MH Daily Bulletin: March 7

News relevant to the plastics industry:

At M. Holland

- Plastics News named M. Holland among the Best Places to Work for 2023! This marks the company’s sixth consecutive year receiving this award. Congratulations to all 22 finalists this year!

- Plastics Business published a story written by M. Holland’s Todd Waddle, Director, Sustainability, which reviews key considerations for implementing post-consumer recycled (PCR) and post-industrial recycled (PIR) materials. Click here to read the full article.

Supply

- Oil rose slightly Monday as top executives at a Houston conference discussed supply tightness and hopes for rising Chinese demand.

- In mid-morning trading today, WTI futures were down 2.1% at $78.78/bbl and Brent was down 1.8% at $84.62/bbl.

- Forecasts for milder weather and lower heating demand sent U.S. natural-gas prices plummeting over 12% Monday. U.S. natural gas was up 2.1% at $2.63/MMBtu this morning.

- U.S. regulators continue to probe Freeport LNG’s readiness as it prepares to restart operations at its massive Texas export facility following a fire-related shutdown eight months ago.

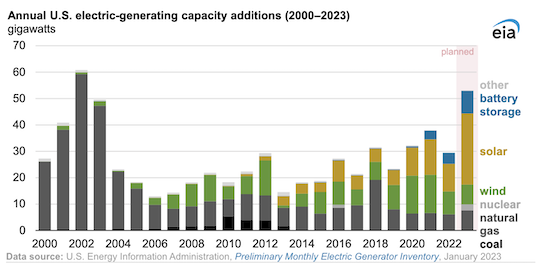

- A shortage of transmission lines could prevent the U.S. from accommodating its quickening energy transition, experts say.

- In just the first two months of the year, Russia’s budget deficit nearly matched the nation’s budgeted deficit for all of 2023 as oil revenues plunged. The country’s overall seaborne crude exports shrank 14% last week.

- Russia remained India’s top oil supplier for a fifth month in a row in February, a sharp contrast to minimal volumes shipped between the two countries in years past.

- Shell, Chevron and Petrobras are among the 10 firms taking part in Guyana’s next oil tender, a growing hotspot for supermajors.

Supply Chain

- Global supply-chain pressures have returned to pre-pandemic levels, according to a survey by the New York Federal Reserve.

- Stronger rates for capesize and panamax ships sent a widely tracked gauge of dry-bulk rates to a 10-week high Monday.

- U.S. intermodal volumes declined by 8.4% in February from a year ago, their 12th straight monthly decline.

- Maersk’s air cargo unit parked several jets and dialed back flight activity in response to weakening demand for airfreight.

- Old Dominion Freight Line’s revenue fell in February as tonnage dropped.

- CMA CGM reported fourth-quarter profit of $3.04 billion, down 3.7% compared to a year earlier.

- CEVA Logistics joined a growing list of third-party logistics companies cutting staff with the announcement it is laying off 142 employees at its Nashville, Tennessee, campus.

- Lufthansa Cargo saw record revenue for the third year in a row, despite global trade demand falling 16% in December.

- Apple’s main manufacturer, Foxconn Technology Group, is considering tripling its Indian workforce to 100,000 people in a bid to expand its supply chains outside of China.

- UAE-based DP World is investing $35 million into updating and expanding Brazil’s Port of Santos.

- U.S. imports of solar panels are finally picking up after months of gridlock stemming from a new law banning some goods out of China.

- In the latest news from the auto industry:

- Losses continue to mount for electric-vehicle startups as they struggle to bolster assembly lines and sales.

- Lordstown Motors posted a larger-than-expected quarterly loss of $102.3 million as it struggled with production expenses and missed the delivery target for its pickup truck.

- Autonomous truck startup Embark Trucks, the first to make a fully autonomous cross-country haul, is laying off most of its employees and winding down operations as it seeks a buyer or possible liquidation.

- Mounting losses will force GM’s robotaxi unit Cruise to focus on cutting costs this year, an executive said.

- Rivian Automotive plans to sell bonds worth $1.3 billion as weakening demand and high costs tighten a cash crunch for electric-vehicle makers.

- Automakers are giving the semiconductor industry a boost as demand from other industries wanes.

- Tesla could begin producing its first cars in Mexico as soon as 2024, a government official said.

- Plastics use in cars has risen 16% over the past decade, according to new research.

- Fires spurred by lithium-ion batteries are becoming more frequent in electric bicycles.

Domestic Markets

- Bank of America’s chief executive expects the U.S. economy to reach a technical recession starting in the third quarter.

- A plunge in aircraft orders in January caused much of the 1.6% decline in U.S.-manufactured goods activity for the month.

- U.S. banks are raising rates on deposits for the first time in nearly 15 years as the Federal Reserve ratchets up benchmark interest rates.

- Operators of hotels, bars and restaurants are now among the country’s fastest-growing employers, partially making up for a recent slowdown in tech-related hiring.

- Lower-income and less-educated workers have seen outsized wage gains since the start of the pandemic, new data shows.

- Facebook parent Meta plans to cut thousands more jobs as soon as this week in a fresh round of layoffs.

- The Justice Department is expected to take legal action this week to block JetBlue Airways’ $3.8 billion merger with Spirit Airlines due to antitrust concerns.

- Pratt & Whitney won a $5.2 billion contract to support production of new U.S. fighter jets.

- The U.S. housing market is showing signs of slowing as the normal peak spring season approaches.

International Markets

- Europe’s central bank chief said it is likely that the bank will raise interest rates again this month to keep a lid on inflation.

- Canadian economic activity expanded at a slower pace in February, with a key purchasing managers index falling from 60.1 to 51.6.

- A top China official said insufficient demand remains a pronounced problem in the country and that sentiments of private investors and businesses are unstable.

- Artificial intelligence and semiconductor executives in China are playing a bigger role at political meetings as the nation’s priorities shift amid rising competition with the U.S.

- The Bank of Japan is set to maintain ultra-low interest rates this week as it awaits a leadership transition that could potentially change policy goals.

- South Korean inflation slowed to 4.8% in February, the lowest level in 10 months.

- French truck drivers and garbage collectors joined trade unions in walking off their jobs for a sixth day of labor unrest since January in protest of the government’s proposed pension reforms.

Some sources linked are subscription services.