MH Daily Bulletin: June 27

News relevant to the plastics industry:

At M. Holland

- M. Holland will be charging a fee to recover the reinstated Superfund Excise Tax for applicable U.S. orders starting July 1, 2022. Clients will be notified of details this week. Learn more about the tax in this Plastics News article.

- M. Holland is sponsoring AMI’s Polymers in Cables on June 28-29 in Philadelphia, Pennsylvania. This conference covers the latest technical developments, manufacturing solutions and trends in the wire and cable industry. M. Holland is also hosting the event’s networking reception on June 28 at 5:30 pm ET!

- If you’re attending AMI’s Polymers in Cables in Philadelphia, mark your schedule for M. Holland’s technical session:

- Paul Lorigan, Manager of Technology & Laboratory Services for M. Holland, will be giving a presentation on new cable applications for fluoropolymers, graphene and sustainability solutions. Don’t miss his talk on June 29 at 11:50 am ET.

Supply

- Oil prices jumped 3% Friday but declined for the second week in a row over worries that rising interest rates will cause a global recession.

- In mid-afternoon trading today, WTI futures were up 1.7% at $109.40/bbl, Brent was up 1.7% at $115.00/bbl, and U.S. natural gas was up 4.3% at $6.49/MMBtu.

- Active U.S. oil and gas rigs rose by 13 last week to 753, up 60% from the same time last year for a record 23 months of increases.

- U.S. LNG deliveries to Europe are up 75% year over year, while rates for 10-year LNG contracts have risen roughly 75% as importers attempt to lock in prices.

- The EPA is considering new air quality labels that critics say would slow oil and gas drilling in parts of the prolific Permian Basin.

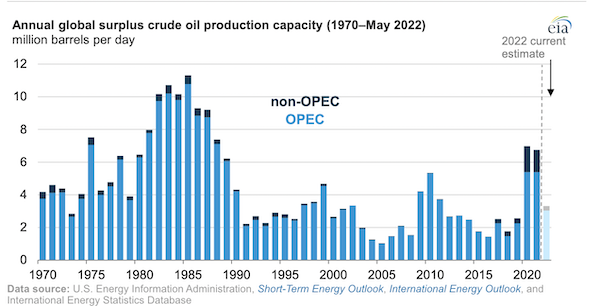

- Global surplus crude production capacity fell to less than half its 2021 average in May, including an 80% decline in non-OPEC countries:

- More oil news related to the war in Europe:

- German officials say lowered shipments of Russian gas could force entire industries to close this winter. On Saturday, the world’s largest sugar producer headquartered in Germany announced it would raise prices and shift to coal power to offset rising costs.

- Germany may repurpose sections of the uncompleted Nord Stream 2 pipeline to carry gas to and from the Black Sea.

- Indian imports of Russian crude are up 50-fold since April.

- G7 nations are considering a plan that would permit insuring Russian crude shipments sold below a certain price threshold, a potential avenue for boosting supplies.

- Spain and Portugal put a cap on gas prices in local electricity markets.

- Germany is pushing G7 nations to walk back commitments to end financing for overseas fossil fuel projects, a major policy reversal that threatens to quash Europe’s Paris-accord climate targets.

- OPEC+ is expected to stick to a plan to boost August production only slightly when it meets this Thursday.

- Exxon Mobil says U.S. tax credits for carbon capture and storage should be doubled to incentivize wider use.

- Sri Lanka’s 22 million residents are down to just 15,000 tons of gasoline and diesel as the island struggles to secure more supplies.

- Surging gas prices in the U.S. have forced some drivers of ride-sharing services to wrap their cars in advertisements to offset costs and earn more money.

Supply Chain

- Temperatures will remain unseasonably high in Texas and across the South this week on the tail end of a weeks-long heat wave in much of the U.S.

- Unusually hot weather in Japan is straining Tokyo’s electric grid, prompting officials to call on residents to conserve power to avoid blackouts.

- Taiwan will raise power prices for large industrial users by 15%, its first rate hike in four years, amid surging fuel prices.

- South African power cuts will continue this week as worker protests delay maintenance and repairs at power plants.

- Containers are piling up at rail hubs across the U.S. as port bottlenecks shift to inland freight. On Friday, BNSF Railway said it will begin limiting the number of boxes it carries from Los Angeles and Long Beach ports.

- U.S. rail regulators ordered Class 1 railroads including BNSF, CSX, Norfolk Southern and Union Pacific to provide more detailed plans for correcting severe service problems across networks.

- U.S. maritime regulators are urging their rail counterparts to block Canadian Pacific Railway’s merger with Kansas City Southern, saying the move would take away business from U.S. ports.

- May saw the first rise in container shipping prices of 2022, according to German online container marketplace Container xChange.

- Container shipping lines are more aggressively seeking volume commitments under new contracts with retailers seeking guaranteed slots.

- Over 20 ships were backed up off the Port of Hamburg in early June amid labor unrest at the main German gateway.

- Transatlantic air cargo capacity is back to pre-pandemic levels as passenger travel continues to grow, according to California freight forwarder Flexport.

- DB Schenker will expand its North American operations with the $285 million acquisition of USA Truck.

- Danish freight forwarder DSV is looking to acquire the international logistics operations of C.H. Robinson Worldwide.

- Truckload carrier P.A.M. Transportation acquired family-owned Metropolitan Trucking for $79.8 million.

- Federal trucking regulators are updating their definitions of “broker” and “bona fide agent” based on complaints that new technology has led to more unauthorized brokerage.

- DHL will raise its parcel-delivery prices in Europe this Friday.

- Shipowners that invested in scrubbers to burn dirtier fuel are seeing massive discounts due to abundant supplies of high-sulfur fuel oil.

- Tesla, Ford, GM, Rivian and Lucid have all raised prices on electric vehicle models in recent months to counter rising battery material costs.

- Industrial metals are on track for their worst quarter since the 2008 financial crisis amid fears of slowing industrial activity across major economies, particularly China.

- Harvests across Asia, Africa and the Americas will take a hit this year as farmers struggle to cope with rising fertilizer and energy prices.

- The U.S. will contribute one-third of the $600 billion that G7 nations aim to raise for infrastructure projects in developing countries over the next five years, a counter to China’s multi-trillion dollar Belt and Road initiative.

Domestic Markets

- The U.S. reported 18,551 new COVID-19 infections and five virus fatalities Sunday.

- Pfizer’s updated COVID-19 vaccine produced stronger immune responses to Omicron than the current version of its shot, paving the way for potential use by this fall.

- U.S. consumer sentiment hit a record-low in June even as the outlook for inflation improved slightly, according to a widely followed University of Michigan index.

- The U.S. economy will narrowly avoid recession as it slows this year and next, the International Monetary Fund predicts.

- Interest costs on U.S. national debt are 30% higher this year and will likely keep growing due to rising interest rates across the globe.

- The four-week average of jobless claims is at its highest level since January, an early sign of cracks emerging in the robust U.S. labor market.

- Almost half of 2021’s new entrepreneurs were women compared to just 28% in 2019, a new survey shows.

- Companies could save big as more employment prospects signal willingness to take a pay cut in order to work from home.

- The average U.S. mortgage rate has almost doubled since the end of 2021, reaching 5.81% last week, according to Freddie Mac. Meanwhile, monthly mortgage payments on the typical home climbed to $2,031 in May from $1,378 a year earlier, according to Zillow.

- New U.S. home sales rose 10.7% from April to May, topping market expectations with large gains in the West (+39.3%) and South (+12.8%).

- U.S. airport traffic hit the highest level since February 2020 Friday even as pilot shortages ground flights and ticket costs soar. At least one U.S. pilot union is pressing the FAA to discipline airlines for scheduling too many flights.

- Over 800 flights were canceled yesterday and more than 6,500 were delayed due to staff shortages and high demand causing havoc for airlines.

- United Airlines became the first major U.S. carrier of the pandemic to revamp its pilot contracts with substantially raised pay.

- Frontier Group Holdings received a major endorsement from a proxy advisory firm that could give its bid to acquire Spirit Airlines the edge over JetBlue Airways.

- New electric vehicles from South Korean automakers Hyundai and Kia are quickly surpassing sales of American models from Chevrolet and Ford in the U.S.

- GM will expand its robotaxi business to all of San Francisco this year and move into other cities in 2023, a growth push that comes after getting its first paying customers.

- Verizon, AT&T and T-Mobile are among the wireless companies boosting fees and raising costs for monthly cellphone plans in recent weeks.

- Minnesota-based 3M faces billions of dollars in potential claims related to its comparatively small business of supplying earplugs to the U.S. military.

- The American Lifeguard Association says one-third of public pools will be closed this year due to a shortage of lifeguards.

International Markets

- China’s latest efforts to stamp out COVID-19 are proving successful, with Shanghai reporting zero new cases for the first time in two months and Beijing reopening schools this week.

- Thailand lifted its indoor and outdoor mask mandates amid a slowdown in COVID-19 infections.

- BioNTech broke ground on its first production site for COVID-19 vaccines in Africa.

- The U.K. has spent an estimated $459 billion in its efforts to control the COVID-19 pandemic.

- More news related to the war in Europe:

- Leaders from G7 nations agreed to provide indefinite support for Ukraine’s defensive efforts against Russia at a meeting on Sunday. The group of nations also agreed to ban Russian gold imports and are expected to move forward with efforts to pursue a price cap on Russian oil.

- With the grace period for $100 million in missed bond payments ending last night, Russia defaulted on its debt for the first time in more than 100 years.

- A Chinese central bank adviser doubted the nation’s ability to meet its 5.5% annual growth rate target this year, a sentiment shared by most economists.

- The economies of both Germany and France, Europe’s largest, slowed dramatically in June, as supply chain disruptions and surging prices cooled their manufacturing industries.

- Mexico’s economy expanded 1.1% in April, the fastest pace in over a year.

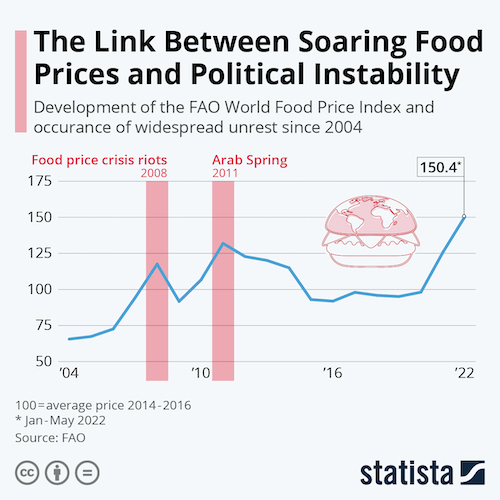

- Fuel-price spikes across Latin America are adding instability to an already fraught political situation in many countries.

- Indonesia’s central bank broke course and held its benchmark rate at a record-low again, cementing its place as a monetary policy outlier.

- A widely followed Singaporean inflation gauge accelerated for a third month to the fastest pace in almost 14 years.

- Saudi Arabia’s central bank injected $13 billion into banks to avoid a liquidity crisis occurring despite soaring oil revenues and a strong economy.

- The Bank for International Settlements — also known as the central bank of central banks — urged countries to continue sharply raising interest rates even if it significantly hurts economic growth.

- The value of announced mergers and acquisitions declined 25.5% year over year in the second quarter as rising inflation put a halt on deal making.

- Automakers Toyota and Suzuki are teaming up to manufacture hybrid vehicles in India.

- Imminent walkouts at Ryanair, EasyJet, British Airways and Aeroports de Paris will add to the thousands of flights that European airports have already canceled this month due to labor shortages. On Friday, Lufthansa scrapped 3,100 flights planned for this summer and said it expects operations will not return to normal until next year.

Some sources linked are subscription services.