MH Daily Bulletin: May 12

News relevant to the plastics industry:

At M. Holland

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- If you’re attending the Injection Molding & Design Expo in Detroit, check out M. Holland’s speakers during the show:

- Haleyanne Freedman, M. Holland’s 3D Printing Market Manager, will be discussing Open Platform Adoption in Additive Manufacturing. Don’t miss her presentation in the Designing the Future Theater on Wednesday, May 25 at 4:00 pm ET.

- Josh Blackmore, M. Holland’s Global Healthcare Manager, is facilitating a training seminar on Understanding Material Selection for Medical Devices, from Qualification to Approval. Mark your schedules for this session in the Training and Development Theater on Thursday, May 26 at 9:15 am ET.

Supply

- Oil prices jumped nearly 5% Wednesday after Ukraine halted use of a major transit route for Russian gas to Europe.

- In mid-morning trading today, WTI futures were up 1.0% at $106.80/bbl, Brent was up 0.6% at $108.10/bbl, and U.S. natural gas was down 0.3% at $7.62/MMBtu.

- U.S. crude stocks rose 8 million barrels last week after a government release from its strategic reserves. Gasoline stocks were down by 3.6 million barrels and distillate stocks fell to a 17-year low as refiners sent more fuel products abroad.

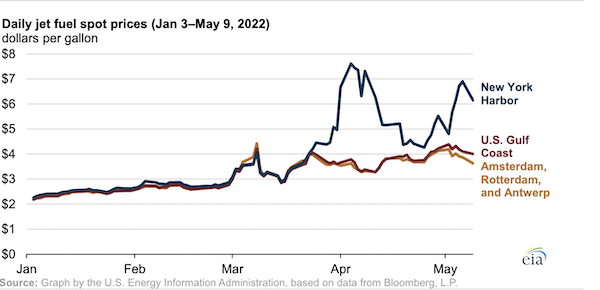

- East Coast jet fuel prices recently traded at record levels for several weeks as low inventories clashed with rising demand for air travel.

- Crude flows from the Permian Basin to the Gulf Coast will hit pre-pandemic levels by October, while the basin’s production will rise to 5.7 million bpd next year, analysts say.

- The S&P 500 Energy Sector Index is up 40% so far in 2022, the best-performing segment amid sharp losses for most other equities.

- A 300,000-bpd oil refinery in southeastern Malaysia resumed crude processing for the first time in two years following a deadly fire, potentially bringing some relief to the Asian refined-products market.

- Libya’s oilfields are expected to soon reopen after militias agreed to lift a siege on facilities, officials said. The nation is working to secure $3 billion for an offshore project that could boost domestic production to 1.4 million bpd this year.

- The IEA expects 320 GW of renewables capacity to come online this year, roughly equivalent to Germany’s annual demand.

- TotalEnergies and U.S. power company Duke Energy made combined bids of $315 million to win leases for offshore wind development off North and South Carolina yesterday.

- The EU proposed strengthening its 2030 clean-energy targets with the help of $205 billion for renewables and storage projects.

- More oil news related to the war in Europe:

- Russia hit back at Europe late Wednesday with sanctions on 31 energy companies, including a key unit of Gazprom that Berlin took control of in April as well as the owner of the Polish stretch of the Yamal-Europe pipeline. European and British gas prices spiked more than 10% to settle four times higher than this time last year.

- Analysts are warning the EU’s plan for eliminating reliance on Russian gas could cost hundreds of billions more than initially thought.

- Italy’s prime minister appeared to suggest European nations pay for Russian gas in rubles, breaking with EU guidance to the contrary.

Supply Chain

- New Mexico’s Calf Canyon wildfire surpassed 236,000 acres yesterday with just 33% containment, threatening thousands more evacuations in the state’s north-central region.

- Californians used almost 19% more water to start the year despite a plea from the governor to consume less as drought hit the state early and hard.

- Imports at major U.S. retail container ports set a record in March at 2.34 million TEUs, up 3.2% from the previous year, with near-record volumes continuing.

- High-level U.S. and EU officials will meet in Paris Sunday to begin discussions on bolstering cross-ocean supply chains and resolving other logistics disruptions.

- Supply in the U.S. logistics real estate market is at a 16-month low while rents are up 22% so far this year, according to Prologis.

- Federal regulators are requiring the four largest U.S. railroads to provide six months of weekly updates on plans to restore service and rebuild workforces, after major shippers detailed challenges with rail transport at an emergency hearing last month.

- South Korea’s biggest shipping line, HMM, will continue to deploy extra vessels to help reduce global congestion.

- Hourly output at a DHL distribution center in Atlanta rose fourfold after the installation of two robotic sorting systems, the firm said.

- LTL carrier Yellow said it will shrink its terminal network and cut costs after reporting a first-quarter net loss.

- Boeing continues to battle certification and production headaches across its portfolio, with 787 deliveries still likely weeks away and over 300 737 MAX jets stacked up in inventory. Emirates airline said it doesn’t expect delivery of its 787 orders until at least 2024, a year later than planned.

- Party City expects to take a $7 million hit this quarter as high spot rates for helium push up the cost of filling party balloons.

- Candy maker Tootsie Roll plans to shut down one or more manufacturing lines due to shortages of ingredients and packaging.

- Tesla shipped its first vehicles from Shanghai in almost a month yesterday.

- India’s billion-dollar incentive packages for electric vehicle producers appear to be paying off, with Toyota saying the nation would become its export hub for several Southeast Asian nations.

- GM reached agreement with workers at its biggest factory in Mexico, averting a potential strike at the end of the month.

- Toyota said rising prices for raw materials would lower operating profits by $11 billion this fiscal year, resulting in a 21% decline in net profit. BMW also is warning about the impacts of high raw material costs even as it secured enough supply for the year.

- Illinois-based Abbott Laboratories says it hopes to resume baby formula production within two weeks at a Michigan plant shut since February, potentially bringing relief to retailer shortages.

- Wet and cool temperatures in key parts of the Midwest are delaying the planting season, with just 22% of corn planted so far compared to 50% for the previous five years.

Domestic Markets

- The U.S. reported 163,335 new COVID-19 infections and 949 virus fatalities Wednesday.

- Total COVID-19 hospitalizations in Florida surpassed 1,000 for the first time since March.

- The nation’s largest school district in Los Angeles postponed its COVID-19 vaccine mandate until next year.

- New COVID-19 infections and hospitalizations are up sharply across Oregon.

- A growing number of school districts in Maine are reimposing indoor mask mandates.

- The majority of cruise ships sailing in U.S. waters are under investigation by the CDC for COVID-19 outbreaks.

- Major league baseball had its first game of the season postponed due to COVID-19 after several Cleveland Guardian players tested positive for the virus before a game with the Chicago White Sox.

- Health officials hope impending approval of Moderna’s COVID-19 vaccine for children aged 6 to 11 will push up dismal vaccination rates for the age group.

- New subvariants of Omicron seem to possess a stubborn ability to evade vaccination and immunity provided by earlier infection, although there is as yet no indication that they are more dangerous.

- Producer prices rose at an 11% annualized rate in April, the fifth straight month of double digit increases.

- Initial unemployment claims rose to 203,000 last week, topping 200,000 for the first time since February.

- A new survey suggests 80% of New York City employers expect to move into a hybrid work model as the pandemic eases.

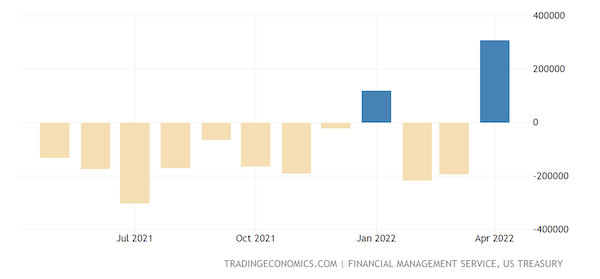

- The U.S. budget deficit is down $1.57 trillion so far this fiscal year, driven by record receipts from a strong economy and a slowdown in spending on pandemic programs. April’s $308 billion surplus was an all-time high:

- More news related to U.S. inflation:

- The slight easing of the annual inflation rate in April is not expected to change Federal Reserve plans for increasing interest rates at its upcoming meetings.

- In April, Americans paid less for gasoline compared to March but more for groceries, new cars and air travel, where fares rose 18.6% from a month earlier.

- Egg prices were up 23% in the U.S. in April, the fastest rise for all consumer products, as avian flu outbreaks hit supplies.

- Phoenix and Atlanta topped the list of cities where inflation surged significantly higher than the national average last month.

- Mortgage applications rose 2% last week, their second straight week of gains, as the spring housing market enters a historically busy time.

- Over 93% of Americans now have access to online food delivery services, researchers say, with most platforms getting a big boost from the pandemic.

- To attract more of the surging business travel market, Southwest will invest $2 billion into offering faster Wi-Fi, bigger overhead bins and in-seat power ports for the first time.

- Hawaiian Airlines is helping develop all-electric “seagliders” with capacity to ferry up to 100 people between islands at an altitude of five to 30 feet above ocean waves.

- Ohio-based Lordstown Motors said it completed a deal to sell certain assets to Taiwanese manufacturer Foxconn, clinching funds essential to producing its Endurance electric pickup truck.

- In the latest news from quarterly earnings season:

- Disney saw a surprise jump in first-quarter subscriber growth for its Disney+ streaming service, keeping the business unit on track to achieve profitability by late 2024.

- Embattled electric vehicle startup Rivian posted $95 million in revenue, below market expectations, while the firm’s net loss quadrupled to $1.6 billion as it worked to manufacture its first vehicles. Ford unloaded over $214 million of shares in the startup while retaining a 10.5% stake as Rivian’s fourth-largest investor.

- Panasonic expects operating profit to remain flat this year as component shortages caused by COVID-19 lockdowns in China pose a risk to earnings.

- Beyond Meat shares fell over 20% Wednesday after losses nearly quadrupled to $100 million and U.S. demand continued to weaken.

- U.S. casinos won more than $5.3 billion from gamblers in March, the best month ever, with quarterly financials remaining strong.

International Markets

- Although Shanghai officials have not formally announced any new citywide measures, residents say restrictions are tightening as more people are forced into quarantine facilities and non-essential deliveries are prohibited in more districts.

- North Korea, which hasn’t vaccinated its population, declared a “severe national emergency” and imposed lockdowns in all major cities after claiming it found its first COVID-19 case of the pandemic yesterday.

- The EU no longer recommends that member nations impose mask mandates at airports and on airplanes, ending two years of the guidance.

- France dropped masking requirements for public transit for the first time since 2020.

- New Zealand plans to fully reopen its borders at the end of July, two months earlier than scheduled. A limited reopening from March has already spurred a 500% increase in incoming travelers.

- South Africa is stripping back plans to produce hundreds of millions of COVID-19 vaccines amid waning demand.

- Global COVID-19 testing demand is down between 70% and 90% from the first to the second quarter of this year, health officials estimate.

- More news related to the war in Europe:

- New car sales slumped almost 80% year over year last month in Russia, the tenth monthly decline in a row.

- Ukraine has lost roughly 30% of prewar employment, or 4.8 million jobs, since late February.

- Russia’s invasion will lower global output by about $1.5 trillion this year, economists warn.

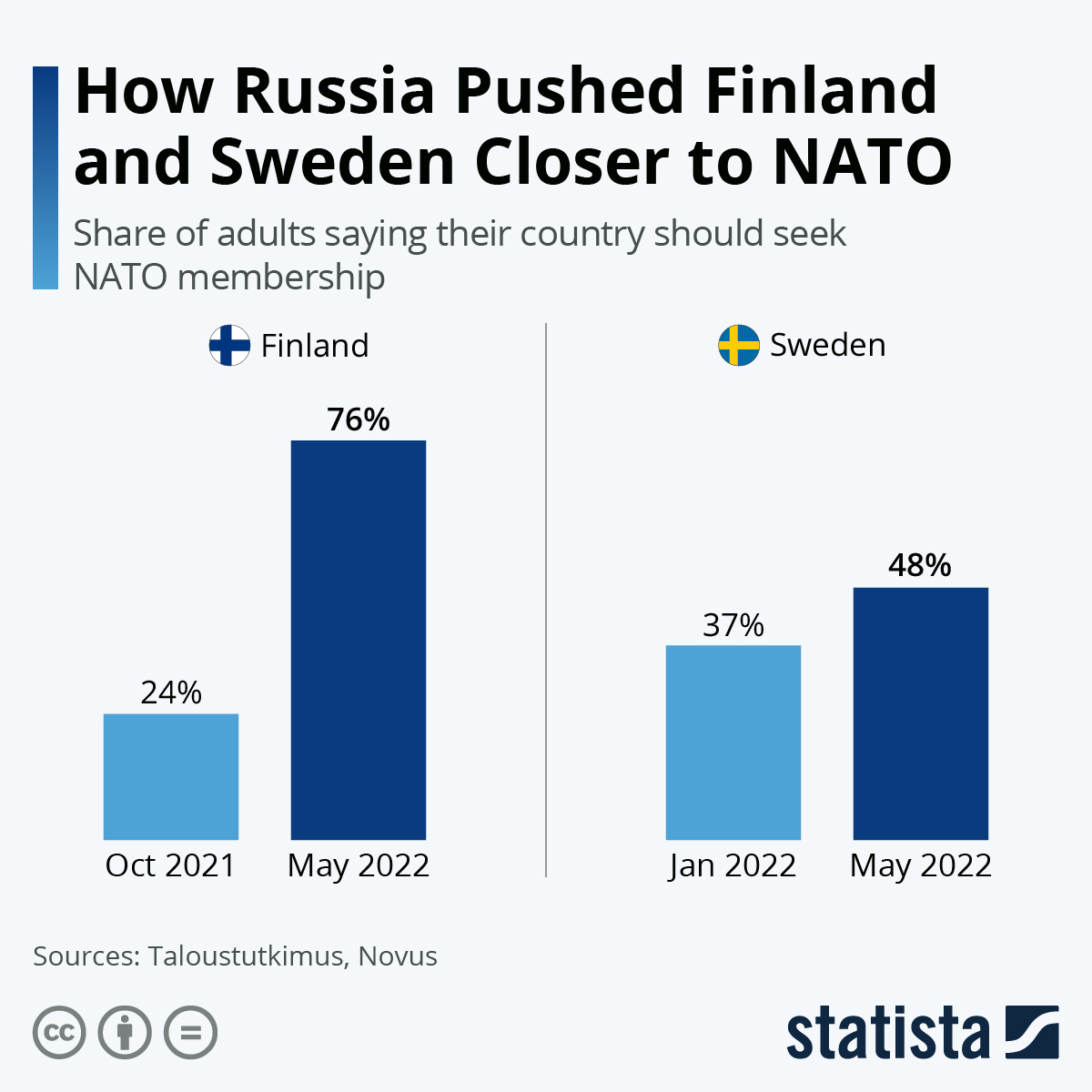

- Finland’s president and prime minister advocated joining NATO as sentiments surge in Finland and Sweden for joining the defense alliance:

Some sources linked are subscription services.