MH Daily Bulletin: October 6

News relevant to the plastics industry:

At M. Holland

- Plastics News interviewed experts at M. Holland about how material and chemical suppliers are working to meet automotive OEM demands for both electric and internal combustion vehicles amid an ongoing market shift. Click here to read the article!

- We are sponsoring MAPP’s Benchmarking & Best Practices Conference in Indianapolis on Oct. 5-7! If you’re planning to attend, don’t forget to stop by M. Holland’s booth and tune in for our session featuring Debbie Prenatt, Market Manager, Sustainability. Click here to read more.

- Come see us at the IWCS Cable & Connectivity Industry Forum in Providence, Rhode Island, on Oct. 10-13! M. Holland is a Gold Sponsor. If you are attending, please stop by Booth #113 to discuss our materials and offerings serving the wire and cable market.

- At our Plastics Reflections Web Series event on Oct. 13, M. Holland will host panelists from Maersk and Bank of America to discuss the macroeconomic factors influencing global and domestic economies, including impacts on the plastics industry. Click here to register!

- M. Holland’s latest press release features our post-consumer recycled (PCR) resins, which are cleaner and easier to color, enabling brand owners and OEMs to meet aggressive sustainability goals. Click here to read the full press release.

Supply

- Oil rose 1.5% to three-week highs on Wednesday after OPEC+ agreed to its steepest production cuts since early 2020. The White House criticized the move and suggested it could release more fuel from strategic reserves to stabilize markets.

- In mid-morning trading today, WTI futures were up 0.8% at $88.45/bbl, Brent was up 0.8% at $94.10/bbl, and U.S. natural gas was up 2.2% at $7.08/MMBtu.

- U.S. crude, gasoline and distillate inventories posted larger-than-expected declines last week in a sign of tightening supplies.

- Shell says third-quarter earnings will take a sharp dive after market volatility and transport costs weighed on margins.

- The U.S. government is considering easing sanctions on Venezuela to let Chevron resume more operations there, although officials say a deal could fall through.

- France is dipping into strategic fuel reserves as a worker strike at refineries across the nation stunts production.

- Saudi Arabia surprised markets by keeping oil prices for Asia unchanged and lowering prices for Europe this month.

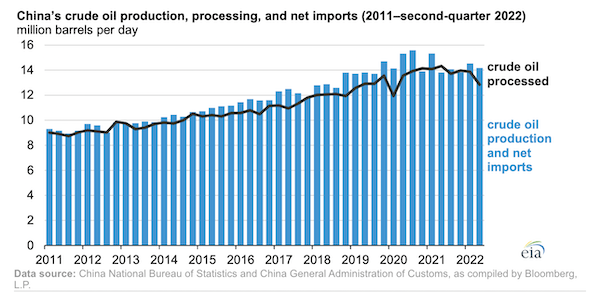

- Oil demand from China is expected to rebound after the government increased import and export quotas, allowing refiners to source more crude to process for export:

- Just 19 LNG vessels from the U.S. docked in China in the first eight months of the year, compared with 133 a year ago.

- Qatari officials predict global LNG production will lag behind surging demand, particularly in Europe, potentially for the next two decades.

- German officials reported a radioactive leak at one of the nation’s decommissioned nuclear sites Wednesday.

- More oil news related to the war in Europe:

- EU officials agreed to a new package of sanctions against Russia Wednesday, including a price cap on Russian oil sold to third parties and import bans on steel, wood pulp, chemicals and other materials. Russia threatened to cut oil production in response.

- Germany will subsidize industrial and consumer power bills next year under a $13 billion scheme to pay ballooning grid fees.

- France finalized a 2023 windfall tax on electricity producers that could bring in billions in revenue to help companies pay energy costs.

- Japan is building its second stimulus plan in as many months in an effort to curb rising electricity bills for households and firms.

- Gazprom resumed exports to Italy after resolving a payment issue that halted flows last weekend.

- Europe’s executive branch urged member states to jointly buy gas to avoid bidding against each other on world markets.

- France is turning off hot water in public buildings as part of broader plans to reduce energy consumption.

- TotalEnergies says it will continue shipping LNG from Russia as long as there are no European sanctions on the fuel.

Supply Chain

- In extreme weather news:

- The White House extended Florida’s disaster declaration from Hurricane Ian, opening up more funding for debris removal and emergency measures. Over 202,000 Florida homes and businesses remain without power.

- Over 100,000 Puerto Rican homes and businesses remain without power more than two weeks after Hurricane Fiona.

- A fourth union reached agreement with U.S. freight railroads on new contracts, while another eight groups are working through tentative deals.

- FedEx Express pilots and management filed for mediation for help with contract negotiations that began over a year-and-a-half ago.

- The U.S. Logistics Managers’ Index rose in September for the first time in six months, pointing to sustained growth in the industry. Transport capacity increased while prices continued falling.

- Some commercial shipments stalled on southern portions of the Mississippi River this week due to low water levels.

- Big U.S. retailers grappling with supply-chain snarls are imposing tougher standards on how goods are received.

- Hapag-Lloyd is pushing further into inland logistics with the $1 billion acquisition of South and Central American terminal operator Sociedad Matriz.

- Maersk Line is starting a new rail service between Britain and Spain that could help tackle Europe’s worsening driver shortage.

- Regulatory challenges and other production delays have prompted Boeing to remove some engines from stored-away planes for use in new jets rolling off the assembly line.

- Boeing is seeing fewer aircraft orders from China as political tensions rise with the West.

- Apple is moving some production of its headphones and earbuds from China to India.

- Prices for certain computer chips will fall by double-digit percentages in the fourth quarter due to weakening demand, analysts say.

- The Netherlands’ STMicroelectronics plans to build a $728 million semiconductor wafer factory in Italy, which could begin production by next year.

- In the latest news from the auto industry:

- U.S. automakers and other firms in the electric vehicle supply chain could soon start getting tradable biofuel credits, as the EPA considers including them in its biofuel blending program.

- Class 8 truck orders skyrocketed in September to a record 53,700 units, as manufacturers opened bookings for 2023.

- Ford will raise the price of its hugely popular electric F-150 by 11% next year due to rising costs.

- Unionized Italian workers at Stellantis, Ferrari, Iveco and CNH Industrial are asking for wage increases next year to help cover soaring food and energy bills.

- U.S. car haulers are asking lawmakers to raise road-weight limits amid rising transport of electric vehicles, whose batteries make them heavier than their gas-powered counterparts.

- Small auto suppliers face years of peril in adapting to fading use of gas-powered cars and rising electric vehicle adoption.

- GM dealers had 359,292 vehicles at the end of the third quarter, nearly triple the inventory from a year ago.

- Demand for electric vehicles spurred a 4.6% rise in Britain’s new car registrations in September.

- California self-driving startup Gatik AI is testing completely autonomous middle-mile deliveries on a 7-mile route in Canada.

- Michigan is using incentives to secure billions in new investment for electric vehicle battery projects in the state.

- Steelmakers are investing heavily into “iron-air” battery development after the U.S.’s Inflation Reduction Act cemented tax credits for the next decade.

- China’s BYD outsold South Korea’s LG Energy to remain the world’s second-biggest electric vehicle battery maker for a second month in August.

- Schlumberger, the world’s largest oilfield contractor, is teaming up with MIT to reduce water usage in the production of lithium, a major environmental hurdle for the key battery metal.

- Commodities trader Cargill is in talks for its first-ever order of methanol-fueled bulk ships.

- Europe’s meat and dairy production will fall this year amid drought, disease outbreaks and rising costs. Skyrocketing egg prices have already forced some food companies to lower output or change recipes.

Domestic Markets

- The U.S. reported 70,991 new COVID-19 infections and 1,085 virus fatalities Wednesday.

- American Express is ending its COVID-19 vaccination requirement for employees Nov. 1.

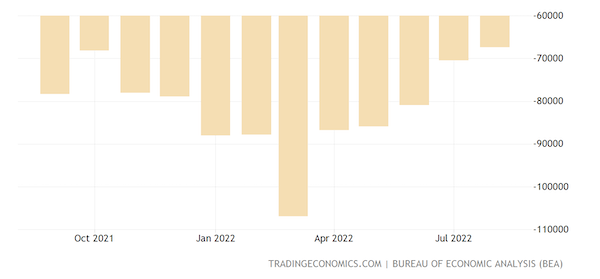

- The U.S. trade deficit narrowed by 4.3% to $67.4 billion in August, primarily on a decline in imports:

- The U.S. services industry expanded in September, but at a slightly slower pace than in August, the ISM’s latest index shows. Separately, a measure of input costs fell to a 1.5-year low.

- First-time jobless claims jumped over 13% last week to 219,000, the highest in five weeks, indicating possible softening in the labor market.

- U.S. payrolls rose by 208,000 jobs last month, building on August’s 185,000 gain, according to ADP. The news was received positively, prompting at least one major U.S. bank to raise its GDP growth estimate for the third quarter.

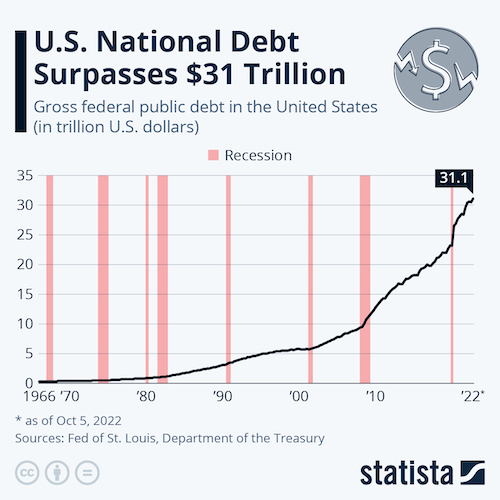

- U.S. national debt surpassed $31 trillion, a record, edging closer to the $31.4 trillion cap imposed by Congress:

- The average U.S. mortgage rate jumped to a 16-year high of 6.75% last week, while mortgage applications plummeted 14.2%.

- Urban hotel prices are expected to keep rising next year as demand for business gatherings rebounds from pandemic lows.

- Eighteen U.S. retailers, including Bed Bath & Beyond, Party City and Wayfair, face a heightened risk of bankruptcy as demand slows and it grows harder to raise capital, according to researchers.

- Wind turbine maker Siemens Gamesa fired the head of its onshore unit and will lay off 2,900 employees after reporting a 446 million euro loss in the three months to August.

- General Electric is laying off 20% of its onshore U.S. wind workers as part of a broad restructuring.

- The rising threat of sophisticated cyberattacks is expanding the role of chief information security officers at many firms.

- Cloud service sales are falling as more companies become mired in a web of multiple providers and higher-than-expected costs.

- Health insurance companies are set to raise prices next year faster than the projected increase in medical costs, adding pressure on U.S. employers already facing severe inflation.

International Markets

- A decline in euro zone business activity deepened last month, with S&P Global’s composite PMI falling to a 20-month low of 48.1.

- British private-sector activity hit a 22-month low in September as the nation’s cost-of-living crisis worsened. Ratings agency Fitch lowered the outlook for U.K. government debt from “stable” to “negative.”

- Canada’s exports fell for a second month in August as crude prices dropped.

- The Middle East and North Africa are expected to post GDP growth of 5.5% this year, the fastest pace in six years, the World Bank says.

- Spain halved its 2023 GDP growth forecast due to higher energy prices and lower consumer spending.

- Poland’s central bank surprised markets by holding its benchmark interest rate unchanged at 6.75% this week.

- Emerging market portfolios and global bond funds are seeing heavy outflows this year amid fears of a recession.

Some sources linked are subscription services.