MH Daily Bulletin: October 3

News relevant to the plastics industry:

At M. Holland

- M. Holland is a Gold Sponsor of the SPE Automotive TPO Engineered Polyolefins Global Conference happening this week in Troy, Michigan. If you’re planning to attend, please stop by M. Holland’s booth to meet our Automotive team!

- We are sponsoring MAPP’s Benchmarking & Best Practices Conference in Indianapolis on Oct. 5-7! If you’re planning to attend, don’t forget to stop by M. Holland’s booth and tune in for our session featuring Debbie Prenatt, Market Manager, Sustainability. Click here to read more.

- Come see us at the IWCS Cable & Connectivity Industry Forum in Providence, Rhode Island, on Oct. 10-13! M. Holland is a Gold Sponsor. If you are attending, please stop by Booth #113 to discuss our materials and offerings serving the wire and cable market.

- At our Plastics Reflections Web Series event on Oct. 13, M. Holland will host panelists from Maersk and Bank of America to discuss the macroeconomic factors influencing global and domestic economies, including impacts on the plastics industry. Click here to register!

- M. Holland’s latest press release features our post-consumer recycled (PCR) resins, which are cleaner and easier to color, enabling brand owners and OEMs to meet aggressive sustainability goals. Click here to read the full press release.

Supply

- Oil rose last week for the first time in five weeks on signs that OPEC may cut November output, tightening supply. In the third quarter, crude prices were down roughly 25%.

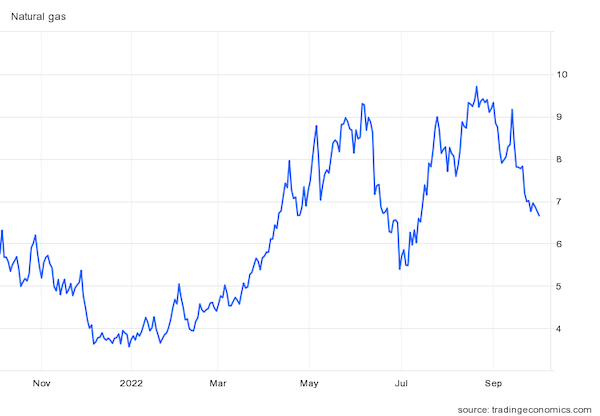

- In mid-day trading today, WTI futures jumped 5.2% to $83.59/bbl and Brent was up 4.3% at $88.81/bbl. U.S. natural gas, which fell for a sixth straight week last week, was down 4.1% at $6.49/MMBtu this morning.

- Active U.S. drilling rigs rose by 12 in the third quarter, the smallest increase in two years.

- Rates for very large crude carriers have pushed to their second-highest level on record amid rising trading volumes.

- OPEC+ is expected to cut November production quotas by over 1 million bpd when the group meets this Wednesday. The move comes after group output hit 29.81 million bpd in September, the most in 2.5 years.

- Gas stations in France are running out of fuel as a strike among refinery workers enters its second week.

- India delayed new taxes on dirty and unblended fuel as it tries to contain surging inflation.

- More oil news related to the war in Europe:

- Gazprom halted gas deliveries to Italy Saturday over alleged regulatory issues, escalating Europe’s energy crisis. Italian energy major Eni says it is working to resolve the issue, but no deliveries are expected today.

- EU nations agreed to a windfall tax on oil companies but failed to agree on a price cap on Russian gas imports amid stiff opposition from Germany, Europe’s largest economy.

- EU leaders will meet this week to discuss energy-asset security following damage to Nord Stream pipelines that is widely suspected to be the result of sabotage. Experts say the ruptures could be the biggest single release of climate-damaging methane ever recorded.

- Slovakia says it may halt electricity supplies to other EU nations absent more support for soaring energy costs.

- Greece and Bulgaria commenced operations on a long-delayed gas pipeline last weekend in a move expected to lower southeast Europe’s dependence on Russian gas.

- German utility RWE agreed to buy Con Edison’s clean energy business for $6.8 billion, nearly doubling the U.S. renewables portfolio of Germany’s largest power producer.

- Trading house Mitsubishi is considering launching one of the world’s largest ammonia production facilities in Texas, while rival Itochu is eying a project in Alberta, Canada, as the Japanese firms look to North America for greener energy investments.

Supply Chain

- In extreme weather news:

- The remnants of Hurricane Ian drifted through Virginia Sunday while storm-ravaged residents in Florida and the Carolinas faced a disaster recovery that could potentially cost $100 billion, making it one of the costliest storms in U.S. history. Ian’s fatality count rose above 80 yesterday.

- Fuel supplies in the U.S. Southeast will be tight for several days after Hurricane Ian caused several coastal fuel markets to shut down. Logistics disruptions — including delayed deliveries, restricted port operations and rail shutdowns — could take weeks to clear.

- U.S. regulators waived hours-of-service limits for truck drivers in eight states affected by Hurricane Ida.

- Farmers and ranchers in Florida are facing widespread crop destruction from Hurricane Ian.

- Cuba made a rare request for emergency assistance from the U.S. government after Hurricane Ian knocked out power to the whole island of 11 million people.

- Category 3 Hurricane Orlene will dump torrential rain on Mexico’s northwest Pacific coast in the coming days.

- Roughly 70% of the U.S. West is under some level of drought, the latest in a dry spell that has lasted almost two decades.

- Dockworkers at the U.K.’s largest container port of Felixstowe went on strike for the second time in two months last week.

- Ocean carriers are canceling dozens of sailings on the world’s busiest routes as inflation weighs on demand for goods. Trans-Pacific carrier rates have fallen almost 75% from a year ago.

- The average price to ship a container from Shanghai to Los Angeles dropped to $3,779 per FEU last week, down 38% from a month ago to the lowest level in two years.

- Maersk suspended one of its routes from Asia to the U.S. East Coast as bookings fall.

- Hong Kong’s Cathay Pacific Airways says cargo demand will pick up in mid-October but stay below all-time highs seen last year.

- Air cargo handler SATS of Singapore is acquiring Worldwide Flight Services in a $1.1 billion deal to create the world’s biggest global air cargo handler.

- Jacksonville-based Patriot Rail is acquiring Louisiana’s Delta Southern Railroad, whose customer base includes large-scale chemical manufacturers and forest industry shippers.

- Walmart plans to hire 1,500 truck drivers as part of its 40,000-worker hiring push for the holidays.

- Amazon unveiled a “pinch-grasping” robot that operates like a human hand and can handle over 1,000 items an hour.

- U.S. retail inventories are now at their highest level relative to sales since the start of the pandemic.

- Benchmark aluminum prices have fallen 50% from a March record as manufacturers hold off booking next year’s raw material orders.

- Lumber prices are down to their lowest level in over two years as the U.S. Federal Reserve’s rate hikes hit demand for housing construction.

- In the latest news from the auto industry:

- Toyota cut its October production target by 6.3% due to ongoing computer chip shortages.

- Despite hitting a new record of 343,830 vehicles, Tesla’s third-quarter deliveries fell short of targets due to persistent logistics issues. The automaker plans to sharply boost production this quarter as capacity expands at factories in Austin and Berlin.

- Mercedes-Benz says India could become a major export hub for its vehicles if the EU works out a trade agreement with the nation.

- Electric-truck maker Nikola is trimming output expectations amid rising production and credibility challenges.

- British electric-van-maker Arrival missed third-quarter production targets due to logistics issues.

- Stellantis’ chief executive expects global computer chip supplies to remain tight until the end of 2023.

- Qualcomm took in roughly $1.3 billion in auto revenue in its most recent fiscal year, up 33% from the prior year.

- Intel is moving forward with plans to publicly list shares in its Mobileye self-driving car unit, an Israeli company it acquired in 2017 for $15.3 billion.

- Car buyers may be choosing between Google and Apple-branded vehicles in the coming years.

- Electric vehicle charging sites in Manhattan now drastically outnumber the borough’s gas stations, with 320 public available charging locations compared to just 29 fuel stations.

- The U.S. administration expects to complete new rules on tax breaks for electric-vehicle purchases by the end of the year.

- Volkswagen is searching for ways to help its European suppliers counter natural-gas shortages, including making more parts locally and shifting manufacturing capacity.

- Spurred by Russia’s invasion of Ukraine, the world is seeing its worst food supply crisis since at least 2008, according to the United Nations.

Domestic Markets

- The U.S. averaged 45,725 new COVID-19 infections and 325 virus fatalities over the past seven days.

- COVID-19 cases in New York are rising, with nine of the state’s counties now considered at “high risk,” prompting the CDC to recommend mask-wearing in those areas.

- New York City saw sharp declines in child academic proficiency on the first release of state test scores since the start of the pandemic.

- A stopgap bill to fund the U.S. government into December was passed by lawmakers just hours before the deadline on Friday. The bill allocates over $12 billion in additional aid to Ukraine.

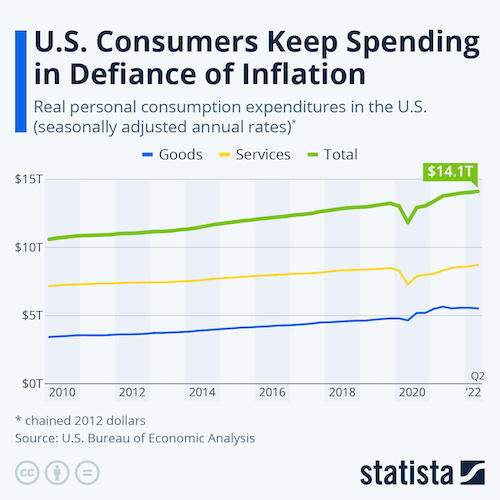

- U.S. consumer spending rose a larger-than-expected 0.4% in August amid signs of a cutback on discretionary purchases.

- The S&P 500 saw its worst September in over 20 years as U.S. stock indices notched their third quarterly decline in a row.

- JPMorgan Chase plans to hire about 2,000 software engineers across the globe by year’s end, in contrast with other large firms cutting back on staff in the face of a possible recession.

- Power tools maker Stanley Black & Decker cut 1,000 finance roles last week to trim costs.

- Companies are making significant investments in artificial intelligence and machine-learning, threatening office jobs once thought to be untouchable by automation.

- Walgreens is setting up a network of automated drug-filling centers as big as city blocks as the nation’s second-biggest pharmacy chain grapples with a nationwide shortage of pharmacists.

- Delta Air Lines pilots will vote this month on whether to authorize a strike in an escalating dispute over new contracts.

- United Airlines will suspend service later this month to New York’s JFK airport, fulfilling a threat it said it would take if the FAA did not grant the carrier additional flights. America’s fourth largest airline also is cutting 12 routes, mostly at its western hubs, due to a pilot shortage.

- Nike shares fell by the most in over two decades Friday after a glut of unwanted merchandise eroded profitability. The company’s North American inventories surged 65% in the quarter ended Aug. 31.

International Markets

- COVID-19 infections in the U.K. rose 14% last week, the biggest increase since summer.

- Germany is seeing a sharp rise in COVID-19 cases as it heads into autumn, officials say.

- Australia will end its forced isolation requirement for COVID-infected people starting Oct. 14.

- South Korea ended all COVID-19 travel restrictions.

- The annual inflation rate in the eurozone jumped to 10% in September, the highest in records dating back to 1997.

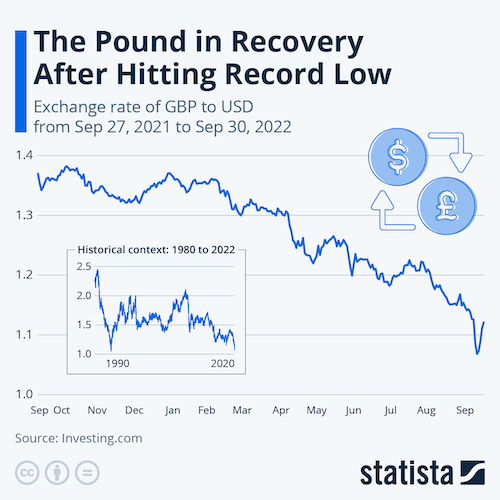

- Today, the British government reversed course on a plan for unfunded tax cuts, which last week sent the British pound to record lows and forced the Bank of England to intervene to calm markets. Amid the financial turmoil, ratings agency S&P downgraded British sovereign debt from “stable” to “negative.”

- After the yen hit a 24-year low against the dollar last week, Japan spent nearly $20 billion intervening in foreign exchange markets to prop up its flagging currency, draining nearly 15% of available foreign currency reserves.

- South Korea’s exports grew just 2.8% in September, the slowest pace in two years.

- Sales by major Chinese retailers fell sharply in the third quarter, worrying investors over long-term impacts of the nation’s pandemic and regulatory policies.

- New home prices in China fell for a third month in September as the nation’s slowing economy discouraged potential homebuyers.

- Chinese companies have sold a net $23.6 billion of U.S. commercial properties since 2019, a dramatic turnaround from over $50 billion in net purchases between 2013 and 2018.

- Mexico’s government revealed that it suffered a major cyber hack of sensitive data last week.

Some sources linked are subscription services.