MH Daily Bulletin: March 17

News relevant to the plastics industry:

At M. Holland

- M. Holland announced a new partnership with Lavergne, a global manufacturer specializing in the formulation of customized compounded engineered resins, to distribute PCR resins for customers in North America. Click here to read the press release.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil rose 1% Thursday, ending a three-session losing streak, following reports that Saudi Arabia and Russia met to discuss ways to boost market stability.

- In mid-morning trading today, WTI futures were up 1.9% at $67.07/bbl, Brent was down 2.0% at $73.20/bbl, and U.S. natural gas was down 4.4% at $2.40/MMBtu.

- The U.S. administration predicts high global demand for petroleum products will lead to continued growth in U.S. production, maintaining the nation’s status as a net exporter.

- The banking crisis threatens to curb U.S. oil and gas supply growth, sowing the seed for future imbalance, analysts say.

- Refinery crude demand in China has doubled the daily rate for very large crude carriers (VLCCs) to over $100,000 in the past month.

- California regulators opened an inquiry into high natural gas prices that have sent utility bills soaring during the state’s cold and stormy winter.

- Global oil production fell by 365,000 bpd in January, hitting a seven-month low.

- Saudi Arabia’s crude exports rose by 221,000 bpd to a three-month high in January.

- European natural gas prices are swinging markedly amid concerns over storage refills being disrupted from strikes in France along with low hydro and nuclear output.

- Brazil’s Petrobras faces a potential $3.4 billion tax bill over the oil giant’s chartering of vessels to foreign companies.

- Duke Energy will start construction of a 1-megawatt floating solar array project in Florida this month.

Supply Chain

- An atmospheric river dumped more torrential rain on California Wednesday, forcing evacuations, power outages and road closures. Much of the U.S. Northeast, meanwhile, remained buried under snow.

- A BNSF train that derailed Wednesday in Arizona’s Mohave Desert did not spill hazardous chemicals as originally feared.

- Trains derailed yesterday in Kentucky (CSX) and on tribal lands in Washington state (BNSF), the latter spilling diesel fuel.

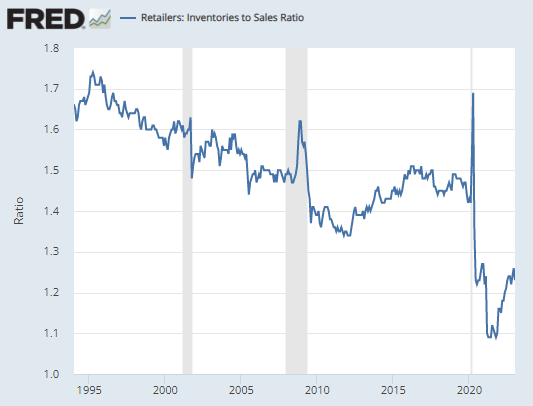

- U.S. retailers saw a 1.23 inventory-to-sales ratio in January, down from 1.26 in December and the lowest level since October 2022.

- Shares of FedEx surged Thursday evening as the company raised its outlook and said it cut more costs after earnings declined for the second straight quarter.

- Some shipping executives say companies are proving reluctant to pay the higher prices for alternative fuels and zero-emissions vehicles that can easily double or triple transport costs.

- Airbus executives say the company is making more frequent checks on the financial health of small suppliers amid continued supply-chain pressures.

- Drone operator Zipline will start operating delivery services in multiple U.S. cities under agreements with three hospitals and the Sweetgreen salad chain.

- Ocean Network Express ordered 10 midsize container ships capable of using methanol and ammonia fuel power.

- Developers are moving forward with a long-delayed 40.6-million-square-foot warehouse project in Southern California’s Moreno Valley that will occupy the equivalent of 700 football fields.

- A shortage of skilled workers in places such as upstate New York is posing a major challenge for the White House’s plans to spur chip manufacturing in the U.S.

- Japan lifted restrictions on exports of semiconductor manufacturing materials to South Korea.

- More than 50 companies, including Boeing, Netflix and SpaceX, are visiting Vietnam next week to explore development and sales opportunities.

- In the latest news from the auto industry:

- A group of technicians at a Nissan plant in Tennessee voted overwhelmingly against joining a union Thursday.

- Volvo will restructure its European bus-making operation to restore profitability, affecting 1,600 jobs.

- Toyota’s St. Petersburg plant may be transferred to a Russian state entity, officials said Thursday.

- Audi forecast more conservative earnings after a bumper 2022 in which income rose 40% to €7.6 billion.

Domestic Markets

- The U.S.’s biggest banks created a $30 billion rescue fund for First Republic Bank Thursday in an effort to stop a spreading panic following a pair of recent bank failures.

- Banks borrowed a combined $164.8 billion from two Federal Reserve backstop facilities last week, a sign of escalating funding strains in the aftermath of Silicon Valley Bank’s failure.

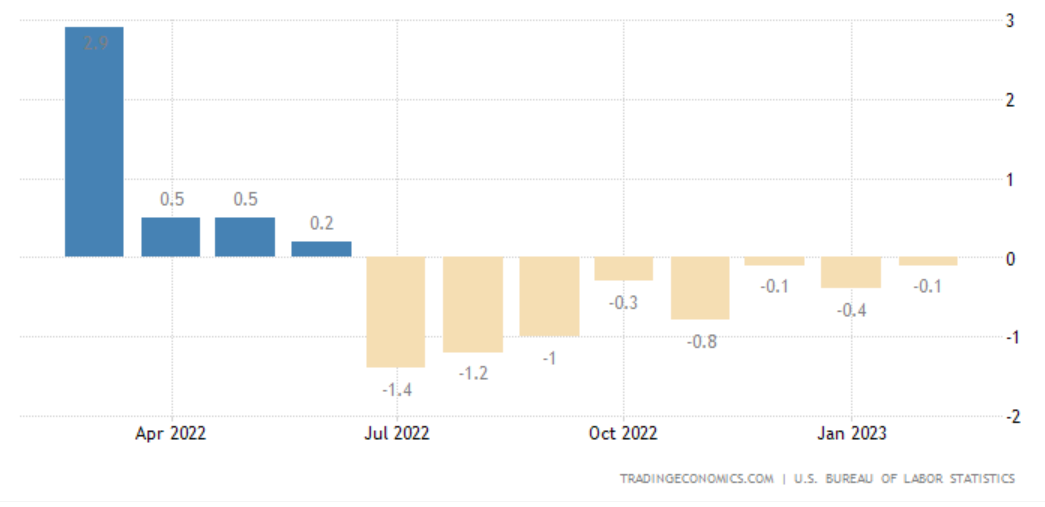

- U.S. import prices fell 0.1% in February and 1.1% year over year, marking the first annual drop since 2020.

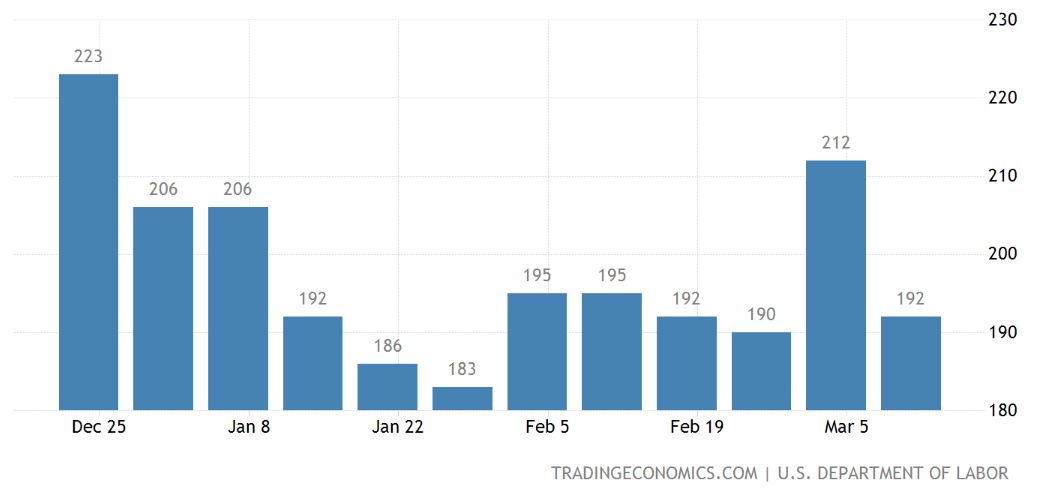

- U.S. jobless claims declined by a larger-than-expected 20,000 last week, pointing to continued labor market strength.

- Single-family U.S. homebuilding, which accounts for the bulk of housing construction, increased 1.1% in February but was down 31.6% year over year.

- Boeing delivered a 787 Dreamliner to Lufthansa this week, its first delivery of the aircraft following a shutdown in late February due to a component issue.

- Dollar General missed Wall Street estimates for fourth-quarter results as the retailer struggled with surging costs and a decline in customer traffic.

- U.S. maternal mortality rates surged in 2021 to their highest level since 1965 as COVID-19 worsened longstanding problems with hypertension, heart health and access to care.

International Markets

- The French administration bypassed parliament in raising the nation’s retirement age Thursday, a step expected to worsen protests among millions of French workers.

- On Thursday, the European Commission presented the main tenets of a strategy to ensure its green energy and technology sectors remain competitive with the U.S. and China.

- Mexican officials plan to discuss cutting trade tariffs at an inflation-focused meeting next month.

- Mexico faces a looming water shortage due to years of drought, population growth and lax infrastructure management.

- Argentina’s central bank hiked the country’s benchmark interest rate by 300 basis points to a total of 78% on Thursday.

- Annual sales at Zara owner and fast-fashion leader Inditex jumped 17.5% and net profit rose 27%, outperforming major retailing rivals.

Some sources linked are subscription services.