MH Daily Bulletin: October 10

News relevant to the plastics industry:

At M. Holland

- Plastics News interviewed experts at M. Holland about how material and chemical suppliers are working to meet automotive OEM demands for both electric and internal combustion vehicles amid an ongoing market shift. Click here to read the article!

- Come see us at the IWCS Cable & Connectivity Industry Forum in Providence, Rhode Island, on Oct. 10-13! M. Holland is a Gold Sponsor. If you are attending, please stop by Booth #113 to discuss our materials and offerings serving the wire and cable market.

- At our Plastics Reflections Web Series event on Oct. 13, M. Holland will host panelists from Maersk and Bank of America to discuss the macroeconomic factors influencing global and domestic economies, including impacts on the plastics industry. Click here to register!

Supply

- Oil prices jumped 4% Friday, touching five-week highs, in reaction to the OPEC+ decision to cut supply in November. Brent rose 11% and WTI rose 17% for the week.

- In mid-morning trading today, WTI futures were up 0.3% at $92.93/bbl, Brent was up 0.1% at $98.04/bbl and U.S. natural gas was up 0.4% at $6.78/MMBtu.

- U.S. heating oil futures jumped 19% last week to their highest level since June.

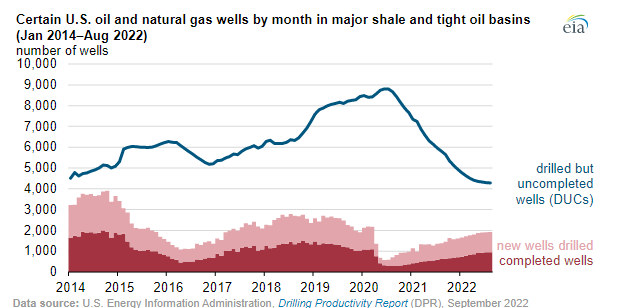

- Active U.S. drilling rigs fell by three last week while the nation’s crude production was flat at 12 million bpd. New data suggests that more wells are being completed rather than fresh wells being drilled.

- Oil and gas activity in the U.S. Midwest and Mountain West fell sharply in the third quarter but remained at historically high levels, according to the Kansas City Fed. Industry executives said prices must stay above $62/bbl for firms to stay profitable and above $102/bbl to prompt significant new drilling.

- TotalEnergies is starting wage talks a month early as it looks to end a worker strike that has disrupted supplies to almost a third of France’s gas stations. The nation’s refinery output is also down by 60%.

- BP is targeting the North Sea and U.S. shale basins to boost short-term oil and gas supplies in response to the global energy crisis.

- Shell warned of lower-than-expected third-quarter profits due to a sharp rise in refining costs and weaker earnings from natural gas trading.

- Employment in the U.S. oil and gas industry fell 4.8% in the third calendar quarter as firms grapple with a worker shortage, contributing to rising input costs for most firms surveyed by the Dallas Fed.

- More oil and gas news related to the war in Europe:

- Weekend shelling again shut down Ukraine’s Zaporizhzhia nuclear plant, Europe’s largest, forcing it to use backup generators to prevent a meltdown. Power was restored as of Sunday, according to authorities.

- Moscow ordered the seizure of the massive Exxon-led Sakhalin-1 oil and gas project in Russia’s Far East, following a strategy used to seize control of other energy properties in the country.

- German officials are considering paying off one month of gas bills for households this year before imposing a price break next March or April that could potentially subsidize 80% of gas consumption, officials say.

- Demand for firewood is surging in Europe as households prepare for limited gas supplies this winter. France’s most famous monuments are going dark as local governments join in the scramble to preserve energy.

- Germany’s industrial production fell by 0.8% from July to August due to a significant drop in energy-intensive industries grappling with natural gas shortages.

Supply Chain

- Tropical storm Julia was downgraded from a hurricane after it pummeled Nicaragua with rain Sunday.

- Parts of southern Florida are beginning to reopen after Hurricane Ian, while the state’s death toll from the storm is nearing 100.

- A backup of more than 2,000 boats and barges on the Mississippi River is being cleared after two closures caused by low water levels reopened Sunday.

- German rail traffic was halted for several hours Saturday after key cables were severed in what officials say was a deliberate action.

- South Africa’s state utility will resume rolling power cuts this week as supplies dwindle and it works to replenish generation capacity.

- The average U.S. diesel price fell 5.3 cents last week to $4.836 a gallon, notching its fifth week of declines.

- U.S. rail (-1.1%) and intermodal volumes (-4.8%) fell in September compared to the same time last year as consumer demand shifted from goods to services.

- U.S. container imports at major ports rose to 2.26 million TEUs in August, down 0.4% annually, the most recent data shows.

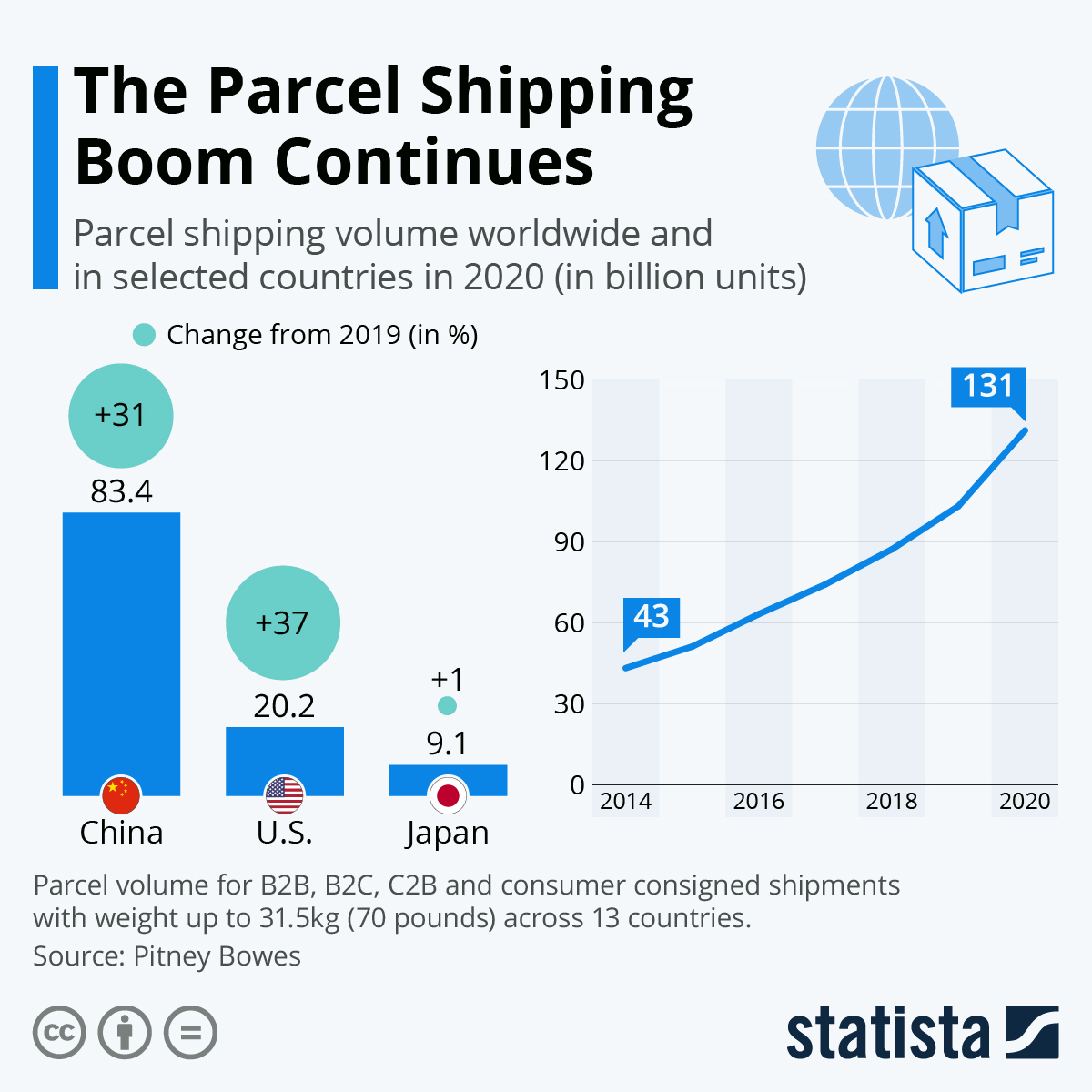

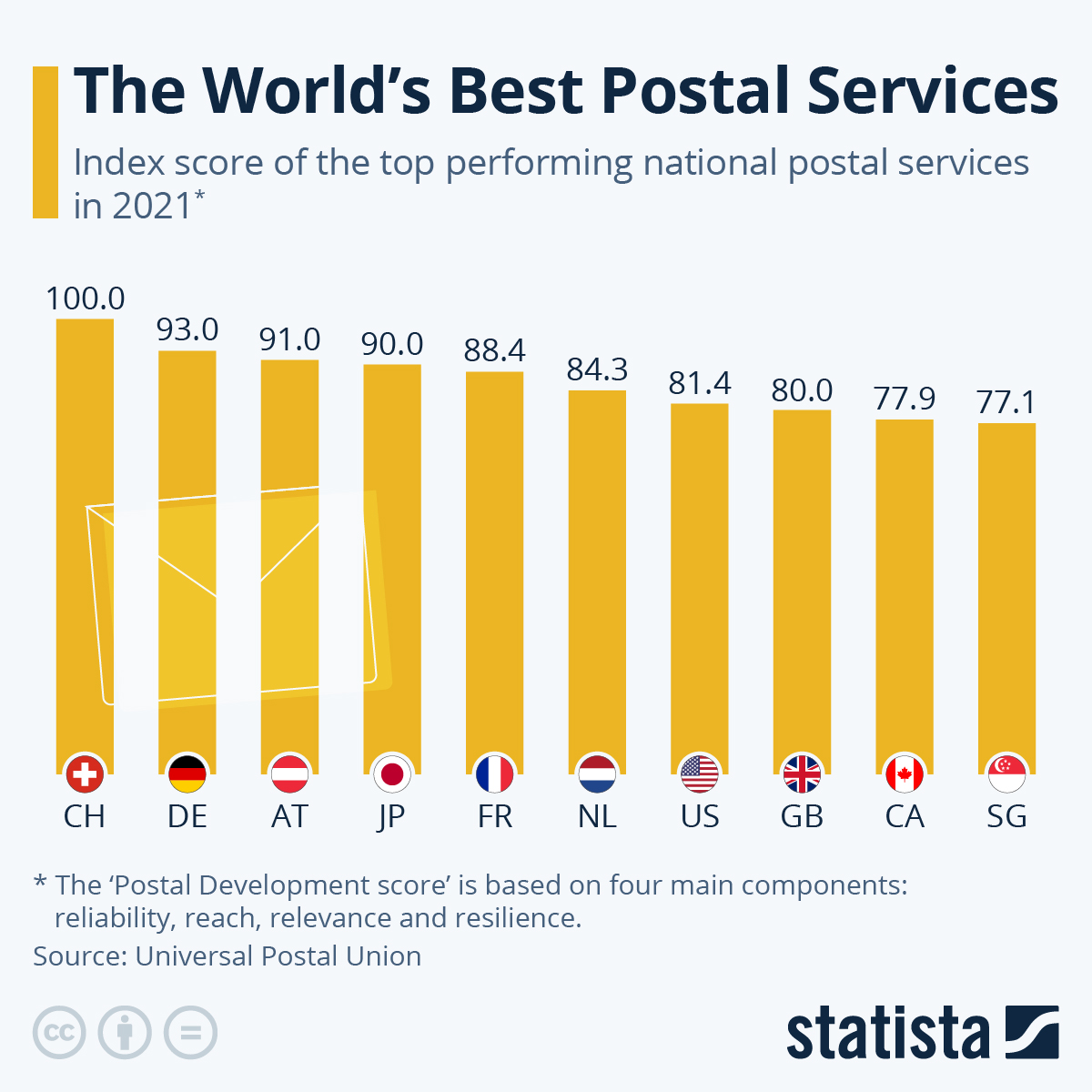

- The U.S. Postal Service is pursuing a 10-year plan to secure its place as the largest parcel delivery service in the face of formidable private competition.

- Chicago-area freight bottlenecks are rippling across inland U.S. logistics.

- Just eight container ships were waiting outside Southern California ports last week, down from a peak of 109 in January as maritime transport calms following two years of chaos.

- The Port of Houston could impose a fee for long-dwelling containers after importers rejected new Saturday hours.

- Global air cargo traffic fell 8.3% year-over-year in August, the sixth month of declines.

- FedEx’s fast-growing ground unit expects holiday shipment volumes to fall more than expected this year as e-commerce activity slows.

- Freight forwarder Kuehne + Nagel International says it faces challenges adjusting its business to weakening demand.

- U.S. trucking jobs declined by 11,400 in September, the second biggest decline of the pandemic, surpassed only by April 2020, and the third biggest monthly decline in over a decade.

- The White House on Friday unveiled a sweeping set of rules that restrict exports of U.S.-made computer chip equipment to China, marking one of the biggest policy shifts regarding Beijing since the 1990s. Over 30 Chinese entities, including top chipmakers, were added to an “unverified” trade list, which could trigger even tougher penalties by year’s end.

- In the latest news from the transportation industry:

- Class 8 truck orders for September hit a record 56,500, up 169% from August and 102% from the same time last year.

- Tesla delivered over 83,000 China-made electric vehicles in September, smashing its monthly record as it continues to build out capacity in the nation.

- Nissan is pressing Renault to cut its stake in the Japanese automaker and revamp their more than 20-year-old alliance as Renault pushes ahead with plans to split its EV and combustion businesses.

- Electric-vehicle maker Rivian Automotive will recall nearly all its 13,000 delivered vehicles due to a steering control issue.

- U.S. hybrid vehicle sales surged 73% last year as automakers bet gas-electric cars will play a lasting role in the transition to fully electric.

- Amazon will invest nearly $1 billion over the next five years to build a fleet of electric delivery vehicles across Europe.

- Chinese electric-vehicle maker Nio will only lease vehicles when it launches in four European markets this year with lease terms as short as a month, a bet that flexibility will sell drivers on switching to the technology.

- The U.S. Postal Service may soon raise the price of stamps from 60 cents to 63 cents in response to some $1 billion in added inflationary costs in the current budget.

- A union of over 10,000 pilots is supporting U.S. Congress’ effort to extend a December regulatory deadline for Boeing to complete the certification for its MAX 7 and MAX 10 aircraft.

- U.S. apparel imports rose 20.6% in the first eight months of the year.

- Norwegian chemical tanker operator Stolt-Nielsen more than doubled its third-quarter profit to $74.7 million amid an upturn in the chemical tanker market.

- Canadian shippers worry the country has too little rail capacity to handle much-needed grain harvests this year.

- The United Nations is working to extend for a year its brokered deal allowing Ukrainian grain exports from the Black Sea, currently set to expire next month.

Domestic Markets

- The U.S. averaged 41,855 new COVID-19 infections last week, down from 45,725 the prior week. The seven-day average for virus deaths rose to 345 from 325 a week ago.

- Only 5.3% of eligible Americans have received an Omicron-tailored booster shot in the first five weeks of rollout, the CDC says. The U.S. has a much lower booster rate in general compared to its peers.

- New research pointing to the adaptability of COVID-19 suggests that most people will become infected multiple times with the virus.

- COVID-19 vaccines are estimated to have saved 330,000 fatalities and nearly 700,000 hospitalizations in the U.S. last year.

- Some 40 states have dropped pandemic-era exemptions to restrictions on providing telemedicine across state lines, causing confusion for healthcare providers and hardships for many patients.

- Big U.S. banks are expected to post soft third-quarter profits this week after volatile markets hampered deal-making.

- Global mergers and acquisitions fell 34% in the first nine months, the biggest decline since the Great Recession, as companies retrench due to economic uncertainty and investment banks plan layoffs.

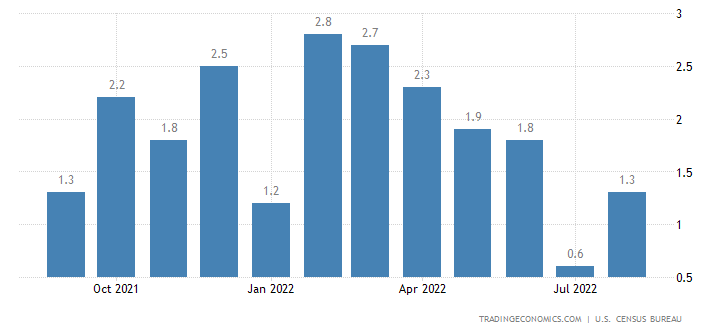

- U.S. wholesale inventories rose by 1.3% in August, a potential sign of an unwanted build-up in goods.

- The strengthening U.S. dollar threatens to undermine a rebound in American manufacturing by giving foreign producers an advantage in selling into the U.S., experts say.

- The ISM’s index of U.S. manufacturing hit 50.9 in September, its 28th month of decline despite remaining narrowly in growth territory above a reading of 50.

International Markets

- China posted 1,645 new COVID-19 infections Saturday, the most in a month with cases in Xinjiang, Beijing and Shanghai.

- Ukraine’s economy shrank an estimated 30% in the first three quarters of the year.

- The Bank of England extended its intervention to support the U.K.’s bond market after the government’s ill-fated plan for unfunded tax cuts created a crisis in confidence in the country.

- Virgin Atlantic Airways is dropping its service to Hong Kong due to issues stemming from the closure of Russian airspace.

- China’s services activity contracted for the first time in four months in September as COVID-19 restrictions dented already fragile demand.

- China’s new home sales fell 37.7% year-over-year last week as strict COVID-19 curbs keep demand low.

- Mexico’s economic growth is projected to slow in the next few quarters due to impacts from the pandemic and rising uncertainty across the globe, according to the IMF.

- The IMF is moving forward with plans to unlock nearly $4 billion in new funding for Argentina, whose spiraling inflation rate could top 100% this year, according to experts.

- After lending record amounts during the pandemic, the IMF and World Bank are nearly fully committed, posing serious economic risks to emerging nations facing a squeeze from inflation and the strong U.S. dollar.

Some sources linked are subscription services.