MH Daily Bulletin: June 21

News relevant to the plastics industry:

At M. Holland

- M. Holland will be charging a fee to recover the reinstated Superfund Excise Tax for applicable U.S. orders starting July 1, 2022. Clients will be notified of details next week. Learn more about the tax in this Plastics News article.

- M. Holland is sponsoring AMI’s Polymers in Cables on June 28-29 in Philadelphia, Pennsylvania. This conference covers the latest technical developments, manufacturing solutions and trends in the wire and cable industry. M. Holland is also hosting the event’s networking reception on June 28 at 5:30 pm ET!

- If you’re attending AMI’s Polymers in Cables in Philadelphia, mark your schedule for M. Holland’s technical session:

- Paul Lorigan, Manager of Technology & Laboratory Services for M. Holland, will be giving a presentation on new cable applications for fluoropolymers, graphene and sustainability solutions. Don’t miss his talk on June 29 at 11:50 am ET.

Supply

- Brent futures rose 0.9% in a volatile trading Monday, while WTI rose half-a-percent in subdued trading due to the Juneteenth holiday.

- In mid-day trading today, WTI futures were up 1.4% at $111.10/bbl, Brent was up 0.8% at $115.10/bbl, and U.S. natural gas was down 1.2% at $6.86/MMBtu.

- Weekly U.S. crude output is back to pre-pandemic levels as the nation’s active rig count slowly grows.

- The average U.S. gasoline price fell slightly for a second day on Monday to $4.98 a gallon but will likely rise heading into the Fourth of July weekend. The White House continues to weigh pausing the 18.4-cent federal gas tax to bring down prices, which could take effect before the holiday.

- Venture Global LNG struck the first binding deal by a U.S. natural-gas exporter to supply a German energy company starting in 2026.

- As American refiners deal with tightening supplies of blendstocks to make premium gasoline, flows from Asia to the U.S hit the highest level in three months.

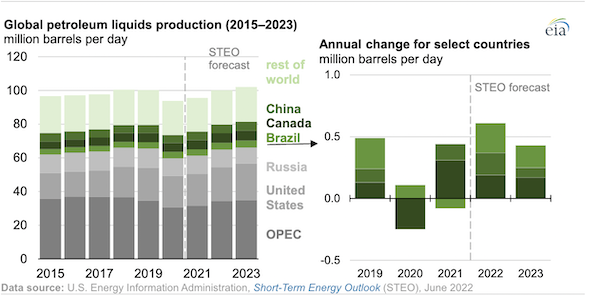

- Liquid fuels production in Brazil, Canada and China will rise this year and next, while the U.S. will provide the bulk of overall growth in non-OPEC petroleum production:

- More oil news related to the war in Europe:

- Russia tightened its grip on Europe’s gas supply Monday, rejecting Ukraine’s offer to book more transit capacity to make up for reduced flows on a key pipeline to Germany. Russia’s moves are endangering Europe’s push to stockpile gas and avoid shortages next winter as more European countries ramp up coal use to replace supplies.

- Several major German industrial consumers will cut fuel consumption to support the government’s efforts to stockpile gas supplies for winter.

- Russia displaced Saudi Arabia as China’s top oil supplier in May as imports from the country soared 55% from a year earlier to a record high.

- European oil refineries took 1.84 million bpd of crude from Russia last week, the third straight weekly increase, according to tanker data.

- Ukraine began striking Russia’s offshore oil and gas platforms in the Black Sea, forcing temporary halts in production.

- Libya’s oil production has recovered from extreme lows to about 700,000 bpd despite continuing political blockades of oilfields.

- Prospects are dwindling for Iranian sanctions relief that could result in a meaningful increase in the nation’s crude exports.

- Unusually warm temperatures are causing power demand to hit new records in some parts of China.

- Greece is subsidizing new refrigerators and air conditioners to help ease the burden of soaring power bills.

- More than 25 British electricity and gas suppliers collapsed last year due to record-high wholesale energy prices.

- Petrobras’ chief executive resigned Monday amid lawmaker backlash over the producer’s decision to raise fuel prices last week.

- Egypt and Saudi Arabia signed 14 investment deals valued at $7.7 billion, including for renewable energy and green hydrogen projects.

Supply Chain

- The continental U.S. will see its third straight week of excessive heat, with record-high temperatures forecast for hotspots in the South and Southeast.

- A forest fire in New Jersey is on track to become the state’s largest wildfire in 15 years after nearly tripling in size to 13,500 acres since Sunday.

- More than half of Mexico is currently under moderate to severe drought conditions due to extreme heat.

- Roughly 750 Canadian railway signal workers walked off the job due to contract disputes, as Canadian National Railway attempted to quell fears of disruption to its cross-border operations.

- Over 50,000 British rail workers rejected a last-minute contract offer and will move forward with a strike planned for three days this week, which could temporarily paralyze the U.K.’s travel network.

- South Africa’s government reached agreement with trucking associations to end periodic blockades of key trade routes that recently cost its economy over $18 million.

- The threat of a worker strike looms at Canadian jet maker Bombardier if the most recent contract proposal is not approved by Wednesday.

- Empty container boxes crucial for Asian exports are being held up at the congested port of Rotterdam, Europe’s largest maritime gateway.

- More ocean carriers are adding new services as they adjust to the shift of cargo from the U.S. West Coast to less congested ports on the Gulf and East coasts.

- Global port congestion will continue until at least early 2023 and keep spot freight rates elevated, as logistics executives urge charterers to switch to long-term contracts to manage costs.

- Slowing demand for goods is expected to shrink the air freight market by several percentage points this year, a worrying sign for airlines that relied on the service to stay afloat during the pandemic.

- Construction projects across the U.S. are running short on labor just as funding from the government’s massive $1 trillion infrastructure package begins to kick in.

- Australia’s biggest building manufacturers are cutting back operations, hiking prices and considering offshoring to manage surging energy costs.

- Gulf carrier Emirates could start taking faster deliveries of Airbus jets due to continued production uncertainty at Boeing.

- Volvo Trucks is doing early testing on hydrogen fuel-cell trucks with a claimed range of over 620 miles.

- Anheuser-Busch InBev, maker of Corona and Bud Light, plans to raise prices and adjust sizes to combat rising supply costs.

- GM raised the pre-order price for its Hummer electric pickup truck by $6,250 to offset rising costs.

- Nineteen of the world’s 20 fastest growing semiconductor firms are from China, compared to just eight at the same time last year.

- Over 70,000 people rallied in Belgium’s capital Brussels on Monday to protest the soaring costs of fuel and food, while strikes at transport services brought the city to a standstill.

- The UAE announced plans to build a new Red Sea port in Sudan as part of a $6 billion investment package.

Domestic Markets

- The U.S. reported 50,980 new COVID-19 infections and 80 virus fatalities Monday.

- With most Americans now carrying some immunity to COVID-19, fatality rates have remained well below previous levels despite a recent rise in springtime cases.

- New COVID-19 cases in Florida appear to be plateauing from a recent surge, while virus hospitalizations jumped 13% last week.

- Almost 3% of the U.S. public-school workforce exited the profession since the beginning of the pandemic, with survey results showing many more teachers and staff are planning the move this summer.

- The president of the St. Louis Federal Reserve said the economy still appears on track to grow this year despite rising expectations of a slowdown caused by high inflation.

- Large U.S. banks believe they will see positive results this week from the Federal Reserve’s annual stress testing, paving the way to unlock billions of dollars in excess capital to investors.

- U.S. capital flow data shows the foreign cash pile of dollars is close to records as investors reduce risky assets in portfolios and hang on to the world’s reserve currency.

- Over 5,000 U.S. flights were canceled over the holiday weekend, with airlines citing poor weather and a shortage of staff and air traffic controllers.

- Economists expect U.S. housing prices to fall as much as 5% by mid-2023 as rising interest rates cool the market.

- Los Angeles County homebuying cooled by 16.1% in May as rising prices and interest rates created 37% higher house payments.

- Mondelez International plans to continue raising snack food prices and will acquire Clif Bar & Co. for at least $2.9 billion, a deal likely to take place in the third quarter.

- Tesla is cutting its salaried workforce by about 10% over the next three months, confirming earlier reports. The automaker sold about 13 times as many electric vehicles as GM and Ford combined in the first quarter.

- JetBlue, in its quest to buy budget rival Spirit Airlines, is increasing its offer by several dollars per share and committing to divest itself of assets to get regulatory approval for the deal.

International Markets

- COVID-19 hospitalizations are rising in the U.K., with the increase attributed to the fast-spreading BA.4 and BA.5 subvariants of Omicron that appear to do extra damage to the lungs.

- China appears to have succeeded in its COVID-zero efforts for the time being, with just three cases reported in Beijing and two cases reported in Shanghai Monday.

- Macau, the world’s biggest gambling hub and a special administrative region of China, began mass testing residents after dozens of COVID-19 cases were reported over the weekend.

- Israel saw over 10,000 COVID-19 cases in a single day for the first time since early April.

- Japan will reopen three more regional airports for international flights in July amid a further easing of travel restrictions.

- More news related to the war in Europe:

- Ukrainian refugees could boost the euro area’s active labor force by up to 1.3 million people, slightly easing labor market tightness, the European Central Bank predicts.

- The ruble surged to a seven-year high yesterday as the divide grows between its valuation and the nation’s export competitiveness and financial health.

- Some companies, such as Phillip Morris, are finding it difficult to exit Russia due to shifting regulations, fears of arrest and the risk of expropriation. So far, global companies have incurred an estimated $59 billion in losses from their Russian operations.

- Over 80% of Britons expect the nation to fall into recession within a year ahead of May inflation data set to be released this week.

- Unemployment in China hit a nine-year high in May after strict COVID-19 lockdowns halted large swaths of the nation’s economy.

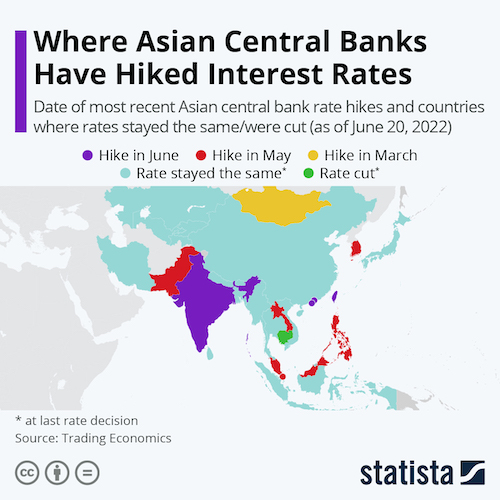

- While homegrown inflation in Asia is behind the world average in some places, global market pressures induced several countries to hike benchmark rates in recent months:

- More international carriers are delaying or canceling flights due to staffing shortages. Europe’s EasyJet cut its summer flight capacity by 7% while London’s Heathrow Airport asked airlines to cancel up to 10% of flights in some terminals.

- Ryanair’s British pilots accepted a deal to avert a strike, while the carrier still faces strike action this week from employees in Italy, Spain, Portugal, France and Belgium.

- Hong Kong carrier Cathay Pacific’s passenger volumes are down 98% since restrictions were imposed several months ago.

- A Japanese government-backed bank is set to spend about $40 billion for sustainable projects over the next five years.

- Canada laid out its final rules Monday for banning the manufacture of plastic bags, straws, takeout containers and other single-use plastics starting December 2022. The nation is also tightening rules for which plastic items can receive recyclability arrows, a bid to step up enforcement of recyclability marketing.

Some sources linked are subscription services.