MH Daily Bulletin: March 14

News relevant to the plastics industry:

At M. Holland

- Each year, M. Holland joins organizations around the globe to celebrate the profound achievements and ongoing efforts of women on International Women’s Day. To celebrate, a few Mployees shared their thoughts on this year’s theme of #EmbraceEquity. Click here to watch the video.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

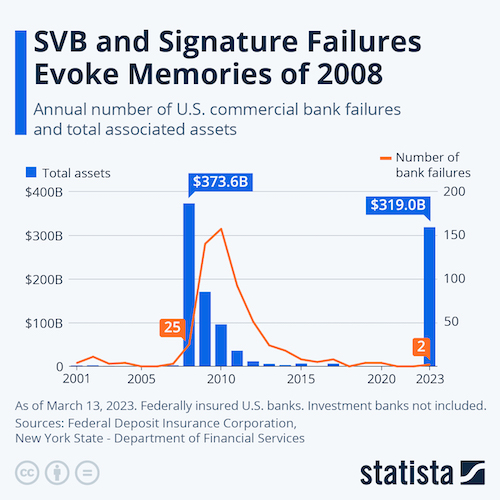

- Oil fell over 2% Monday as the collapse of a pair of U.S. banks roiled equities markets and raised fears of a financial contagion.

- In mid-morning trading today, WTI futures were down 1.8% at $73.45/bbl, Brent was down 1.4% at $79.62/bbl, and U.S. natural gas was down 0.6% at $2.59/MMBtu.

- The White House approved the massive Willow oil-drilling project in Alaska that will boost the state’s crude production by 40%.

- Crude production in the seven biggest U.S. shale basins is expected to rise in April to its highest since December 2019.

- Strikes that have shut down some of France’s refineries and LNG trading terminals continued for a sixth day Monday.

- Russia plans to cut oil exports and transit from its western ports.

- The World Bank is considering reversing a 2019 pledge not to fund any more upstream oil and gas projects, according to reports.

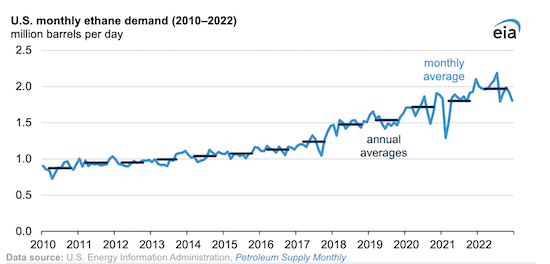

- U.S. ethane demand rose by roughly 9% last year, according to the U.S. Energy Information Administration:

Supply Chain

- Severe weather will hit both the East and West coasts of the U.S. this week.

- The number of containerships in U.S. coastal waters has fallen 51% since last year to a total of 106.

- Freightos, an online freight booking platform, slashed its growth forecasts amid sputtering cargo volumes and faltering freight rates.

- Growing demand for oil in a reopening China have sent spot rates for very large crude carriers (VLCCs) above $100,000 per day, up from $38,000 a day in January, with rates from the Mideast to China up over 20% just last Friday.

- Norfolk Southern reached an agreement with two of its unions to provide up to seven paid sick days per year to workers.

- U.S. regulators are taking a closer look at Apollo Global Management’s proposed takeover of Atlas Air.

- India and Australia are deepening security and economic ties as they seek to diversify their markets and shore up supply chains.

- The United Nations is working to extend a Black Sea initiative signed with Russia that allows for safe grain transport to prevent a global food crisis.

- In the latest news from the auto industry:

- Volkswagen plans to spend $192 billion over the next five years to develop electric vehicles and strengthen its positions in China and the U.S.

- Volkswagen chose Canada for its first battery cell plant outside Europe.

- GM agreed to hike salaries by 10% this year at its largest Mexico factory, marking one of the largest-ever raises in Mexico’s auto sector.

- Rivian Automotive and its largest shareholder Amazon are in talks to end the exclusivity part of their electric van deal.

- Porsche expects sales to rise to as much as $45 billion this year after the luxury carmaker posted its highest annual earnings in 2022 since going public.

- GM is exploring the use of groundbreaking new artificial-intelligence chatbots as an in-car voice assistant.

- British electric-vehicle startup Arrival raised over $300 million to launch U.S. production of its first van in 2024.

- Hyundai is nearing a deal to buy a plant from GM as part of its expansion plan in India.

Domestic Markets

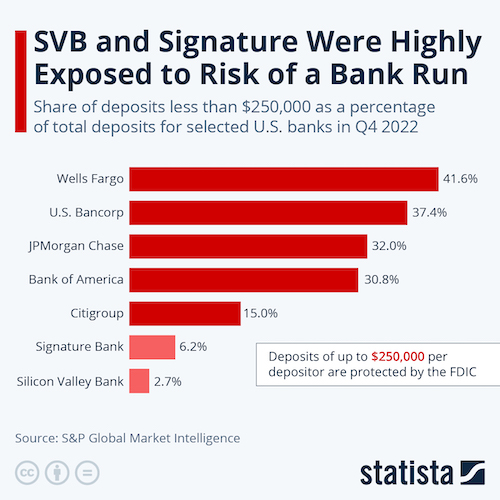

- Federal officials scrambled to avert a broadening banking meltdown after the collapse of two regional banks.

- The collapse of Silicon Valley Bank will leave early-stage biotech companies with a large funding void, experts say.

- In the wake of the SVB and Signature bank failures, depositors are flocking to large U.S. banks from regional institutions.

- The annual inflation rate fell to 6.0% in February, in line with expectations and the lowest since September 2021.

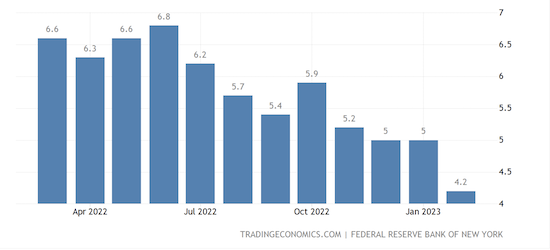

- U.S. consumer inflation expectations for the year ahead fell sharply to 4.2% in February, the lowest point since May 2021:

- Shares of United Airlines fell after the carrier said it expects to post a loss in the current quarter.

- Uber, Lyft and other gig-economy firms scored a victory with a California court ruling that preserves their independent-contractor model in the state.

- Bracing for a steep fall in COVID-19 vaccine sales, Pfizer struck a $43 billion deal to acquire cancer treatment developer Seagen.

- Private U.S. fast-food chain Chick-fil-A plans to spend about $1 billion to open new locations in five international markets by 2030.

- The number of renter households making $150,000 or more a year rose by almost 90% between 2016 and 2021 as housing costs inflated.

- A new survey suggests some 3 out of every 4 Americans regret relocating during 2021’s housing market boom.

International Markets

- European banks are well positioned to avoid the capital squeeze affecting many regional U.S. banks in the aftermath of the SVB and Signature bank failures.

- Wage growth in the U.K. declined to 6.5% in the three months ended in January, down from 6.7% in the three months ended in December, the first decline since 2021.

- China is fully opening its borders and will resume issuing all types of visas beginning Wednesday.

- South Korea’s import prices for February fell for the first time in two years on weaker oil prices.

- Staff at several airports in major German cities went on strike Monday, grounding all outbound commercial flights and impacting arrivals.

- The recent rally has stalled for copper prices, which fell 4.3% from January to February, due to a sluggish recovery for the economy in China, which consumes over 50% of the metal globally.

Some sources linked are subscription services.