MH Daily Bulletin: March 23

News relevant to the plastics industry:

At M. Holland

- M. Holland’s partnership with Lavergne, a global manufacturer of customized compounded engineered resins, was recently shared in Plastics Today. To learn more about this agreement to distribute post-consumer recycled (PCR) resins for customers in North America, click here.

Supply

- Oil rose 2% to a one-week high Wednesday after the U.S. Federal Reserve delivered a smaller-than-expected rate hike while hinting it was on the verge of pausing future increases.

- In mid-morning trading today, WTI futures were down 2.2% at $69.35/bbl, Brent was down 1.8% at $79.32/bbl, and U.S. natural gas was down 1.2% at $2.14/MMBtu.

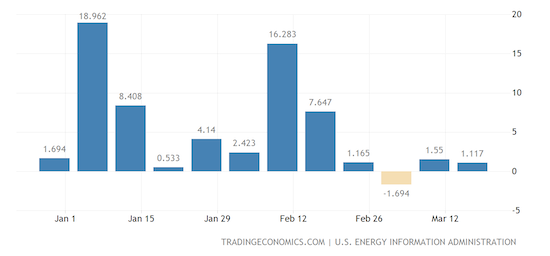

- U.S. crude stocks rose by 1.1 million barrels last week, according to the Energy Information Administration.

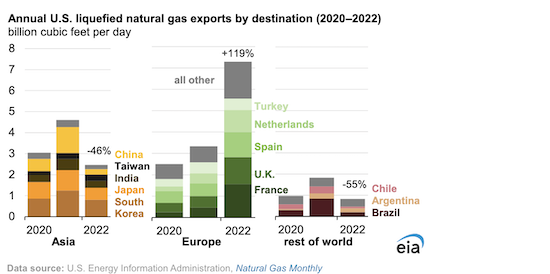

- U.S. LNG exports rose 9% last year, led by strong demand in Europe:

- More than half of Europe’s LNG import capacity could go unused by 2030 as current buildout plans are set to vastly exceed projected demand, according to some analysts.

- OPEC+ is not expected to change its current output policy to prop up falling oil prices this year, according to reports.

- Shell predicts maritime operators will need about 10,000 hydrogen carriers by 2040 to help meet global climate goals.

- Rising demand for biofuels could put a strain on global supplies of cooking oil, experts say.

- The European Central Bank and euro zone central banks will publish their first detailed carbon-footprint analyses in the coming days.

Supply Chain

- Over 130,000 people were left without power in California amid severe storms Wednesday.

- Freight companies are dialing back expectations for demand in the second half of 2023 as economic concerns make retailers more cautious about placing large orders.

- The American Trucking Association’s truck tonnage index rose 1.4 points to a total of 118.4 in February, the third straight increase.

- New EU rules for 2024 will require firms operating at big ports to take cybersecurity measures and report hacks to authorities, the first such demands for many companies that provide services to crucial sectors.

- Major tanker owners are holding off on ordering new vessels amid uncertainty over emission regulations, creating tight demand and windfall profits for operators.

- Freight forwarder DSV is buying two Arizona-based logistics operators to take advantage of growing cross-border trade between the U.S and Mexico and to service the burgeoning semiconductor industry in the region.

- CMA CGM says it is considering entering the market for car carriers.

- Boeing said it should meet delivery guidance for commercial aircraft this year but is seeing delays in its military fuel tank deliveries due to supplier quality issues.

- In the latest news from the auto industry:

- Tesla’s new facility in Monterrey, Mexico, expected to begin production in 2024, could boost cross-border trade by $15 billion a year.

- Stellantis plans to invest $140 million in its Eisenach plant in Germany to build a new electric vehicle there in the second half of the year.

- Volkswagen plans to build 3 million small electric vehicles at its two plants in Spain between 2025 and 2030.

- Carvana shares surged as much as 29% Wednesday on news that it expects a smaller core loss in the current quarter due to successful cost-cutting efforts.

- The U.S. Treasury will release guidance next week on sourcing requirements for electric-vehicle battery tax subsidies, the first in a string of highly anticipated rules to determine how broadly the credits can be used.

- Albemarle chose Chester County, South Carolina, as the site for a $1.3 billion lithium processing plant for the rapidly growing U.S. electric-vehicle industry.

- The pace of auto-supplier mergers and acquisitions is expected to pick up as companies attempt to reposition for the electric-vehicle era.

Domestic Markets

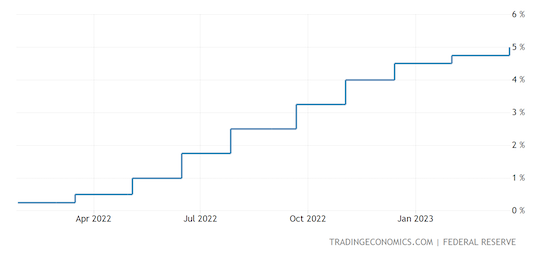

- The Federal Reserve approved another quarter-percentage-point interest-rate increase and signaled that turmoil in the banking system might interfere with its campaign to continue boosting rates. One more rate hike could come this year before the bank starts to ease rates in 2024.

- Deposit flows in the U.S. banking system have stabilized in the past week after a run on deposits at Silicon Valley Bank prompted its collapse, the Fed chair said Wednesday.

- Stock markets, particularly bank stocks, sank late yesterday when the Secretary of the Treasury said the administration is not considering a blanket guarantee of all bank deposits.

- U.S. mortgage rates tumbled by the most in four months last week as worries grew over a domestic banking crisis.

- Corporate bankruptcy filings are up sharply this year, with many filers citing persistent price pressures.

- Facing an earnings squeeze due to weakening demand and rising inflation, many companies are switching from LIFO to FIFO inventory accounting to boost reported earnings.

- U.S. companies borrowed 11% more in February than last year to finance equipment investments.

- The airline industry expects even higher demand for international travel this summer compared to 2022, potentially adding to strains amid continued worker shortages.

- U.S. aviation regulators will temporarily cut airline minimum flight requirements, under which airlines surrender their reserved slots if they don’t use them 80% of the time, at congested New York City airports. The decision was made to address summer congestion issues, particularly air traffic controller staffing levels.

- A group of seven U.S. senators say raising the mandatory retirement age for commercial pilots from 65 to 67 could help the airline industry with staffing issues.

- Boeing secured a deal worth at least $2.5 billion to sell 21 of its 737 MAX jets to Japan Airlines.

- Despite company-wide cost-cutting, Amazon is finding success in rolling out its palm-scanning and contactless checkout technology to more U.S. stores.

- U.S.-based job search platform Indeed will cut about 2,200 jobs, or 15% of its workforce, joining a host of tech firms taking drastic measures to shave costs.

International Markets

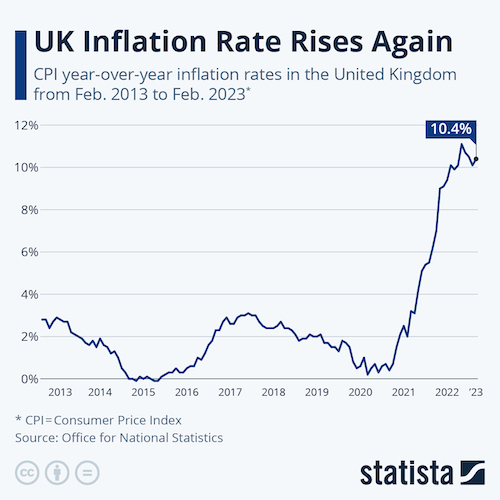

- The Bank of England is under pressure to raise interest rates today after British inflation unexpectedly rose to 10.4% in February.

- Switzerland’s central bank followed the ECB and Federal Reserve in raising interest rates, hiking it 50 basis points yesterday.

- Workers and citizens across France staged a ninth day of protests Wednesday, angered by the government’s pension overhaul.

- China plans to strengthen its support for advanced manufacturing, top officials said Wednesday.

- Chinese tech giant Tencent said it will focus on cost cutting after experiencing a 1% revenue decline last year, its first ever drop in annual revenue.

Some sources linked are subscription services.