MH Daily Bulletin: May 9

News relevant to the plastics industry:

At M. Holland

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- If you’re attending Injection Molding & Design Expo in Detroit, check out M. Holland’s speakers during the show:

- Haleyanne Freedman, M. Holland’s Market Manager of 3D Printing, will be discussing Open Platform Adoption in Additive Manufacturing. Don’t miss her presentation in the Designing the Future Theater on Wednesday, May 25 at 4:00 pm CT.

- Josh Blackmore, M. Holland’s Global Healthcare Manager, is facilitating a training seminar on Understanding Material Selection for Medical Devices, from Qualification to Approval. Mark your schedules for this session in the Training and Development Theater on Thursday, May 26 at 9:15 am CT.

- M. Holland recently hosted panelists from Business Publishing International, Jabil and LyondellBasell to discuss the ongoing pandemic, material shortages, the war in Europe, supply chain issues, high inflation and more. Read a recap of the broadcast here and access the recording here.

Supply

- Oil prices rose nearly 1.5% Friday, capping a second week of gains as traders prepare for the EU’s embargo plan to tighten supply.

- In mid-morning trading today, WTI futures were down 4.7% at $104.70/bbl, Brent was down 4.3% at $107.60/bbl, and U.S. natural gas was down 8.1% at $7.39/bbl.

- U.S. natural gas prices are up 90% since the beginning of March amid unusually warm spring weather and higher export demand.

- U.S. fuel prices rose twice as fast as oil prices since late February, suggesting refiners are having trouble meeting demand even as more crude becomes available through big reserve releases.

- Oil majors are spending about half as much on capital expenditures as the last time prices hit $100/bbl in 2013. The U.S. is a prime example, where the nine largest producers spent 54% more on dividend increases and share buybacks than new development in the first quarter.

- Canadian pipeline firm Enbridge saw better-than-expected quarterly profit and moved forward with plans to eventually deliver 9 billion cubic feet of gas per day to the U.S. Gulf Coast, more than quadruple the current amount.

- More oil news related to the war in Europe:

- EU foreign ministers will convene this week should member nations fail to agree on a Russian oil embargo within six months. Planners have already accommodated longer phaseout periods for Hungary, Slovakia, and the Czech Republic.

- At least one German refinery warns it will face a crude shortage when new EU sanctions take effect.

- India continues to ramp up purchases of discounted Russian crude, with at least seven 100,000-ton cargoes reportedly scheduled for delivery this month.

- Shell’s latest effort to withdraw from Russia includes selling its retail fuel stations in the country.

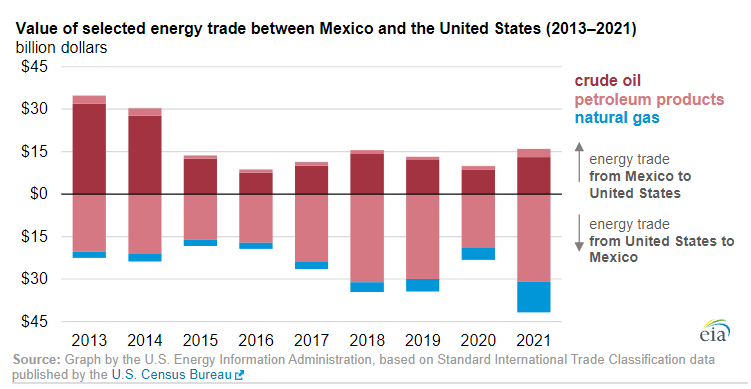

- Energy trade between the U.S. and Mexico reached a nine-year high last year, including record American exports.

- Nigeria and Angola account for almost half the shortfall in OPEC+’s planned output increases each month.

- India plans to reopen over 100 coal mines considered financially unsustainable as century-high temperatures spur demand.

- Vietnam is building a series of LNG-fired power plants as it seeks to move away from coal.

- British fertilizer-maker CF Industries secured a site on the U.S. Gulf Coast for a $2 billion ammonia-fuel plant that could begin production in 2027.

- Occidental Petroleum shareholders overwhelmingly rejected an activist investor’s proposal to broaden the firm’s emissions targets.

- According to the Department of Energy, 86% of plastic waste in the U.S. was landfilled in 2019, 9% was burned, and just 5% was recycled.

- BP entered a 10-year contract to receive the output of a planned recycling facility in the U.K. that will convert hard-to-recycle plastic waste into petrochemical products.

Supply Chain

- Wind gusts approaching 75 mph are turning otherwise manageable fires in New Mexico into record-setting blazes. The largest, the Calf Canyon fire, grew to over 170,000 acres and forced the evacuation of some communities.

- U.S. grid operators warn that power-generating capacity is straining to keep up with demand, a gap that could lead to rolling blackouts during heat waves and peak-demand periods as soon as this year.

- Supply chain issues pose the greatest recession risk to the U.S. economy, according to the Minneapolis Federal Reserve.

- High-stakes contract negotiations start this week between some 22,400 West Coast dockworkers and the cargo-handling companies that employ them.

- U.S. truckload rates on the spot market are down as much as 15% from last year while contract rates are sharply rising.

- Turmoil erupted at a Shanghai factory last weekend as “closed-loop” workers fled to escape lockdowns following a small outbreak of COVID-19.

- Most Japanese firms with factories in Shanghai have yet to resume production, according to a survey.

- A major Alabama healthcare system started rationing key medical supplies as China’s lockdowns disrupt deliveries.

- A national trade group says auto sales in China dropped 48% in April from the prior year, with electric vehicles suffering the steepest declines.

- U.S. regulators approved plans to continue rerouting New York-to-Shanghai flights to a different Chinese airport through the end of this month.

- China’s government is releasing $15 billion to help banks provide low-cost lending to logistics, transport and storage firms, a bid to kickstart supply chains after months of lockdowns.

- U.S. lawmakers are ironing out details on a $52 billion funding package to boost semiconductor production at home, a plan that recently cleared the House and Senate in slightly different formats.

- Japan’s second-largest steelmaker will raise prices by at least $230 a tonne in the current quarter in response to soaring raw material and shipping costs.

- U.S. farm equipment maker AGCO says a ransomware attack is halting dealer deliveries during the crucial planting season.

- The U.S. poultry industry has been forced to cull 37 million birds as the worst outbreak of avian flu continues.

- In the latest supply chains news from quarterly earnings season:

- Truckload carrier Werner Enterprises posted a 35% rise in profits.

- Flatbed operator Daseke saw revenue jump 26.1% despite declining volume.

- Freight forwarder Expeditors International saw a 20% rise in operating profit despite a February cyberattack.

- Korean Air posted $431.3 million in quarterly profit with cargo accounting for 75% of revenue.

- More supply chain news related to the war in Europe:

- The U.S. announced new sanctions aimed at Russian banks, state-controlled media and industry.

- European banks are reporting combined losses of around $10 billion from a broad pullback of Russian operations.

- Russia’s largest shipper is in talks to sell up to a third of its tanker fleet to repay Western loans ahead of British and European sanctions.

- Norway is closing its borders and ports to all Russian transports except for fishing vessels.

- Ukraine is halting more grain exports due to rail congestion at its borders. Nearly 25 million tonnes of the staple crop are likely stuck in the country.

Domestic Markets

- The U.S. reported 4,981 new COVID-19 infections and 23 virus fatalities Sunday.

- The CDC recommends people in the Northeast resume wearing masks indoors as COVID-19 infections near three-month highs across New England and the greater New York/New Jersey region.

- The White House is warning the U.S. of a potential 100 million more COVID-19 infections this fall and winter, part of a plea for more pandemic funding that lost traction with Congress in recent weeks.

- Nevada will lift its COVID-19 state of emergency in two weeks.

- The U.S. Federal Reserve said the nation’s banking system remains strong despite heightened volatility and geopolitical risk.

- Shares of Netflix, Amazon and Facebook parent Meta are down over 30% this year compared to a milder 13% decline in the S&P 500, as surging pandemic growth for large tech firms deflates. All sectors of the S&P were lower in morning trading today.

- U.S. manufacturing employment rose by 55,000 in April, while transportation and warehousing jobs increased by 52,000, as employment in most sectors now exceeds pre-pandemic levels.

- Google is raising employee salaries and streamlining its review process to retain talent in the face of the “Great Resignation.”

- Foreign investment in the U.S. is rising as executives search for growth and stability not found in war-weary Europe and COVID-zero China.

- More wealthy Americans are buying “Golden Passports,” which grant foreign dual citizenship in exchange for a financial investment, as insurance against future pandemics and climate catastrophes.

- Inflation is driving more Americans to food banks just as supply chain disruptions are inhibiting charities from sourcing supplies.

- Some hospitals grappling with rising nurse salaries are seeking to raise prices by up to 15% this year, substantially higher than the 3% average rise in recent years.

- A decade-long population decline in the rural U.S. may be reversing as more Americans look for space and lower costs of living.

- The latest installment of Marvel’s Dr. Strange raked in an 11th-best $450 million during opening weekend, a promising start to the summer movie season and the theater industry in general.

- In the latest news from quarterly earnings season:

- Shares of Under Armour tumbled over 23% Friday on larger-than-expected losses and sales declines.

- Hilton’s average U.S. hotel rates were 36.4% higher than a year ago, consistent with data showing rising prices and congestion across the travel industry.

- Amazon plans to close six Whole Foods stores following its first quarterly loss in seven years.

- Twenty broadband providers, including AT&T and Verizon, will participate in the federal government’s effort to expand internet access to the millions of people who remain unconnected.

- South Carolina and Kentucky are the reported frontrunners for new investment by China’s CATL, the world’s largest battery maker, to serve the budding electric-vehicle businesses of BMW and Ford.

- Wells Fargo unveiled new targets aimed at tracking and reducing emissions related to its lending.

International Markets

- Shanghai, which continues to report the bulk of China’s several thousand COVID-19 cases per day, tightened lockdowns in a renewed effort to achieve COVID-zero by late May, while mass testing continues daily in Beijing. China will set up thousands of permanent testing stations, including 9,000 in Shanghai alone, to monitor infections after the current wave ends.

- COVID-19 cases in South Africa rose 50% in 24 hours on the rapid spread of two new subvariants of Omicron. The nation’s positivity rate is back near record levels around 30%.

- Economists say China’s trade sector is losing momentum as COVID-19 curbs hit production and imports continue to decline. The nation’s consumer prices rose just 1.5% in March, contrasting sharply with record or near-record inflation rates in the U.S. and eurozone.

- Adidas’ sales in China collapsed 35% in the first quarter, prompting a lowered outlook for 2022.

- German industrial production fell a larger-than-expected 3.9% in March, the steepest decline in two years.

- Antitrust concerns are holding up an acquisition between two of Canada’s largest telecom firms.

- British Airways’ parent company expects passenger volumes to hit 80% of 2019 levels this quarter and rise to 90% by the fourth quarter.

- World food prices eased slightly in April after hitting a record-high in March, new data shows.

Some sources linked are subscription services.