MH Daily Bulletin: May 10

News relevant to the plastics industry:

At M. Holland

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- If you’re attending Injection Molding & Design Expo in Detroit, check out M. Holland’s speakers during the show:

- Haleyanne Freedman, M. Holland’s 3D Printing Market Manager, will be discussing Open Platform Adoption in Additive Manufacturing. Don’t miss her presentation in the Designing the Future Theater on Wednesday, May 25 at 4:00 pm CT.

- Josh Blackmore, M. Holland’s Global Healthcare Manager, is facilitating a training seminar on Understanding Material Selection for Medical Devices, from Qualification to Approval. Mark your schedules for this session in the Training and Development Theater on Thursday, May 26 at 9:15 am CT.

- M. Holland recently hosted panelists from Business Publishing International, Jabil and LyondellBasell to discuss the ongoing pandemic, material shortages, the war in Europe, supply chain issues, high inflation and more. Read a recap of the broadcast here and access the recording here.

Supply

- Oil prices slid about 6% Monday, the steepest decline in five weeks, on prospects of more Russian oil staying on the market amid a setback in the EU’s embargo plans.

- In mid-morning trading today, WTI futures were down 3.3% at $95.65/bbl, Brent was down 3.3% at $102.40/bbl, and U.S. natural gas was up 4.10% at $7.32/MMBtu.

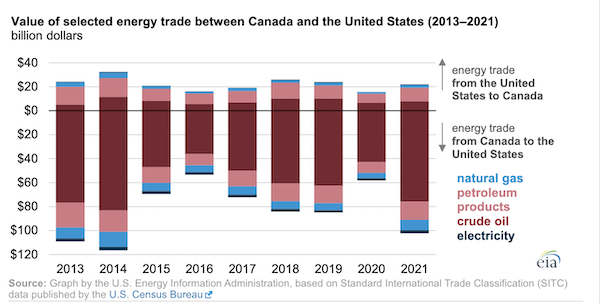

- Energy trade between the U.S. and Canada shot up 37.5% from 2020 to 2021, new data shows:

- Repairs to Exxon Mobil’s refinery in Billings, Montana, will extend three more weeks after a fire forced its crude distillation unit to shut down in late March.

- Negotiations were completely stalled for a third straight week between Chevron and union employees at a refinery in Richmond, California.

- China’s crude imports grew nearly 7% in April from a year ago, the first rise in three months, while coal imports surged 43% over fears of supply shortages driven by Russia’s invasion of Ukraine.

- ConocoPhillips plans to invest $1.1 billion in a Norwegian North Sea production site, the first of an expected rush of new projects to be launched in Norway this year.

- More oil news related to the war in Europe:

- The EU failed to reach agreement on a proposal to ban Russian oil in six months on holdout from Hungary. Hopes for swift approval of the embargo faded as the EU’s president headed to Budapest to meet with objecting officials. An updated proposal could include funds to upgrade oil infrastructure in Eastern Europe in exchange for its support.

- Japan joined the other G7 industrialized nations in pledging to eventually ban Russian oil imports, although no timeline was given.

- German officials are reportedly working behind-the-scenes to prepare for a sudden drop-off in Russian gas deliveries.

- Talks between Germany and Qatar to boost LNG shipments to Europe temporarily stalled over differences about terms.

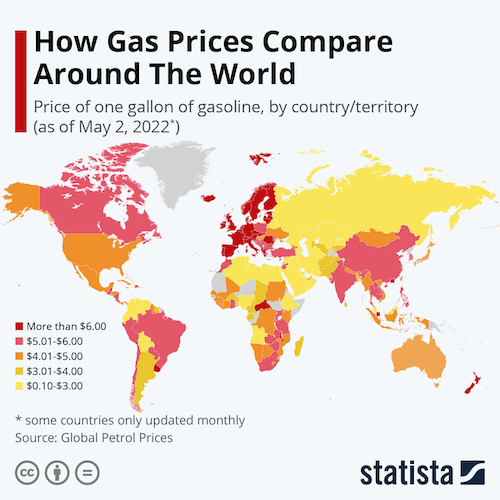

- Western Europe was paying around $6 a gallon for gasoline last week, as fallout from Russia’s invasion spreads unevenly on fuel markets across the globe:

Supply Chain

- Extreme drought is spreading throughout the U.S. Southwest with reservoir levels below normal in all Western states except Washington.

- First-quarter industrial construction in the U.S. rose 48% from a year ago while the national warehouse vacancy rate fell to a 27-year low.

- American importers say some container lines are ignoring contract obligations to impermissibly seek higher prices on spot markets.

- First-quarter profit at Cosco Shipping Ports rose 31% to $80.9 million despite a decline in cargo throughput in the Greater China region.

- A queue of 27 container ships backed up at the Port of Charleston is down to five.

- Global airfreight demand fell 5.2% in March, according to the International Air Transport Association.

- Air Lease Corp, an influential leader in the airline industry, expressed doubt over the future of Boeing’s 777X Freighter whose production was recently pushed back to 2025, five years later than it was originally due. Fears were slightly allayed after Lufthansa announced it placed $6 billion in new orders with Boeing, including for 10 cargo planes.

- Flatbed trucking, often associated with the housing and construction markets, is showing signs of softening.

- Uber’s Freight unit showed its first measure of profitability in the first quarter on positive impacts from its acquisition of logistics operator Transplace.

- Declining spot rates could squeeze out tens of thousands of small operator-owned trucking companies that rushed into the market when rates were surging earlier this year, analysts say.

- Prices for palladium, a key metal in automobiles, jumped Monday after Britain said it would raise tariffs on imports from Russia, the world’s largest miner.

- Tesla halted production at its Shanghai plant Monday due to supply shortages, just three weeks after the automaker partially emerged from Chinese lockdowns.

- Auto supplier Aptiv stopped shipping parts from a Shanghai plant that supplies Tesla and General Motors after COVID-19 infections were detected among workers.

- After more than 160 years in business, Armstrong Flooring filed for bankruptcy due to its inability to raise prices fast enough to keep up with rising costs and production disruptions.

- XPO Logistics named a new chief executive for the planned spinoff of its freight brokerage business, part of the firm’s reorganization into three separately traded public companies.

- The cost of insuring ships in the Black Sea and Sea of Azov regions are at record levels due to the threat of Russian attack.

- Expectations that drought in Kansas, Texas and the surrounding region will severely shrink U.S. crop yields is adding to fears of worsening global food inflation and shortages.

Domestic Markets

- The U.S. reported 110,182 new COVID-19 infections and 514 virus fatalities Monday. The seven-day average is up to 73,000 from just 27,000 a month ago, with the highest infection rates in the Northeast and Puerto Rico.

- Hospital admissions for COVID-19 in the U.S. are up 17% over the past week.

- One in five people getting tested for COVID-19 in New York City are positive, while virus transmission rates are up 90% the past month. Still, mask mandates are not likely to come back anytime soon.

- Thirteen percent of hospitalized COVID-19 patients developed serious neurological conditions, most commonly brain disease or damage, new research suggests.

- Major COVID-19 vaccine makers are shifting gears to a smaller, more competitive COVID-19 booster market on the belief that most people who wanted to get vaccinated have already done so.

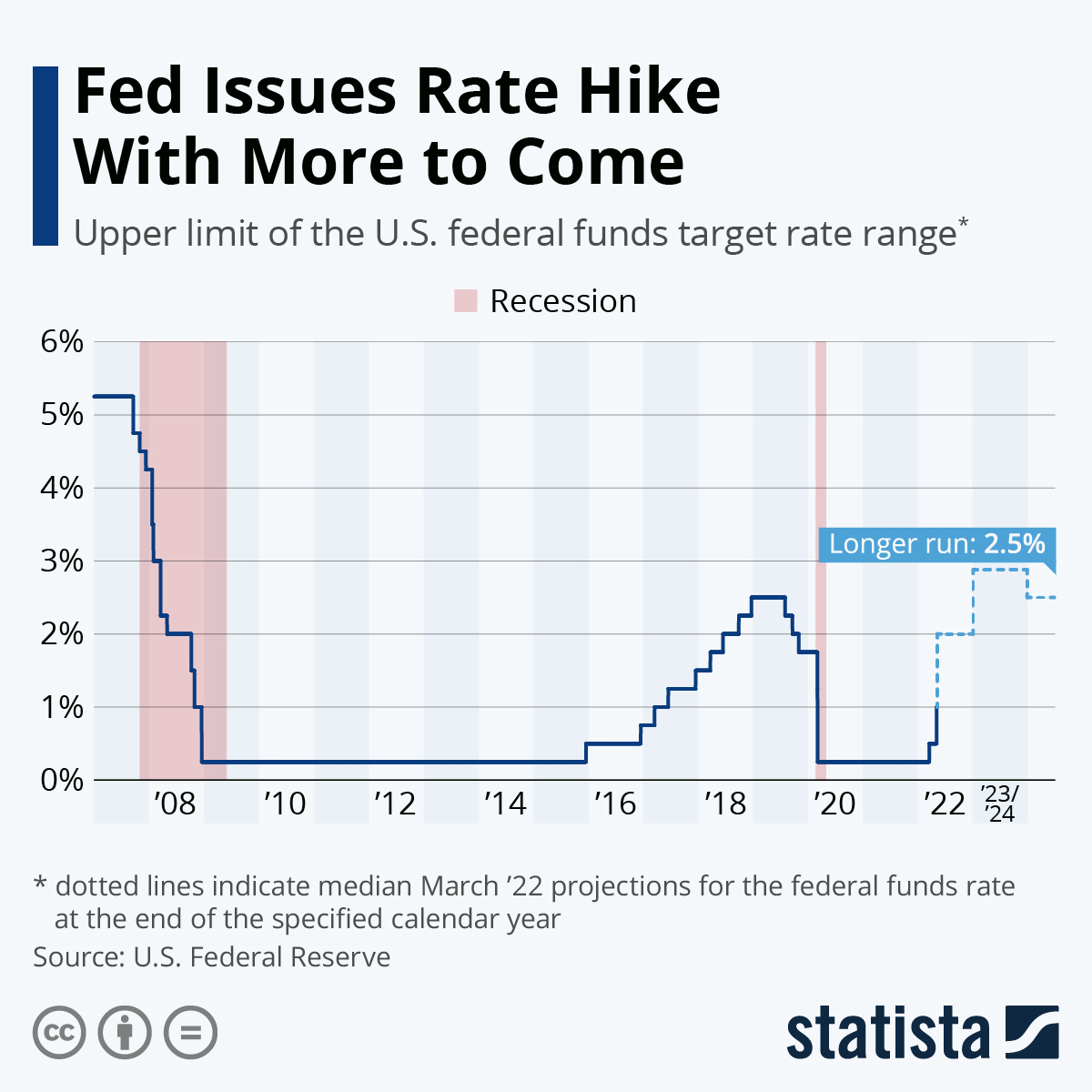

- High inflation, commodity volatility and Russia’s invasion pose the greatest threats to the U.S. economy, according to the Fed’s latest Financial Stability Report. The report showed the financial position of many households continued to improve since late 2021, while business credit could erode with the steep rise in interest rates planned for this year.

- Morgan Stanley is the latest major financial firm to express warnings of possible recession.

- An estimated 2 million workers are missing from the U.S. labor force, according to the Kansas City Federal Reserve, with employment participation lagging pre-pandemic levels by about 1%.

- U.S. wholesale inventories rose a solid 2.3% in March, new data shows.

- The IRS is moving slower than usual to process tax returns, with interest payments on backlogged refunds now totaling roughly a quarter of the agency’s budget.

- While still far behind pre-pandemic levels, travel firms say corporate flying is rising sharply from recent Omicron lows.

- Hyundai is likely to build a new electric vehicle manufacturing plant in Georgia, reports suggest.

- Electric vehicle startup Lordstown Motors said it needs $150 million more to start delivering its promised Endurance pickup truck to customers, sending the firm’s shares down 12%.

- Shares of Rivian Automotive slumped 14% Monday after reports signaled Ford, an early investor, would sell part of its stake in the electric-car maker.

- The SEC reopened the public comment period for another month for its landmark proposal to require U.S.-listed companies to disclose a range of climate-related risks and emissions.

- Stocks fell to a 13-month low yesterday as economic headwinds continue to gather. The nation’s three largest app-based gig companies — Uber, Lyft and DoorDash — lost a combined $9 billion in market value after Uber said it would scale back on marketing and hiring. Meanwhile, recession fears are hampering growth for banks that usually prosper from higher interest rates.

- Analysts are downgrading corporate profit expectations for the current quarter and the rest of 2022 as costs surge for oil and other supplies.

- In the latest news from quarterly earnings season:

- AMC’s sales rose fivefold from a year ago, the best in two years, as the theater chain predicts high demand for the rest of the year.

- Tyson Foods raised its full-year sales outlook as soaring meat prices drove larger-than-expected revenue gains.

- High-end cosmetics maker Coty posted 21% revenue growth and said demand remains strong for its fragrances and skincare products despite rising prices.

- BioNTech’s sales and earnings more than tripled thanks to demand for its COVID-19 vaccine, although the firm says sales will decline for the rest of the year.

International Markets

- Shanghai reported just 3,014 new COVID-19 cases Monday, the lowest in over a month, though there are no signs of easing re-tightened lockdowns. Several districts in Beijing were moved into effective lockdowns Monday.

- Africa saw a 38% jump in COVID-19 cases last week as deaths fell, supporting evidence that recent surges are driven by more transmissible but less lethal strains.

- New British research suggests long-COVID symptoms were more likely to come after infection with Delta than Omicron.

- Growth in Chinese exports rose just 3.9% in April compared to 14.7% a month earlier, a two-year low caused by the impact of lockdowns. The nation’s central bank said it would step up support for the slowing economy.

- Consumer prices in Mexico rose 7.68% in April from a year ago, the fastest increase in over 20 years.

- Economic growth in emerging markets will slow sharply this year on ripple effects of China’s lockdowns and European investment funds tied up by Russian controls.

- Tesla is adding a second assembly line near its Shanghai factory that will make the city the auto maker’s largest export hub.

- Amazon plans to export $20 billion worth of goods from India by 2025, up from its initial $10 billion goal.

- Renault will sell over one-third of its Korean unit for roughly $200 million, a bid to raise funds for electric-vehicle production that the firm hopes will reverse three straight years of declining sales.

- The world’s biggest airline trade body says rebounding travel activity will bring passenger volumes back to pre-pandemic levels in 2023.

- Nigerian airlines suspended at the last minute a plan to ground local flights due to surging costs for jet fuel.

- More news related to the war in Europe:

- The U.S. House of Representatives will vote this week on approving $40 billion more in aid for Ukraine. Separately, the U.S. administration resumed a WWII lend-lease measure aimed at stepping up support for Ukrainian defense.

- The White House lifted U.S. tariffs on Ukrainian steel for a year.

- Japan unveiled a new round of sanctions on cutting-edge Russian exports.

- Ukraine says it loses $170 million each day it is cut off from access to the sea for its important farm and metals exports.

Some sources linked are subscription services.