MH Daily Bulletin: November 23

News relevant to the plastics industry:

At M. Holland

- M. Holland’s U.S. and Puerto Rico offices will be closed Thursday, Nov. 24 and Friday, Nov. 25 in observance of the Thanksgiving holiday.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil rose 1% Tuesday after Saudi Arabia said OPEC+ would stick with output cuts despite rumors to the contrary.

- In mid-morning trading today, WTI futures were down 4.4% at $77.42/bbl, Brent was down 4.0% at $88.29/bbl, and U.S. natural gas was up 10.1% at $7.47/MMBtu.

- U.S. crude stocks dropped by a larger-than-expected 4.2 million barrels last week, according to the American Petroleum Institute. Government data is due today.

- A worker strike at BP’s Rotterdam refinery, its largest in Europe, is delaying plans to restart the facility.

- Italy’s Enel, the world’s largest energy retailer, will sell green power to U.S. businesses for the first time ever after receiving a license to operate in Texas.

- More oil news related to the war in Europe:

- European gas prices surged 5% Tuesday after Gazprom threatened to cut flows sent via Ukraine next week, citing a dispute with Moldova.

- Dec. 5 will see the start of an EU ban on Russian crude imports as well as a G7 plan to cap the price of Russia’s oil exports, which Europe proposed softening.

- After months of wrangling and internal division, the EU’s executive arm proposed an emergency brake on the bloc’s natural-gas prices that is more than double current price levels, raising questions of whether it will ever be used. Equinor, one of the first companies to respond to the move, says it will have little impact on the producer’s exports to Europe.

- China’s crude buyers are pausing some purchases of Russian oil as they wait to see if a U.S.-led price cap will lower prices.

- Germany plans to spend some $55.5 billion next year to cap domestic energy prices for companies and households. Experts say the nation’s economic picture is getting brighter due to improvements in gas supply.

- Millions of lives could be at risk in Ukraine as some 10 million people, or 25% of its population, are without power.

- Bulgaria’s only oil refinery may have to shut down if the government does not allow the Russian-owned business to continue exporting due to Western sanctions, executives said.

- The U.K. is heading into winter with its tightest power reserves in seven years, raising fears of deliberate measures to curb consumption.

- Top business executives in 20 major economies see the war in Ukraine speeding up the global energy transition, a survey found.

- Earnings from product tankers, which carry clean petroleum, have grown some 300% since February as vessels travel longer routes in response to disruption from the war in Ukraine.

- Germany is considering subsidies for renewable energy manufacturers in response to the U.S.’s backing of green businesses in the recently passed Inflation Reduction Act. European policymakers are calling for similar measures on a bloc-wide scale.

- A coalition of 65 international firms agreed at the COP27 climate summit to collectively buy $12 billion of low-carbon products by 2030 in an effort to help suppliers scale up production.

- Linde, the world’s largest industrial gases company, started producing green hydrogen at its facilities in Greece.

- One of Australia’s biggest real estate developers pledged to remove fossil fuels from its building projects by 2040.

- Britain’s competition watchdog has flagged Baker Hughes’ acquisition of Altus Intervention over potential impacts to businesses that buy coiled tubing and pumping services.

Supply Chain

- Paid sick leave is turning into a sticking point in negotiations between tens of thousands of U.S. rail workers and freight companies, as prospects of a strike in early December loom. The U.S.’s largest business lobby is asking Congress to step in, while the White House says it resumed direct involvement in negotiations as well.

- Breakbulk dockworkers at Alabama’s Port of Mobile began striking Tuesday over a contract dispute.

- South Korean truckers are planning their second strike of the year starting Thursday.

- Workers at Chile’s San Antonio port, home to the nation’s largest container terminal, are striking as part of a countrywide industrial action.

- Container lines are set to cancel two-thirds of trans-Atlantic sailings and more than half on the trans-Pacific in the run-up to Christmas.

- A downturn in container shipping is clogging ports with empty boxes.

- Norfolk Southern will buy Cincinnati Southern Railway for $1.62 billion in a bid to eliminate uncertainty around lease costs in the Cincinnati region.

- Apple extended the wait time for its high-end iPhones into early next year as COVID-19 lockdowns in China continue to squeeze production at a key factory in Zhengzhou.

- U.S. semiconductor maker Analog Devices saw its seventh straight quarter of record revenue at $3.25 billion.

- Shares of Medtronic fell 6% Tuesday after the medical device maker lowered its full-year outlook for profit and revenue growth, blaming a stronger dollar and persistent supply-chain issues.

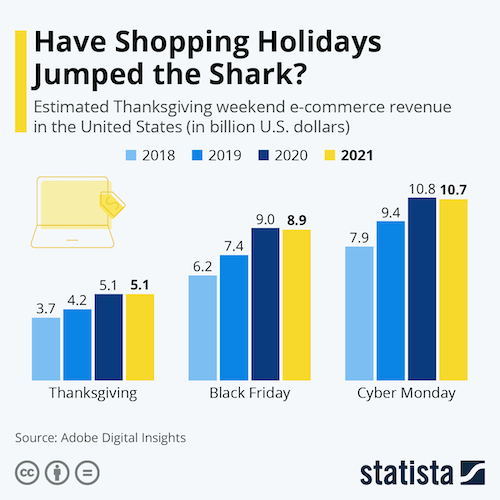

- Online sales during Black Friday and Cyber Monday dipped in 2021 for the first time in years of unabated growth:

- In the latest news from the auto industry:

- Stellantis says thousands of cars are stacking up in inventory in eastern France due to persistent logistics problems.

- Volkswagen’s China sales will stagnate at about 3.3 million cars this year as it struggles to make up for supply-chain issues in the first half.

- Tesla is boosting insurance subsidies for buyers in China as it works to compete with domestic rivals.

- Mazda unveiled a $10.6 billion spending plan to electrify its vehicles and potentially invest in battery production.

- Australia’s Syrah Resources, the largest supplier outside China of graphite, a critical material in electric-vehicle batteries, warns supply could be tight in the coming years due to pricing opacity in the China-dominated market.

- New York private equity firm Stonepeak Partners is looking to raise $20 billion to invest in North American infrastructure amid strong demand from investors.

- Trade and investment between the U.S. and Europe are booming as Russia’s war in Ukraine and fraying ties between the West and China draw the Atlantic allies closer.

- Italy will press ahead with plans to sell its majority stake in airline ITA Airways after shipping group MSC backed away from a deal.

Domestic Markets

- The U.S. reported 34,678 new COVID-19 infections and 552 virus fatalities Tuesday.

- COVID-19 cases are on the rise in 24 states, led by a 423% increase in Washington state over the past two weeks.

- COVID-19 cases in Florida appear to have plateaued, but a rise in other respiratory viruses could put undue strain on hospitals recovering from pressures of the pandemic.

- The White House announced a new campaign to get updated COVID-19 boosters to vulnerable populations ahead of a feared winter wave.

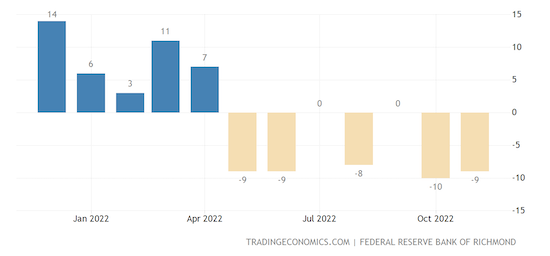

- The Richmond Fed’s index of factory activity in the region stretching from Maryland down to South Carolina edged higher in November despite generally weak conditions for manufacturing firms:

- In the latest news from earnings season:

- American Eagle beat third-quarter estimates, but said it expects a larger-than-expected fall in fourth-quarter sales.

- Abercrombie & Fitch saw a surprise quarterly profit and forecast a smaller-than-expected drop in current-quarter sales.

- Nordstrom trimmed its full-year profit forecast as it wrestles with supply-chain issues and aggressive discounting to clear excess inventory.

- Best Buy forecast a smaller drop in annual sales than previously estimated, saying discounts will boost sales to inflation-weary shoppers this holiday season.

- Dollar Tree lowered its annual profit forecast for a second time as price cuts pressure the discount retailer’s margins.

- HP said annual profit will fall below estimates and that it will cut 6,000 jobs, or 10% of its workforce, by FY 2025.

- Fintech giant Fidelity National Information Services plans to cut thousands of workers, targeting $500 million in cost savings in coming quarters.

- Shares of Zoom Video Communications have tumbled 90% from their pandemic peak as the firm struggles to adjust to a post-COVID world.

- Teva Pharmaceuticals and AbbVie finalized settlement terms worth over $6.6 billion to resolve thousands of U.S. opioid lawsuits.

- Barry Callebaut, the world’s largest maker of bulk chocolate, plans to boost production capacity by 15% in the Americas to meet rising demand from the ice cream industry.

International Markets

- Beijing shut parks, shopping malls and museums Tuesday as more Chinese cities resumed mass testing for COVID-19. The nation’s daily average for new infections doubled to over 22,000 last week, as Shanghai tightened rules for people entering the city.

- Hundreds of workers at Foxconn’s locked-down Zhengzhou complex rioted this morning in protest of China’s COVID-zero policy and living conditions at the site.

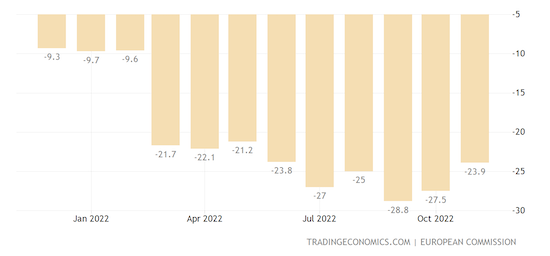

- Euro-area consumer sentiment hit a five-month high of -23.9 in November.

- The Bank of Canada says higher interest rates are starting to slow the national economy as intended.

- Israel is in talks with Japan on a potential free-trade deal that could unlock some $3.5 billion in bilateral trade.

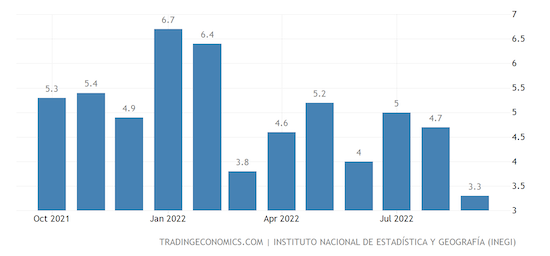

- Mexico’s headline inflation probably dropped slightly from October to November despite remaining well above official targets, according to a Reuters poll of economists. New data shows the nation’s retail sales rose 3.3% in September, the second month of slowing growth:

- Mexican companies are spinning off sports, gambling and cell-tower businesses in a bid to revive depressed stock prices, with more deals likely in the coming months.

- Ukraine began receiving emergency funds of over $2.5 billion from Europe and over $4.5 billion from the U.S. this week.

- Collective global debt fell by $6.4 trillion to $290 trillion in the third quarter, a positive, although economists warn of drastic consequences from rising debt-service costs. Debt-to-GDP ratios in emerging markets are already at record highs.

- Dubai’s main airport saw passenger traffic nearly triple in the third quarter from a year ago.

Some sources linked are subscription services.