MH Daily Bulletin: November 9

News relevant to the plastics industry:

At M. Holland

- M. Holland is hosting a free 3D Printing Technology Forum in Chicago on Nov. 16! Attendees will learn how additive manufacturing technologies can support the development of applications — especially injection molding! Click here to RSVP, or contact 3dinfo@mholland.com for more information.

- During our recent Plastics Reflections Web Series broadcast, M. Holland’s expert panelists discussed the macroeconomic factors influencing global and domestic markets, including impacts on the plastics industry. Click here to read a recap of the webinar

Supply

- Oil fell 3% Tuesday on growing worries about fuel demand in COVID-hit China.

- In mid-morning trading today, WTI futures were down 1.4% at $87.68/bbl, Brent was down 1.4% at $94.04/bbl, and U.S. natural gas was down 5.0% at $5.83/MMBtu.

- U.S. crude stocks rose by a larger-than-expected 5.6 million barrels last week, according to the American Petroleum Institute. Government data is due today.

- The U.S. Energy Information Administration unveiled a bevy of new data Tuesday, including forecasts for 2023 and beyond:

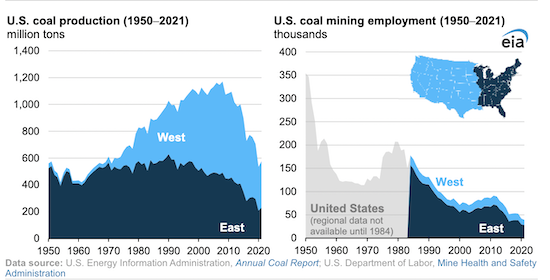

- U.S. power consumption will hit a record-high this year due to rebounding economic activity and warmer summer weather. Coal’s share of U.S. power generation will drop from 23% in 2021 to 19% in 2023 as renewable output rises.

- U.S. natural-gas production, demand and exports will hit record highs this year.

- Growth in U.S. crude output next year was revised downward by 21%, from 610,000 bpd to 480,000 bpd amid rising costs and material shortages for producers.

- Total U.S. crude production next year will hit 12.31 million bpd, slightly less than 2019’s record high.

- Global oil demand growth was revised downward for 2023.

- Standard Chartered bank warned of rising risk of negative oil growth, forecasting demand in the fourth quarter could fall 400,000 bpd below the year-ago period due to economic weakness in China.

- U.S. producer Diamondback Energy says rising costs will limit expansion in the U.S. shale industry.

- Concerns are mounting that Freeport’s fire-damaged LNG export plant in Texas may not restart as planned this month.

- Top U.S. LNG exporter Cheniere Energy says it needs 18 months to upgrade facilities to comply with Louisiana’s new pollution limits.

- More oil news related to the war in Europe:

- European natural-gas prices spiked Tuesday amid uncertainty over the EU’s plans for a bloc-wide price cap.

- Europe’s ravenous demand for natural gas to replace Russian supplies is “driving energy poverty” in emerging nations, a condition which could last for years.

- Oil refiners across the globe are scrambling for supply guarantees from the Middle East ahead of Europe’s upcoming ban on Russian crude.

- Russia is sending more oil tankers on a new Arctic route to China.

- Demand for gas and diesel tankers has surged to three-decade highs as sanctions on Russia boost the distances that tankers must travel.

- Spain will idle a major hydropower plant as drought conditions reduce water levels.

- Ecopetrol, the state oil firm of Colombia, saw quarterly profit rise more than 150% from a year ago to $1.9 billion.

- U.S.-based Peabody Energy and Australia’s Coronado Global Resources ended talks over merging to create a new global coal giant.

Supply Chain

- Florida declared a state of emergency ahead of Tropical Storm Nicole’s landfall later this week.

- Global box volumes fell 9.5% from August to September, according to Container Trade Statistics.

- North American container imports likely hit a little over 2.2 million TEUs in September, down 13% from August.

- A “complete collapse” in global container demand could deepen in the coming months, according to Sea-Intelligence.

- Current-quarter package volumes are below projections at FedEx.

- Spot rates for most very large fossil fuel carriers now top $100,000 per day.

- Third-quarter operating profit at BNSF Railway fell 7.1% to $2.1 billion despite a 16.8% gain in revenue.

- South Korea’s Daewoo shipbuilding booked its 37th LNG tanker order this year in a $252 million deal.

- CMA CGM ordered four 24,000-TEU container ships with dual-fuel LNG capability.

- Truckload carrier Werner Enterprises acquired Florida-based freight operator ReedTMS Logistics for $112 million.

- For the third straight year, FedEx is suspending money-back guarantees during the peak holiday season.

- In the latest news from the auto industry:

- Renault unveiled a major overhaul that will see it separate into five businesses, deepen ties with China and spin off its electric vehicle unit.

- Stellantis is halting operations at its Melfi plant in southern Italy due to chip component shortages.

- South Korea, Japan, Brazil and the EU are pressuring the U.S. to delay imposing new electric-vehicle tax credit rules.

- Wholesale U.S. car prices are falling even as retail prices continue to surge.

- U.S. auto loan delinquencies are at their highest level in a decade.

- Renault is expanding its partnership with Google to improve vehicle software.

- U.S. used-car seller Vroom’s third-quarter profit per vehicle rose by 64% from the same time last year.

- BMW is substantially downsizing its geographic footprint in California amid the shift to remote work.

- U.S. self-driving tech firm Aurora Innovation entered a service contract with Ryder.

- Electric-vehicle-maker Lucid saw thousands of pre-orders pulled in the third quarter.

- British electric-vehicle startup Arrival warned it may run out of cash before it starts generating revenue in 2024.

- Chinese electric-vehicle giant BYD will launch a new premium brand early in 2023.

- Quality control issues lowered Boeing’s monthly deliveries from 51 in September to 35 in October. The plane-maker secured a $1.7 billion deal to build five 777 freighters for Emirates Airline.

- Airbus ramped up deliveries in October but will likely fall short of its targeted 700 deliveries this year.

- Nintendo cut its sales forecast for the popular Switch gaming handset after chip shortages constrained production.

- Confusing environments on warehouse floors and streets will keep human operators behind the controls of autonomous robots for years to come, analysts say.

Domestic Markets

- The U.S. reported 17,379 new COVID-19 infections and 197 virus fatalities Tuesday.

- Pfizer and Moderna are working on new shots that mix flu and COVID-19 vaccines.

- Novavax cut its full-year outlook amid a glut in the COVID-19 vaccine market, even as new research shows its updated booster shots give strong protection.

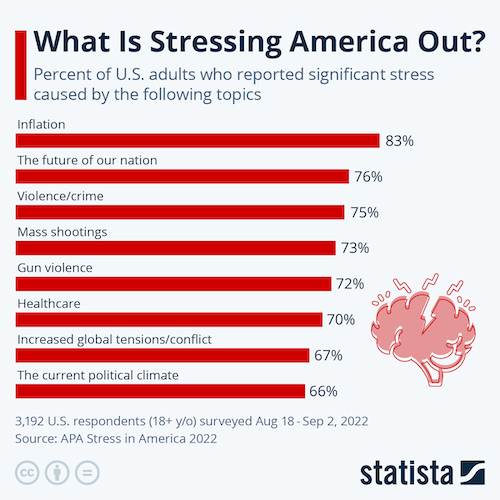

- The American public went to the polls for midterm elections Tuesday, with most believing high inflation is the nation’s biggest issue, according to surveys.

- U.S. small business confidence hit its lowest level since July last month.

- Job cuts by U.S. employers jumped 13% to 33,843 in October, the most in over a year.

- Facebook parent Meta Platforms announced today it is cutting 11,000 jobs, or 13% of its staff.

- Enterprise software leader Salesforce reportedly cut 1,000 jobs this week, with more expected.

- U.S. credit-card balances hit a record-high $866 billion in the third quarter, driven primarily by Gen Z and millennial borrowers.

- One in four surveyed Americans say they may skip Thanksgiving this year in order to save money.

- Newly built single-family homes are taking over listings amid excess supply from two years of the pandemic-fueled construction boom.

- In the latest news from earnings season:

- Walt Disney lost over $1.5 billion on its streaming service in the third quarter, sending its shares down 10% Tuesday.

- U.S. chipmaker GlobalFoundries topped expectations on healthy demand for its cheap computer chips for industrial, communication and auto applications.

- DuPont de Nemours topped expectations and announced a $5 billion share buyback.

- Bayer saw better-than-expected earnings on price boosts for its popular weedkillers.

- Shares of Party City fell more than 30% after the decoration supplier cut employees and lowered its full-year outlook.

- Norwegian Cruise Line beat expectations after occupancy climbed by 17% in the third quarter.

- American beauty firm Coty beat estimates on sustained demand for its fragrances and cosmetics.

International Markets

- New COVID-19 infections in China hit 7,475 Tuesday, with nearly a third coming from the global manufacturing hub of Guangzhou. The nation’s pandemic controls now impact more than 12% of its GDP.

- China’s annual inflation dropped to 2.1% year over year in October, the lowest figure since May:

- China’s exports to the U.S. fell 13% in October, while producer prices fell 1.3%, the first year-over-year decline since 2020.

- China expanded a private lending program to support its struggling property sector, where defaults are at record levels.

- Japanese manufacturing optimism dropped to a 22-month low in November.

- Inflation in Chile fell to a surprise eight-month low in October, rising just 0.5%.

- Gap is selling its business in China and Tawain for $50 million, the latest retailer to back away from China’s ultrastrict COVID policies.

- London-based Barclays started cutting jobs across its investment-banking group as recessionary fears stymie deals. It joins Citicorp and other major banks in cutting staff.

- EU officials started a heightened antitrust review of Microsoft’s proposed $69 billion bid to acquire Call of Duty-maker Activision Blizzard.

- LATAM Airlines, South American’s largest carrier, more than halved last year’s quarterly loss on a 97% surge in third-quarter revenue.

- Mexico is raising its 2030 emissions-cutting target from 22% to 30%.

Some sources linked are subscription services.