MH Daily Bulletin: May 16

News relevant to the plastics industry:

At M. Holland

- Lindy Holland-Resnick, Market Manager for Packaging at M. Holland, is presenting during the upcoming Re|focus Sustainability & Recycling Summit in Cincinnati, Ohio. Her session on Developing a Sustainably Minded Staff will cover how to create a holistically sustainable company from top to bottom. If you’re attending Re|focus, don’t miss Lindy’s session on Tuesday, May 24 at 11:15 am ET.

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- If you’re attending the Injection Molding & Design Expo in Detroit, check out M. Holland’s speakers during the show:

- Haleyanne Freedman, M. Holland’s 3D Printing Market Manager, will be discussing Open Platform Adoption in Additive Manufacturing. Don’t miss her presentation in the Designing the Future Theater on Wednesday, May 25 at 4:00 pm ET.

- Josh Blackmore, M. Holland’s Global Healthcare Manager, is facilitating a training seminar on Understanding Material Selection for Medical Devices, from Qualification to Approval. Mark your schedules for this session in the Training and Development Theater on Thursday, May 26 at 9:15 am ET.

Supply

- Oil prices rose about 4% Friday, with WTI closing above $110/bbl for its third straight weekly rise.

- In mid-morning trading today, WTI futures were up 1.0% at $111.50/bbl, Brent was up 0.4% at $112.00/bbl, and U.S. natural gas was up 3.2% at $7.91/MMBtu.

- U.S. gasoline prices rose to an all-time high $4.45 a gallon Saturday after domestic stockpiles fell for the sixth straight week.

- Active U.S. drilling rigs rose by nine to 714 last week, 261 higher than the same time last year and the highest since April 2020. Crude production slipped for the first time in three months.

- France’s nuclear output could fall 25% this winter due to maintenance and repairs, cutting off a crucial supply of cheap energy to Europe.

- Saudi Aramco’s first-quarter profit rose 82% to a record $39.5 billion, as the firm overtook Apple as the world’s most valuable company.

- The president of the UAE, OPEC’s highly influential and third-largest producer, died last Friday.

- More oil news related to the war in Europe:

- Russia halted electricity exports to Finland after the nation said it would apply to join NATO this week. Finnish officials say Russian electricity accounts for about 10% of domestic consumption.

- The EU hopes its eastern member states will agree to a Russian oil embargo by the end of May.

- A ban on major trading houses dealing with Russian oil firms took effect Sunday.

- Russian diesel exports fell by 14% last month, exacerbating global shortages.

- Russia’s exports of naphtha — a key ingredient for producing plastics and gasoline — hit a six-year low in April, threatening higher gasoline prices in top importer Europe.

- Germany’s lower house of parliament approved a bill allowing the government to take over critical energy infrastructure in case of emergency.

- Fortum, a major Finnish energy firm, expanded its sanctions and will sell all its Russian assets.

- Plains All American Pipeline agreed to a $230 million settlement related to a 2015 oil spill off the California coast.

- Environmental groups are pressuring the U.S. EPA to address high levels of benzene pollution from refineries on the Gulf Coast.

- Carbon emissions could start to increase as more oil and gas assets are moved to companies without climate goals, according to a U.S. environmental group.

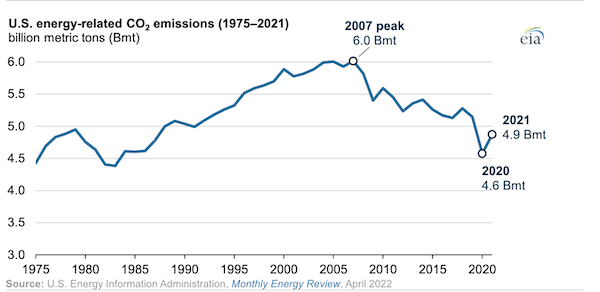

- Emissions from the U.S. energy sector rose almost 6% last year but remained about 5% lower than the pre-pandemic level of 2019:

Supply Chain

- Diesel prices hit a record $5.56 a gallon Saturday as East Coast inventories fell to all-time lows. Some refiners expect rationing to be required this summer, while Pilot Flying J and Love’s said they are monitoring the situation but have no plans to restrict purchases.

- In the latest climate-related news:

- Temperatures will approach 100 degrees in Houston today, testing Texas’ newly bolstered power grid.

- California’s proposed budget includes $5.2 billion in reserves to prevent blackouts during extreme heat, drought and fires.

- Scientists say a new era of wildfire activity could result in hundreds of billions of dollars in damage this year.

- India banned wheat exports as century-high temperatures destroy this year’s crop yield. Officials warn low-income nations could start seeing food shortages as early as next year.

- The Port of Long Beach handled 820,718 TEUs of cargo last month, up 10% from last year for a new April record.

- Labor talks began today between West Coast ports and their dockworkers union with the current contract set to expire on July 1.

- The Port of Charleston set its 14th straight month of record cargo volumes in April while easing its vessel backlog from 15 to two.

- The global container market has likely passed its peak as declining spot rates reflect a slowdown in goods demand, Hapag-Lloyd executives say.

- The freight market’s two-year surge has “downshifted with a thud,” according to a widely anticipated report from Cass Information Systems.

- Analysts are concerned by accelerating drops in truckload van spot rates during the usually busy May and June season.

- Trailer orders fell 60% from March to April as supply shortages limit production.

- Miami-based Ryder System is considering an offer to be taken private in a $4.4 billion deal from an activist investor.

- Tennessee-based U.S. Xpress is cutting 5% of its workforce after reporting an $8.9 billion quarterly loss. Separately, the firm is ramping up adoption of Embark Trucks’ self-driving software.

- Amazon will add 33% fewer third-party delivery partners this year after expanding too fast during the pandemic, its CFO said.

- As of Saturday, all federally funded projects in the U.S. must use U.S.-made iron and steel.

- “Friend-shoring” is supplanting “near-shoring” as a way to better control supply chains while reducing reliance on countries with autocratic governments and nonmarket economies.

- Intel expects the global chip shortage to last into 2024, a year longer than initial forecasts.

- Honda expects earnings to fall 7% this year due to chip shortages and rising raw material costs.

- Legacy diesel-engine maker Cummins is partnering with Daimler North America to fit Class 8 trucks with hydrogen fuel cells.

- Tesla halted plans to sell cars in India after failing to get favorable tariff rates.

- Norfolk Southern issued nearly $500 million of green bonds to fund sustainability-related projects last year, the rail line said.

- Over 40% of baby formula is out-of-stock across the U.S. as dietitians raise safety concerns about homemade recipes being posted online.

Domestic Markets

- The U.S. reported 30,890 new COVID-19 infections and 32 virus fatalities Sunday.

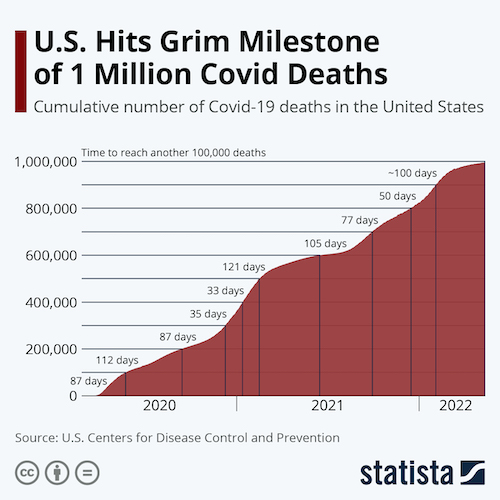

- It took 100 days for the U.S. to see its latest 100,000 COVID-19 fatalities, about double the time for the previous 100,000.

- Fed surveys show consumers are dialing down inflation expectations a year from now even as sentiment declines to its lowest level in a decade. But falling consumer sentiment belies their robust spending activity.

- The probability of a U.S. recession within the next year is up to 30%, according to a survey of Bloomberg economists.

- Construction material prices were 18% higher in April than a year ago, the fastest rise since 1948. New-home buyers are feeling the crunch, with costs to build sometimes doubling from when deposits were paid.

- A global shortage of contractors and materials is raising construction costs and forcing many homeowners to rethink their renovation plans.

- United Airlines reached agreement on a new labor contract with its pilots’ union, the first among major airlines struggling to deal with an acute pilot shortage.

- JetBlue launched a hostile all-cash takeover of Spirit Airlines just days after its original $3.6 billion offer was rejected.

- Amid a shortage of manager candidates, Walmart is offering more incentive-laden retention programs that fast-track current employees into higher-level jobs.

- International U.S. air travel remains down about 15% from pre-pandemic levels as airlines urge the White House to drop rigid COVID testing requirements.

- Used-car prices are starting to plateau as buyers push back against double-digit increases each month. Sky-high prices hit online seller Carvana particularly hard, with shares falling over 50% the past month.

- Ford unloaded more of its shares in electric vehicle maker Rivian, which continues struggling to roll out its first models amid supply-chain bottlenecks.

- Several of the most prominent U.S. tech firms plan to slow hiring this year after overextending during the pandemic.

- Two-thirds of the workforce said they would find a new job if required to return to the office full-time, according to an ADP survey of more than 32,000 workers.

International Markets

- China’s mass testing programs could cost up to 2.3% of annual GDP if expanded to the whole country, economists predict.

- Shanghai authorities pledged to allow more businesses to reopen today, although global observers doubt the announcement after weeks of reneging on similar promises.

- Beijing continues to report dozens of new COVID-19 cases per day, raising fears that gradually increasing restrictions will turn into an all-out lockdown like in Shanghai. Panicked residents are stripping store shelves of food and staples.

- China withdrew from hosting the Asian Cup soccer tournament slated for the summer of 2023.

- Lockdowns bruised China’s economy last month, with consumer spending, industrial production and infrastructure spending all falling, while unemployment hit a two-year high 6.1%.

- China’s consumer inflation accelerated at its fastest pace in five months in April, jumping 2.1% for the month amid rising prices due to COVID-19 lockdowns the war in Ukraine.

- Tesla is walking back its plans to restore production at its Shanghai plant to pre-lockdown levels by at least a week.

- The EU dropped its mask mandate for air travelers beginning today.

- Rising fuel costs could offset gains from rebounding passenger volumes at Norwegian Air, the airline said.

- Dubai’s Emirates airline, which only operates international services, reported a 91% revenue jump for the year ended March 31 as passenger numbers tripled from pandemic lows.

- China test flew its first homegrown C919 narrow-body jetliner Saturday after years-long production delays caused by tighter U.S. export rules.

- More international news related to Russia’s invasion of Ukraine:

- More Ukrainian refugees are returning to their homeland than leaving, inspired by the nation’s military victories and courage.

- McDonald’s will sell its business in Russia, which includes 850 restaurants employing 62,000.

- Renault will sell its interest in a Russian venture for a single ruble and an option to repurchase its position within the next six years.

- In reporting its fiscal results, Ryanair cited Russia’s invasion of Ukraine and Omicron as contributing factors for its loss.

- Russia’s invasion of Ukraine generated one of the most severe food and energy crises in recent history, according to leaders of the G7 nations.

- Chinese firms bought $8.9 billion of goods from Russia last month, an almost 57% jump from the same time last year.

- The West’s foothold in the wind turbine market is slipping to Chinese manufacturers, which doubled their exported wind capacity last year.

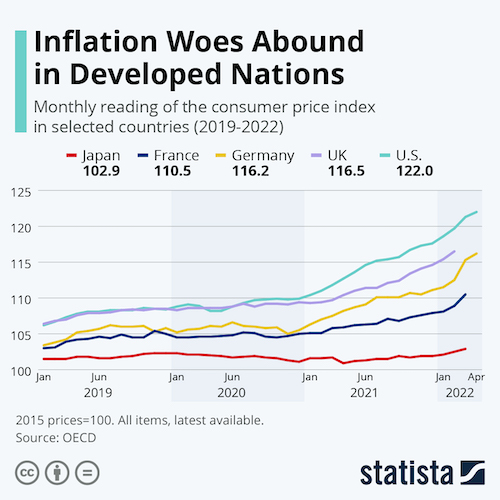

- Japan has largely escaped the soaring inflation rates of other developed economies:

- COVID-19 prevention measures have increased waste generation in China more than four-fold since February.

- A British recycling firm plans to capture emissions from incineration plants in London and store them under the Norwegian North Sea.

Some sources linked are subscription services.