MH Daily Bulletin: June 10

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell half a percent Thursday after new lockdowns were announced in Shanghai, threatening demand.

- In mid-morning trading today, WTI futures were down 0.1% at $121.40/bbl and Brent was off 0.5% at $122.50/bbl.

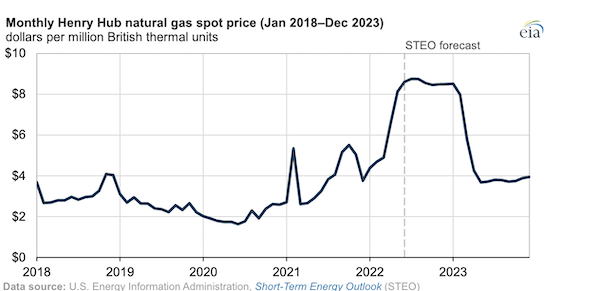

- U.S. natural gas prices rose about 3% Thursday on news of unusually low inventories compared to the five-year average. In mid-morning trading, futures were down 2.1% at $8.77/MMBtu.

- British natural gas prices spiked as much as 39% Thursday on news that Freeport’s fire-damaged export facility in Texas — which provides a fifth of all U.S. LNG exports — will shut down for three weeks. Benchmark EU prices also jumped.

- The U.S. government expects natural gas prices to average $8.71/MMBtu this summer and remain high throughout the year:

- The average U.S. gasoline price touched $4.986 a gallon Friday morning, with stockpiles down to an eight-year low.

- The U.S. Internal Revenue Service raised its mileage rate for calculating business tax deductions, a rare midyear change in response to surging gasoline prices.

- China’s crude oil imports rose nearly 12% in May from a year ago, while exports of refined oil products were down 40%.

- The U.S. Department of Energy closed on a $504.4 million loan guarantee for the world’s largest hydrogen storage facility to be built in Utah.

- More oil news related to the war in Europe:

- British officials met with representatives of Shell this week to discuss boosting North Sea production.

- The EU plans to import more gas from Egypt and Israel to reduce dependence on Russian supply.

- Russia says it has no plans to cut gas supplies to any more countries in Europe.

- The White House is urging lawmakers to back a $4.3 billion plan to purchase enriched uranium from domestic producers instead of Russian suppliers.

Supply Chain

- Temperatures could reach 116 degrees in Phoenix this weekend as a dangerous heat wave envelops the U.S. Southwest. Power demand in Texas will hit all-time highs every day from now to Monday.

- An oil spill closed shipping on a major route between Lake Superior and Lake Huron Thursday.

- The U.S. marine economy shrank 5.8% in the first year of the pandemic, outpacing overall GDP losses, new government data shows.

- Automation is shaping up to be a key issue in high-stakes contract negotiations between unionized dockworkers and West Coast shipping lines and cargo handlers.

- U.S. ports and their tenants plan to invest almost $33 billion annually by 2025, according to the American Association of Port Authorities.

- Cars are piling up at Georgia’s Port of Brunswick, the second largest carport in the U.S., due to a shortage of truckers to transport them.

- North European container ports say they are running at capacity with the peak shipping season still to come.

- Out-of-stock rates for U.S. baby formula rose to 74% nationally for the week ended May 28.

- Lumber prices fell to a nine-month low this week as U.S. mortgage demand plummeted.

- China’s May exports jumped a larger-than-expected 16.9% from a year earlier as easing COVID curbs allowed some factories to restart.

- Airbus saw its deliveries fall 6% in May from a year ago amid continued supply shortages.

- Boeing’s Air Force One redesign will likely see further delays due to a shortage of mechanics.

- Taiwan Semiconductor Manufacturing Co. warned it may not be able to increase production as quickly as hoped over the next two years due to manufacturing equipment shortages.

- White House efforts to pass a $52 billion bill to boost domestic semiconductor production is at risk of stalling.

- Orders for workplace robots in the U.S. increased a record 40% in Q1 compared to the same period in 2021, according to the Association for Advancing Automation.

- Tesla’s Chinese production tripled in May even though its Shanghai factory only recently emerged from COVID lockdowns.

- A surge in battery metal prices means it could take years for electric vehicles to become as affordable as conventional cars.

- Panasonic plans to quadruple its production of electric vehicle batteries by 2028.

- Volkswagen is scouting the U.S. for an in-house battery cell manufacturing plant.

- LG Energy Solution broke ground on nickel processing plants in Indonesia as part of its $9.8 billion plan to build electric-vehicle batteries in the country.

- Truckload carrier Heartland Express acquired Pennsylvania-based Smith Transport for $170 million.

- U.S. regulators levied a $2 million fine on Hapag-Lloyd for improperly charging a detention fee in mid-2021.

- Brazilian mining giant Vale plans to buy 14 new dual-fuel very large crude carriers capable of running on methanol at a cost of $1.5 billion.

- Chaotic commodity markets pushed net profit at Swiss trading giant Trafigura 29% higher in the first half of 2022 compared to a year ago.

Domestic Markets

- The U.S. reported 115,620 new COVID-19 infections and 285 virus fatalities Thursday.

- COVID-19 cases in Los Angeles County are up 118% over the past month.

- Arizona saw its sixth straight week of rising COVID-19 infections.

- Tourist destinations Miami-Dade County in Florida, Honolulu County in Hawaii, and San Juan in Puerto Rico are experiencing the fastest infection rates in the nation and test positive rates exceeding 20%.

- Half the officers at a southwest Louisiana town’s police department, including the chief, are out sick with COVID-19, as cases pick up across the state.

- New COVID-19 cases in New York City fell 26% in the two weeks to June 5, with officials declaring the latest wave ended.

- Maine’s COVID-19 infection rate dropped by nearly 75% over the past week.

- Beginning Sunday, the CDC will end its COVID-19 testing requirement for air travelers entering the U.S.

- About 18 of the nation’s largest 500 school districts are keeping masking requirements for summer school.

- The White House will repurpose $10 billion in funding for COVID-19 tests and equipment to provide more antivirals and vaccines, as Congress stalls on approving more dollars.

- The U.S. administration has made 10 million COVID-19 vaccine doses available to states and health providers ahead of expected approval of the shots for children under age 5 next week.

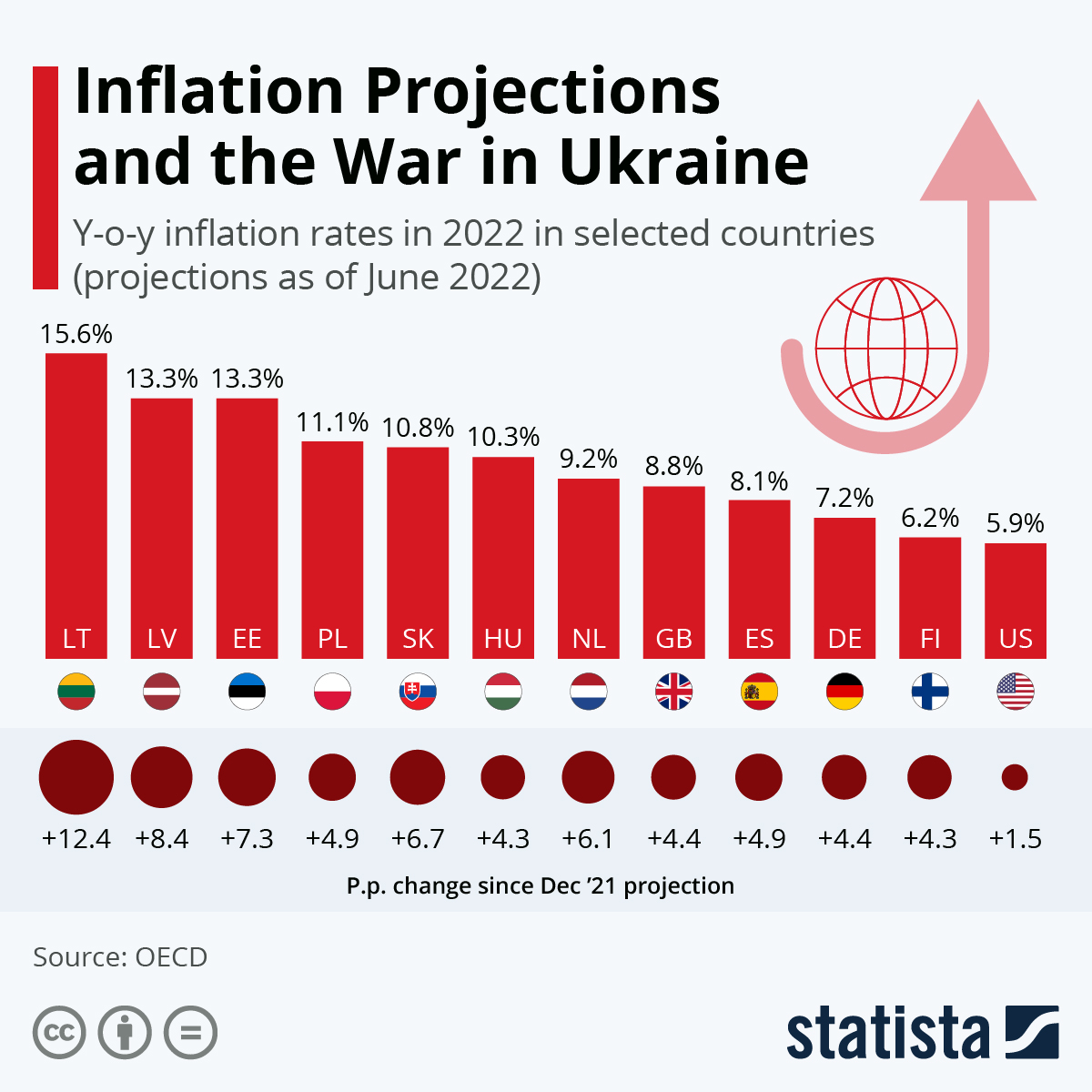

- Consumer prices rose 8.6% in May from a year ago, the highest inflation rate in four decades.

- U.S. inflation for goods sold online rose 2% in May, down from 2.9% the previous month as consumers pull back on discretionary spending.

- Consumers could benefit this summer as stores offer discounts in the hopes of clearing out unwanted merchandise.

- Active U.S. home listings rose by 13% last week while weekly price growth fell for the first time in almost two months, according to realtor.com.

- Inbound interest in Austin homes dropped to one-fifth of its 2021 level in April and May, as higher interest rates and a fear of overpaying cool down the pandemic’s hottest housing market.

- The U.S. administration proposed new standards for its program to build a national network of 500,000 electric-vehicle charging stations by 2030, which will require a station to appear every 50 miles on federal highways and no more than a mile off the road.

- Tesla electric vehicle (EV) registrations soared 52% in January-April from the same time a year ago, while Ford saw the most EV registrations in the mainstream segment.

- U.S. auto-safety regulators are probing further into crashes related to Tesla’s self-driving software, moving closer to a potential safety recall.

- U.S. renewable energy credits may allow firms to bypass meaningful emissions reductions in favor of misleading gains on paper.

International Markets

- Shanghai will lock down several city districts this weekend to mass test millions of people as COVID-19 cases continue to emerge, risking more disruption after a grueling two-month shutdown.

- India added 7,240 new COVID-19 cases Thursday, the most since March.

- Japan eased its strict border restrictions for foreign tourists starting today.

- AstraZeneca’s COVID-19 antibody treatment cut the chance of severe disease by 88%, according to company trials.

- South African researchers say COVID-19 patients are more likely to be hospitalized or develop diabetes or hypertension in the months after their illness.

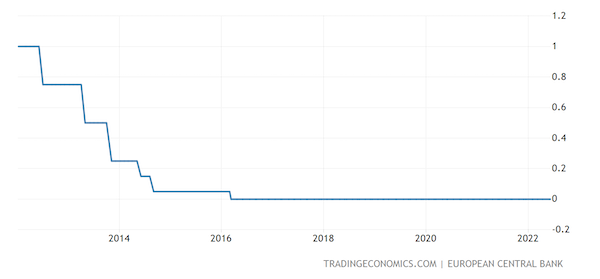

- The European Central Bank laid out plans to increase interest rates by 25 basis points in July, the first hike in more than a decade.

- More news related to the war in Europe:

- Almost 1,000 global companies racked up more than $59 billion in losses from their Russian operations since late February.

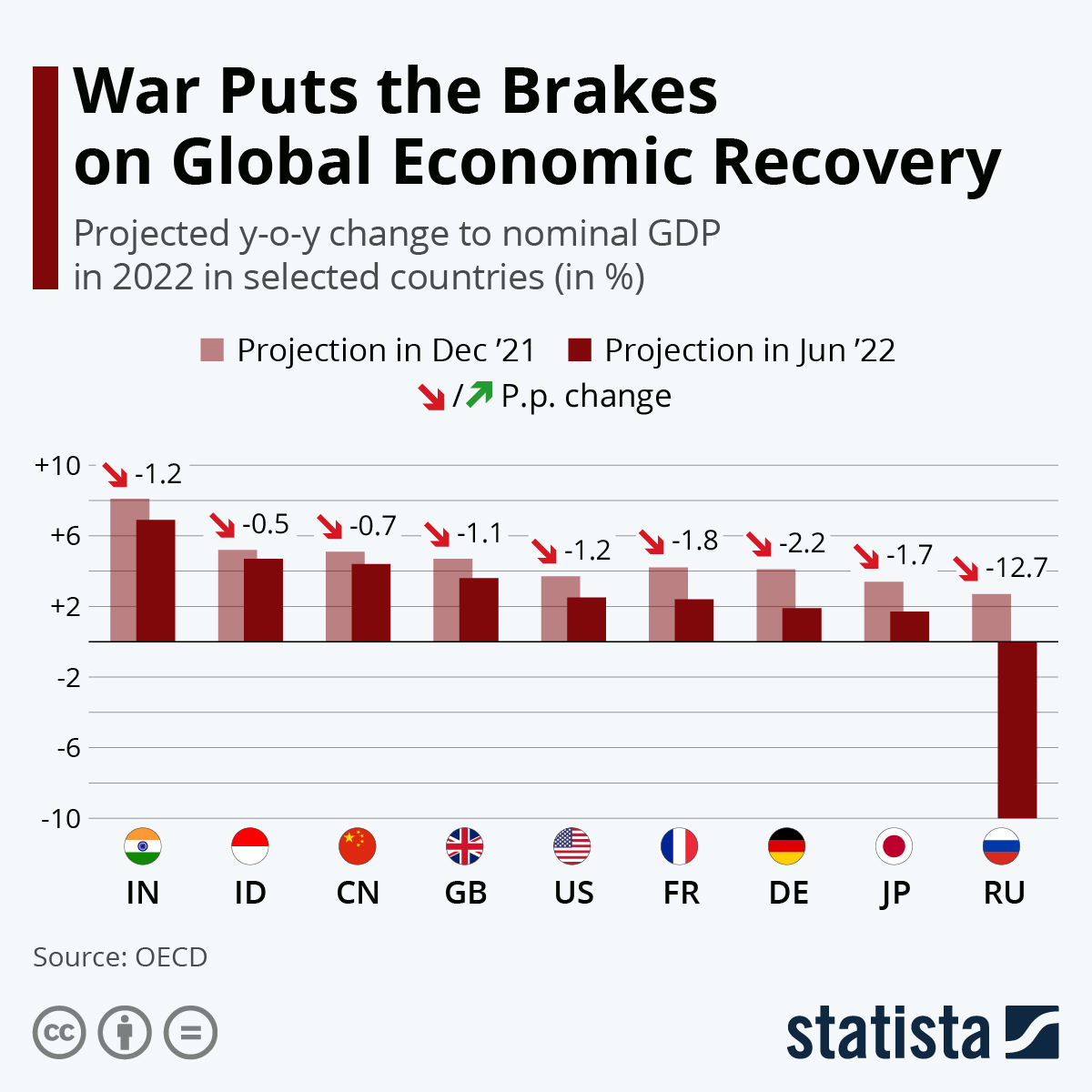

- GDP growth forecasts have been widely revised downward since December 2021 due to the war in Ukraine:

- China’s inflationary pressure increased an annualized 2.1% in May as lockdowns hammered domestic demand.

- The Czech Republic’s headline inflation jumped 16% in May, a 30-year high.

- Peru’s central bank hiked its interest rate for the 11th straight month to 5.5% in June.

- Global airline capacity surpassed 100 million seats for the first time since early 2020.

- Over 1,000 pilots in Denmark, Norway and Sweden are threatening to strike later this month, while recent walk-offs at France’s Charles de Gaulle nixed a quarter of the airport’s flights.

- Over 6% of departures were canceled at Canada’s busiest airport in Toronto last week, as labor shortages wreak havoc on airport operations.

- GM will start production of its Chevrolet Tracker SUV in Argentina next month, with 80% of output headed to Brazil and Colombia.

- India plans to ban straws packaged with small packs of juices and dairy products on July 1.

- Australian researchers claim to have found a species of worm that can live and grow on a strict diet of styrofoam, a potential recycling method.

Some sources linked are subscription services.