MH Daily Bulletin: May 5

News relevant to the plastics industry:

At M. Holland

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- How can healthcare organizations improve the environmental impact of their healthcare packaging, increase the recyclability of products and reduce overall waste? Read the insight from our experts here.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices jumped 5% Wednesday after the EU unveiled plans to phase out Russian oil within six months.

- In mid-morning trading today, WTI futures were down 0.9% at $106.90/bbl, Brent was off 0.6% at $109.50/bbl, and U.S. natural gas was up 1.3% at $8.53/MMBtu.

- OPEC+ said it will stick to a 432,000-bpd output increase in June.

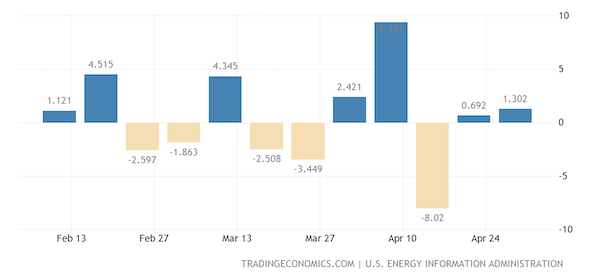

- U.S. crude inventories rose unexpectedly by 1.3 million barrels last week, according to the government. Distillate and gasoline stocks fell on strong export demand.

- Shell’s first-quarter profits nearly tripled, and the company said it will take a $3.9 billion impairment charge related to assets in Russia.

- Cheniere, the U.S.’s largest LNG exporter, posted a first-quarter net loss of over $865 million that it attributed to poorly performing LNG derivative instruments. The firm raised its 2022 profit forecast by 17% on strong export demand.

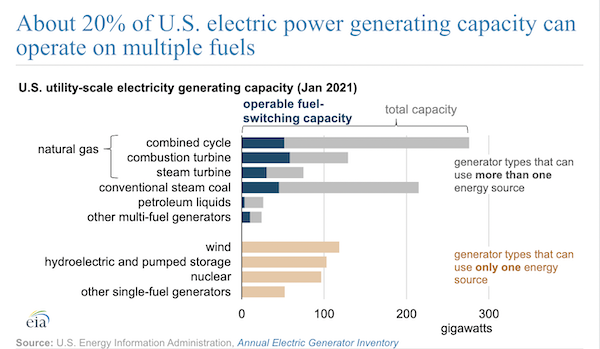

- Roughly 20% of U.S. electricity generation can operate on multiple fuels including gas, petroleum liquids and coal, a positive indicator of supply reliability:

- More oil news related to the war in Europe:

- Russia’s commodity exports likely rose 2% last month, staying resilient as Asia imported more fuel at steep discounts, down to nearly $70/bbl by some reports. Analysts say Russia’s output will fall 10% once Europe’s proposed ban takes effect.

- Europe may temporarily allow Hungary to import Russian oil after Hungarian officials said they would vote against the EU’s sixth sanctions package. Slovakia, Bulgaria and the Czech Republic also may see temporary exemptions from the proposed ban on Russian oil imports within six months.

- Europe’s sixth package of proposed sanctions would end all services for the transport of Russian oil worldwide within a month. Several marine insurance firms have already dropped coverage for Russian tanker operators.

- BP has emptied its European refineries of Russian oil and expects to end most of its contracts with Russia by yearend.

- Norway is on track to pump a record amount of gas to Europe this year.

- New drilling in the British North Sea could release up to 4 billion cubic meters of gas annually by 2024.

- European nations quickly stepped up to fill Poland’s gas supplies after Russia cut off deliveries last week.

- Germany’s interior minister said it would make sense for people to begin stockpiling food and medicine amid threats to energy supplies and infrastructure networks.

- Switzerland is preparing for “severe” electricity and gas shortages and set up a crisis warning system in the event of emergency.

Supply Chain

- Diesel prices hit an all-time high $5.43 a gallon yesterday, according to AAA, as the price spread with gasoline grows.

- The U.S. industrial vacancy rate dropped to 3.1% in the first quarter, well below the historical average of 5.9%, with asking prices also rising several percentage points.

- Major U.S. rail lines told regulators it may take months to clear congestion in their networks.

- Employers are clashing with West Coast dockworkers over rising automation at U.S. ports, a potential sticking point as labor negotiations ramp up ahead of new contracts due this summer.

- Ports and inland networks are facing severe capacity restraints with erratic levels of containers flowing in and out, leading to more blank sailings and slowing recent gains in schedule reliability. Ripple effects from Chinese lockdowns could extend for months, experts say.

- Sherwin-Williams began using its private fleet of trucks and rail cars to pick up deliveries from suppliers last quarter, as logistics bottlenecks strained its production.

- Paint and coating supplier PPG will soon reopen six of its Chinese facilities that were shut down the past month due to lockdowns.

- U.S. truck driving schools are getting more applications as wages increase and firms offer other incentives.

- In the latest supply chain news from earnings season:

- Canadian Pacific Railway saw revenue (-6%) and profits (-2%) dip on weak grain harvests, harsh temperatures and a multi-day worker strike in March.

- Revenues for China’s COSCO Shipping rose 24.2% last quarter.

- Japan’s Ocean Network Express more than quadrupled full-year net profit to $16.8 billion as revenue doubled.

- The Port of Montreal moved 1.7 million TEUs in 2021, up 7.5% from the previous year after several upgrades were completed.

- Maersk completed an acquisition of Ohio-based Pilot Freight Services, giving the Danish shipping giant further reach into the U.S. overland logistics market.

- MSC, the world’s largest container carrier with 665 ships carrying 4.3 million TEUs, has over 100 ships on order comprising 1.3 million TEUs of additional capacity.

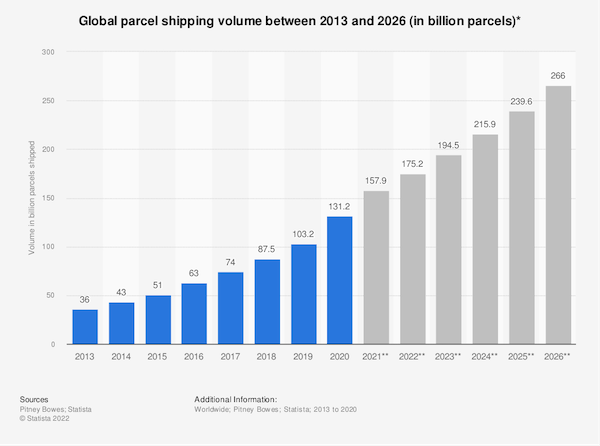

- Global parcel shipping volumes are expected to double from 2020 levels over the next five years, according to Pitney Bowes.

- Yazaki and other Japanese auto suppliers are setting up production bases in North Africa to diversify their supply chains.

- Automakers should be able to boost electric vehicle production from 4.2 million units last year to 14 million units in 2023 based on the available supply of key battery materials, new data suggests.

- Autonomous trucking startup TuSimple will focus on retrofit technology after executives signaled its 2024 commercialization plans were too aggressive.

- More supply chain news related to the war in Europe:

- Maersk says it found buyers for its 30.75% stake in Russian port operator Global Ports Investments.

- Russian forces littered Ukrainian fields with mines and destroyed equipment in what Ukraine says is an effort to destroy its agricultural production.

- Activity in Russia’s manufacturing sector declined deeper into contraction territory for the third straight month in April, according to the latest data.

Domestic Markets

- The U.S. reported 114,308 new COVID-19 infections and 1,960 virus fatalities Wednesday. Total fatalities since the start of the pandemic surpassed 1 million, the most of any nation.

- The CDC’s forecasting model projects increasing COVID-19 hospitalizations and fatalities in coming weeks, with New Jersey, New York and Ohio expected to experience the most deaths.

- Cases of two potentially more infectious subvariants of Omicron — BA.2.12.1 and BA.2.12.2 — have doubled in the U.S. over the last two weeks.

- COVID-19 hospitalizations in New York are up 153% the past month.

- Municipalities with rising COVID-19 cases are shunning new masking orders even after reaching “high-risk” transmission levels.

- A Carnival cruise ship made an emergency docking in Seattle after more than 100 people caught COVID-19 on-board, overwhelming the crew.

- First-time jobless claims climbed by 19,000 to 200,000 last week.

- Markets largely shook off the Federal Reserve’s half-point increase to its benchmark interest rate announced yesterday, the biggest hike since 2000. The Fed also outlined plans to shrink its nearly $9 trillion balance sheet by one-third over the next three years.

- The U.S. trade deficit swelled 22.3% to a record $109.8 billion in March, as U.S. demand exceeds economic activity in many other nations.

- A purchasing managers index for U.S. services activity fell from 58.3 to 57.1 in April, a slight contraction largely due to worker shortages.

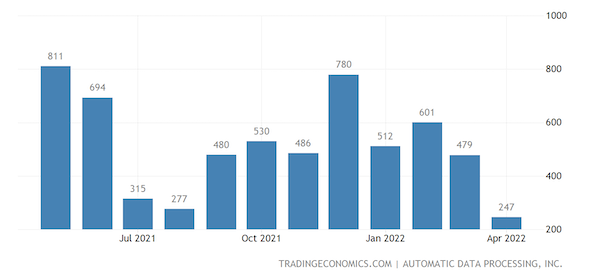

- ADP says U.S. company payrolls rose just 247,000 last month, the smallest increase of the pandemic recovery, as small businesses struggled with a tight labor market and rising costs.

- Only one-third of Americans think now is a good time to buy a home, a record-low percentage in survey results going back to 1978, according to Gallup.

- Jacksonville International Airport saw almost 9,000 delays totaling 543,000 minutes – a year’s equivalent – in March alone, as congestion soars alongside rebounding travel activity. The FAA said it would immediately boost staffing in South Florida.

- U.S. gym memberships and concert ticket purchases are surging past pre-pandemic levels.

- In the latest news from first-quarter earnings season:

- COVID-19 vaccine sales helped Moderna triple first-quarter revenue and profit from a year ago.

- Uber’s revenue more than doubled from a year ago as its driver base hit the highest level of the pandemic, a sharp contrast to Lyft, whose stock fell 30% Wednesday on weak earnings forecasts.

- CVS reported upbeat results, including an 11% gain in sales spurred by demand for COVID-19 vaccines and testing kits during the Omicron wave.

- Booking Holdings, the U.S.’s largest online travel firm, saw revenue rise 136%, while Marriott posted an 81% jump in sales, two promising signs of rebounding travel activity.

- Tupperware Brands’ stock fell over 30% Wednesday after the firm posted a 16% decline in first-quarter sales and pulled its full-year guidance.

- Allstate’s closely watched adjusted net income declined 61% as rising prices for repairs and replacement vehicles made claims more expensive.

- Russia’s invasion has Volkswagen looking for a bigger share of the U.S. auto market, potentially up to 10% from the current 6% by 2030.

- A U.S. vehicle-battery startup raised $400 million from a group led by Porsche to construct a second factory in eastern Washington state.

- Companies are looking at ways to commercialize recycling of an impending surge of solar-panel waste over the next few years.

- New Jersey began enforcing one of the nation’s strictest bans on single-use plastic bags and polystyrene foam containers and cups yesterday.

- The U.S. recycling rate fell below 6% in 2021 from 8.7% in 2018 due to reduced waste exports and a surge in plastics usage.

International Markets

- Shanghai’s exit from five weeks of lockdowns is being delayed by persistent community spread of COVID-19, even as cases decline below 5,000 per day.

- Hong Kong eased more pandemic restrictions as new COVID-19 cases drop to under 300 per day.

- More news related to the war in Europe:

- Europe’s sixth package of proposed sanctions would cut off Russia’s top lender from the SWIFT global payment system and bar Russian nationals from purchasing European real estate.

- New British sanctions will cut off 10% of Russian imports of management, accounting and consulting services, officials say.

- German exports to Russia fell over 60% in March, the first month of Western sanctions on Moscow.

- The Bank of England raised rates for the fourth consecutive session but signaled it will move cautiously on future increases on concerns about recession for the world’s fifth largest economy.

- An index of China’s services activity continued to plunge in April, falling to just 36.2 where a reading below 50 signals contraction.

- Canadian trade with the rest of the world surged in March, the latest data shows, including a 7.7% rise in imports and a 6.3% rise in exports.

- Volvo’s sales dropped 24.8% year over year in April on weak demand from China and supply fallout from the nation’s lockdowns.

Some sources linked are subscription services.