MH Daily Bulletin: October 20

News relevant to the plastics industry:

At M. Holland

- During M. Holland’s Plastics Reflections webinar last week, our panelists discussed the macroeconomic factors influencing global and domestic economies — including what it means for suppliers, distributors and manufacturers in the plastics industry. In case you missed it, click here to gain access to the full recording.

- A recent Plastics News article focuses on M. Holland’s distribution of Purell medical-grade resins from LyondellBasell. Click here to read the article.

Supply

- Oil rose around 3% Wednesday on news of a weekly draw in U.S. crude stocks.

- In mid-day trading today, WTI futures were flat at $85.57/bbl, Brent was down 0.3% at $92.13/bbl, and U.S. natural gas was down 1.8% at $5.36/MMBtu.

- U.S. crude stocks fell by 1.7 million barrels last week, according to the government.

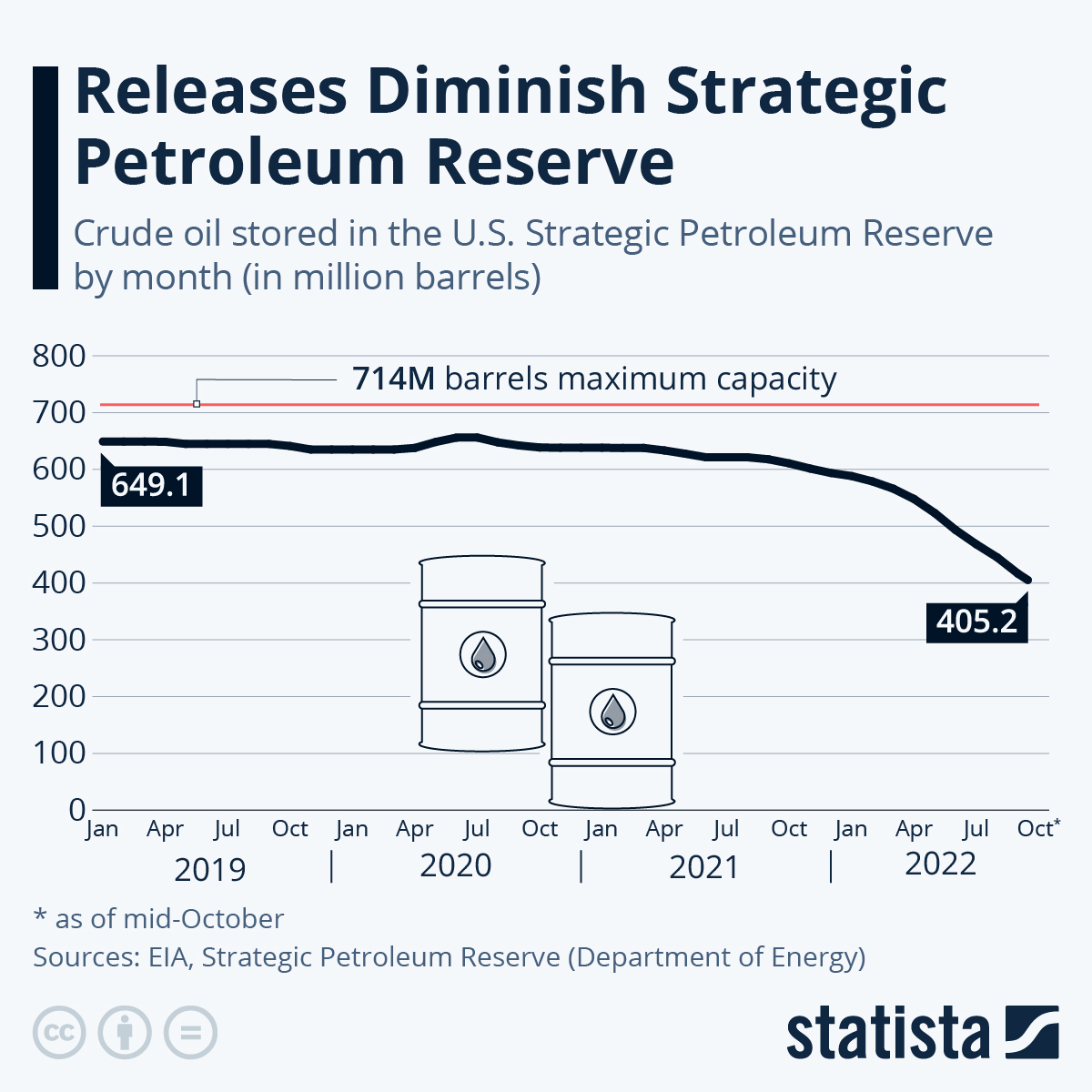

- The White House plans to sell in December the remaining 15 million barrels of crude from its 180-million-barrel release announced earlier this year. More sales could be authorized afterward, while emergency stocks won’t be refilled until prices dip below $72/bbl.

- The average U.S. gasoline price is down 30% from summer highs above $5 a gallon.

- Baker Hughes kicked off earnings for oil field service companies with a quarterly loss, due largely to a $230 hit from a voluntary restructuring. The firm expects U.S. crude production to jump next year on easing supply-chain issues.

- U.S. pipeline operator Kinder Morgan saw a 16.4% gain in quarterly profit on surging jet fuel volumes.

- China’s LNG imports are expected to plummet 14% this year in what would be the steepest drop since it began importing the fuel in 2006.

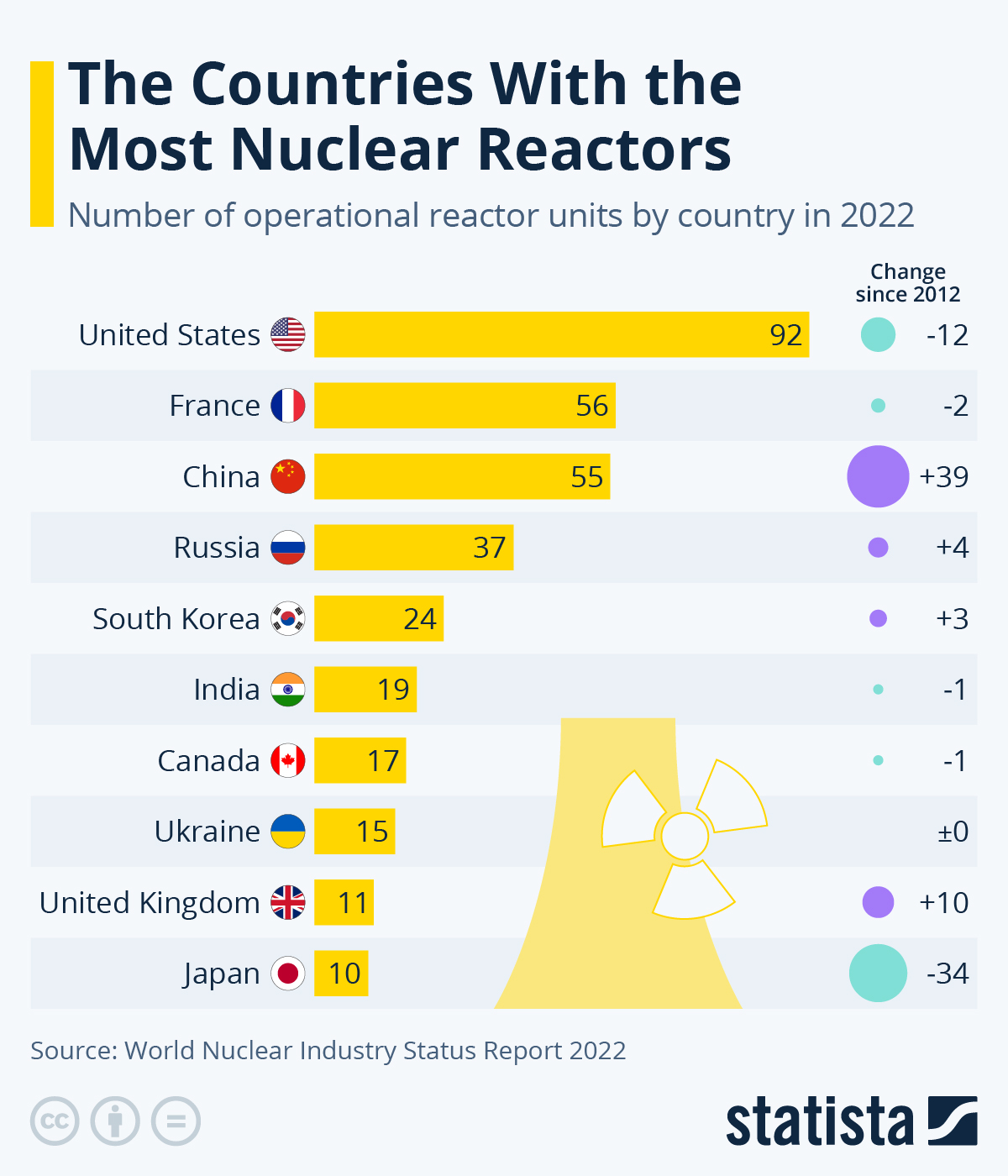

- Workers at several French refineries voted to end a month of strikes on Wednesday. A large share of the nation’s nuclear plants are still affected by strikes.

- More oil and gas news related to the war in Europe:

- Ukraine will impose regular power outages after Russia attacked a substantial portion of its energy infrastructure the past week.

- Despite opposition from member nations, the EU’s executive is still advocating for a bloc-wide price cap on gas used to generate electricity.

- Germany and Norway are beefing up security for energy infrastructure.

- Thirty-five LNG tankers are floating off the coast of Europe as the continent races to top up storage ahead of a winter without Russian gas.

- Flooding across Nigeria has hobbled gas production in Africa’s most populous nation.

- Australia is trying to head off efforts by Timor-Leste to seek Chinese investment for a stalled natural gas project.

- Global emissions growth will stay under 1% this year due to a surge in electric-vehicle adoption and renewables generation.

- The Netherlands is following Spain in pulling out of a European treaty that protects energy investments, citing environmental concerns.

Supply Chain

- U.S. container imports fell 12.4% from August to September, an unusually sharp drop for peak season. The data aligns with declining freight volumes across the globe.

- The ports of Long Beach (-0.9%) and Los Angeles (-27%) saw their lowest imports for the month of September in over a decade.

- Container rates per FEU from China to the U.S. West ($2,492) and East ($5,719) coasts are down to their lowest levels since March 2021.

- Carriers are idling more boxships amid a downturn in container demand.

- Containers are stacking up at China’s Port of Ningbo due to COVID-19 lockdowns.

- Hawaii-based shipper Matson is forecasting a 13% year-over-year drop in quarterly income as volumes out of China fall.

- Labor shortages at U.S. railroad operators will limit transport volumes into 2023, analysts say.

- Roughly 4.2 million tons of cargo went through the Great Lakes-St. Lawrence Seaway in September, 5.6% below last year.

- Air cargo operators are worried about proposals to cut flights at Amsterdam’s Schiphol airport.

- Germany’s Port of Hamburg is poised to start using feeder ships to transfer containers between terminals rather than trucks.

- The crude oil tanker market is forecast to remain strong for at least another year due to a shortage of ships.

- Rents for warehouses near airports are outpacing industry averages, while demand growth for warehouse space, in general, is slowing.

- Prologis, the world’s largest developer of logistics properties, is pulling back on speculative development as it prepares for an economic downturn.

- Less-than-truckload carrier Yellow will consolidate its New Penn and Holland carriers as part of a multiyear plan to build a super-regional network for one- to two-day deliveries.

- In the latest news from the automotive industry:

- Tesla saw near-record quarterly profit of $3.3 billion but said full-year deliveries will fall short of targets due to logistics issues.

- Foxconn is expanding its electric-vehicle (EV) business in Thailand, the U.S. and Taiwan as it looks to diversify from China. The Apple supplier unveiled two new EV prototypes this week.

- U.S. trailer orders in September were 10% lower than last year, a sign that manufacturers are being more cautious in accepting bookings due to production issues.

- Chinese automakers delivered a record number of cars to dealers in the first nine months of 2022.

- Almost 5 million fewer vehicles were assembled during the pandemic than in the previous comparable period.

- BMW announced plans to invest $1.7 billion to produce electric vehicles in South Carolina.

- Foreign auto execs say the U.S. needs to give them more time to satisfy sourcing requirements in order to qualify for U.S. electric-vehicle tax incentives.

- The U.S. announced the winners of $2.8 billion in grants to boost domestic production of electric-vehicle batteries.

- Germany plans to spend $6 billion over the next three years to rapidly scale up electric-vehicle charging infrastructure.

- Dutch computer-chip equipment supplier ASML saw record new bookings in the third quarter while downplaying the impacts of U.S. sanctions on tech exports to China.

- Global computer-chip shortages have spawned a “gray” market where out-of-date or stolen chips sell for vastly inflated prices.

- AT&T is in talks on a joint venture that could invest up to $15 billion to expand its fiber-optic network.

- Prefabricated home-building is gaining popularity because of rising construction costs and supply-chain delays.

- Natural gas and electricity prices now make up 25% of production costs for Europe’s textile makers, up from 5% before Russia invaded Ukraine.

- Factories in Vietnam aren’t seeing the usual year-end bump in peak season orders.

- The U.S. is beefing up maritime security in the Indian and Pacific Oceans at the same time as it requires U.S. railroads to expand cybersecurity defenses.

- The U.S. administration says it will help oversee Ukraine’s eventual rebuilding of transport and energy infrastructure.

- The U.S. sanctioned several Mexico-based carriers with alleged ties to Mexico’s Sinaloa drug cartel.

- Global mining giants are seeing disruption from government policy in Chile and protests in Peru, the world’s No. 1 and 2 copper producers.

Domestic Markets

- The U.S. reported 60,137 new COVID-19 infections and 746 virus fatalities Wednesday.

- White House officials will start recommending COVID-19 boosters once a year, starting with the new Omicron-tailored shots this fall.

- Novavax’s COVID-19 shot was granted emergency authorization in the U.S.

- The Federal Reserve’s latest “Beige Book” pointed to rising business pessimism despite a modest easing in inflationary pressures.

- This year’s holiday shopping season will be one of the longest on record as retailers push promotions to get rid of excess inventories. Retailers were sitting on $548.8 billion of inventory in July, a 21.6% increase from a year ago.

- Americans are cutting back on buying luxury goods at the same time as luxury-goods-makers continue raising prices to head off inflation.

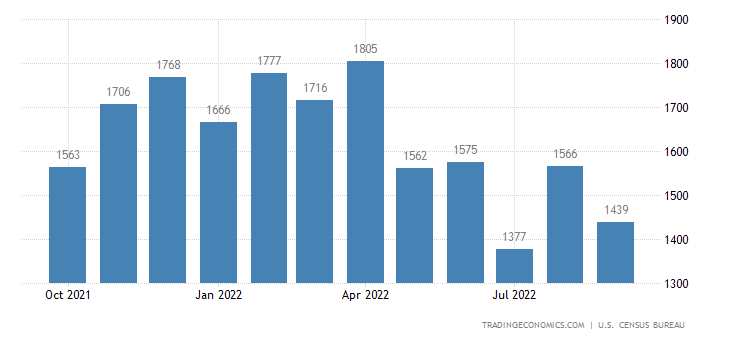

- U.S. housing starts dipped 8.1% in September, while new single-family home construction fell 4.7% to a two-year low.

- College enrollment is down about 1% this fall semester, signaling that high school graduates who delayed college during the pandemic are not pursuing higher education.

- American Airlines posted quarterly revenue 13% above pre-pandemic levels as travel demand remained strong even with higher ticket prices and summer disruptions.

- AT&T raised its profit and revenue outlook after topping expectations for subscriber growth in the third quarter.

- IBM posted a 6.5% gain in quarterly sales on signs of steady demand for software, mainframe computers and cloud services.

- Nestle saw its strongest nine-month sales growth in 14 years as demand remained robust despite higher product prices.

- Hit by supply challenges in China, Abbott Laboratories posted a 0.5% quarterly sales decline.

- New York-based investment giant Blackstone saw third-quarter net income plummet due to stock market losses.

- Shareholders of Spirit Airlines voted in favor of JetBlue’s $3.8 billion takeover offer, moving the companies closer to creating the nation’s fifth-largest carrier.

- Uber is launching a new advertising division as it looks to diversify its revenue through tie-ups with brands and marketers.

- Amazon and New York state mutually agreed to halt litigation over the firm’s COVID-19 protections at the start of the pandemic.

International Markets

- COVID-19 remains a global health emergency, the WHO says.

- Shanghai will spend $191 million to build a 3,250-bed quarantine facility on a small island close to its city center. The Chinese government is also in talks to cut mandatory quarantine periods for incoming travelers.

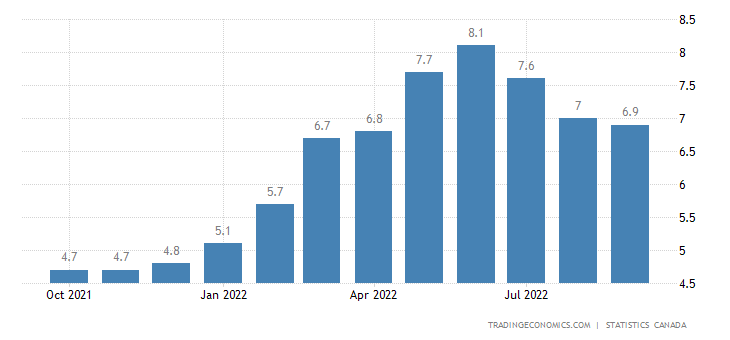

- Canada’s inflation hit 6.9% in September, slightly lower than August but still ahead of forecasts. Analysts say its central bank will almost certainly hike interest rates by another 75 basis points next week.

- Europe’s central bank is widely expected to raise its benchmark interest rate by another 75 basis points when it meets next week.

- Japan’s administration signaled it will stick to its loose monetary policy despite rising voter dissatisfaction and a crashing currency.

- U.K.’s prime minister resigned less than two months after taking office, becoming the shortest-serving PM in the nation’s history.

- The Bank of England will resume bond sales in two weeks, after its effort to shrink its balance sheet and temper inflation was interrupted when the government’s ill-fated announcement for unfunded tax cuts sent the British pound crashing.

- Italy’s GDP is set to shrink 0.2% in the third quarter due to impacts from high energy prices and lower consumer spending.

- Amazon is launching a home insurance portal in Britain and has signed up three big-name insurers as it pushes further into financial services across the globe.

- The number of global firms disclosing environmental data rose 42% year over year in the third quarter.

Some sources linked are subscription services.