MH Daily Bulletin: October 7

News relevant to the plastics industry:

At M. Holland

- Plastics News interviewed experts at M. Holland about how material and chemical suppliers are working to meet automotive OEM demands for both electric and internal combustion vehicles amid an ongoing market shift. Click here to read the article!

- Come see us at the IWCS Cable & Connectivity Industry Forum in Providence, Rhode Island, on Oct. 10-13! M. Holland is a Gold Sponsor. If you are attending, please stop by Booth #113 to discuss our materials and offerings serving the wire and cable market.

- At our Plastics Reflections Web Series event on Oct. 13, M. Holland will host panelists from Maersk and Bank of America to discuss the macroeconomic factors influencing global and domestic economies, including impacts on the plastics industry. Click here to register!

- M. Holland’s latest press release features our post-consumer recycled (PCR) resins, which are cleaner and easier to color, enabling brand owners and OEMs to meet aggressive sustainability goals. Click here to read the full press release.

Supply

- Oil rose 1% on Thursday, holding at three-week highs.

- In mid-morning trading today, WTI futures were up 2.3% at $90.45/bbl and Brent was up 1.9% at $96.24/bbl. Prices are headed for their second weekly gain.

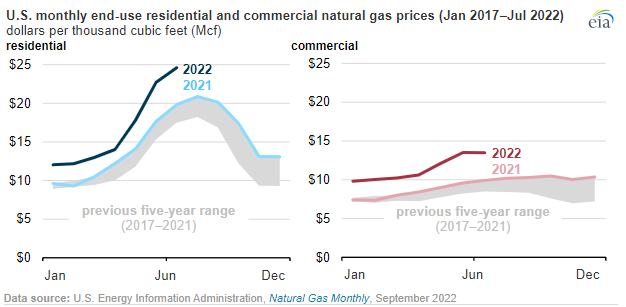

- U.S. natural gas fell 3.4% to $6.74/MMBtu this morning after hitting two-week highs on Thursday. Prices remain well above the five-year average for this time of year:

- U.S. banks are raising forecasts for oil prices next quarter following OPEC’s production cuts planned for November. Saudi Arabia says the cuts, pegged at 2 million bpd, will be closer to 1 million bpd due to OPEC’s persistent underproduction.

- The U.S. is pressing ahead with plans for new oil and gas drilling auctions in New Mexico, Wyoming and the Gulf of Mexico in the coming months.

- Wind and solar now make up 11% of global power generation after a new capacity surge in 2021. Still, investment into renewables must quadruple by 2030 to meet global emissions targets, researchers say.

- The resignation of Mexico’s economy minister could imperil negotiations in the nation’s energy dispute with the U.S.

- Norway expects its oil and gas income to rise 18% to a new record of $131 billion in 2023.

- Chevron would face major hurdles restarting production in Venezuela if the U.S. eases sanctions on the country, providing no guarantee that the nation’s fuel could quell markets.

- The U.S. will distribute $950 million in global loans to help expedite developing nations’ transition from fossil fuels.

- More oil news related to the war in Europe:

- European ministers are meeting today to etch out plans for a potential cap on the continent’s gas prices, a proposal facing stiff opposition from Germany, the Netherlands and Denmark.

- France unveiled a sweeping plan to cut power use by 10% over the next two years in response to dwindling gas supplies.

- Swedish investigators believe last week’s ruptures on the Nord Stream 1 and 2 pipelines were caused by deliberate detonations, spurring heightened concerns over energy-asset security.

- Ireland does not expect to see forced blackouts this winter despite increasingly tight electricity supplies, officials say.

- The Czech government proposed a 60% tax on excess profits in its energy sector.

Supply Chain

- In extreme weather news:

- Over 200,000 Florida homes and businesses remain without power from Hurricane Ian, while over 82,000 in Puerto Rico are without power from Hurricane Fiona.

- Parcel carriers still have service suspended in parts of Florida hit by Hurricane Ian.

- Over 300 unionized Sysco truck drivers went on strike in New England, disrupting operations for one of the U.S.’s largest product distributors.

- Uber’s freight unit says spot rates for dry vans and reefer shipping are around 20% below contract rates and falling fast.

- Nearly half of containerships arrived on time in August 2022, the highest level in two years, as schedule reliability continues to improve.

- The global containership order book is up to 7.1 million TEUs of capacity, surpassing 2008’s record of 6.6 million TEUs.

- One of the U.S.’s largest barge shippers declared force majeure on Thursday as low water levels on the Mississippi River have halted transport.

- The warehouse utilization portion of the latest U.S. Logistics Managers’ Index rose sharply to 76.8 in September, a four-year high.

- Amazon is hiring 150,000 seasonal workers for the holidays this year, roughly in line with 2021.

- DHL Supply Chain is hiring an 12,000 extra warehouse workers to handle peak-season volume this year.

- Walmart is cutting over 1,000 jobs at an Atlanta fulfillment center, at the same time stepping up acquisitions of warehouse automation firms.

- Weaker-than-expected demand for consumer electronics is hitting chipmakers’ quarterly results, with Samsung posting a 32% dive in operating income and PC-processor maker, AMD, saying it would miss forecasts by $1 billion. Taiwan’s TSMC, an outlier, saw a 48% surge in quarterly revenue to over $19 billion.

- Taiwan’s’ exports, a bellwether for global tech demand, fell 5.3% in September, the first decline in over two years.

- Samsung and SK Hynix will likely be left out of the new U.S. restrictions on China’s computer chip makers that will be announced in the coming days.

- In the latest news from the auto industry:

- One week after its initial public offering, Porsche has already surpassed the market value of its parent Volkswagen, becoming Europe’s most valuable automaker.

- Toyota is restarting production of its first electric-vehicle model after safety issues halted sales for three months.

- Honda will cut October output by 40% at two Japanese plants due to persistent supply chain issues.

- Europe’s car market is on track to shrink by 1% this year due to sustained pressure on auto supply chains.

- PepsiCo is slated to receive Tesla’s first-ever deliveries of electric semi trucks this December.

- Volkswagen is soon expected to announce a $1 billion partnership with an unnamed Chinese firm to build vehicle software.

- With its new partnership with San Francisco-based Motional, Uber is returning to the self-driving market just two years after selling its autonomous vehicle unit.

- CALB, a newly listed electric-vehicle battery maker in China, is aggressively expanding toward becoming one of the world’s largest battery makers within five years.

- An Australian mining company is developing the first new U.S. manganese mine in decades as automakers rush to secure the key battery material.

- Indian automakers have proposed cutting taxes on imported cars by 30% as part of a trade deal with Britain, an unprecedented move for one of the world’s most protected auto markets.

- Airbus expects the global aircraft services market to return to pre-pandemic size by the end of 2023.

- Hong Kong’s Cathay Pacific is in talks with Boeing and Airbus to expand its passenger and cargo fleets after two years of severely reduced operations.

- Canon will build a $345 million semiconductor equipment plant in eastern Japan.

- Apple supplier Foxconn says it is “cautiously optimistic” about the fourth quarter following record sales in September.

- Apple iPhone exports from India are on track to nearly double in the fiscal year beginning in April.

- The Canadian housing market will remain tight due to a shortage of skilled builders, experts say.

Domestic Markets

- The U.S. reported 47,202 new COVID-19 infections and 546 virus fatalities Thursday.

- The CDC will stop publishing daily COVID-19 infections later this month in favor of weekly reports.

- Roughly 86% of U.S. children have antibodies from prior COVID-19 infection, the CDC estimates.

- Four in five Americans with long-COVID symptoms struggle to perform normal daily tasks, according to new research.

- High housing costs and the end of pandemic aid is driving a big spike in homelessness in many American cities.

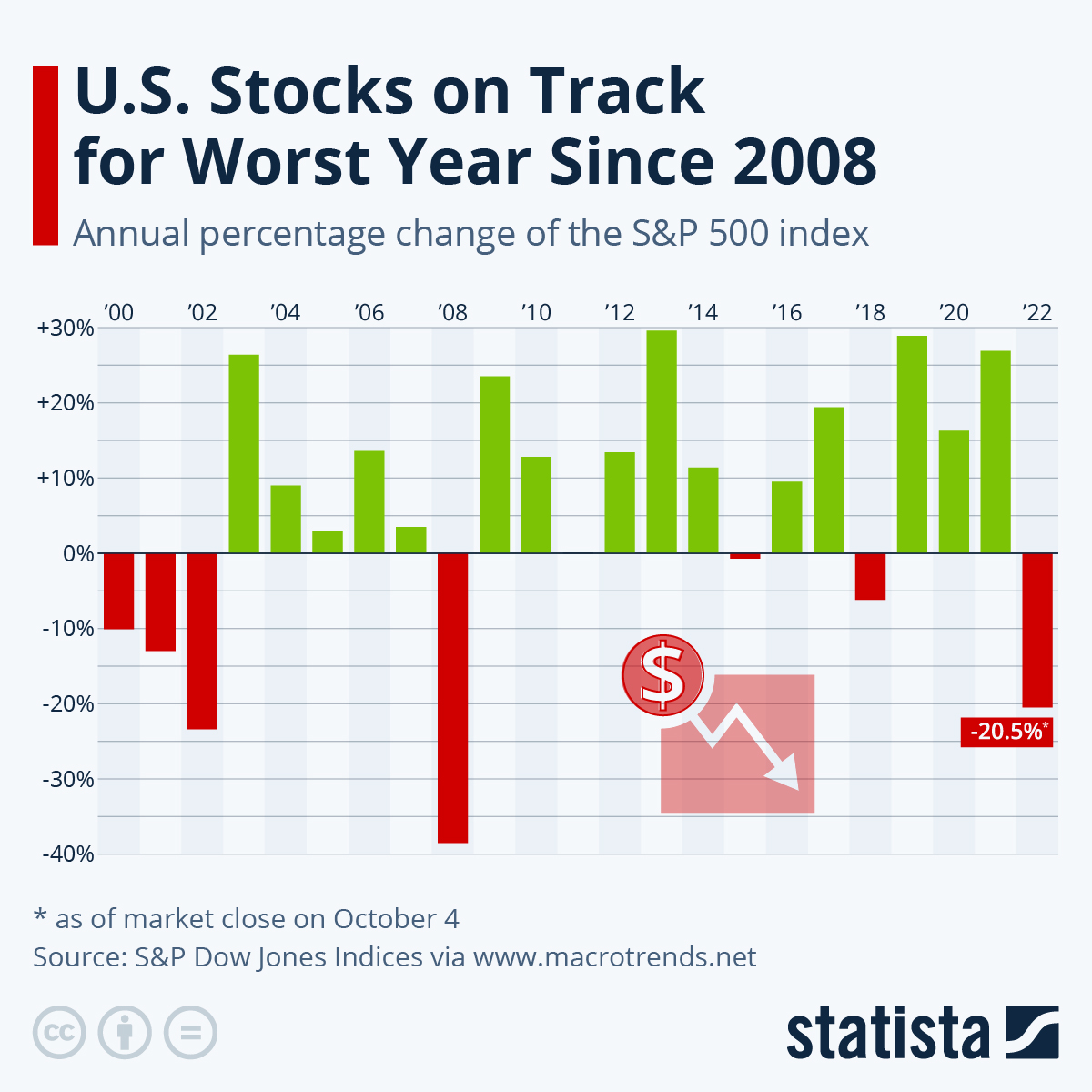

- U.S. payrolls rose by 263,000 in September as the unemployment rate stood at 3.6%, signaling steady strength in job markets. Stock futures dipped on the news.

- The Federal Reserve’s benchmark interest rate will likely hit 4.75% by the spring of 2023, the Chicago Fed says.

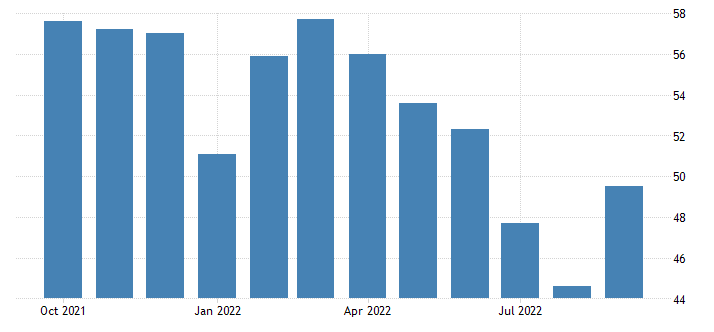

- U.S. private-sector activity picked up in September but remained in contraction territory due to slowing services activity.

- U.S. apparel makers are missing third-quarter estimates as inflation turns consumers away from discretionary purchases. On Thursday, Levi Strauss posted a slight sales boost but said disruptions in the U.S. supply chain cost an extra $40 million.

- U.S. retailers are putting a significant share of holiday workers on store floors this year as Americans are widely expected to shift back to in-person shopping rather than mostly online.

- More retail stores opened than closed in the U.S. last year for the first time since 1995, while second-quarter asking rents were 16% higher than five years ago.

- Conagra Brands beat quarterly estimates as a 14.3% rise in selling prices offset a 4.6% decline in sales.

- Google unveiled a new lineup of smartphones and other tech Thursday as the firm expands its role in the hardware space. Pixel smartphone sales rose 131% in the first half of the year compared to 2021.

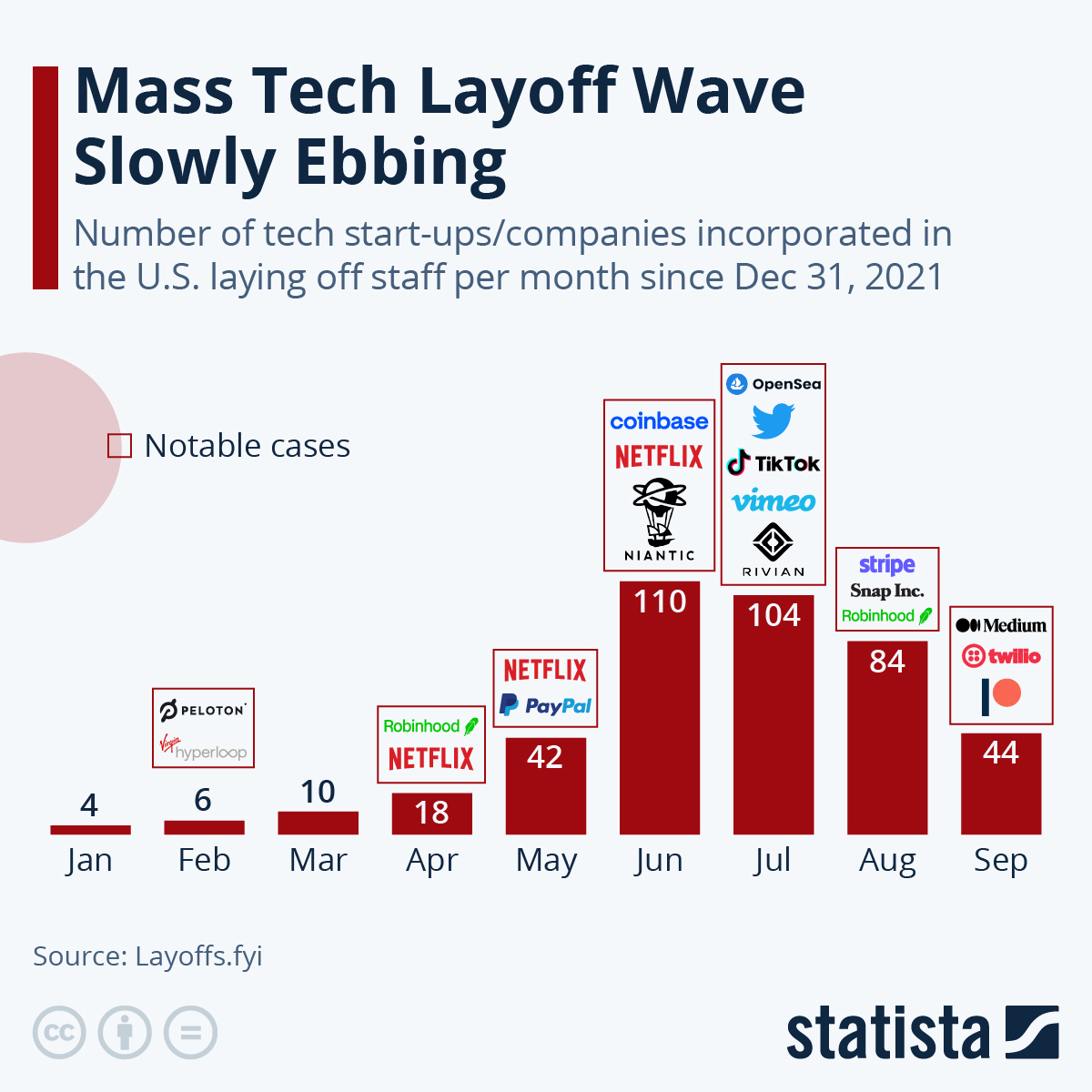

- Peloton will lay off an additional 12% of global employees, its fourth round of cuts this year, in a scramble to cut costs and stay afloat.

- Petitions for union representation are up 53% this year compared to 2021, labor groups say.

International Markets

- COVID-19 is back on the rise in Britain, with the country reporting 61% more cases week-over-week.

- European COVID-19 cases rose 8% last week as colder weather has started to keep people indoors.

- China saw 1,138 new COVID-19 cases Wednesday, a one-month high that spurred renewed lockdowns in southern Hainan province.

- The German government expects national GDP to contract 0.4% next year, according to reports.

- Almost 40% of British firms expect profits to decline in the coming year, according to surveys. The news comes as the country’s recruiters see weak hiring, retailers see their slowest sales of the pandemic, and company insolvencies rise to a 13-year high.

- Japan’s real wages fell for a fifth month in August as the plunging yen pushed inflation to an eight-year high. Household spending rose, adding pressure to consumers.

- The International Monetary Fund is lowering its global growth forecast for 2023 from 2.9% to a number still to be determined, its fourth downward revision this year.

- The World Bank downgraded its growth forecast for India’s economy from 7.5% to 6.5% in the year to March, citing global economic headwinds.

- Hong Kong is giving away a quarter of a billion dollars in free airfare as it looks to revive tourism after two years of lockdowns.

- Thailand will ban imports of plastic scrap by 2025 in an effort to reduce environmentally harmful dumping by other nations.

- The United Nations’ index of world food prices fell for a sixth month in September, steadily declining after hitting a record-high in March.

Some sources linked are subscription services.