MH Daily Bulletin: May 26

News relevant to the plastics industry:

At M. Holland

- M. Holland is excited to be the Headline Sponsor for the Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- Nick Chodorow has joined M. Holland as Chief Innovation Officer! In this role, Nick will lead efforts to enhance the company’s technology platforms and accelerate its digital journey.

- M. Holland will be closed Monday, May 30 for the Memorial Day holiday.

Supply

- Oil prices rose half a percent Wednesday as U.S. refining activity surpassed pre-pandemic levels.

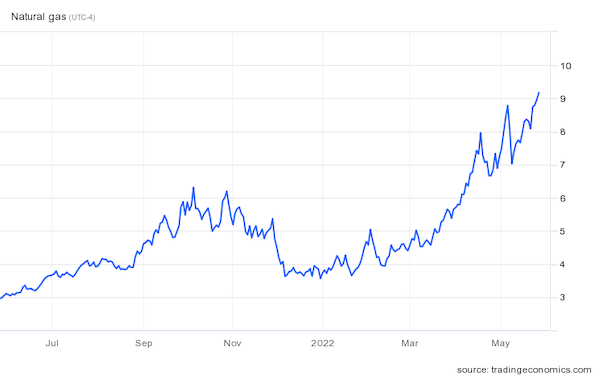

- In mid-morning trading today, WTI futures were up 3.1% at $113.80/bbl, Brent was up 2.3% at $116.70/bbl, and U.S. natural gas was up 2.0% at $9.15/MMBtu.

- U.S. natural gas briefly surpassed $9/MMBtu for the first time since 2008 yesterday as exports continue to boom alongside muted production increases. Prices are 20% higher the past month and have tripled from a year ago.

- U.S. crude stockpiles fell by 1 million barrels last week, the government said, with gasoline inventories also sliding modestly. Refiners boosted capacity use to 93.2%, the highest level since December 2019.

- JPMorgan Chase predicts the average U.S. gasoline price could hit $6.20 a gallon by August.

- At $6.09 a gallon, the price of gasoline in Los Angeles is the highest in the nation and tops the national average by $1.50.

- Natural gas buyers in Asia and Europe are seeking to lock in supplies via long-term contracts as a buffer against volatile prices, reversing a decade-long trend of rising spot purchases.

- Britain’s network operator asked some Scottish wind turbines to shut down after sending an unmanageable amount of storable energy to the nation’s grid.

- Saudi Aramco has approached Valvoline about a potential takeover of its lubricants business, reports suggest.

- TotalEnergies will spend $2.4 billion to purchase 50% of renewable energy firm Clearway Energy Group, which owns 5 GW of wind, solar and energy storage in the U.S.

- French rivers are warmer than average for this time of year, putting some nuclear production at risk during a period of historically high unavailability.

- Shareholders of Exxon Mobil rejected proposals to quicken the firm’s emissions reduction plans. Chevron shareholders recently passed a pro-recycling resolution as major companies face growing sustainability scrutiny from shareholders.

- More oil news related to the war in Europe:

- Germany plans to bring back coal- and oil-fired power plants should Russia cut off natural gas shipments, officials said.

- Self-sanctioning by numerous European companies has led to a record amount of Russia’s crude sitting in vessels at sea in search of buyers. Before the invasion, northwest Europe took over 70% of Russia’s Baltic-shipped crude, a figure now closer to 20%.

- The EU hopes to agree on a Russian oil phaseout before the next meeting of the European Council on May 30.

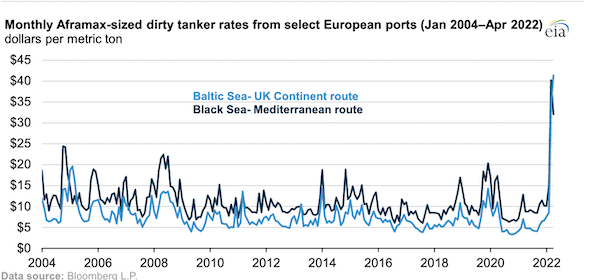

- Oil tanker rates more than tripled for some vessels originating in the Black Sea in April:

Supply Chain

- The growth of U.S. import containers through East Coast ports is outpacing inbound volumes on the West Coast.

- Automation plans are a sticking point in new contract negotiations between East Coast dockworkers and their employers.

- Cosco Shipping Ports is extending China’s Belt and Road initiative with plans for a new deep-water port in Peru.

- Charter rates for ocean car carriers are up fivefold from mid-2020 levels to record highs.

- British car production in April fell 11.3% year over year to 60,554 units amid ongoing supply issues.

- J.D. Power cut its forecast for global light vehicle sales this year, citing lockdowns in China.

- Sales of full-electric and plug-in hybrid vehicles doubled globally last year to 6.6 million.

- Thieves are stealing semiconductor-loaded powertrain modules from parked freight trucks.

- California, Florida, Oregon and Texas are among states reporting rising thefts of catalytic converters as thieves seek the valuable metals inside.

- Apple plans to keep iPhone production roughly flat in 2022, an unusually conservative stance amid gathering economic headwinds.

- Georgia Central Railway will service Hyundai Motor Group’s new $5.5 billion electric vehicle and battery manufacturing facility near Savannah, Georgia.

- A Florida utility curtailed coal-fired generation at a power plant over delayed rail shipments.

- Electric vehicle startup Rivian is suing a supplier of seats, warning that a pricing dispute could affect production of an electric van ordered by Amazon.

- Latin American airline Avianca is buying freighters to help boost growth after emerging from bankruptcy six months ago.

- Ethiopian Airlines placed an order for five of Boeing’s 777 freighters, confirming earlier reports.

- Walmart plans to expand the number of stores offering drone-delivered packages to 34 sites across the U.S.

- Hyundai and California-based startup NowRX are testing prescription medication delivery through automated logistics services.

- The FDA commissioner blamed outdated technology and coordination breakdowns for delays in responding to warnings about infant formula safety, a precursor to the current shortage.

- Britain’s Reckitt Benckiser is working with the FDA to expedite delivery of baby formula supplies from Mexico.

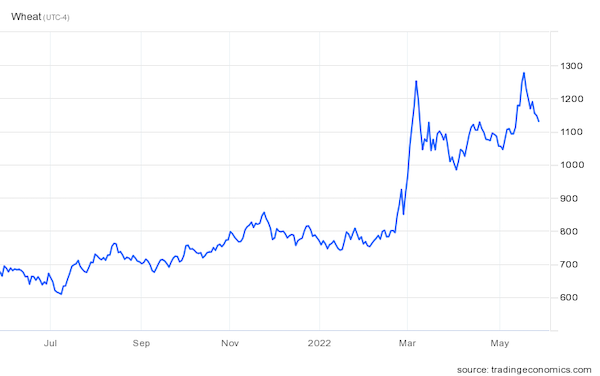

- Chicago wheat futures fell to the lowest in two weeks after Russia said it would open corridors to allow foreign ships to leave Black Sea ports:

Domestic Markets

- The U.S. reported 205,205 new COVID-19 infections and 1,017 virus fatalities Wednesday.

- The White House plans to make Pfizer’s COVID-19 antiviral pill more accessible across the U.S. as it projects rising infections over the summer travel season.

- Millions of Americans risk losing healthcare coverage when the U.S. government’s pandemic health emergency expires July 15.

- Just 12 of the nation’s 500 largest school districts are requiring masks despite rising infections.

- Vaccines may do little to protect from long-term COVID-19 symptoms, which last for 15 months on average, new research suggests.

- Fed officials agreed they may have to raise rates to levels that would deliberately weaken the economy in an effort to fight inflation, newly released minutes show.

- U.S. inflation and economic growth are forecast to cool later this year and in 2023, the Congressional Budget Office said Wednesday.

- U.S. durable goods orders rose 0.4% in April, driven by an increase in new aircraft orders. Orders for capital goods rose by a smaller-than-expected amount, suggesting firms are slowing their pace of spending on equipment.

- Of the nine U.S. cities with more than a million people, only Phoenix and San Antonio grew last year, as the pandemic continued sending Americans to areas with more space.

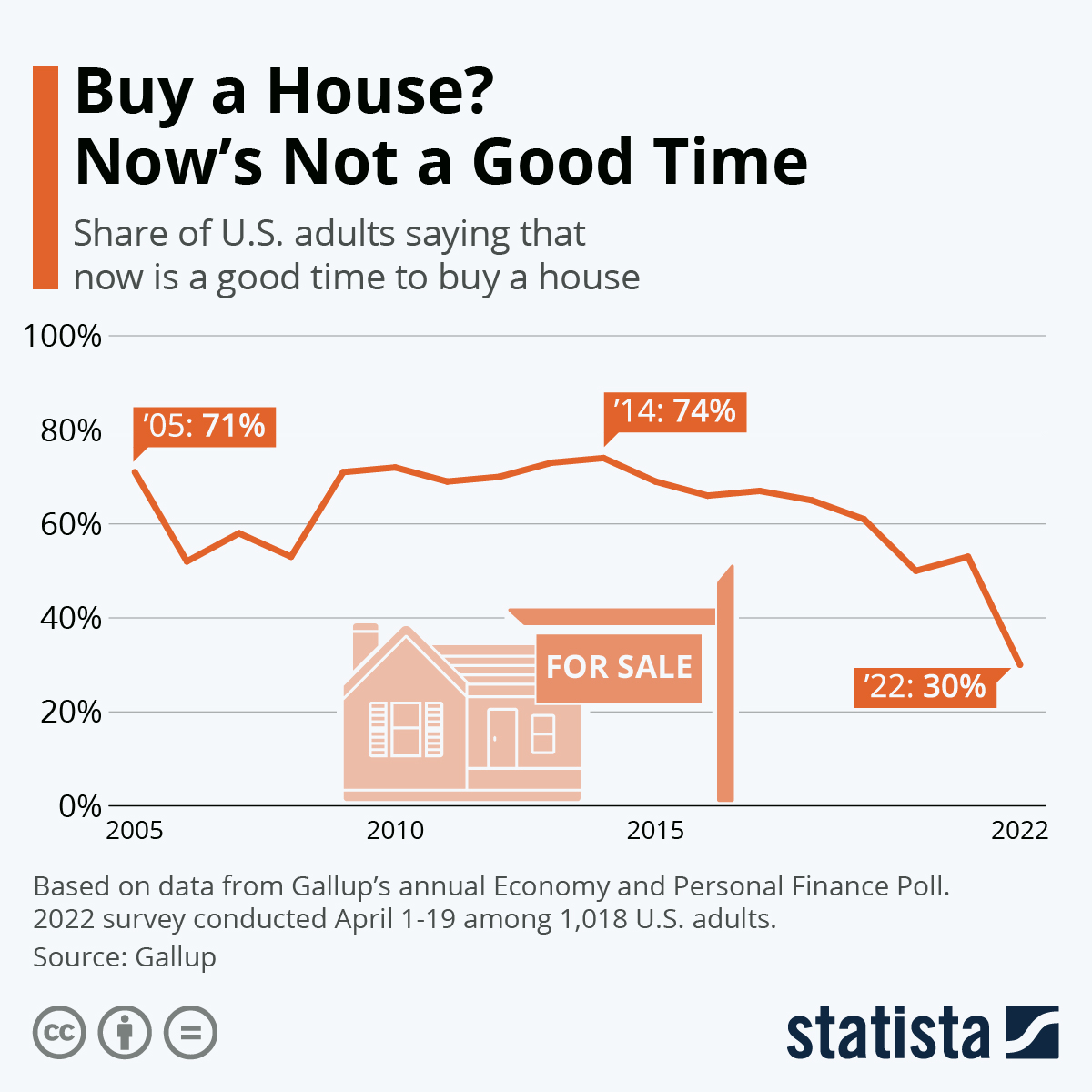

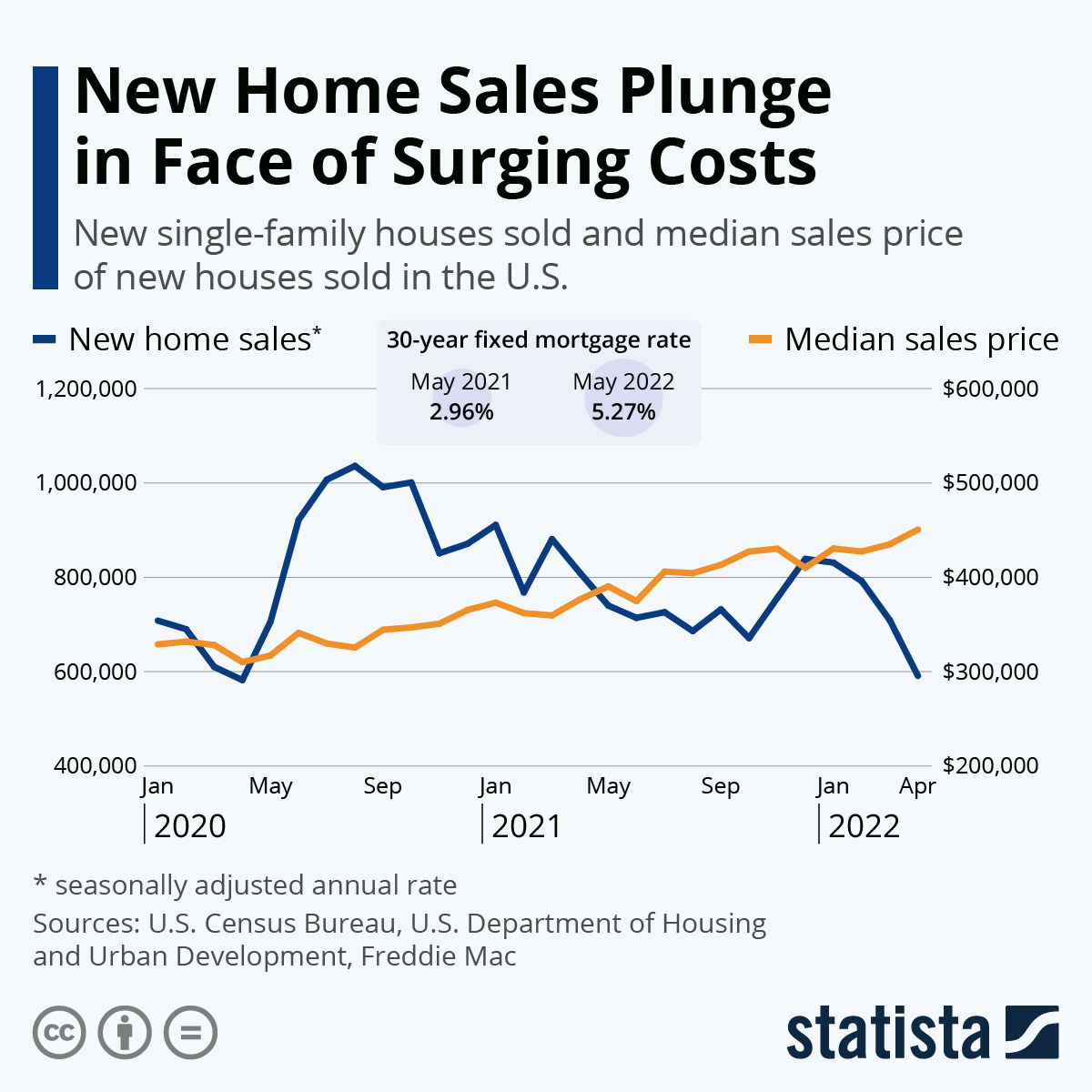

- Mortgage lenders are trimming staff in a bid to survive a sharp drop in demand and refinancings as interest rates rise.

- Apple is raising salaries for workers in the U.S. by 10% or more as it faces a tight labor market and unionization efforts across its retail stores.

- Domestic air fares climbed 18.6% in April, the biggest monthly increase from data going back to 1963.

- The top 11 U.S. airlines will fly 12% fewer flights this summer primarily due to a lack of pilots.

- The vast majority of Alaska Airlines’ 3,100 union pilots voted to strike over stalled contract negotiations.

- Amazon opened its first brick-and-mortar clothing store Wednesday in Los Angeles.

- Dick’s Sporting Goods cut its earnings outlook for the year after posting a 7.5% decline in first-quarter sales.

- Designer clothing retailer Nordstrom raised its yearly outlook after reporting a 23.5% gain in quarterly sales.

- Alphabet, Microsoft and Salesforce committed $500 million to a global CO2-removal project unveiled at the Davos economic summit in Switzerland.

- The SEC proposed a slate of new restrictions aimed at ensuring ESG funds accurately describe their investments to avoid greenwashing.

International Markets

- New COVID-19 infections in Shanghai fell 19.4% from a day earlier, the fourth consecutive daily decline. Schools in the city will reopen for the first time in three months.

- Chinese cities and provinces have turned to regular mass COVID-19 testing even in the absence of a local outbreak, raising concerns about mounting economic tolls.

- Belgium became the first country to impose a quarantine mandate on those infected with monkeypox as the virus, normally endemic to Africa, spreads globally.

- A multi-billion dollar fund set up by G20 countries to help developing countries better prepare for pandemics could be operational within months, the World Bank said.

- More news related to the war in Europe:

- Russia is scrambling to undo its initial currency controls following its invasion of Ukraine that have made the ruble this year’s best performing currency versus the dollar and an additional weight on the economy.

- Russia will try to service its dollar debt in rubles after new sanctions from the U.S. Treasury took effect Wednesday, potentially putting Moscow on track to default.

- Nike will effectively exit the Russian market after not renewing agreements with its largest franchisee in Russia.

- South Korea raised its base interest rate by 25 points to 1.75%, the highest since June 2019.

- Chinese retail spending plunged 11.1% in April while factory output sank 2.9%. Yesterday, China’s cabinet held an emergency video call with more than 100,000 state and local officials to discuss the priority of stabilizing the economy.

- Shanghai lost its top currency-trading hub title to Beijing for the first time, as fallout from citywide lockdowns spreads.

- China’s strict COVID-19 protocols are hurting multinational firms with a big presence in the country, including Starbucks, Adidas and InterContinental Hotels Group.

- Ryanair’s chief executive said bookings are nearing pre-pandemic levels for the summer.

- The parent of Emirates Airlines lost $1.1 billion in the fiscal year ending March 31, although revenue nearly doubled to $16.1 billion.

- Saudi Arabia expects U.S.-based Lucid Motors to build three manufacturing plants in the kingdom, which owns 60% of the electric vehicle maker’s shares.

Some sources linked are subscription services.