MH Daily Bulletin: November 17

News relevant to the plastics industry:

At M. Holland

- M. Holland’s U.S. and Puerto Rico offices will be closed Thursday, Nov. 24 and Friday, Nov. 25 in observance of the Thanksgiving holiday.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil fell 1.5% Wednesday as rising COVID-19 cases in China weighed on demand prospects.

- In mid-morning trading today, WTI futures were down 3.8% at $82.35/bbl, Brent was down 2.6% at $90.48/bbl, and U.S. natural gas was up 2.4% at $6.35/MMBtu.

- European oil flows through a key pipeline from Russia restarted after a brief outage Wednesday, easing some supply concerns.

- U.S. crude stocks fell by a larger-than-expected 5.4 million barrels last week, according to the Energy Information Administration.

- U.S. diesel inventories are 15% below the five-year average for the current season and at their lowest since 1951.

- OPEC’s oil exports are down sharply this month, according to vessel trackers.

- OPEC member Iraq plans to raise its production capacity from 5 million bpd to 7 million bpd by 2026.

- The White House is asking lawmakers for $500 million to upgrade four strategic crude facilities in Texas and Louisiana.

- More oil news related to the war in Europe:

- The EU’s executive is considering plans for a price ceiling on one of the world’s biggest natural gas hubs in the Netherlands.

- European power prices will remain high in the medium term due to a confluence of factors, according to Moody’s Investors Service.

- An international arbitrator has ruled that Finnish energy provider Gasum is not obligated to pay Russian gas supplier Gazprom in rubles.

- High heating and electricity costs are prompting some companies in Europe to unwind return-to-office mandates.

- Chinese refineries are seeking government help to mitigate disruptions to the supply of Russian crude caused by pending EU sanctions.

- U.S. coal producers are expected to outperform returns from every other U.S. industry next year, as the global energy crisis boosts prices to record highs.

- Chevron Phillips Chemical is partnering with QatarEnergy to build an $8.5 billion PE facility in Orange, Texas, to operate by 2026.

- Top U.S. solar-panel-maker First Solar chose Alabama as the home for its fourth domestic billion-dollar factory.

- BP will pay 25% more tax this year under a windfall levy imposed by the British government.

- Idemitsu Kosan, Japan’s second-largest oil refiner, is investing $5 billion into its clean energy transition over the next three years.

- India raised its windfall tax on crude oil producers.

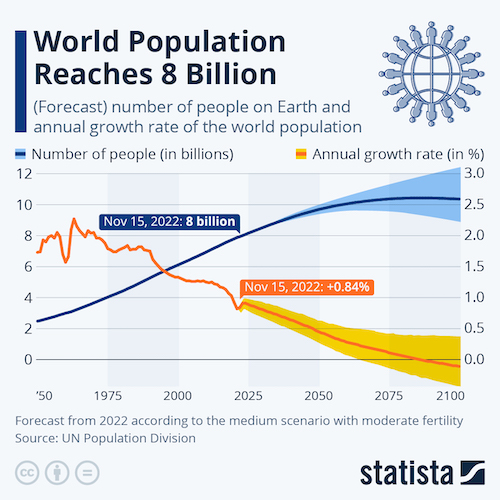

- The difficulty of controlling climate change will jump enormously as the world’s population continues to grow past 8 billion people, experts say.

Supply Chain

- Maersk-owned Svitzer will indefinitely lock out all its Australian tugboat crews in an escalating labor dispute. The move will effectively close shipping traffic to the nation’s 17 major ports.

- Combined inbound volumes into the ports of Los Angeles and Long Beach plummeted 26% last month, the third straight year-over-year decline.

- A container terminal at the Port of Oakland resumed operations after longshore workers went on strike.

- Container volumes handled by the UAE’s AD Ports Group soared 31% in the third quarter.

- U.S. business inventories rose by a moderate 0.4% from August to September, suggesting firms were more cautious about ordering merchandise.

- Walmart’s inventories ended the third quarter up 12.6% from a year ago but substantially smaller than the first and second quarters.

- U.S. defense contractor Raytheon Technologies says its dependence on small suppliers is worsening raw material shortages as many vendors struggle to recruit workers.

- China’s semiconductor output contracted 26.7% in October, the largest single-month decrease on record.

- China is calling on retired soldiers and government workers to take on temporary positions at electronics factories amid worker backlash over COVID-19 conditions.

- U.S.-based Micron Technology will scale back production of its chip wafers and cut capital expenditures due to softening demand.

- U.S. graphics-chip-maker Nvidia issued a muted outlook after quarterly revenue fell 17%. Sales in its gaming segment plummeted, while its data center and auto divisions surged.

- Global PC shipments contracted by 15% in the third quarter, according to International Data Corp., echoing a broader decline in electronics sales.

- India might soon join Europe in mandating that Apple change the charging port for its phones to USB-C.

- In the latest news from the auto industry:

- Ford’s construction of a $5.6 billion auto plant near Memphis, Tennessee, is the automaker’s first new plant in 53 years.

- Mercedes slashed prices for its electric vehicles in China by up to $33,000, as sales lagged behind local rivals.

- Volvo is partnering with Pilot to add heavy-duty charging stations to selected U.S. truck stops and travel plazas.

- U.S.-based Advanced Micro Devices won a bid to supply Japan’s major auto supplier Aisin Corp. with processors for advanced car functions.

- Russian auto sales are down 60% this year and may end up being less than a quarter of what they were a decade ago.

- A coalition of U.S. shippers formed a freight buyers’ alliance aimed at boosting zero-emissions shipping.

- FedEx began testing the use of diesel made from renewable sources in its Dutch operations.

- Facing a shortfall of power, South African localities are turning to private generators to supply the grid.

- Prices for key agriculture commodities will likely dip next year as major economies enter recession, analysts say.

- The American Chemistry Council warned that a U.S. rail strike could begin closing petrochemicals plants within a week.

Domestic Markets

- The U.S. reported 83,096 new COVID-19 infections and 825 virus fatalities Wednesday.

- U.S. hospitals are running out of effective COVID-19 antibody treatments as virus strains rapidly evolve to evade immunity.

- The U.S. administration is asking Congress to approve an additional $9.25 billion for COVID-19 measures.

- JPMorgan says the U.S. will see a “mild” recession in 2023 on impacts from the Federal Reserve’s interest-rate hikes. One million Americans could ultimately lose their jobs in the downturn, the bank said.

- The San Francisco Fed says the central bank’s policy rate could peak in the 4.75%-5.25% range next year.

- First-time jobless claims fell by 4,000 to 222,000 last week, despite big staff reductions in the tech sector, indicating the employment market remains tight.

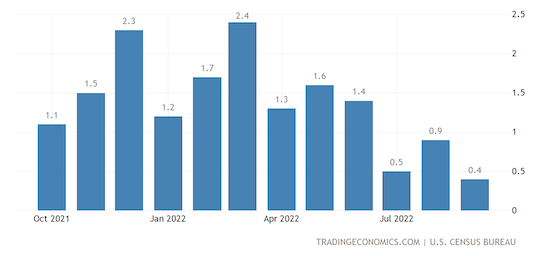

- While U.S. retail sales rose by a sharp 1.3% in October, spending patterns have shifted as consumers spread out purchases and buy more gift cards to avoid stock outs.

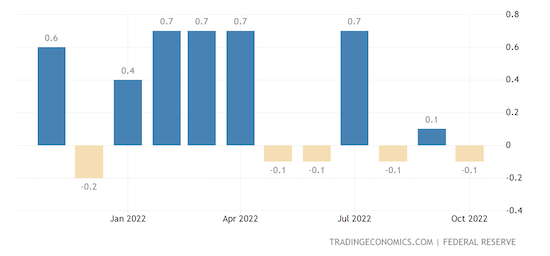

- U.S. import prices dropped by 0.2% in October, the fourth straight decline in a further signal that inflation has peaked.

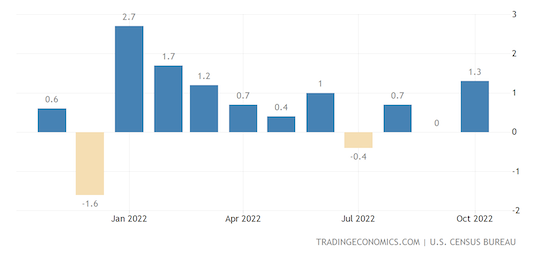

- U.S. manufacturing output barely rose in October, while overall industrial production decreased by 0.1%:

- U.S. mortgage rates dipped below 7% last week, prompting a brief surge in purchase applications that otherwise remained depressed.

- More people are tapping the equity in their homes as high interest-rates drive up the cost of borrowing money, with home-equity lines of credit rising an annual 40% in the second quarter to $66 billion.

- United Airlines says Thanksgiving travel will surge 12% this year to 5.5 million passengers, roughly in line with 2019 levels.

- Target’s disappointing third-quarter earnings report sent its shares down 17% and prompted a broad selloff in U.S. retailer stocks Wednesday.

- Macy’s said third quarter sales fell 3.9% as it offered promotions to reduce bloated inventories.

- Lowe’s raised its annual profit forecast after comparable sales grew a stronger-than-expected 2.2% in the third quarter.

- T.J. Maxx parent TJX raised its outlook as cash-strapped consumers turned to the discount store for affordable clothing and home décor last quarter.

- Cisco Systems raised its full-year revenue and profit forecast as supply-chain hurdles ease ahead of the conglomerate’s cost-cutting restructuring.

- Upside Foods received the first ever FDA approval for a meat product grown from the cells of live animals.

International Markets

- Global COVID-19 cases climbed 2% last week to 2.3 million, the first increase in four months. Deaths dipped slightly to 7,400.

- China reported 20,199 new COVID-19 infections Tuesday, including hundreds of cases in Beijing, Guangzhou and the manufacturing hub of Zhengzhou. Other regions surpassed 100 days of lockdowns Wednesday.

- Chinese government advisers will recommend modest GDP growth targets of 4.5% to 5.5% next year, a pickup from 2022 but still suppressed by COVID-19 and other challenges.

- British trade is slowing much faster than the rest of the world due to lingering impacts from 2016’s Brexit, the Bank of England says.

- The U.K.’s new administration reversed its predecessor’s failed economic policies and announced tough spending cuts and tax hikes to restore the nation’s economy.

- Canada’s annual inflation rate held steady at 6.9% in October, matching forecasts.

- Canadian housing starts fell 11% in October, a sharp pullback from the previous month.

- Russia’s economy shrank 4% year over year in the third quarter and is headed for an even steeper decline to start 2023.

- JetBlue will expand its trans-Atlantic coverage by offering flights to Paris next year, a bid to cash in on robust travel demand.

- Swiss drugmaker Novartis is considering selling its ophthalmology and respiratory units for well over $5 billion, according to reports.

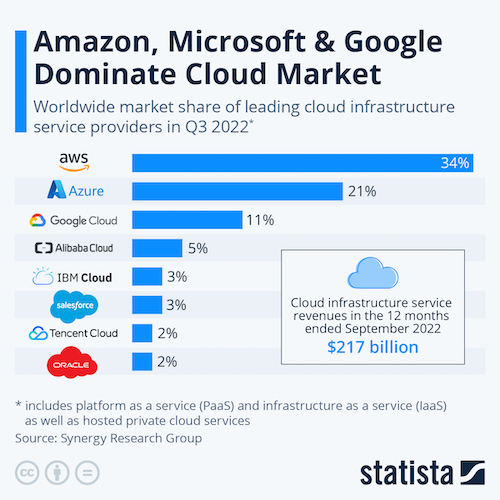

- Amazon’s market-dominating AWS cloud unit will invest $2.6 billion in Spain over the next decade.

Some sources linked are subscription services.