MH Daily Bulletin: November 4

News relevant to the plastics industry:

At M. Holland

- The use of recycled material was previously limited to plastic products that did not require color. Luckily, new products made from post-consumer recycled (PCR) materials, like carrier resins for masterbatches from M. Holland, can be colored. These resins enable companies to incorporate recycled plastics into their sustainability strategies. Click here to read the blog post.

- M. Holland is sponsoring the Association of Rotational Molders (ARM) Annual Meeting in Atlanta on Nov. 6-9! Please stop by Booth #19 to meet our team of Rotational Molding experts and learn more about our product offerings and grinding capabilities.

Supply

- Oil prices fell 2% Thursday after China reaffirmed its COVID-zero policy, potentially threatening demand.

- In mid-morning trading today, WTI futures were up 4.0% at $91.77/bbl, Brent was up 3.5% at $97.97/bbl, and U.S. natural gas was up 1.8% at $6.08/MMBtu.

- The U.S. sold off the last 15 million crude barrels from its 180-million-barrel release announced in March.

- The U.S. will seek public comment on allowing year-round sales of higher ethanol gasoline blends in the Midwest, a bid to ease pump prices and help farmers.

- ConocoPhillips is the latest in a string of producers to report bumper third-quarter earnings.

- Top U.S. LNG exporter Cheniere Energy saw quarterly profit more than double despite a nearly $5.5 billion loss on derivatives and foreign exchanges.

- Shell’s LNG trading unit reportedly lost nearly $1 billion in the third quarter due to market volatility.

- Brazil’s Petrobras plans to distribute dividends of around $8.5 billion, more than twice the dividend payouts of major Western competitors, prompting criticism of the massive windfall for investors.

- U.S. crude exports to Asia will hit a record 1.8 million bpd this month as demand climbs on a widening discount to global oil.

- China will see excess crude imports in the coming weeks with the arrival of cargoes bought before its latest COVID-19 lockdowns.

- More oil news related to the war in Europe:

- The EU’s price cap on Russian oil is set to start Dec. 5. The cap is expected to have only a muted effect on oil flows and prices.

- European policymakers will wait until next week to negotiate a plan to cap Russian gas prices. Meanwhile, Britain is pushing forward with its own cap on Russian gas, set to take effect Dec. 5.

- German power supplier Uniper posted a record $39.3 billion loss in the first nine months of 2022, the biggest in German corporate history.

- Ukraine’s Zaporizhzhya nuclear plant, Europe’s largest, is running on backup diesel generators after Russian shelling damaged its last operational power lines.

- Some 4.5 million Ukrainians, 10% of the pre-war population, were without power Thursday due to Russian attacks.

- Russia’s LNG exports rose 1.1% in October to their highest level since March.

- The U.S. will need to massively scale up production of floating wind components for the White House to reach its goal of 15 GW of new capacity by 2035.

- Sunrun, America’s biggest residential-solar company, topped Wall Street estimates in the third quarter on forecasts of 25% growth in installations this year.

- Canada will launch tax credits for clean technology worth up to 30% of investment costs in a bid to close competitive gaps with the U.S. renewables market.

- Prices for European carbon permits will fall over the next two years, as sluggish economies see lower industrial output and emissions, analysts say.

- Danish renewables firm Ørsted raised its full-year outlook but posted lower-than-expected quarterly earnings on weakness in its key offshore unit.

Supply Chain

- Political protests blocking key roadways in Brazil have mostly fizzled out.

- The Logistics Manager’s Index, a measure of U.S. logistics-sector activity, fell to 57.5 in October, the lowest level since May 2020.

- Container dwell times are growing at Canada’s Port of Vancouver amid congestion on inland rail networks.

- Global air cargo volumes fell 8% year over year in October and were off 3% from pre-pandemic levels, according to Clive Data Services.

- Stock market turmoil is sending supply-chain visibility specialist project44 back to private investors for more backing before it goes public.

- In the latest news from the auto industry:

- Electric and hybrid vehicles accounted for 43% of new car sales in the EU last quarter.

- Stellantis’ net revenue jumped 29% last quarter on higher prices and strong Jeep sales. Separately, the automaker is rethinking some brand strategies in China due to disappointing sales.

- Higher car prices at BMW helped the automaker deal with persistent computer chip shortages.

- BMW will skip the dealership and sell cars directly to consumers starting in 2026.

- Tesla delivered just over 71,700 China-made cars in October, down 14% from a record-high the previous month.

- U.S. self-driving startup Aurora Innovation is assuaging investors spooked by the recent shutdown of its Ford- and Volkswagen-backed rival Argo AI.

- Nikola says deliveries of its electric semitrucks will fall short of targets this year due to worsening economic conditions.

- Carvana posted a larger-than-expected 8% decline in quarterly sales.

- Japan is providing over 75% of Russia’s surging used-vehicle imports after Western sanctions hammered Russian auto production.

- Saudi Arabia’s wealth fund is partnering with Apple supplier Foxconn to build electric vehicles under a new Saudi brand.

- Lithium producer Livent Corp is eyeing acquisitions in Canada as it looks to boost its production of the key electric vehicle battery material.

- The U.S. Defense Department is meeting with defense industry executives to address potential supply chain constraints in anticipation of increased military spending among European countries concerned about Russia’s territorial ambitions.

- LTL carrier Yellow Corp. suffered a year-over-year tonnage decline of 16.2% in the third quarter.

- Chemical and seed company Corteva posted a smaller-than-expected quarterly loss as farmers looked to maximize yields at a time of low global grain supplies.

Domestic Markets

- The U.S. reported 68,994 new COVID-19 infections and 573 virus fatalities Thursday.

- Pfizer started an early-stage study over whether it can make a vaccine that targets both COVID-19 and the flu.

- Non-farm payrolls rose by a higher-than-expected 261,000 in October as the U.S. unemployment rate crept up to 3.7%. Average hourly earnings were up 4.7% year over year.

- U.S. holiday retail sales are poised to rise at a slower rate than last year, retail groups say.

- U.S. banks are raising estimates for how much the Federal Reserve will ultimately raise interest rates, with current forecasts coming in above 5% by June 2023.

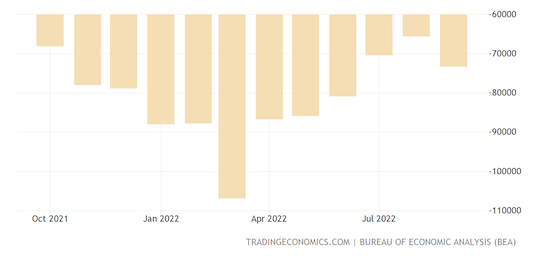

- The U.S. trade deficit widened sharply in September to $73.3 billion, as a strong dollar and softening global demand weighed on exports.

- The U.S. services industry grew at its slowest pace in nearly 2.5 years in October, according to the Institute for Supply Management.

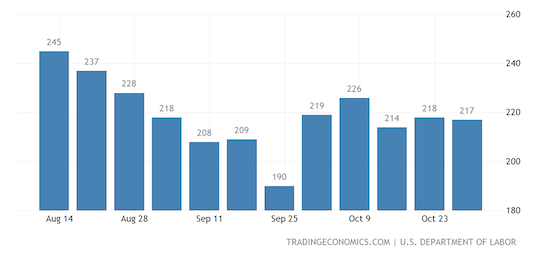

- U.S. jobless claims held steady at a low level last week, the latest sign that the labor market remains tight:

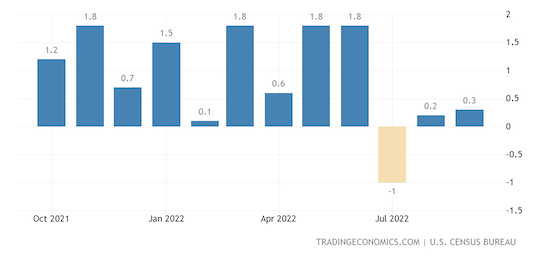

- New orders for U.S.-manufactured goods rose moderately from August to September, led by a surge in bookings for civilian aircraft:

- U.S. mortgage rates fell back below 7% after three weeks of gains.

- Both first-time and repeat U.S. homebuyers are now the oldest on record, the latest evidence that it’s increasingly difficult to buy a home.

- U.S. homeowners continued to build their equity positions last quarter even as the housing market cooled, new figures show.

- The outlook for tech industry jobs worsened Thursday, with Lyft and payments company Stripe both announcing major layoffs and Amazon saying it will freeze corporate hiring for months.

- Morgan Stanley is set for a fresh round of global layoffs in the coming weeks as its dealmaking business suffers from worsening economic conditions.

- In the latest news from earnings season:

- Moderna saw quarterly revenue fall 32% from the prior year as supply-chain issues hampered its COVID-19 vaccine deliveries.

- Compared to the prior year, sales for Starbucks’ grew 3% in the third quarter, a quarterly record, while earnings fell 50%, beating estimates.

- Higher product prices led Kellogg to a 9% sales gain in the third quarter.

- Peloton’s quarterly sales fell 23% as challenges mount for the struggling fitness firm.

- Online payments firm PayPal cut its growth forecast in anticipation of a broader economic downturn.

- DoorDash beat forecasts with a 33% gain in revenue from a year earlier as consumers kept spending on delivery of food and household essentials.

- Marriott joined its rival Hilton in raising its annual profit forecast on higher pricing and a strong rebound in leisure and business travel.

- Cruise line Royal Caribbean says its bookings more than doubled from the second to the third quarter.

- Shares of Tupperware Brands tumbled 41% Wednesday after the maker of food storage products missed quarterly estimates and warned its debt burden may put it out of business.

- Aircraft lessors AirCap and Air Lease Corp are reporting better-than-expected results amid surprisingly strong air traffic.

- Boeing expects to generate about $100 billion in annual sales by 2026.

- State attorneys general are stepping up their legal challenges to Kroger’s $25 billion proposed acquisition of Albertsons, citing antitrust concerns.

- California’s attorney general is investigating several plastic-bag makers over potentially misleading recycling claims.

International Markets

- China’s COVID-19 cases hit their highest in 2.5 months Thursday as lockdowns expanded to several cities.

- China is considering scraping its circuit breaker rule, that temporarily penalizes airlines with flight suspensions if they transport COVID-19 infected passengers into the country.

- The Bank of England acknowledged that its 75-basis-point rate hike on Thursday, the largest increase since 1989, could tip the economy into recession.

- A shake-up of Mexican trade officials has clouded prospects for a quick resolution of an energy dispute with the U.S. and Canada.

- Chinese policymakers pledged on Wednesday that economic growth is still a priority, a response to worries over power concentration in the country’s leadership that has already prompted some U.S. investors to pull out of Chinese equities.

- Japan’s services sector grew at the fastest pace in four months in October on a rebound in travel activity, according to private surveys.

- A multi-month slide in Toronto home prices slowed in October, while average prices were still down 17.7% from a year ago.

- European steelmaker Ternium reported an 84% drop in third-quarter profit, hurt by lower realized steel prices and higher raw material and energy costs.

- China’s Lenovo Group reported its first revenue decline in 10 quarters on weakening computer demand and fallout from China’s lockdowns.

- Canadian jet-maker Bombardier saw losses narrow to $2 million in the third quarter on robust demand for private jet travel.

Some sources linked are subscription services.