MH Daily Bulletin: November 11

News relevant to the plastics industry:

At M. Holland

- M. Holland is hosting a free 3D Printing Technology Forum in Chicago on Nov. 16! Attendees will learn how additive manufacturing technologies can support the development of applications — especially injection molding! Click here to RSVP, or contact 3dinfo@mholland.com for more information.

- During our recent Plastics Reflections Web Series broadcast, M. Holland’s expert panelists discussed the macroeconomic factors influencing global and domestic markets, including impacts on the plastics industry. Click here to read a recap of the webinar

Supply

- Oil rose about 1% Thursday after three days of declines.

- Oil futures rose in mid-morning trading today on news that China will ease some COVID-19 curbs. WTI was up 2.5% at $88.61/bbl, Brent was up 2.1% at $96.65/bbl, and U.S. natural gas was down 5.7% at $5.88/MMBtu.

- U.S. fuel oil prices rose nearly 20% from September to October, even as other measures of inflation slowed more than expected.

- U.S. lawmakers will soon propose industry-backed legislation that would expand national sales of E15, the higher ethanol-gasoline blend that could help reduce supply worries.

- Workers at a BP refinery in Rotterdam are threatening to strike if a new contract is not reached by Nov. 14.

- High LNG spot prices are pushing India’s industrial customers away from the fuel, leaving large storage buildups at import terminals.

- Kazakhstan will start ramping up oil output after finishing repairs at a major export terminal in the next few days.

- More oil news related to the war in Europe:

- Europe’s natural gas consumption dropped 22% in October amid unusually warm weather, giving some relief to the continent’s energy crisis:

- Oil-laden tankers could languish at sea if insurers do not get prompt clarity on unfinished G7 and EU proposals to cap the price of Russian crude.

- Moldova will need to spend the equivalent of 8% of its GDP to cover additional energy costs this winter, officials say.

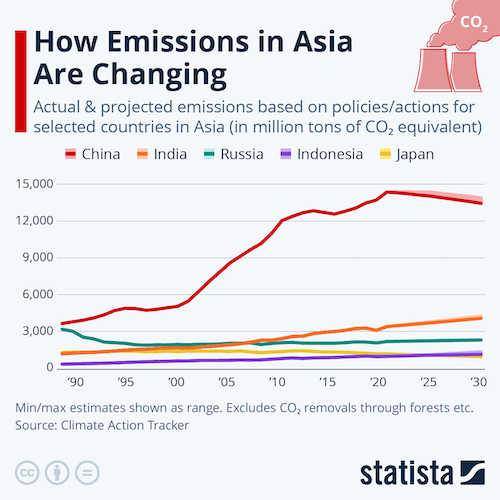

- Global CO2 emissions are on track to rise 1% this year, driven by higher oil use in transport, particularly aviation.

- India says it will keep using coal-generated power until at least 2040.

Supply Chain

- Hurricane Nicole weakened into a tropical storm after making landfall on Florida’s east coast Thursday, bringing heavy wind and rain that downed power lines, flooded homes, canceled flights and killed at least two people.

- Striking subway workers shut down half of Paris’ metro lines Thursday as part of a nationwide day of walkouts and protests by French train drivers, teachers and other public-sector workers.

- Port of Antwerp workers staged a strike Wednesday and Thursday, with threats of more labor actions ahead.

- China’s manufacturing hub of Guangzhou locked down more of the city amid a worsening COVID-19 outbreak.

- Global air cargo volumes in September fell 10.6% from a year ago and 3.9% from 2019, according to the International Air Transport Association.

- Low demand for iron ore has more bulk carriers being converted to carry coal on new routes across the globe.

- Truckload carrier U.S. Xpress lost $22.7 million in the third quarter on rising costs for insurance and claims.

- Amazon will start a broad review of its unprofitable businesses, including its Alexa smart speaker unit, in a bid to cut costs.

- Chip delivery times shrank by six days in October, the biggest drop since 2016 in a sign of falling demand for electronic components.

- U.S. tech giant Cisco Systems will open a new computer chip design center in Barcelona.

- Together with six other Japanese companies, Toyota and Sony are creating a new business to design and make advanced computer chips by the late 2020s.

- Analysts expect Apple’s December quarter revenue to be up about 2% from a year earlier, what would be the slowest growth for the quarter in four years.

- Apple supplier Foxconn is adjusting production to prevent COVID-19 curbs at its iPhone factory in China from impacting holiday orders. The company also plans to quadruple its iPhone-making workforce in India.

- In the latest news from the auto industry:

- Tesla is starting to see inventory pile up at its Shanghai plant, a sign of weakness in the world’s largest car market.

- Chinese electric-vehicle-maker Nio posted a larger-than-expected quarterly loss despite higher deliveries and sales.

- Foxconn’s first electric vehicle will be a boxy single-row three-seater for the Asian market.

- U.S. chipmaker Nvidia is expanding its research and development on self-driving vehicles in Israel.

- Canadian Tire reported a 20% fall in quarterly profit, hurt by higher costs and declining consumer demand for discretionary purchases.

- German auto supplier Continental posted a 47% jump in quarterly earnings and said it plans to continue passing on more energy and labor costs to customers next year.

- Google’s self-driving unit Waymo is opening up its ride-hailing service for customers in Phoenix.

- Rivian Automotive is sticking by its production target after losing $1.74 billion in the third quarter.

- Online spending rose 10.9% to $72.2 billion from September to October but remained flat with last October, according to Adobe Analytics.

- China’s usual year-end export surge is in doubt due to weak global demand.

- Luxury fashion firms Tapestry and Ralph Lauren warned of slowing North American demand for high-end goods.

- Target is designing a new generation of stores with five times the usual space for same-day pickup operations.

- GXO Logistics plans to expand its returns business after quarterly revenues rose by 15%.

- Amazon unveiled an advanced robotic arm and a delivery drone that can fly through rain, potential breakthroughs in the firm’s fulfillment operations.

- German chemicals giant BASF acquired Cargill’s canola seed plant in Idaho Falls, Idaho.

Domestic Markets

- The U.S. reported 64,772 new COVID-19 infections and 545 virus fatalities Thursday.

- New research shows reinfections with COVID-19 are substantially more dangerous than first infections, regardless of vaccination status.

- U.S. health officials are urging people to get booster shots this winter ahead of an expected surge in respiratory illnesses, including COVID-19.

- The U.S. Supreme Court rejected a challenge to New York City’s COVID-19 vaccine mandate for city workers.

- AstraZeneca is no longer pursuing U.S. approval for its COVID-19 vaccine, as demand in the country wanes.

- Medical equipment-maker Becton Dickinson says COVID-19 test sales will plummet next year as infections continue to fall.

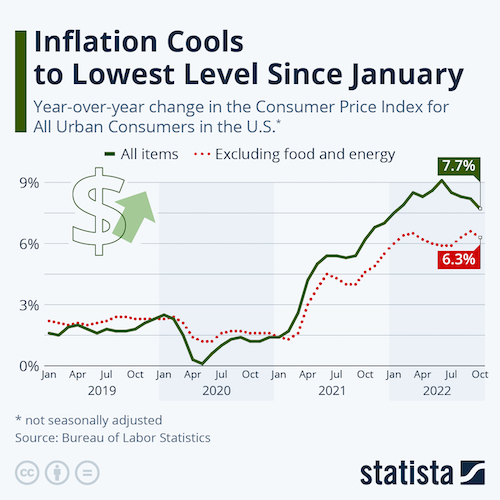

- U.S. stocks surged Thursday on October data showing inflation may have peaked. As part of the broad rally, Apple stock set the record for a single-day gain, increasing the company’s market capitalization by $191 billion.

- A larger-than-expected drop in U.S. inflation may prompt the Federal Reserve to pare down future interest-rate increases, according to some economists.

- U.S. home-price growth slowed sharply to 8.6% last quarter even as affordability remained near its lowest level in decades.

- Workspace provider WeWork lowered its outlook and said it will exit dozens of U.S. locations as it deals with higher expenses, including rent.

- The U.S. hotel experience is declining despite record-high rates, leaving many travelers frustrated.

- United Airlines is giving pilots a 5% pay raise months ahead of schedule as the airline and its pilots union struggle to agree on terms of a new contract.

International Markets

- Despite the highest case levels since April and growing lockdowns, China will reduce quarantine periods for close contacts of COVID-19 cases and incoming travelers as officials seek to ease the economic impact of the nation’s zero-COVID policy. A total of 20 easing measures were released Thursday.

- Britain’s GDP fell by 0.7% from the second to the third quarter, putting the country on track to be the first G7 nation in recession this year.

- Europe’s executive arm predicts the euro zone economy will contract this quarter and next due primarily to surging energy prices.

- The Bank of Mexico hiked its key interest rate by 75 basis points to a record 10% on Thursday.

- The U.S. government reclassified Russia as a non-market country from a market economy, a move aimed at further reducing bilateral trading and isolating Moscow over its war in Ukraine.

- The U.S. president will hold a face-to-face meeting with China’s leader Monday as trade and geopolitical tensions run high between the two nations.

- New bank lending in China slumped in October as COVID-19 outbreaks and a property sector downturn weighed on credit demand.

- Japan’s wholesale prices rose an annual 9.1% in October, slowing from September’s record but remaining at high levels due to the weak yen.

- Brazilian consumer prices rose by a higher-than-expected 6.5% in October, breaking with three straight months of declines.

- Deutsche Bank is Germany’s latest financial institution to pay employees a bonus to help offset soaring inflation.

- Brazil’s JBS, the world’s largest meat producer, saw quarterly profit surge 47.1% despite shrinking margins in its U.S. beef division.

- Japanese conglomerate Toshiba cut its full-year outlook after quarterly profit slumped 75%.

- Germany’s Merck KGaA beat quarterly estimates but said growth in its semiconductor chemicals unit could lose momentum next year.

- Asian airline travel should reach about two-thirds of pre-pandemic levels by the end of the year, trade groups say.

- Chinese aircraft manufacturer COMAC says it has orders for 300 of its narrow-body passenger jets.

- Paris opened a hub for testing electric air taxis as it looks to introduce the word’s first service with the new category of aircraft by 2024.

Some sources linked are subscription services.