MH Daily Bulletin: June 24

News relevant to the plastics industry:

At M. Holland

- M. Holland will be charging a fee to recover the reinstated Superfund Excise Tax for applicable U.S. orders starting July 1, 2022. Clients will be notified of details next week. Learn more about the tax in this Plastics News article.

- M. Holland is sponsoring AMI’s Polymers in Cables on June 28-29 in Philadelphia, Pennsylvania. This conference covers the latest technical developments, manufacturing solutions and trends in the wire and cable industry. M. Holland is also hosting the event’s networking reception on June 28 at 5:30 pm ET!

- If you’re attending AMI’s Polymers in Cables in Philadelphia, mark your schedule for M. Holland’s technical session:

- Paul Lorigan, Manager of Technology & Laboratory Services for M. Holland, will be giving a presentation on new cable applications for fluoropolymers, graphene and sustainability solutions. Don’t miss his talk on June 29 at 11:50 am ET.

Supply

- Oil prices fell 1.5% Thursday on indications that the U.S. Federal Reserve will keep an aggressive stance on raising interest rates.

- In mid-morning trading today, WTI futures were up 3.8% at $108.30/bbl, Brent was up 3.2% at $113.50/bbl, and U.S. natural gas was up 0.5% at $6.27/MMBtu.

- The average U.S. gasoline price fell to $4.94 a gallon Thursday, about 10 cents off the recent peak.

- Major oil refiners emerged from a Thursday meeting with the U.S. administration with no concrete solutions to lower gasoline prices, although the two sides agreed to work together.

- Kentucky’s governor declared a state of emergency yesterday to activate price-gouging laws in an effort to bring down record gasoline prices.

- A measure of business activity for energy firms operating in Texas, northern Louisiana and southern New Mexico jumped in the second quarter to the highest level in six years, according to the Dallas Fed.

- The most closely watched oil data in the world — the U.S. government’s weekly Petroleum Status Report — won’t be released this week due to system issues stemming from a power problem, officials said.

- The White House announced a new partnership with 11 states to quicken the development of offshore wind farms on the East Coast.

- Labor shortages are delaying Georgia’s efforts to finish constructing the U.S.’s first new nuclear reactors in over three decades.

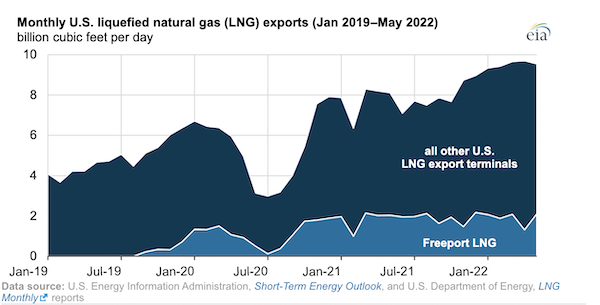

- The fire at Freeport LNG’s Gulf Coast export facility reduced total U.S. LNG export capacity by roughly 17%, the government predicts:

- More oil news related to the war in Europe:

- European power prices surged to their highest level since December after Germany took a step closer to rationing natural gas supplies amid cuts to flows from Russia. The spillover effect of a complete halt of Russian deliveries could spark a global recession, the nation said.

- Russia expects to earn more than $100 million per day from the gas it sells to Europe despite slashed deliveries the past week, an amount equal to last year’s revenue.

- Qatar is seeking more long-term deals to supply natural gas to Europe.

- India is replacing Western agencies that provided the pre-war safety certifications for Russian oil tankers.

- OPEC will likely stick to a plan for accelerated oil output increases in August as Western nations continue pressuring the group to address global energy shortages.

- Ethanol prices are up 14% this year, boosted by the U.S. administration’s mandate to blend more of the biofuel into gasoline.

- Some G7 nations will ask to ease biofuel mandates when they meet this Sunday, a bid to free up supplies of grain and vegetable oil for use in the global food market.

- British gasoline and diesel prices hit a record high Thursday.

- Construction will begin in 2024 on the $30 billion Sun Cable project that aims to export solar power from Australia’s Outback to Singapore.

- A decrepit oil supertanker laden with 1.1 million barrels has been rusting in anchorage off Yemen’s coast for almost a decade, threatening severe environmental impacts.

Supply Chain

- California’s Lake Oroville, which provides water to 27 million people in the state, is only half full, its peak depth of this year but still near historic lows.

- Texas’ power grid may need to tap into reserves as power demand continues to topple daily records amid a lingering heat wave.

- Italy is facing a water crisis as the worst drought in decades spreads rapidly through the country.

- Strikes crippled Britain’s rail network for a second day this week with only 1 in 5 train services operating.

- Workers at Chile’s state-owned mining firm Codelco, the world’s largest copper producer, agreed to end a national strike Thursday, sending copper prices to a 16-month low:

- Boeing says labor shortages at mid-tier and smaller suppliers will disrupt supply chains well into 2023.

- FedEx’s per-package revenue jumped 11% in the latest quarter after the firm increased fuel surcharges, culled unattractive shipments and saw labor costs stabilize.

- Samsung Heavy Industries received the largest shipbuilding order in South Korean history, a nearly $3 billion deal to supply 12 LNG carriers to an undisclosed buyer.

- Abercrombie & Fitch’s first-quarter freight costs were $15 million higher than expected due to rising rates and supply chain disruptions.

- Zipline, a U.S. drone delivery firm, received FAA certification yesterday to operate as a small air carrier, allowing it to ship healthcare products from its North Carolina headquarters.

- Sweden’s Einride, which builds electric self-driving trucks with no space for a driver or passengers, will begin testing vehicles on Tennessee roads in the third quarter.

- Intel delayed the groundbreaking ceremony of a massive chip-making facility in Ohio as Congress stalls over approving billions in funding for the industry.

- Saddled with heavy debts from the pandemic and supply chain issues, a key Japanese supplier for automakers Nissan and Stellantis is heading for a court-led rehabilitation path after failing a process that allows companies under financial strain to continue operating while renegotiating debt.

- Warehouse giant Prologis plans to reach net-zero emissions across its supply chain by 2040.

- EU lawmakers voted to include shipping in the bloc’s updated carbon market, adding pressure for the industry to quicken its decarbonization efforts.

Domestic Markets

- The U.S. reported 121,315 new COVID-19 infections and 507 virus fatalities Thursday.

- The BA.5 subvariant of Omicron is now the U.S.’s dominant strain, accounting for almost a quarter of new infections last week.

- The U.S. sent out over 4 million COVID-19 vaccine doses marked for children under 5 years old since regulatory approval last weekend.

- Following Pfizer, Moderna’s COVID-19 vaccine will shortly become the second approved shot for children aged 6 to 17 years.

- Nearly 70% of respondents in a recent survey of C-suite executives said they are suffering burnout and considering quitting their jobs.

- S&P Global’s U.S. composite purchasing managers index, which measures activity in both the manufacturing and services sectors, fell to 51.2 in June from 53.6 the previous month, a five-month low.

- U.S. companies borrowed 16% more year over year in May to finance equipment purchases, a sign of continuing strong demand.

- The governor of the U.S. Federal Reserve expects another 75-basis-point rate hike when the central bank meets this month.

- Large U.S. banks uniformly passed the Federal Reserve’s annual stress test, with results showing that lending to households and businesses would continue even in a severe recession. The U.S. units of major European lenders also cleared the tests.

- Moody’s predicts a widespread correction in the U.S. housing market will bring down prices in the most overheated regions, including the Southeast and Mountain West.

- Netflix laid off 300 employees, or about 4% of its workforce, this month after the streaming giant lost subscribers for the first time in more than a decade.

- Travel review firm Yelp is shutting its offices in New York and Chicago in favor of remote work.

- One of the country’s largest hedge funds is moving its headquarters from Chicago to Miami, the third major employer to announce a move from Illinois in two months.

- Merck is pushing forward with a potential deal to acquire cancer-treatment maker Seagen in what would be one of the largest takeovers of the year.

- U.S. consumers lodged more than quadruple the number of complaints against U.S. airlines in April compared to pre-pandemic levels. The figures coincided with a jump in delays and cancellations as carriers struggled to handle increased demand.

- United Airlines is cutting around 12% of its departures from Newark Liberty International Airport in New Jersey in an effort to relieve congestion.

- Rising gasoline prices are prompting more companies to offer fuel stipends, gift cards and other benefits as they try to retain employees.

- Cadillac said its first electric vehicle, the Lyriq SUV, is sold out for 2023, and the automaker plans to sell its luxury model Celestiq, still on the drawing board, for $300,000 and up when it goes into production late next year.

- GM’s Cruise unit began charging its first customers for driverless taxi rides in San Francisco.

- Workers at a Chipotle Mexican Grill in Maine are the fast-food chain’s first to seek to unionize.

International Markets

- The number of new COVID-19 cases rose in Southeast Asia, the Middle East and Europe last week, while the number of deaths globally dropped by 16%, according to the WTO.

- COVID-19 vaccines are estimated to have saved 20 million lives in 2021 alone.

- Austria scrapped its COVID-19 vaccine mandate.

- More news related to the war in Europe:

- Cisco Systems and Nike announced plans to fully exit Russia as the pace of Western departures accelerates.

- The U.S. said it will provide another $450 million in aid to Ukraine, the latest in a multibillion-dollar effort to help push back Russia’s invasion.

- Gauges of factory activity released in Japan, Britain, the euro zone and the U.S. all softened in June in the face of slumping consumer and business confidence.

- Mexican consumer prices rose 7.88% in the first two weeks of June, topping expectations, while the nation’s central bank increased its benchmark rate by a record 75 basis points to 7.75%.

- At 2.5%, Japanese inflation remained above targets for the second straight month in May and matched the fastest rise since 1991.

- British consumer confidence fell to a record-low in June for the second consecutive month.

- An official index that tracks apartment and house sales in China posted its 11th year-over-year decline this month, a record low since the nation created a private property market in the 1990s.

- Qantas Airways slashed Australian flight schedules by 15% through March next year to help offset the rising cost of fuel.

- Hundreds of London Heathrow staff voted in favor of walkouts during peak travel periods this summer in a dispute with British Airways over pay.

- Congestion caused by labor shortages at Amsterdam’s airport could take several months to clear.

- Toyota cut its stake in Uber by about half after the ride-hailing giant divested the autonomous driving unit at the center of their collaboration.

- Canada’s BlackBerry topped Wall Street estimates for first-quarter revenue powered by growth in its auto products and cybersecurity services.

- BMW fired up production at its new, $2.24 billion electric vehicle plant in China to boost Chinese output by over 100,000 vehicles this year.

- Audi said it will sell only electric vehicles beginning in 2026, well before the EU goal to effectively ban the sale of combustion engine cars in 2035.

- Chinese battery giant CATL will start mass producing its latest generation product next year, which promises to significantly expand electric vehicle range.

Some sources linked are subscription services.