MH Daily Bulletin: June 30

News relevant to the plastics industry:

At M. Holland

- M. Holland will be charging a fee to recover the reinstated Superfund Excise Tax for applicable U.S. orders starting July 1, 2022. Clients will be notified of details this week. Learn more about the tax in this Plastics News article.

- M. Holland will be closed Monday in observance of the July Fourth holiday. We wish all subscribers a safe and happy holiday weekend.

Supply

- Oil prices slid about 2% Wednesday on news of a larger-than-expected rise in U.S. gasoline and distillate inventories, pointing to lower demand.

- In mid-morning trading today, WTI futures were down 3.8% at $105.60/bbl, Brent was down 1.7% at $114.50/bbl, and U.S. natural gas was down 6.6% at $6.07/MMBtu.

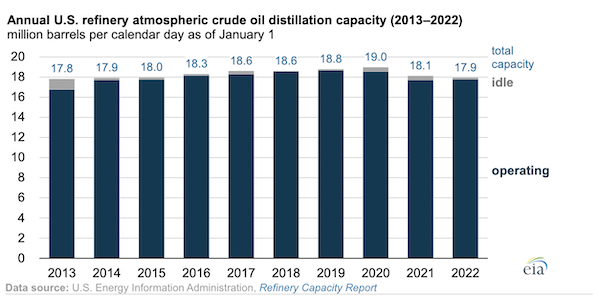

- The U.S. administration said crude inventories fell last week even as production hit its highest level since April 2020, with U.S. refiners operating at about 95% of capacity. Government data shows refinery capacity has declined for two years in a row:

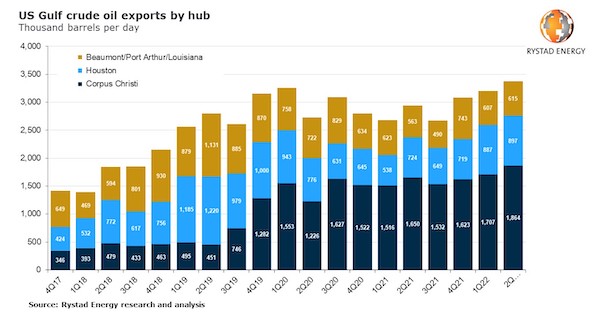

- U.S. crude exports from the Gulf Coast are projected to hit an all-time high in the current quarter, according to Rystad:

- British natural gas futures skyrocketed almost 50% Wednesday on news that Norway, the nation’s biggest supplier, reduced capacity at a major field due to a compressor failure.

- Exxon Mobil will sell its Canadian shale gas business for roughly $1.5 billion, a retreat from regions rich in gas but lacking in pipelines and other infrastructure.

- OPEC+ leaders are likely to stick to plans for a modest output increase for August upon conclusion of a two-day meeting today.

- Uncertainty in global oil and gas markets could stay “for some time to come” as spare capacity is very low while demand continues recovering, Shell’s chief executive said.

- More oil news related to the war in Europe:

- Germany is in talks to bail out energy giant Uniper SE to stem a broader fallout from Russia’s slashed natural gas deliveries.

- Britain could cut off gas supplies to mainland Europe in the case of emergency shortages at home.

- Russian oil production jumped by 5% in June to an average of 10.7 million bpd, Moscow claims.

- China says it will begin subsidizing refineries if oil prices remain elevated above $130/bbl.

- Shell is set to follow other Western energy majors by taking a stake in a $29 billion project to boost Qatar’s LNG exports.

- The U.S. Supreme Court today curtailed the authority of the EPA to restrict greenhouse gas emissions at power plants.

- California utility PG&E is asking the federal government to give it more time to apply for the funds that would allow it to continue operating its California nuclear plant.

- Spain restarted natural gas shipments to Morocco for the first time since November following a diplomatic row with Algeria.

- South Africa’s largest real estate trust is running out of diesel to operate generators as the country grapples with its worst electricity shortage since 2019.

- Global offshore wind added 21.1 GW of capacity last year, a record, although the International Energy Agency warns it is off track of current net-zero targets.

- China is hoping regulatory changes will reduce industrial energy consumption per unit of output by 13.5% in 2025.

Supply Chain

- Power grids in the western half of the U.S. could face reliability issues this summer due to more frequent extreme weather events and record demand, agencies warn.

- A truckers’ protest in Argentina is threatening the nation’s key grain exports.

- BNSF is halting rail shipments of food, diesel and other commodities from several states into California until July 31, citing labor constraints and severe weather.

- Amid heavy congestion, the Port of Oakland is reducing free dwell times for containers from seven to four days starting tomorrow.

- Port Houston moved 335,000 TEUs in May, up 16% from last year to a new all-time high.

- The Port of New Orleans saw a large increase in breakbulk cargo (+88%) for the third consecutive month, while container volumes declined.

- The Port of Corpus Christi in South Texas moved 15.2 million tons of cargo in May, a 9% year over year gain.

- Container throughput at Australia’s Port of Melbourne tumbled 6% in May, a worrying sign ahead of peak shipping season.

- Spot container shipping rates from China to the U.S. West Coast have fallen below long-term contract rates, a bearish signal.

- The U.S. Army Corps of Engineers endorsed a plan to deepen the channel at the Port of New York and New Jersey to allow higher volumes of large ships.

- Under-construction refrigerated warehouse space in the current quarter is 1,000% greater than the same time in 2019, a signal that developers believe e-commerce will permanently shape the way Americans buy groceries and meals.

- The American Trucking Association’s for-hire truck tonnage index hit 117.1 in May, up 3.7% from the same time last year.

- Google’s self-driving unit Waymo says it will begin shipping Wayfair furniture with its autonomous heavy-duty trucks on routes in Texas.

- Some developers are rolling out faster, more powerful vehicle chargers that promise to boost adoption of electric big rigs.

- Mercedes does not expect the global computer chip shortage to ease until at least next year.

- Daimler Truck’s chief executive says the truck maker still faces “enormous pressure” in supply chains that is holding up production.

- South Korea’s computer chip inventories jumped 53.4% in May from a year earlier, suggesting a slowdown in global demand.

- Maersk is preparing to order four 16,000-box, methanol-fueled container ships at a cost of roughly $2.2 billion.

- Over 90% of companies surveyed say they have changed how their packaging is sourced due to pandemic supply disruptions.

- Industrial baked-goods supplier Gold Standard Baking is preparing to sell itself out of bankruptcy after succumbing to high labor and material costs.

- Walgreen’s chief supply chain officer says the retailer will rely more on micro-fulfillment centers, drones and other strategies to reach customers faster.

- The cost to build a production stage is up about 15% from last year, forcing film and television studios to cut back on spending.

Domestic Markets

- The U.S. reported 193,201 new COVID-19 infections and 710 virus fatalities Wednesday.

- The seven-day average COVID-19 infection rate is at its highest level in six weeks, while the daily average for hospitalizations is up 9% and for deaths is up 18% from two weeks ago.

- COVID-19 positivity rates in New York City are back up to January levels, raising fears of a sixth virus wave.

- The White House will buy 105 million doses of Pfizer’s COVID-19 vaccine for roughly $3.2 billion ahead of a fall booster campaign.

- Pfizer will begin human tests of a universal COVID-19 vaccine targeting all viral strains in the second half of this year.

- Consumer spending eased 0.4% in May, the first decline of the year, while a key measure of consumer price inflation rose a less-than-expected 0.3%.

- U.S. consumer outlays rose just 1.8% in the first quarter, the softest spending rate of the pandemic recovery.

- U.S. corporate profits fell 4.9% to $2.4 trillion in the first quarter following a modest gain in the previous period.

- The S&P 500 is down 20% year-to-date this week as it heads for its worst first-half since 1970.

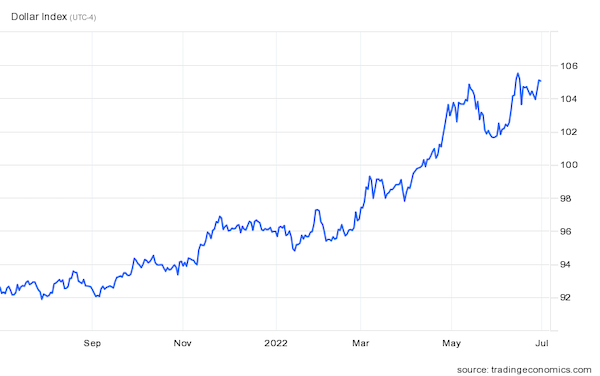

- The U.S. dollar is hovering near a 20-year high compared to a basket of other currencies, benefiting from safe-haven demand amid fears of a global recession:

- The number of active U.S. home listings jumped 18.7% in June from a year ago, the largest annual increase since 2017, according to Realtor.com.

- U.S. mortgage refinancings saw a jump last week after the average interest rate fell for the first time in four weeks to 5.84%. Homebuyer demand, on the other hand, was flat.

- U.S. airlines canceled over 1,800 flights Wednesday heading into the Fourth of July weekend.

- The average rental-car price for Fourth of July weekend is $100/day compared to $65/day in 2019.

- Spirit Airlines is again postponing a vote on a merger with Frontier Group Holdings after rival bidder JetBlue raised its offer this week.

- LG Energy is reconsidering plans to build a $1.3 billion electric vehicle (EV) battery plant in Arizona due to rising costs, the company said Wednesday. However, the firm did complete its first supply deal with a U.S.-based lithium producer as it builds out its North American EV supply chain.

- Ford will stop letting customers purchase leased electric vehicles at the end of their lease term in order to better manage battery recycling.

- General Mills posted an 8% increase in sales for the quarter ended May 29 despite declining volumes in every segment except for its pet-products business.

- Spice-and-flavorings company McCormick & Co. posted a 34% drop in quarterly profits after costs rose quicker than expected.

- Bed Bath & Beyond’s quarterly sales fell 25% from a year ago while its net loss widened, prompting the board to replace its CEO.

- Book retailers are unable to place new orders with Macmillan, one of the largest U.S. publishers, as the firm grapples with fallout from a cyberattack.

- Cargill will start enrolling U.S. cotton suppliers in its program rewarding growers for sustainable production.

International Markets

- New global COVID-19 cases were up 18% last week.

- Canada will extend through September its current COVID-19 testing measures for travelers crossing land borders, the government said.

- Shanghai is reopening museums and other tourist attractions next week for the first time in three months.

- Hong Kong reported over 2,000 new COVID-19 cases Wednesday, the most in two months. The island may follow China in reducing quarantine periods for incoming travelers.

- Despite a 23% rise in COVID-19 cases last week, health experts do not expect Britain to impose any new pandemic restrictions this summer.

- More news related to the war in Europe:

- The U.S administration says it has immobilized over $300 billion in Russian central bank funds so far.

- Russia’s stock market plunged 8% Wednesday to a two-month low after Gazprom said it would halt dividend payments. The nation’s overall economy contracted 4.3% in May, new figures show.

- Chinese manufacturing activity rose this month for the first time since February, according to an official index.

- Japan’s factory output fell 7.2% in May, the largest monthly drop in two years amid continuing supply issues.

- Industrial production in South Korea jumped 7.3% in May from a year ago, double economist expectations.

- An index of Euro Area consumer confidence fell to -23.6 in June, the lowest since the beginning of the pandemic even as the region’s unemployment rate fell to a fresh record-low.

- In Germany, the unemployment rate hit a record-low 2.8% in May.

- Spain’s annual inflation rate jumped to a higher-than-expected 10.2% in June, the fastest pace in almost 40 years.

- Toyota’s production fell almost 10% below targets this year and was down 5.3% from last year between January and May.

- British car production rose 13.3% year over year in May, the first rise in 11 months but still almost 50% below pre-pandemic levels.

- Stellantis is warning that the EU’s plan to phase out combustible-engine cars by 2035 could cause the auto market to collapse if soaring prices for electric vehicles are not reduced by then.

- Retail car sales in China jumped 28% last week compared to the same time a year ago, an industry group said.

- Japanese chipmaker Renesas Electronics is partnering with India’s Tata Motors to build a line of new auto and 5G system chips.

- Ford will spend over $200 million helping build a new lithium plant for Australia’s Liontown Resources in exchange for five years of supplies of the key battery metal.

- Hyundai is pushing back the rollout of its first hydrogen vehicle to at least 2024 due to issues with fuel cell development.

Some sources linked are subscription services.