MH Daily Bulletin: May 13

News relevant to the plastics industry:

At M. Holland

- The Plastics Industry Association is hosting the Re|focus Sustainability & Recycling Summit in Cincinnati, Ohio, on May Lindy Holland-Resnick, Market Manager for Packaging at M. Holland, is presenting during the upcoming Re|focus Sustainability & Recycling Summit in Cincinnati, Ohio. Her session on Developing a Sustainably Minded Staff will cover how to create a holistically sustainable company from top to bottom. If you’re attending Re|focus, don’t miss Lindy’s session on Tuesday, May 24 at 11:15 am ET.

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- If you’re attending the Injection Molding & Design Expo in Detroit, check out M. Holland’s speakers during the show:

- Haleyanne Freedman, M. Holland’s 3D Printing Market Manager, will be discussing Open Platform Adoption in Additive Manufacturing. Don’t miss her presentation in the Designing the Future Theater on Wednesday, May 25 at 4:00 pm ET.

- Josh Blackmore, M. Holland’s Global Healthcare Manager, is facilitating a training seminar on Understanding Material Selection for Medical Devices, from Qualification to Approval. Mark your schedules for this session in the Training and Development Theater on Thursday, May 26 at 9:15 am ET.

Supply

- Oil prices were mixed Thursday, with Brent falling and WTI rising slightly.

- In mid-morning trading today, WTI futures were up 3.3% at $109.60/bbl, Brent was up 3.4% at $110.70/bbl, and U.S. natural gas was off 1.7% at $7.61/MMBtu.

- OPEC cut its forecast for growth in global oil demand this year for a second straight month, lowering it by 310,000 bpd. Demand is still expected to surpass 100 million bpd by the third quarter.

- The IEA reversed its dire forecasts of a “global supply shock” from the loss of Russian oil, saying a smaller-than-expected 1 million bpd went offline in April. The agency would consider releasing more oil from strategic reserves.

- The U.S. administration scrapped three sales of offshore oil and gas leases in Alaska and the Gulf of Mexico due to “lack of industry interest.”

- More oil news related to the war in Europe:

- A stoppage on the border between Russia and Ukraine’s Donbas region continues to interrupt gas supplies to Europe. Ukraine’s pipeline operator said it would not reopen the transit route until it regains full control over its systems from Russian occupation. European natural gas prices rose 18% Thursday on the news, while British prices spiked as much as 34%.

- Gazprom plans to halt deliveries on the Yamal-Europe pipeline to comply with Moscow’s new sanctions on Western energy firms.

- Russia warned it will cut off gas supplies to Finland today if the country applies for NATO membership.

- Hungary continues to voice opposition over a proposed EU ban on Russian oil, saying it would be too disruptive to its economy.

- Shell will sell its Russian retail-station and lubricants business to oil giant Lukoil by the end of the year, confirming earlier reports.

- Italian major Eni is verging closer to paying for Russian gas in rubles. At least 10 other European buyers have opened accounts with Gazprombank in preparation for paying in rubles.

Supply Chain

- New Mexico’s Calf Canyon fire, the nation’s largest, expanded to 260,000 acres Thursday with just 29% containment, prompting more evacuations.

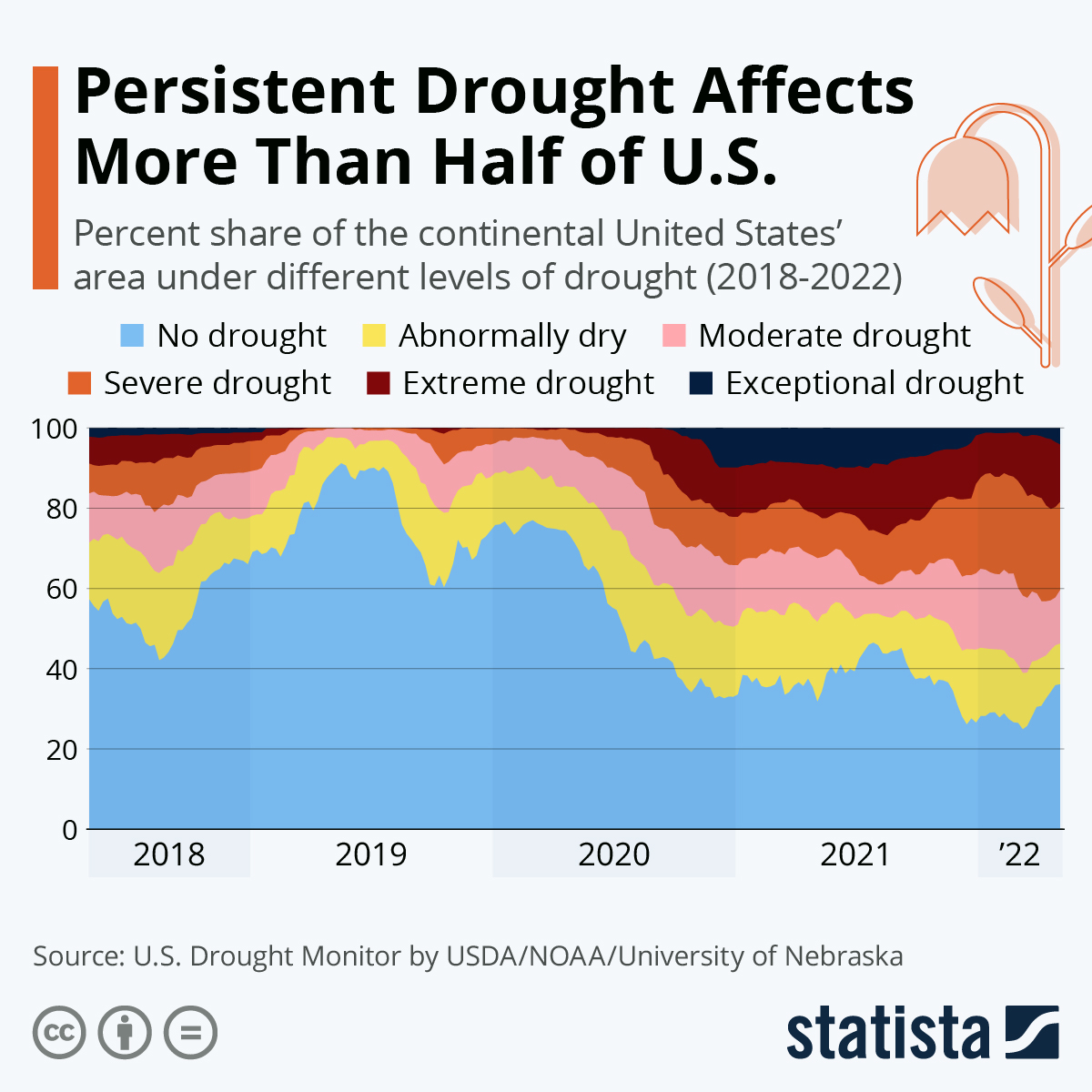

- Almost 64% of the continental U.S. has seen drought conditions since September 2020, one of the longest stretches on record.

- U.S. diesel prices hit an all-time high for the 14th consecutive day, reaching $5.56 a gallon. The sharp price spike the past two months is severely impacting the U.S. trucking market, especially lightly-capitalized smaller fleets.

- The U.S. trucking sector added 13,000 jobs in April after payrolls fell by 3,400 the previous month.

- Global air cargo volumes fell 8% in April from a year ago, with rates 145% above 2019 levels.

- Roughly two-thirds of U.S. and European manufacturers say they will bring some Asian production home by 2025, according to a survey by BCI Global.

- Samsung is negotiating to raise chip prices by up to 20% this year, consistent with similar efforts by rivals TSMC and United Microelectronics.

- Foxconn, the world’s biggest iPhone assembler, warned it could lose up to $8 billion in sales from Chinese lockdowns this quarter.

- Some U.S. hospitals are rationing medical imaging after a GE Healthcare factory was temporarily shuttered by Chinese lockdowns.

- Supply-chain tech firms raised over $62 billion in venture funding last year, more than twice the amount in 2019.

- Global demand for metals will surge for decades as the world transitions to battery-intensive renewables, the World Bank predicts.

- In the latest news from quarterly earnings season:

- Hapag-Lloyd reported “extraordinarily strong” financials, with group profit jumping over 300% from the same time last year to $4.7 billion.

- India’s Tata Motors, parent for Jaguar Land Rover, posted a surprise $133 million loss and said higher input costs will lead to price increases.

- Electric heavy-duty truck maker Nikola posted its first positive quarterly gross profit of $431,000.

- Connecticut-based GXO Logistics saw profit rise 45% to $38 million on a 14% gain in revenue.

- The U.S. Postal Service lost $1.7 billion despite rising revenue and volume.

- U.S. maritime regulators want the three major container shipping alliances to report more detailed information on pricing and capacity.

- China National Offshore Oil Company ordered 12 new LNG tankers for $2.4 billion.

- Russia’s Sovcomflot, among the world’s largest tanker operators, sold about a dozen ships to buyers in Asia and the Middle East as it works to repay loans.

- South Korean shipyard workers are protesting efforts to bring in foreign workers to cope with labor shortages.

- XPO Logistics tanker drivers in Britain called off a threatened strike after getting a 27% pay increase.

- Swedish electric vehicle maker Volta Trucks plans to launch commercial vehicles in North America by the end of 2023.

Domestic Markets

- Flags flew at half-mast across the nation yesterday to commemorate more than 1 million U.S. COVID-19 fatalities since the start of the pandemic. The U.S. reported 102,513 new infections and 128 virus fatalities Thursday.

- U.S. COVID-19 fatalities are up 7% over the past two weeks.

- New COVID-19 cases in California are up 71% over the past two weeks to a three-month high. San Jose reimposed a mask mandate for city workers as cases rise sharply in South Bay.

- The Federal Reserve chair affirmed the central bank will raise interest rates by a half-percentage-point at each of its next two meetings.

- With soaring prices stretching household budgets, over 25% of consumers switched banks in April as they hunt for better interest rates to boost their savings.

- The U.S. collected almost $3 trillion in taxes the first seven months of the fiscal year, a record.

- Median U.S. apartment rents are up 16% the past year, according to rental website Apartment List. Prices rose 39% in Manhattan over the last year, among the highest in the nation.

- The average U.S. mortgage rate continued its rise to 5.53% last week, the highest since 2009.

- Home values surged up to 25% in smaller, more affordable U.S. metro areas in the South and Southwest the past year, new data shows.

- Tesla indicated it will install adapters to allow other brands of electric vehicles to use its super-fast chargers in the U.S. this year. In separate news, the automaker struck a deal with Vale for long-term supply of nickel from the mining giant’s Canadian sites.

- Arkansas-based electric vehicle startup Canoo lost $125 million in the first quarter and cautioned about its ability to stay in business beyond the current quarter.

- Hyundai plans to build a $7.5 billion electric vehicle (EV) plant in southern Georgia and expand an Alabama plant to produce its first EVs in the U.S.

- Electric vehicle startup Rivian recalled more than 500 of its brand new pickup trucks over faulty airbags.

- Colorado will become the third state to pass an extended producer responsibility law that helps fund recycling programs by raising taxes on packaging makers.

International Markets

- Global COVID-19 cases fell 12% and fatalities fell 25% last week, with only the Americas and Africa seeing increases.

- Europe surpassed 2 million COVID-19 fatalities yesterday.

- Daily COVID-19 infections in South Africa hit 10,000 for the first time since January this week.

- Beijing effectively blocked off some parts of its central business district after new COVID-19 cases rose by nine Wednesday.

- New COVID-19 infections in Shanghai fell for the 19th day in a row to 1,449, as authorities set May 20 as an apparent end-date for lockdowns.

- The U.S. administration licensed a key vaccine technology to the World Health Organization, potentially allowing global manufacturers to develop their own COVID-19 shots.

- Generic drugmakers will begin selling versions of Pfizer’s popular COVID-19 antiviral pill for less than $25 in low- and middle-income countries.

- More news related to the war in Europe:

- Siemens AG is ending its 170-year-old business in Russia.

- The Ukrainian refugee toll surpassed 6 million people yesterday, while 14 million have been forced from their homes.

- New bank lending in China fell to its lowest level since 2017 last month as lockdowns continue to dampen the economy.

- A major Chinese property developer missed a dollar-denominated debt payment. China’s beleaguered property sector saw 17 defaults on international bonds last year.

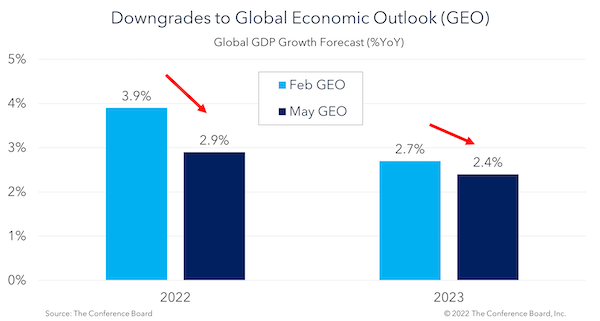

- The Conference Board lowered its projections for global GDP growth for this year and next:

- Britain’s economy grew just 0.8% in the first quarter, the slowest in a year.

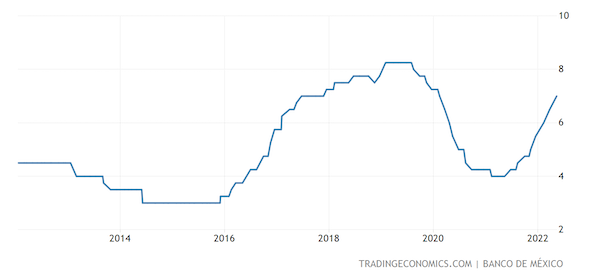

- Mexico’s central bank raised its benchmark policy rate by another 50 basis points to 7% yesterday, the eighth consecutive hike and the highest borrowing costs since February 2020:

- Dubai’s international airport saw passenger volumes rise almost threefold last quarter from a year ago.

- Chinese electric vehicle sales have more than doubled this year from 2021, an industry group said.

- Renault expects Germany and the Netherlands to begin placing initial orders for its hydrogen-powered minibuses and vans.

- Toyota rolled out its first mass-produced battery electric car in Japan for lease only, a strategy the automaker says will help ease driver concerns about battery life and resale value.

- Nissan expects flat operating profit this fiscal year despite rising sales, as fallout from the global chip shortage continues to hit production.

- Subaru aims to build its first electric vehicle factory in Japan in the late 2020s.

- Canadian officials say they are in talks with several companies about establishing electric vehicle battery production in the country.

- Ford reversed plans announced in February to make electric vehicles in India for export as it explores options for two Indian factories that stopped production last year.

- Volkswagen aims to build 800,000 electric vehicles this year and 1.3 million next year as it ramps up electric vehicle output to half of all global production by 2030.

Some sources linked are subscription services.