MH Daily Bulletin: March 28

News relevant to the plastics industry:

At M. Holland

- M. Holland’s partnership with Lavergne, a global manufacturer of customized compounded engineered resins, was recently shared in Plastics Today. To learn more about this agreement to distribute post-consumer recycled (PCR) resins for customers in North America, click here.

Supply

- Oil rose almost 5% Monday on easing worries related to U.S. financial turmoil.

- In mid-morning trading today, WTI futures were up 0.4% at $73.11/bbl, Brent was up 0.4% at $78.41/bbl, and U.S. natural gas was down 0.1% at $2.09/MMBtu.

- U.S. gasoline prices fell for a second straight week, but price drops are likely to be only temporary, analysts say.

- European natural gas prices rose Monday as strikes in France prolong outages throughout the nation’s energy infrastructure.

- Around 400,000 bpd of crude exports from Kurdistan remain offline after the Iraqi government halted a key pipeline to Turkey last week.

- Tensions are escalating between the U.S. and Mexico over the Mexican government’s rollback of reforms intended to open its energy sector.

- Saudi Aramco signed two new crude-supply deals with China, bolstering its rank as China’s top provider of the commodity.

- Russia’s seaborne crude exports remain above 3 million bpd, with most shipments headed to China and India. The nation’s diesel exports are on track to hit a record this month.

- Coming off record profitability in 2022, Shell’s new CEO faces a gauntlet as he decides whether to expand oil production or renewable energy, with environmentalists on one side and pro-production shareholders and industry advocates on the other.

- Berkshire Hathaway raised its stake in Occidental Petroleum to nearly 24%.

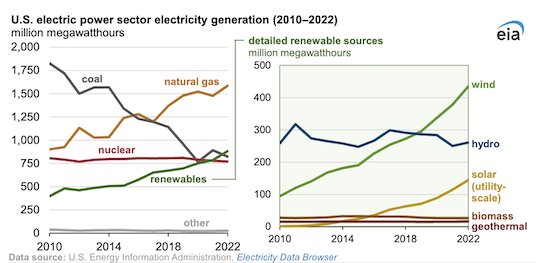

- U.S. electricity generation from renewable sources surpassed coal-fired generation for the first time in 2022:

- The global wind industry is expected to install at least 136 GW per year through 2027, according to the Global Wind Energy Council.

- Portugal will launch its first auction for rights to sell hydrogen for use in the nation’s gas grid in the second half of 2023.

- A major Chinese energy firm is in talks to build a 1,000 MW floating solar plant offshore Zimbabwe, estimated to cost $1 billion.

- Canada’s next budget will implement a new system to lock in future carbon-credit prices, a move proponents say will give businesses certainty when developing low-carbon technologies.

- EU countries remain divided over whether to allow nuclear to count toward meeting renewable energy targets, a dispute that threatens to delay one of the bloc’s key climate policies.

Supply Chain

- California could see more severe storms this week, especially in the northern part of the state, according to forecasters. Millions of people will probably see severe weather in the tornado-battered U.S. Southeast as well.

- Dozens of business and industry groups are formally asking the U.S. administration to step in and facilitate labor talks to keep West Coast ports operating amid a labor dispute.

- The Port of Oakland saw 153,837 TEUs of loaded container imports in February, down 32% from a year earlier.

- Milwaukee’s main airport plans to build a large terminal for freighter aircraft, boosting air cargo competition in the Greater Chicago area.

- The Teamsters union rejected Yellow’s proposal to consolidate many of its regional trucking and terminal operations last week.

- Amazon workers in Britain are planning more strikes as contract negotiations drag on.

- The U.S. Supreme Court rejected a challenge brought by major steel importers to impose 25% tariffs on steel imports.

- The U.S. administration invoked the Defense Production Act Monday to spend $50 million on domestic and Canadian production of printed circuit boards, a key component for many electronics.

- In the latest news from the auto industry:

- The EU reached agreement on deploying more electric-vehicle and alternative fuel service stations and also received Germany’s support for phasing out most internal combustion vehicle sales by 2035, after making a concession for cars using e-fuels.

- The U.S. and Japan reached a critical minerals deal intended to reduce supply dependency on China, removing export levies on essential electric-vehicle minerals and allowing Japan to participate in projects under the Inflation Reduction Act.

- Canadian battery recycler Li-Cycle Holdings announced plans to build a new facility in France to commence operation in 2024.

- Paper-thin electrical steel, used to convert electrical energy into mechanical energy in electric motors, is the latest material in short supply due to the surge in EV demand, prompting large U.S. steelmakers to boost production.

Domestic Markets

- U.S. regulators are backstopping a deal for regional bank First Citizens to acquire failed Silicon Valley Bank, a move that will likely cost $20 billion.

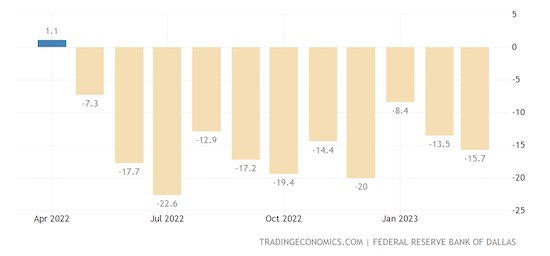

- Manufacturing activity in Texas is falling at a faster pace than in previous months, according to an index from the Federal Reserve Bank of Dallas:

- The electrician labor pool is expected to grow about 7% over the next decade, driven by a shift to renewable energy.

- Housing markets in big U.S. tech hubs are cooling faster than other parts of the country following a recent spate of layoffs in the tech sector.

- Walt Disney began the process of laying off some 7,000 people this week, fulfilling a plan announced earlier this year.

- Furniture and home decor retailer At Home has permanently cut prices on hundreds of items, citing falling supply chain costs.

- Cruise line Carnival Corp. reported a smaller-than-expected quarterly loss Monday, boosted by strong demand for leisure travel.

International Markets

- Average global economic growth could slump to three-decade lows by 2030, warns the World Bank.

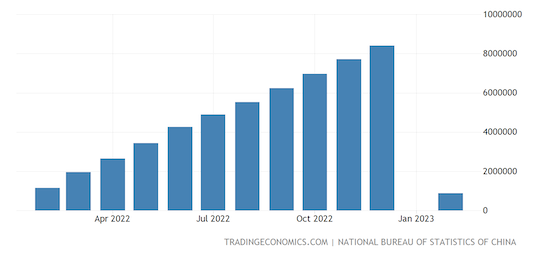

- China’s industrial profits plummeted 22.9% in the first two months of 2023 as factory activity struggled to rebound from pandemic disruptions:

- China has been forced to dole out more than $230 billion in emergency support to distressed foreign borrowers under Beijing’s struggling Belt and Road infrastructure program.

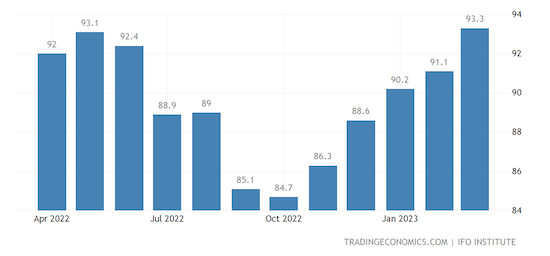

- An index of Germany’s business climate rose to 93.3 in March, the highest in over a year, beating market forecasts:

- British retailers are making optimistic sales forecasts for the first time in seven months, according to a new survey.

- Economists expect the Bank of Mexico to raise interest rates by a more modest 25 basis points at its next meeting this Thursday,

- Mexico reported 237 cases of cargo theft in the first two months of 2023, a 29% decrease from the year-ago period but with rising rates of theft at new industrial parks springing up from reshoring.

Some sources linked are subscription services.