MH Daily Bulletin: October 13

News relevant to the plastics industry:

At M. Holland

- Plastics News interviewed experts at M. Holland about how material and chemical suppliers are working to meet automotive OEM demands for both electric and internal combustion vehicles amid an ongoing market shift. Click here to read the article!

- M. Holland, in collaboration with LyondellBasell, will boost medical packaging manufacturers’ access to medical-grade resins and help ensure regulatory confidence for OEMs. Click here to read the full press release.

Supply

- Oil fell for a third day Wednesday, settling down 0.5% on prospects of lower demand.

- In mid-morning trading today, WTI futures were up 0.1% at $87.37/bbl, Brent was up 0.2% at $92.60/bbl and U.S. natural gas was up 0.7% at $6.48/MMBtu.

- U.S. crude stockpiles saw a large build of 7 million barrels last week following another release from strategic reserves, the API said. Government data is due today.

- The EIA downgraded its forecast for U.S. oil demand and production growth this year and next. Power consumption, on the other hand, will hit a record-high this year before cooling off slightly next year.

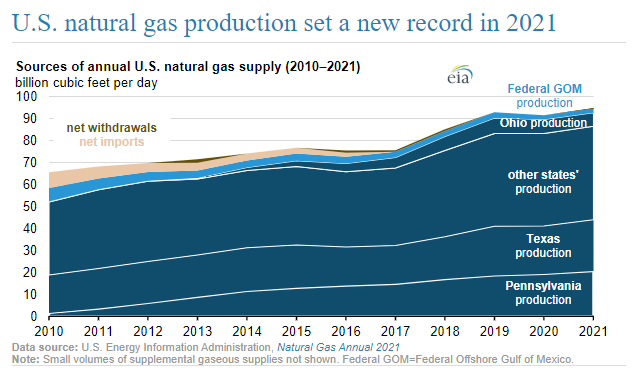

- U.S. natural gas production rose by 3.5% in 2021 to a new annual record:

- France is using requisition laws to order striking staff at Exxon and TotalEnergies fuel depots back to work, escalating a dispute with refinery unions as fuel supplies continue to dwindle.

- OPEC cut its forecast for growth in global oil demand this year and next, a potential attempt to justify its 2-million-bpd supply cut in November.

- OPEC raised group crude production by 146,000 bpd from August to September but remained well short of planned targets.

- More oil and gas news related to the war in Europe:

- Russia hit about 30% of Ukraine’s energy infrastructure in missile attacks on Monday and Tuesday. Moldova says Ukraine, its key electricity supplier, has halted exports due to the damage.

- Germany is getting less crude from Russia after a key pipeline suffered a leak Wednesday.

- Europe’s largest nuclear reactor in Ukraine turned to generators to avoid a meltdown for the second time this week as shelling disrupts its electricity supply.

- German officials say protecting against attacks on the nation’s critical energy infrastructure is one of its highest defense priorities.

- Analysts are downgrading forecasts for long-term gas consumption in Europe, a result of the continent’s move toward other forms of energy since Russia invaded Ukraine.

- The U.S. will soon overtake Russia to become Europe’s biggest supplier of crude, a stark reversal from pre-invasion norms.

- The EU’s executive arm will propose new measures next week to curb high energy prices, according to reports.

- M&A in the U.S. oil patch rose in the third quarter but remained sharply down year-to-date compared to 2021.

- Exxon struck its first major commercial deal to store carbon in Louisiana for ammonia producer CF Industries.

- The global pipeline of offshore wind projects has more than doubled in terms of capacity the past year.

- Oil majors are set to bid on a host of new offshore wind sites being auctioned by the British government.

- U.S. chemical firm Celanese Corp. can move ahead with its $11 billion acquisition of DuPont’s mobility and materials business as long as Celanese divests one of its plastics-producing businesses, the EU ruled.

- BASF will cut jobs and restructure European chemical sites as part of a $485 million cost-cutting plan through 2024.

Supply Chain

- U.S. container imports likely hit 2.215 million TEUs in September, down 11% from a year ago.

- Maersk and MSC are canceling more Asia-to-Europe sailings on falling container demand.

- Slowing freight demand is cooling the M&A market for logistics.

- Businesses are revamping warehouses with amenities in a bid to attract and retain talent.

- Liverpool dock workers resumed striking this week as their employer laid off 15% of staff.

- Worker strikes are slowing operations at South Africa’s Durban port, one of the busiest on the continent.

- Seaborne piracy has fallen to its lowest level of activity since 1992.

- Maersk is on track to double its net income from 2021 to a record $29.3 billion this year.

- Orient Overseas Container Line saw a 21.1% rise in average TEU rates in Q3, leading to a 16.9% jump in revenue.

- China’s state-owned Cosco Shipping expects operating earnings in the first three quarters of the year to reach $20 billion.

- Applied Materials, a leading U.S. producer of chipmaking equipment, says the government’s new export restrictions prohibiting sales to Chinese chipmakers will result in $250-$550 million in losses this quarter. Other top equipment-makers have started pulling employees from Chinese chip firms or halting service to Chinese customers. Meanwhile, some foreign companies with plants in China, who were supposed to be exempt from the restrictions, have been blocked from supplying even basic items like light bulbs, springs and bolts to their facilities there.

- The U.S. administration is briskly approving exemptions for some Asian chipmakers in a bid to limit disruption from its tightened export rules aimed at China.

- Aluminum prices spiked 7% Wednesday after the U.S. government said it was considering restricting Russian imports of the metal.

- U.S. regulators are proposing a rule requiring container lines to thoroughly document their demurrage charges to shippers.

- In the latest news from the automotive industry:

- Volkswagen will invest up to $1.94 billion in a joint venture with China’s Horizon Robotics.

- Ohio is providing over $71 million in tax credits to help Honda and LG build a $4.4 billion joint-venture battery plant.

- Stellantis launched a new software hub in Bengaluru, India, that will focus on cockpit and self-driving technologies.

- Mercedes-Benz and Microsoft are partnering to boost production efficiency at over 30 car plants across the globe.

- Amazon plans to start using 20 electric heavy-duty trucks in Germany this year.

- China’s car sales expanded 2.8% from August to September.

- A Morgan Stanley survey of major retailers revealed the lowest net ordering levels in its 12-year history and a 19% gap between inventory and sales growth levels.

- Boeing finalized a $4.1 billion order for 10 new freighters from Luxembourg-based Cargolux airline.

- Airbus says its recent move to delay full production on some aircraft has eased pressure on suppliers, although some are still pausing operations in Europe due to high energy bills.

- Dutch health-tech firm Philips expects core profit to drop 60% this quarter largely due to supply chain issues.

- The U.S. arm of Japan’s Kobe Steel signed a supply agreement with Sweden’s H2 Green Steel, which aims to build a new steelmaking plant running entirely on hydrogen power.

- Lead will continue outperforming other metals on the London Metal Exchange in the coming months due to tight supplies and as cold weather forces consumers to replace car batteries, analysts say.

- American wheat exports will hit a 50-year trough as low water levels on the Mississippi River make it slower and more expensive to get crops to export terminals. Though cleared in some areas, river bottlenecks are widespread and spilling over into major tributaries such as the Ohio River.

- The United Nations is asking for faster inspections of Ukrainian grain vessels as a flood of outgoing ships overwhelms regional ports.

- China is poised to upend normal trade flows and start importing corn from Brazil instead of the U.S.

Domestic Markets

- The U.S. reported 64,686 new COVID-19 infections and 748 virus fatalities Thursday.

- The CDC on Wednesday approved Omicron-tailored COVID-19 booster shots for kids as young as age 5.

- Fully vaccinated people who suffer breakthrough COVID-19 infections face almost no risk of dying, new research suggests.

- The average U.S. ACT score fell to a three-decade low, which experts attribute to education disruption caused by the pandemic.

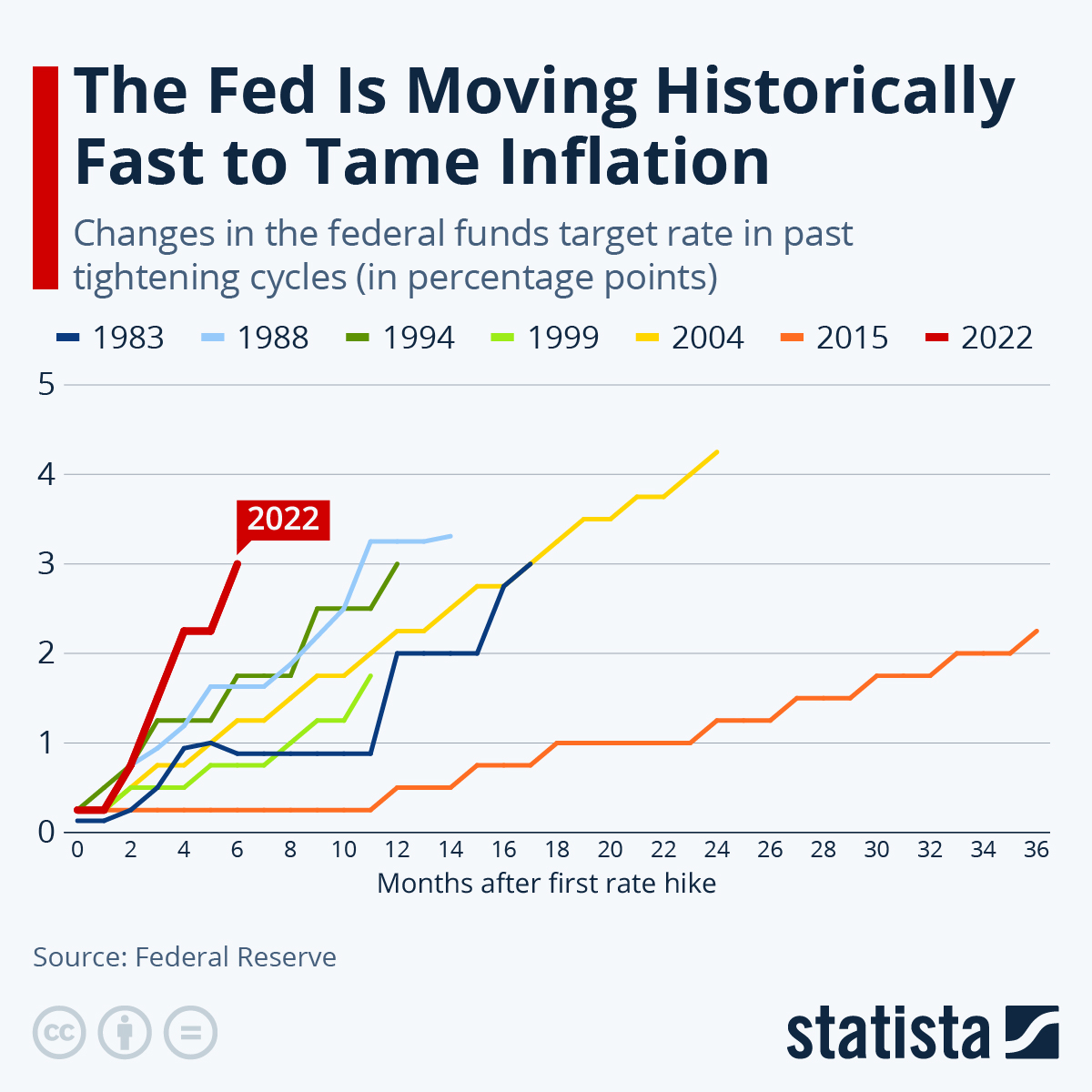

- Consumer inflation rose 8.2% year over year in September, with core inflation up a higher-than-expected 6.6%, a 40-year high, substantially assuring the Federal Reserve will continue its aggressive interest rate hikes.

- Jobless claims jumped by a higher-than-expected 9,000 to 228,000 last week, a six-week high in the wake of Hurricane Ian.

- Newly released minutes from the Federal Reserve’s September meeting show agreement on continuing large interest rate hikes despite growing economic pain.

- Bank of America leadership says U.S. consumers are in good financial health with high savings rates and solid spending growth this month.

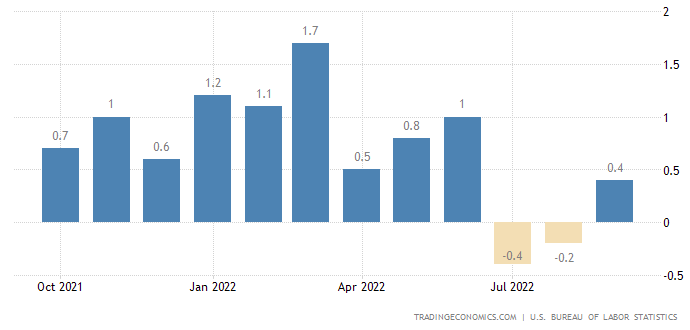

- U.S. producer prices rose a surprise 0.4% in September, led by higher food prices and home-heating costs. Meanwhile, prices for core goods were unchanged, the weakest reading in 2.5 years.

- U.S. business groups are gearing up for a court battle over the White House’s proposed rules that would make it harder for gig companies to use independent contractors.

- U.S. mortgage rates have more than doubled year to date and are now at their highest level since 2006 at around 6.81%.

- PepsiCo saw higher third-quarter sales after it raised the average price on its snacks and drinks by 17% compared to a year ago.

- U.S. airlines are seeing the strongest consumer demand in three years despite a 33% year-over-year rise in airfares.

- Amazon plans to use rockets from a Boeing-Lockheed joint venture to launch its first internet-from-space satellites.

- In 2020, New York City’s booming tech industry saw a net gain of 14,340 jobs compared to a 12.6% decline in total private-sector employment.

International Markets

- COVID-19 cases rose 8% last week in Europe, leading the WHO to warn of a new virus wave.

- With COVID-19 cases tripling in China after its National Day holiday, the central government is reimposing restrictions in numerous cities, including Shanghai, which has been selectively closing schools, gyms and entertainment venues, sparking fears of another total lockdown.

- The topic of COVID-19 was noticeably absent from World Bank and IMF annual meetings on global financial conditions this week.

- The IMF predicts Ukraine will need at least $3 billion a month next year to finance its wartime economy.

- Britain’s economy is headed for recession after data showed an unexpected contraction in August, led by weakness in manufacturing and North Sea oil and gas production.

- British banking officials will abruptly end emergency bond-buying in the next few days despite continued liquidity risks at the nation’s massive pension funds.

- EU central bank officials are closing in on a lending change that could potentially shave off tens of billions of euros in bank profits, according to reports.

- Euro zone industrial production rose 1.5% month over month in August, handily beating forecasts.

- India’s industrial output fell for the first time in 1.5 years in September.

- Argentina’s inflation rate eased in September but the nation is still on track to see a 100% rise in prices for the full year.

- A consortium of mostly domestic firms led by Japan Industrial Partners is in talks to buy Toshiba for roughly $19 billion.

- Europe will keep its waiver on airport slot-use requirements until the end of winter due to continued disruption from Russia’s war in Ukraine.

- LATAM Airlines unveiled an $8 billion financing plan that could see the embattled carrier exit from bankruptcy by November.

Some sources linked are subscription services.