MH Daily Bulletin: March 2

News relevant to the plastics industry:

At M. Holland

- Plastics News named M. Holland among the Best Places to Work for 2023! This marks the company’s sixth consecutive year receiving this award. Congratulations to all 22 finalists this year!

Supply

- Oil rose 1% Wednesday on news of a jump in manufacturing in top crude importer China.

- In mid-morning trading today, WTI futures were up 0.2% at $77.84/bbl, Brent was up 0.1% at $84.42/bbl, and U.S. natural gas was down 0.1% at $2.81/MMBtu.

- U.S. crude stocks rose by 1.2 million barrels last week to a total of 480.2 million barrels, the highest since May 2021.

- Germany paid more than double for natural gas last year despite a 30% decline in import volumes.

- Equinor is nearing a deal to buy the British North Sea assets of Canada’s Suncor Energy for around $1 billion.

- The Canadian Association of Petroleum Producers expects upstream investments in the nation’s oil and gas industry to approach $40 billion this year, higher than pre-pandemic levels and an 11% increase over last year.

- Canada’s Baytex Energy is buying rival U.S. firm Ranger Oil for about $2.5 billion.

- After two misstarts to invest in foreign LNG projects, Saudi Aramco is again considering investing in an LNG export facility either in the U.S. or Asia, according to reports.

- A consortium of cities in four western U.S. states endorsed a small-nuclear-reactor project in Idaho that could expand to other states by 2030.

- Dow and private firm X-energy agreed to develop the first grid-scale next-generation nuclear reactor for an industrial site in North America.

- Norwegian Cruise Line is moving forward with plans to adapt its newbuilds to use methanol as their primary fuel.

- Carbon emissions from the global energy industry grew 0.9% last year to a record high.

Supply Chain

- Large swaths of Argentina were left without power Wednesday after a fire caused damage to the national power grid.

- Carriers have canceled about one-third of Pacific containership capacity as the industry faces its worst slump in years in the face of shrinking consumer demand in the U.S. and Europe.

- A large number of the global fleet of containerships are positioned near China awaiting a renewed flow of exports as the nation’s economy rebounds.

- Strikes among Finland’s port workers have stretched into their third week.

- Global merchandise trade growth slowed at the end of 2022 and is likely to remain weak in the first quarter of this year, the World Trade Organization says.

- Amazon has canceled, closed or delayed 99 facilities in recent efforts to cut costs, impacting nearly 32.3 million square feet of warehouse space in 30 states.

- The Port of Virginia is nearing completion of an expansion project that will make it the deepest port on the East Coast.

- Trucking company ArcBest is expanding its logistics services with new technology allowing warehouse workers to load and unload truck trailers rapidly.

- The U.S. Supreme Court heard arguments Wednesday over New Jersey’s bid to dissolve its 1953 compact with New York establishing the Waterfront Commission of New York Harbor.

- The White House is considering revoking export licenses issued to U.S. suppliers for sales to Chinese telecom giant Huawei Technologies.

- South Korea’s semiconductor inventory rose by 28% in January, the fastest pace in almost 27 years.

- In the latest news from the auto industry:

- Cobalt and lithium prices have dropped dramatically over the past few months.

- Rivian Automotive is recalling more than 12,000 vehicles as production challenges continue to weigh on the young electric-vehicle maker.

- Achieving Tesla’s long-term production goal of 20 million vehicles per year could require up to $175 billion in additional investments, its CFO said.

- Tesla confirmed plans to build a new gigafactory in northern Mexico.

- Vietnamese electric-vehicle maker VinFast delivered its first SUVs to U.S. customers Wednesday.

- Alphabet’s self-driving unit Waymo laid off 137 employees this week, its second round of job cuts this year.

- Germany and Italy are threatening to block the EU’s plans to effectively ban new combustion-engine cars by 2035.

Domestic Markets

- First-time unemployment claims declined by 2,000 to 190,000 last week, the third consecutive decline and seventh straight week of claims below 200,000.

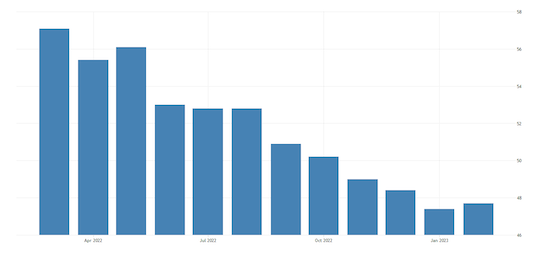

- U.S. manufacturing activity rose slightly in February from January but remained in contraction territory for the fourth straight month, according to the Institute for Supply Management.

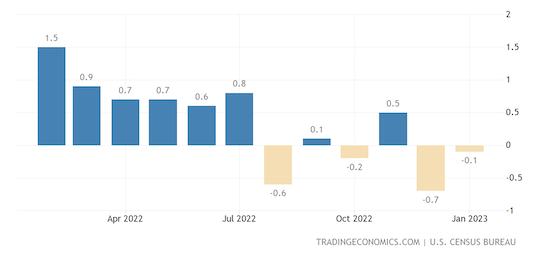

- U.S. construction spending unexpectedly fell in January as investment in single-family homebuilding continued to decline, the Commerce Department reported.

- Delta Air Lines pilots ratified a new contract that provides a 34% pay increase over the four-year agreement, potentially setting a bar for other carrier negotiations.

- Retailer Macy’s reported better-than-expected fourth-quarter profits but expects sales to decline in 2023.

- Best Buy expects sales to decline for a second straight year in 2023 as consumers shift spending from discretionary goods amid inflation pressures.

- Lowe’s forecast annual sales below market expectations and warned of a slight decline in the home improvement market this year due to rising prices and borrowing costs.

- Dollar Tree forecast annual profit well below estimates as the discount retailer battles higher wages and freight costs.

- Consumer products manufacturer Reckitt Benckiser, maker of Dettol and Lysol cleaning products, beat full-year revenue estimates on higher prices and a boost in its baby-formula sales.

- Abercrombie & Fitch reported a 41.5% drop in quarterly profit due to high labor costs and inflationary pressures. Rival American Eagle beat quarterly estimates on steady demand for apparel.

- Average U.S. mortgage rates reached 6.71% this week, a nearly three-month high.

International Markets

- Euro zone inflation eased slightly in February to a higher-than-expected 8.5% as lower energy costs offset stubbornly high inflation in other goods and services, fueling expectations of continued interest rate hikes by the European Central Bank.

- German consumer prices rose a higher-than-expected 9.3% in February from the prior year.

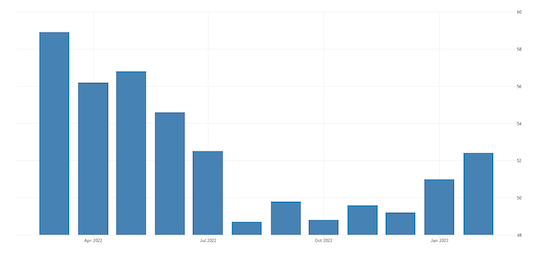

- British factory activity contracted last month at the slowest pace since July, a sign that output will likely rise in the coming 12 months.

- South Korea’s factory activity contracted for an eighth straight month in February.

- The U.S. administration’s effort to promote climate-friendly technologies is attracting German companies to the nation, trade groups say.

- Chinese authorities are considering a 2023 growth target as high as 6% when they announce it on March 5 as optimism grows about the nation’s economic outlook.

- New home sales in China rose 14.9% in February.

- Canadian manufacturing activity expanded at a faster pace in February as measures of output and new orders both rose to nine-month highs.

- The Bank of Mexico says inflation is taking longer than expected to return to its target, prompting a hike in near-term inflation projections.

Some sources linked are subscription services.