MH Daily Bulletin: June 20

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell 6% to a four-week low Friday on worries that higher interest rates could slow the global economy, cutting into energy demand. There will be no U.S. trading today due to the Juneteenth holiday.

- Active U.S. drilling rigs rose by seven last week to 740, about 270 higher than the same time last year.

- Freeport LNG declared force majeure on LNG exports from its fire-damaged Gulf Coast location until September, confirming earlier reports.

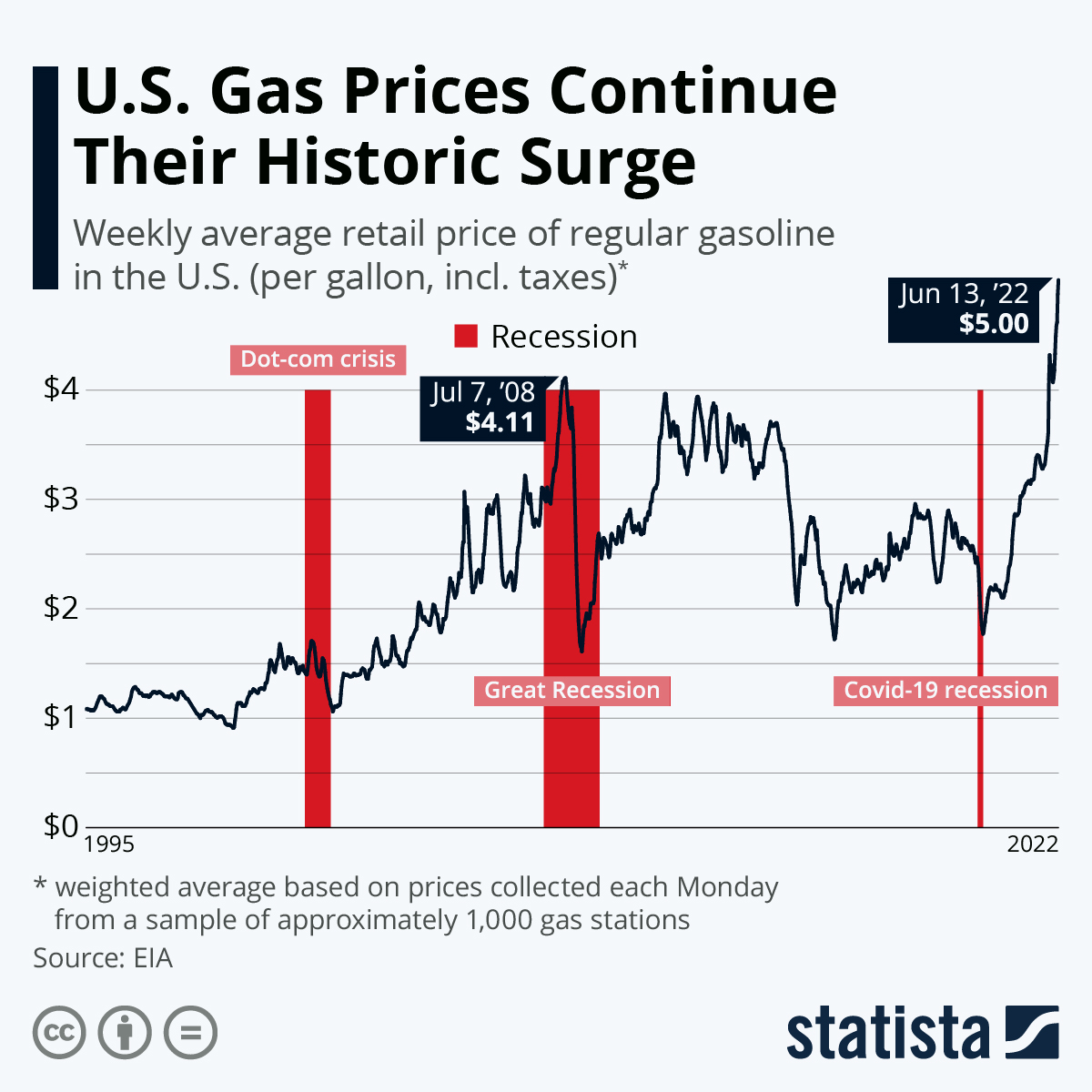

- The average U.S. gasoline price fell to $4.99 a gallon Saturday, marking the first weekly decline in nine weeks after hitting an all-time high of $5.016. The U.S. administration is evaluating a pause on the federal gas tax to bring down prices, while a high-level meeting with U.S. refining executives is set for Thursday.

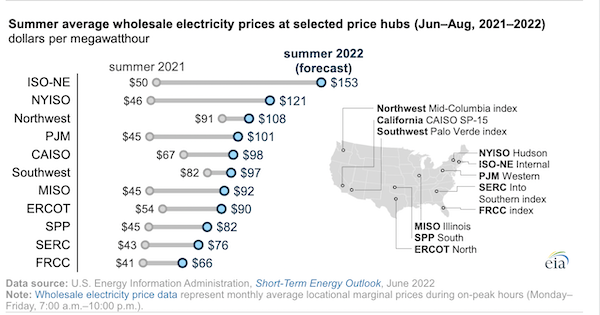

- The U.S. government expects wholesale electricity prices this summer to be significantly higher than last year, including a near doubling in some Northeastern states.

- More oil news related to the war in Europe:

- Russia continued restricting gas supplies to Europe over the weekend at a time when scorching heat boosted demand. Italy, Germany and Slovakia are seeing half or less than half of requested volumes, while France has received zero Russian gas from Germany since Wednesday. Prices in Europe and the U.K. are about 50% higher than a week ago.

- Germany and Italy are preparing an emergency ramp-up of coal use to make up for lowered deliveries of Russian gas. Germany is also providing incentives for companies to curb gas consumption.

- Russia expects its oil exports to rise in 2022 despite Western sanctions and Europe’s embargo, Moscow officials said. The rise will largely come from buyers in Asia, whose imports of Russian gas rose sharply year-to-date.

- An oil tanker chartered by Italy’s Eni will soon depart Venezuela with the nation’s first cargo bound for Europe in two years.

- Tanker operators that had been hauling sanctioned Venezuelan and Iranian crude have shifted their business to Russian cargoes.

- India’s purchases of Russian coal have spiked in recent weeks despite global sanctions on Moscow, as Russian sellers offer discounts of up to 30%.

- The world’s leading industrial nations may discuss imposing price caps on imports of energy from Russia at a summit later this month.

- With the OPEC+ pact ending this August, leader Saudi Arabia and other OPEC members will be tasked with weighing Russia’s continued membership in the weeks ahead.

- Ecuador’s state-owned petrochemicals company declared force majeure due to protests by indigenous groups concerning the state of the economy.

- Brazil’s Petrobras hiked diesel prices by 14% and gasoline prices by 5% Saturday as the country grapples with soaring inflation.

- Chinese state-owned energy companies are negotiating investments in the expansion of Qatar’s North Field gas project, the world’s largest offshore gas deposit.

Supply Chain

- One of the earliest-recorded summer heatwaves in Europe broke several all-time temperature records in France last week, while temperatures in Spain surpassed decades-old highs nearing 110°F.

- Lake Mead, the largest reservoir in the Western U.S., is just 28% full amid a drought that scientists say is the region’s worst in a millennium.

- A surge of tropical moisture will bring needed rain to much of the Intermountain U.S. West this week and could potentially cause flooding.

- Yellowstone National Park will partially reopen this week after catastrophic flooding destroyed bridges and roads and drove out thousands of tourists.

- Monsoon rains in northeastern Bangladesh and India stranded 6 million people Saturday in the region’s worst flooding since 2004.

- Over 50,000 British rail workers will strike for three days this week in a dispute over pay and job cuts, the nation’s largest train strike in 30 years.

- The average U.S. diesel price hit a record-high $5.798 a gallon Friday.

- Major U.S. ports will move 2.31 million TEUs this month, roughly equal with May and up 7.5% from the same time last year, according to the Global Port Tracker. The Port of Los Angeles moved 967,900 TEUs in May, its third busiest month ever, with the port on pace to tie last year’s record annual cargo volume.

- U.S. state and local officials are postponing more critical infrastructure projects as inflation drives up costs.

- Several autonomous trucking firms plan to deploy fully driverless trucks on Texas’ interstates next year.

- Freight-equipment provider Pallet Logistics acquired supply-chain services company Propak for an undisclosed sum.

- Much like the oil industry, mining companies are prioritizing dividends and share buybacks over spending, keeping supplies tight for raw materials critical to the budding energy transition.

- Taiwan Semiconductor Manufacturing is sticking to its 30% revenue growth forecast for this year despite mounting economic troubles in its biggest markets.

- Quarterly profit at Spanish fashion giant Inditex surged 80% as consumers flocked back to stores.

- West Coast farmers are warning of food shortages caused by delayed freight shipments of feedstock and other key supplies.

- Russia’s invasion disrupted over half the global supply of sunflower oil, a more sustainable alternative to palm oil that consumer-goods manufacturers have spent years sourcing in greater quantities.

Domestic Markets

- The U.S. reported 15,119 new COVID-19 infections and 36 virus fatalities Sunday.

- Officials expect Los Angeles County to reimpose an indoor mask mandate due to a rise in COVID-19 cases.

- The CDC recommended children as young as six months old receive newly authorized COVID-19 shots, with first doses set to begin today.

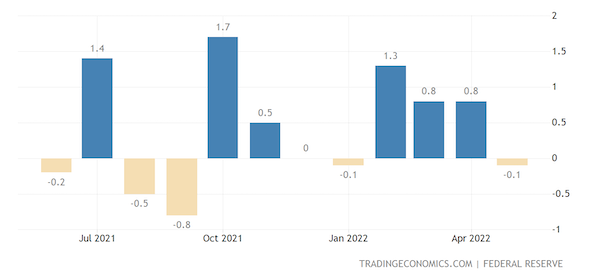

- U.S. factory output unexpectedly fell 0.1% in May, the first decline since January.

- Economists are dramatically raising expectations for a U.S. recession within the next year, as Americans begin to cut back on spending for haircuts, eating out and other routine expenses.

- A governor of the Federal Reserve said the central bank may raise interest rates another 75 basis points at its July meeting, while other Fed officials say it could take two years for inflation to fall to the desired 2% target.

- Finance executives are pulling forward more debt sales planned for the second half of 2022 and retiring more debt with excess cash in the face of rapidly rising interest rates.

- Small companies are losing against their large rivals in the battle for employees, with employment at companies with fewer than 50 people falling in three of the past four months.

- The U.S. president plans to speak with his Chinese counterpart as talks grow about potentially easing U.S. tariffs on China.

- U.S. home foreclosures are about half the peak level of the 2008 recession, as high prices and tight inventory give struggling owners a better chance of selling.

- U.S. home builders are contending with both falling demand and high material and labor costs, leading to more abrupt discounts in some of the pandemic’s hottest real estate markets.

- Over 40% of homeowners report delaying improvements and maintenance due to inflation.

- Tens of thousands of U.S. flights were canceled or delayed from Friday to Sunday, as high storm activity collided with a surge of summer travelers.

- American Airlines scrapped three U.S. cities from its route map and will give a raise to 14,000 pilots as labor shortages hamper its busy summer operations.

- The average payment on a new vehicle in the U.S. is up to a record $656 per month, according to Edmunds.com.

- Apple employees at a retail store outside Baltimore voted to unionize, a first in the tech giant’s sprawling U.S. retail operations.

- Lululemon Athletica and H&M Group are among backers of a $250 million fund supporting efforts to cut carbon emissions in the fashion industry’s supply chain.

- Global hotelier IHG is partnering with Unilever to eliminate single use plastics by 2030.

- After imposing one of the strictest plastic bag bans in the country earlier this year, New Jersey is considering legislation to impose Extended Producer Responsibility in the state.

International Markets

- COVID-19 infections are up in all four nations of the U.K., with the increase attributed to the fast-spreading BA.4 and BA.5 subvariants of Omicron. The variants appear to resist the antibodies of past infections and vaccinations.

- The number of Israeli COVID-19 patients in critical condition spiked 70% last week on spreading cases of the BA.5 subvariant of Omicron.

- COVID-19 vaccination rates in 14 African countries remain below 10% despite recent gains among vulnerable populations.

- Recent financial woes are having an outsized effect on emerging markets, with the World Bank cutting its growth forecast for developing countries from 4.6% to 3.4% this year.

- China’s e-commerce giant JD.com posted its slowest sales growth ever for its annual shopping festival in the 18 days to Sunday at roughly a third of last year’s levels.

- Airlines across the globe are seeing rising labor strikes and shortages, forcing the cancellation of thousands of flights and causing hours-long queues at major airports.

- A U.S. court has approved LATAM Airlines Group’s $8 billion bankruptcy reorganization plan, from which the carrier hopes to emerge in the second half of the year.

- Qantas Airways and Airbus are pairing up to invest $200 million to boost development of sustainable aviation fuels in Australia.

Some sources linked are subscription services.