.

- A Chinese internet company’s concept electric vehicle is fully autonomous, has no door handles and can be fully controlled via voice recognition.

- The price tag of global food imports is expected to total $1.81 trillion this year, surpassing last year’s all-time high by $51 billion.

- Hundreds of millions of people will be affected by higher annual flooding due to rising water levels across the globe this century:

Some sources linked are subscription services.