MH Daily Bulletin: March 21

News relevant to the plastics industry:

At M. Holland

- M. Holland announced a new partnership with Lavergne, a global manufacturer specializing in the formulation of customized compounded engineered resins, to distribute PCR resins for customers in North America. Click here to read the press release.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rebounded 1% Monday after diving to their lowest level in 15 months earlier in the session.

- In mid-morning trading today, WTI futures were up 2.4% at $69.25/bbl, Brent was up 2.1% at $75.30/bbl, and U.S. natural gas was down 1.2% at $2.20/MMBtu.

- Goldman Sachs cut its 12-month price projection for Brent from over $100/bbl to $94/bbl.

- Group of Seven nations are not likely to revise a $60/bbl price cap on Russian oil this week, according to reports.

- European diesel markets are flashing warning signs of tightening supply after nearly two weeks of disruptions at French refineries due to labor strikes.

- U.S. crude exports to Europe are running at a record 2.1 million bpd so far this month, spurred by a wide discount between WTI and Brent price benchmarks and weaker oil demand from U.S. refineries.

- Analysts are speculating that the banking crisis may prevent U.S. gasoline prices from ticking upward as they normally would ahead of the summer driving season.

- Dozens of oil and gas platforms in the British North Sea could come to a standstill in the coming weeks after 1,400 U.K. workers approved strike actions in contract talks with five contractors.

- The EU proposed extending its emergency measure targeting a 15% reduction in the bloc’s natural gas consumption for another 12 months.

- China exported 4.54 million tons of diesel in the first two months of the year, up tenfold from last year’s export rate.

- India plans to extend restrictions on the export of diesel and gasoline beyond the current fiscal year to preserve supplies for the domestic market.

- Russia’s use of old tankers to bypass sanctions is raising the risk of oil spills, experts say.

- Canadian taxpayers may take up to a $15 billion loss on the government-owned Trans Mountain Pipeline due to soaring costs of its continuing expansion.

- International Petroleum, the first foreign oil company to sanction a project in Canada’s oil sands in more than a decade, is seeking government incentives to add carbon capture and storage to the project.

- The airline industry will likely bump into emission caps under the United Nations Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), intended to hold emissions below 85% of 2019 levels, next year due to rising air travel.

- The Dutch government plans to build a 500 MW facility in the North Sea to convert wind power into green hydrogen.

Supply Chain

- It’s a buyer’s market in current shipping contract talks, with concern growing that low contract rates could force shipping lines to cut capacity just when ocean trade recovers.

- Tensions are rising in long-running contract talks at West Coast ports, with contractors accusing union workers of slowing cargo handling.

- Throughput at the port of Los Angeles was down 43% year over year in February to the lowest monthly total since March 2020 at the start of the pandemic, as shippers divert traffic elsewhere due to risk of labor disruptions at the ports of Los Angeles and Long Beach.

- Maersk and rival container line Hapag Lloyd are planning a combined $22.6 billion in dividend payouts despite the threat of falling profits.

- Maersk Air Cargo launched a new Europe-China airfreight service from its hub at Billund Airport in Denmark.

- Taiwan’s exports of integrated circuit chips to China and Hong Kong plummeted 31.3% year over year in February, the fourth month of declines.

- Freight volumes surged following the three waves of U.S. stimulus spending during the pandemic as the government injected a combined $2.3 trillion in stimulus money into the economy.

- In the latest news from the auto industry:

- Tesla plans to slash the cost of building next-generation electric vehicles by 50% in coming years.

- Tesla is leading a drive to remove rare earths from electric vehicles and has already reduced rare earths in powertrains of Model 3 and Model Y vehicles by a quarter.

- The price of lithium has dropped nearly 20% since January.

- General Motors halted production at its Silao, Mexico, assembly plant for two weeks due to supply-chain problems.

- Japan’s Maxell plans to mass produce the world’s first high-power, solid-state batteries for industrial machines.

- Canada’s Ritchie Bros Auctioneers completed the acquisition of U.S. auto retailer IAA Inc. for about $7 billion.

- Insurers and industry experts say electric vehicle insurance premiums will keep rising until automakers make it easier to access battery data to allow third-party repairs.

Domestic Markets

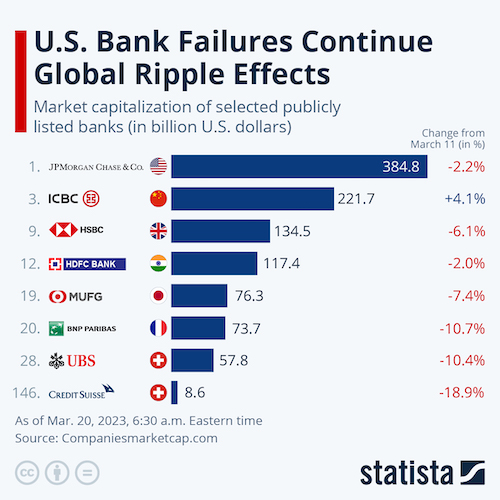

- Federal Reserve officials are meeting this week to consider the next potential rate hike amid the nation’s most intense banking crisis since 2008.

- Amazon will cut 9,000 more jobs, mostly in advertising and cloud computing, on top of the 18,000 it already eliminated, bringing its total staff reduction of recent months to 9% of its corporate workforce.

- JPMorgan Chase is leading discussions with executives of other big banks about fresh efforts to stabilize troubled First Republic Bank, whose shares tumbled nearly 50% Monday.

- U.S. banking regulators decided to break up Silicon Valley Bank and hold two separate auctions for its deposits and its private bank after failing to find a buyer for the failed lender last week.

- The value of U.S. imported goods fell in February for the seventh time in eight months, a tailwind in the fight against inflation.

- Some companies are returning to sourcing from China due to the 2020 expiration of a decades-old trade rule that gave favorable tariff treatment to thousands of goods from more than 100 countries.

- Stanley Black & Decker will close factories in Texas and South Carolina as the company revamps its manufacturing and distribution network.

- Beleaguered retailer Bed Bath & Beyond proposed a reverse stock split to raise its share price above $1, a key threshold to maintain funding from a major investor, sending its shares down 21% Monday.

- Foot Locker forecast a year of declining sales and a 30% drop in profit as the company closes stores, exits businesses and spends more in areas such as technology and wages.

International Markets

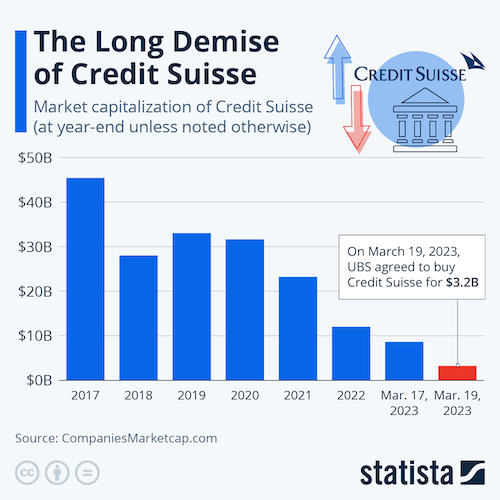

- Credit Suisse Group’s emergency merger with UBS Group will wipe out the bank’s riskiest bonds, rattling investors in the $250-billion market for subprime bank debt.

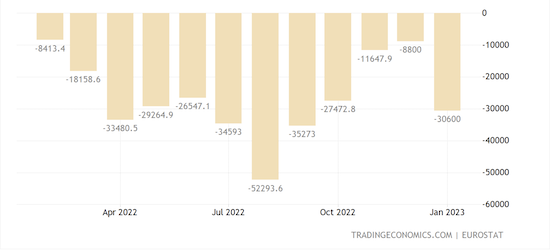

- The euro zone trade deficit was little changed in January from a year earlier, new data shows.

- The French administration narrowly survived a no-confidence vote in parliament Monday, part of a last-ditch effort from lawmakers to scrap the government’s contentious pension overhaul plan.

- Critics of a large lithium mining project in India say the large amounts of water needed for extraction will exacerbate a groundwater crisis.

- A United Nations panel of scientists said the world’s nations must together cut greenhouse-gas emissions 60% by 2035 to avoid the worst effects of climate change.

Some sources linked are subscription services.