MH Daily Bulletin: March 20

News relevant to the plastics industry:

At M. Holland

- M. Holland announced a new partnership with Lavergne, a global manufacturer specializing in the formulation of customized compounded engineered resins, to distribute PCR resins for customers in North America. Click here to read the press release.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil settled 2.3% lower Friday as banking sector fears caused both benchmarks to reach their biggest weekly declines in months.

- Crude prices continued to fall to start the week despite aggressive central bank intervention to calm financial markets. In mid-morning trading today, WTI futures were down 1.4% at $65.83/bbl and Brent was down 1.1% at $72.19/bbl. U.S. natural gas was down 2.5% at $2.28/MMBtu.

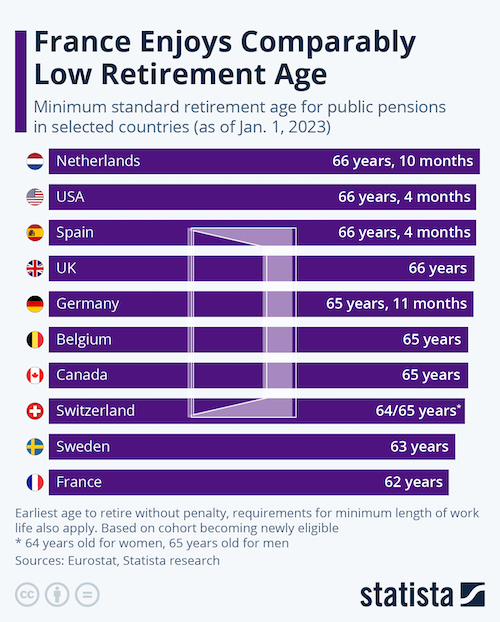

- Four out of France’s six refineries will shut down today as strikes escalate following the government’s controversial pension overhaul.

- Russia surpassed Saudi Arabia as the top exporter of crude to China in the first two months of the year.

- Italian oil and gas major Eni said it discovered potentially up to 200 million barrels of oil in offshore Mexico’s Sureste Basin.

- British Columbia’s decision to toughen emissions standards for new LNG projects creates one of the most robust climate plans in North America, analysts say.

- The Texas agency that regulates the state’s power utilities overstepped its bounds and kept prices too high in the wake of the 2021 Texas freeze, an appeals court ruled.

Supply Chain

- The U.S. West Coast is bracing for another round of storms this week, with wet weather expected in California and the Sierra Nevada region anticipating more snow. Recent deluges have substantially cured the state’s years-long drought.

- The Port of Los Angeles handled 331,811 TEUs in February, a 36% year over year drop led by plummeting imports.

- Georgia’s Port of Savannah handled 395,000 TEUs in February, down 14% from the same month last year.

- Year-over-year net income fell 31% in the first quarter for FedEx on a 6% decline in revenue.

- Toy maker Funko is destroying up to $36 million worth of inventory after surplus stocks strained its fulfillment network.

- Leadership at J.B. Hunt and Ryder System are showing less optimism about the U.S. freight market for the rest of 2023.

- The U.S. Postal Service shifted a big share of its transport spending from air to trucks in the past fiscal year.

- A new alliance of shippers is pushing ocean carriers to step up emissions-reduction efforts.

- Nickel and copper prices are sliding on concerns over China’s economy.

- International negotiators agreed to extend a safe-passage deal for grain exports from the Black Sea for another 60 days.

- In the latest news from the auto industry:

- Volkswagen is looking to release a new low-priced electric vehicle that will cost under $22,000 within the next six to seven years, part of an effort to better compete with Tesla and help boost lagging vehicle sales in China.

- Volkswagen’s Russian assets have been frozen by a Russian court as the automaker looks to sell its plant in Kaluga, just south of Moscow.

- To bring down the cost of batteries, Volkswagen plans to invest in mines to meet half its own demand and sell to third-party customers, consistent with a trend among car makers to vertically integrate into their supply chains.

- Earnings of U.S. auto dealers have eased over the past few months after hitting a record $6.5 million per location in 2022.

- Mercedes-Benz will invest billions to modernize its plants in China, Germany and Hungary over the coming years as the carmaker accelerates its transition to electric vehicles.

- Automakers and dealerships in China are slashing prices after the lifting of pandemic controls failed to reverse slumping demand in the world’s largest car market.

- Stellantis will spend more than $213 million to manufacture four Fiat models in Algeria.

- Czech carmaker Skoda says it will cut 3,000 jobs and axe some models if a proposed EU emissions scheme is passed in its current form.

- Vietnamese electric-vehicle startup VinFast saw the departure of three high-level executives last week.

Domestic Markets

- Some analysts say the collapse of Silicon Valley Bank may be a “wake-up call” to financial markets and companies about the impacts of Federal Reserve rate hikes.

- Wall Street’s top regulator is set to adopt new rules aimed at bolstering oversight of systemic risk in the burgeoning world of private equity and hedge funds.

- U.S. regulators are considering retaining ownership of securities owned by Signature Bank and Silicon Valley Bank to allow smaller banks to participate in auctions for the collapsed lenders, according to reports.

- Stubborn inflation, particularly in building costs, is creating headaches for business insurance customers, raising premiums and the cost of restoration and replacement above coverage limits.

- U.S. consumer sentiment fell for the first time in four months in March, according to the University of Michigan’s widely tracked index.

- American’s one-year inflation expectations fell to 3.8% this month, the lowest in almost two years.

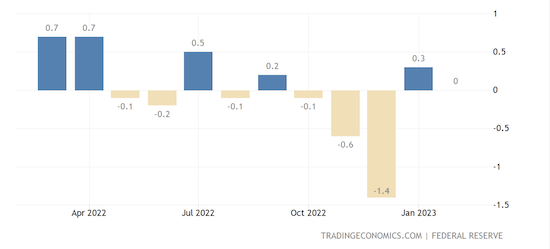

- U.S. industrial production was flat in February, missing market expectations of a 0.2% increase:

- A U.S. government report says American importers bore almost the entire burden of tariffs imposed by the previous administration on more than $300 billion in Chinese goods.

- Amgen will cut 450 jobs, or around 2% of its workforce, marking the company’s second round of layoffs this year.

International Markets

- Regulators looking to halt a dangerous decline in confidence pushed UBS Group to take over its longtime rival Credit Suisse for more than $3 billion, one of the biggest banking deals in years. The state-backed takeover is expected to lead to more job cuts than the 9,000 layoffs Credit Suisse was already planning. The acquisition has sparked concerns about the outlook for banks in Switzerland and caused banking stocks and bonds to plunge.

- The world’s top central banks said they would start offering daily loans in dollars to their banks to avert stress in the funding market after the emergency rescue of Swiss giant Credit Suisse.

- Latin America could see zero economic growth this year if the banking crisis in the U.S. and Europe spreads across the world, top economic officials said.

- A 6.8-magnitude earthquake on the coast of Ecuador caused at least 14 deaths and injured 381 people, while also resulting in fatalities and building damage in northern Peru.

- China’s fiscal revenues fell 1.2% in the first two months of 2023 despite signs that economic activity was starting to recover.

- China’s central bank will cut the amount of cash that banks must hold as reserves for the first time this year to help keep liquidity ample and support economic recovery.

- The global economic outlook has improved from a few months ago, the Organization for Economic Cooperation and Development said.

- Euro zone labor costs jumped 5.7% year over year in the last three months of 2022, with the largest gains in the construction industry.

- Germany and Japan agreed to cooperate closely on economic security during their first-ever high-level government consultations.

- Paris police continued to clash with demonstrators over the weekend as protesters throughout the country marched in opposition to the government’s pension overhaul.

- France is calling on airlines to cut flights at Paris-Orly and Marseille-Provence airports by 20% Tuesday and Wednesday amid ongoing strikes by workers protesting the nation’s pension reform plan.

- Strikes at four German airports led to the cancellation of hundreds of flights Friday.

- EasyJet cabin staff in Portugal will go on a three-day strike in early April to demand higher wages.

- The U.S. government issued a travel alert to spring breakers traveling to Mexico, warning of crime risks.

Some sources linked are subscription services.