MH Daily Bulletin: June 14

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose slightly in volatile trading Monday, buoyed by a growing belief that even an economic slowdown would fail to free up supplies.

- Brent’s nearest futures contract traded more than $3 higher for the next month yesterday, indicating extraordinarily scarce supply.

- In mid-morning trading today, WTI futures were up 1.7% at $123.00/bbl and Brent was up 1.8% at $124.50/bbl.

- U.S. natural gas futures plunged 18% to $7.05/MMBtu in mid-morning trading when Freeport LNG, a major exporter, said repairs may take until year end at its Louisiana facility that was damaged by fire last week.

- The average U.S. gasoline price hit $5.10 a gallon Monday, entering an eighth week of gains. Georgia ($4.48 a gallon) has the cheapest gas, while California ($6.43 a gallon) has the most expensive.

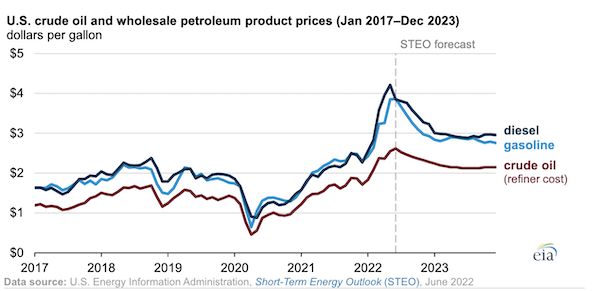

- The U.S. government predicts a big boost in U.S. shale production next month on the back of record production from the Permian Basin, partly a response to higher-than-normal refinery margins for wholesale petroleum products:

- U.S. oil producers’ focus on rewarding shareholders rather than boosting output is costing the market nearly 450,000 bpd, according to some estimates.

- BP will divest its last interest in Canada’s oil sands to Canadian firm Cenovus Energy for $466 million as the British major shifts to offshore oil in eastern Canada.

- Norwegian oil firms reached an agreement in principle to avoid a worker strike at nine fields.

- Libya has lost over 90% of its oil production amid an expanding political crisis that is shutting down more ports and fields.

- Striking South Korean truckers are considering blocking coal shipments to power plants and deliveries to and from petrochemical complexes.

- Britain is looking to revamp its pricing system for power that is currently linked to surging natural gas prices.

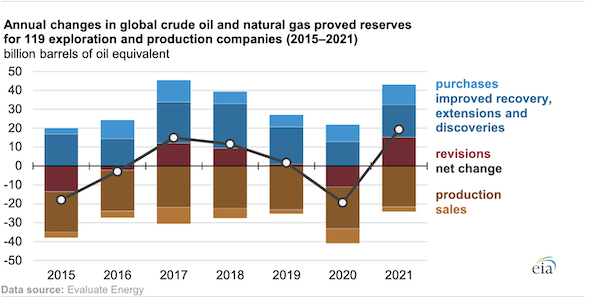

- Over 100 publicly traded oil and gas firms spent 28% less on exploration and development last year compared to the pre-pandemic average, while proven reserves rose above their multiyear levels:

- Old electric vehicle batteries are getting second lives as building blocks for large-scale energy-storage systems.

- More oil news related to the war in Europe:

- Indian refiners almost tripled receipts of Russian oil in May. Asian buyers now take nearly half of all crude shipped from Russian ports.

- Germany may bail out a Gazprom business unit that it expropriated earlier this year after Russia halted gas flows to the unit and forced it to buy at much higher prices on the spot market.

- A major pipeline that pumps Russian gas to Europe will undergo regular maintenance this summer, halting flows for two weeks in July.

- Tensions are rising between Ukraine’s state energy company and its Russian counterpart, threatening to sever an influx of money into Ukraine’s coffers and a primary conduit of Russian natural gas into Europe.

- Ukrainian lawmakers voted to suspend gas, coal and fuel oil exports amid severe domestic shortages.

- The EU is in talks with Israel about it sending gas to Europe via Egypt, which has LNG export terminals.

- More European producers of chemicals, fertilizer, steel and other energy-intensive goods are shutting down amid tougher competition from manufacturers in countries with lower energy costs.

Supply Chain

- Extremely high temperatures will remain in the southwestern and central U.S. until midweek, with more than 235 million people expected to see temperatures over 90°F. Temperatures hit 122°F in California’s Death Valley, breaking a century-old record.

- Arizona’s rapidly expanding Pipeline Fire forced hundreds to evacuate and threatened thousands more evacuations near Flagstaff.

- Pakistan, the fifth largest country in the world by population, is seeing blackouts of 12 hours or more due to severe energy shortages.

- South Korean industries have lost roughly $1.2 billion as of Sunday due to an ongoing trucker strike, officials estimate.

- Bombardier shares fell as much as 17.4% Monday as workers on a key business jet program in Montreal walked off the job over a contract dispute.

- A new bill would give the U.S. government more oversight of maritime shipping, the first major overhaul of maritime rules in over two decades.

- Congestion is rising at China’s Port of Ningbo as shippers divert there from Shanghai, where lockdowns were renewed over the weekend.

- German ports are bracing for backups and congestion amid stalled contract negotiations with dockworkers.

- Prologis, the world’s largest warehouse operator, agreed to buy rival Duke Realty in a $26 billion deal, part of a rising trend of industry consolidation amid cooling tenant demand.

- California-based Applied Materials, maker of chip-manufacturing equipment, lost $150 million in sales in the latest quarter due to delayed parts shipments from China.

- China’s orders for chip-manufacturing equipment from overseas suppliers rose 58% in 2021, making it the biggest market for the second year in a row.

- Issues with steering parts forced a recall of over 105,000 vehicles at 29 companies, including most heavy-duty truck manufacturers.

- Online-only apparel retailers are facing steep losses as consumers return to retail shopping and supply chain disruptions mount.

- Britain wants to scrap some post-Brexit trade rules for Northern Ireland, raising trade tensions between the nation’s newly independent economy and the EU.

- Malaysia will introduce a moving price ceiling for consumer products based on the changing costs of supply chain inputs.

- CMA CGM purchased its fourth boxship in less than a year from Greece’s Tsakos Shipping & Trading.

- Amazon’s e-commerce services were down for thousands of users Monday.

- Amazon tripled its built industrial space in North America between 2020 and 2022.

- Amazon will start delivering its first packages by drone to residents of Lockeford, California, later this year.

- Walmart is looking to expand its e-commerce fulfillment service to more sellers in the U.K.

- A new rule from the International Maritime Organization will require vessels traveling in the Mediterranean Sea to slash pollution-heavy sulfur content in fuel.

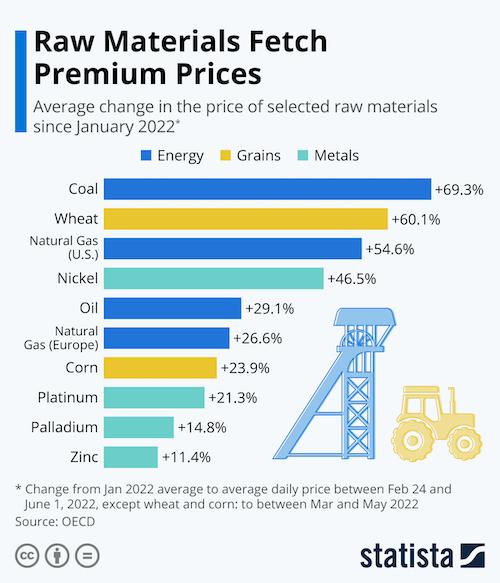

- Coal and wheat top the list for year-to-date commodity price increases, with natural gas and nickel closely in tow:

Domestic Markets

- The U.S. reported 117,279 new COVID-19 infections and 268 virus fatalities Monday.

- COVID-19 infections in New York fell 19% last week.

- COVID-19 infections in Massachusetts are down 31% the past several weeks.

- A spring survey of 3,600 U.S. hourly workers found two-thirds went to work while sick with COVID-19.

- A panel of FDA advisers will meet today to consider Moderna’s COVID-19 vaccine for children aged 6 to 17, what would be the U.S.’s second offering for the age group behind Pfizer’s shot.

- U.S. stock selloffs deepened Monday, with the S&P 500 entering a bear market for the first time since 2020.

- More Wall Street firms predict the Federal Reserve will raise its benchmark interest rate by more than 50 basis points when it meets tomorrow. Economists at JPMorgan Chase and Goldman Sachs expect a 75-basis-point hike.

- The Producer Price Index was up 0.8% in May and 10.8% year over year but showed some moderation in areas other than food and energy.

- Consumer inflation expectations for the year ahead rose to 6.6% in May, higher than April and matching a record from March.

- Nearly 70% of economists in a Financial Times poll expect the U.S. to fall into recession by the first half of 2023.

- A bipartisan legislative proposal would give the U.S. government sweeping new powers to block billions in investment in China, although the measure is attached to a broader bill with dim hopes of passage.

- U.S. existing home sales are forecast to drop 6.7% this year, according to realtor.com. Home prices are already down about 5% to 10% in some areas amid the beginnings of a market cooldown.

- U.S. retailers will likely begin offering steep discounts on consumer electronics, large furniture and casual clothing in early July in an effort to reduce excess inventories.

- United Airlines saw a spike in searches for international travel after the U.S. ended its 17-month-old COVID-19 testing requirement for incoming travelers.

- Demand for airplanes is strong and will continue growing as airlines replace aging fleets, buy more efficient models and continue to see passenger growth, Boeing’s chief executive said.

- Executives from major automakers are calling for the White House to raise their 200,000-unit sales cap before electric vehicle (EV) consumer tax credits disappear, citing continued high production costs for EVs.

- GM’s chief executive said the automaker is selling every truck it can build and expanding North American truck-building capacity even as gasoline prices hit record highs.

- Oracle’s sales rose 5% in the latest quarter to $11.84 billion, soothing concerns over the bellwether business firm’s performance amid growing uncertainty for technology companies.

- Wegmans, a regional U.S. supermarket brand, is removing single-use plastic bags from its North Carolina and Virginia stores.

International Markets

- A COVID-19 outbreak stemming from a bar in Beijing added 74 cases Monday, the most in three weeks, keeping millions under targeted lockdowns and mandatory testing regimens. Shanghai also reported dozens of new cases Monday.

- Weekly COVID-19 infections in the U.K. rose for the first time in two months.

- Two new subvariants of Omicron — BA.4 and BA.5 – are spreading faster than other variants and will likely become Europe’s dominant strains within weeks.

- Filipino police will begin arresting people who defy mask mandates.

- South Korean COVID-19 cases fell to a five-month low Monday as the country returns to pre-pandemic normalcy.

- The CDC raised its travel warning for Mexico to Level 3 (High) due to the rising risk of COVID-19 infection.

- Global wealth grew 10.6% in 2021, the fastest rate in a decade.

- The Bank of Japan is likely to keep interest rates ultra-low when it meets this Friday despite mounting concerns over high import prices caused by a falling yen.

- The global advertising industry, which typically tracks the broader health of economies, is expected to grow 8.4% this year despite gathering economic headwinds.

- JPMorgan Chase and Goldman Sachs will no longer handle trades of Russian debt following the White House’s surprise tightening of investment rules last week.

- LATAM Airlines Group, Latin America’s largest airline, asked a U.S. judge to approve $2.75 billion in new loans to fund the company’s exit from Chapter 11.

- London’s Heathrow Airport saw 5.3 million passengers in May, the most since March 2020.

- Foxconn is partnering with a state-owned oil and gas producer in Thailand to manufacture battery electric vehicles.

- Corporate plans to slash greenhouse gas emissions fall short of what is needed to combat climate change, with “major credibility gaps” found among the world’s largest companies, according to new research.

- Researchers say air pollution has cut global life expectancy by two years, with five-year drops reported for people in South Asia.

Some sources linked are subscription services.