MH Daily Bulletin: October 26

News relevant to the plastics industry:

At M. Holland

- M. Holland is sponsoring the Association of Rotational Molders (ARM) Annual Meeting in Atlanta on Nov. 6-9! Please stop by Booth #19 to meet our team of Rotational Molding experts and learn more about our product offerings and grinding capabilities.

Supply

- Oil rose marginally Tuesday after Saudi Arabia expressed concerns over supply.

- In mid-morning trading today, WTI futures were up 2.9% at $87.80/bbl, Brent was up 2.3% at $95.63/bbl, and U.S. natural gas was down 0.3% at $5.60/MMBtu.

- U.S. crude stocks unexpectedly rose last week, according to the API. Government data is due today.

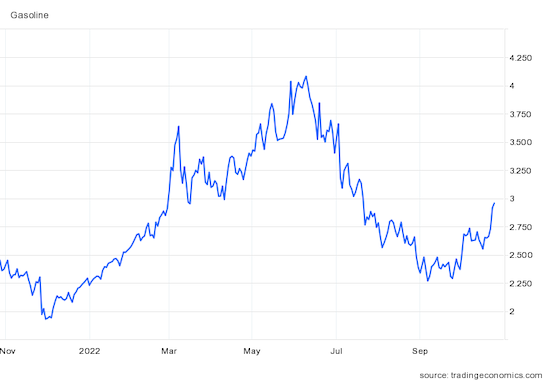

- U.S. gasoline futures are at their highest level since late July as domestic demand remains strong and supplies get tighter:

- On Tuesday, West Texas natural gas prices dipped below zero for the first time since 2020 as booming production overwhelms pipeline networks.

- U.S. fracking giant Halliburton saw third-quarter net income more than double from a year ago.

- Valero Energy provided a strong start to U.S. refinery earnings season, reporting that demand rose above pre-pandemic levels in the third quarter.

- Energy executives don’t expect any new refineries to be built in the U.S. or shuttered refineries to reopen due to high capital costs, long construction times and a secular shift away from refined products, despite the industry’s current 90% operating rate.

- More oil news related to the war in Europe:

- European natural gas prices are continuing to fall, as unusually warm weather contributes to an unexpected supply glut.

- European LNG importers are scrambling to find vessels to serve as floating storage for regasification terminals.

- Russian coal exports to China are up by one-third this year after lockdowns shut down several of China’s coal-producing regions.

- European imports of Russian LNG jumped 41% in the year through August, a sharp contrast to pipeline flows that have dwindled to a trickle.

- European makers of metals, chemicals and gases are lowering fourth-quarter forecasts on the impact of surging energy and raw material costs.

- Iberdrola, Europe’s biggest utility, posted a 29% rise in nine-month profit on strong performance in the U.S. and Brazilian markets and its renewables investments.

- Canada will spend over $700 million to build a grid-scale small nuclear reactor, a key technology for the nation’s long-term plans to cut emissions.

- Indonesia, one of the world’s biggest carbon emitters, bumped up its 2030 emissions reduction target by 10 percentage points to 43.2%.

- BASF maintained its 2022 earnings guidance but said its European operations must be permanently downsized due to sluggish growth, high energy costs and overregulation.

Supply Chain

- Eastern Bangladesh was rocked by Cyclone Sitrang Tuesday, disrupting road, power and communication links and killing at least nine people.

- Authorities in southeastern Australia ordered more evacuations Tuesday as La Niña rainfall worsened flooding.

- Recent rainfall has done little to improve backups on the Mississippi River amid its historically low water levels.

- Dock workers at the U.K.’s Port of Liverpool launched a two-week strike after the latest round of contract talks failed.

- Container lines are canceling growing numbers of sailings from Asia to Europe.

- Falling container shipping rates are reaching intra-Asia regional services.

- Daily rates for very large crude carriers have surged 30% this year to about $80,000.

- U.S. diesel prices appear to be leveling off after surging 50 cents a gallon over the past two weeks.

- Truck maker Paccar’s third-quarter profit surged 102% from a year ago to a new record.

- Truckload carrier Knight-Swift Transportation says it is preparing for more acquisitions after missing third-quarter expectations.

- Trade groups say U.S. airports need subsidies to modernize cargo facilities for larger aircraft and rising trade.

- Hong Kong’s Cathay Pacific expects to see weak cargo demand this holiday season as pandemic restrictions slow China’s factories.

- California and Mexico will share in new toll revenues to help support construction of key infrastructure projects, including a $1.1 billion border crossing south of San Diego.

- In the latest news from the auto industry:

- Mercedes-Benz raised its full-year forecast after quarterly profits at its cars division almost tripled from pre-pandemic levels. The automaker also said it will sell all its investments in Russia.

- Tesla supplier LG Energy Solution saw a 90% gain in quarterly revenue on the back of strong demand for electric vehicles.

- Volvo will temporarily close one of its factories due to computer chip shortages.

- Supply-chain issues are limiting production at auto maker Renault.

- Canadian bus manufacturer NFI Group is cutting output forecasts due to supplier constraints.

- Hyundai’s $5 billion electric vehicle factory in Georgia could start production as soon as 2024 after breaking ground this week.

- Tesla delivered over 83,000 vehicles from its factory in China last month, up 8% from August.

- Australian miners are striking up more partnerships with U.S. and Chinese processing firms in the supply chain for electric vehicle batteries.

- Mobileye, Intel’s self-driving unit, listed in the U.S. on Tuesday at a $16.7 billion valuation, far lower than the $50 billion that Intel initially planned.

- Cummins plans to manufacture hydrogen electrolyzers in Minnesota, its latest effort to make long-haul trucking more environmentally friendly through alternative fuels.

- Tata Steel’s Dutch arm will supply Ford’s plants in Europe with “green” steel starting in 2030.

- South Korean chipmaker SK Hynix halved its capital expenditure for next year after plunging demand for memory chips led to a 60% decline in third-quarter profit.

- Texas Instruments saw quarterly revenue rise 13% but warned that the demand drop-off for semiconductors will expand beyond computers and phones.

- Signs of China’s weakening economy are showing up across all shipping sectors, including containers, dry bulk and fuels.

- Germany may allow Cosco Shipping to take a 24.9% interest in a Port of Hamburg container terminal, less than the 35% stake originally sought by China’s state-owned shipping giant.

- Apple made fresh calls for its suppliers to decarbonize operations and said it will build new solar and wind projects to help power its European business.

Domestic Markets

- The U.S. reported 28,704 new COVID-19 infections and 415 virus fatalities Tuesday.

- New York City scrapped its COVID-19 vaccine mandate for private employers.

- Florida’s COVID-19 cases are trending downward, although virus positivity levels remain high.

- Early studies suggest new COVID-19 boosters tailored to the Omicron variant may be no more effective than original booster formulations.

- About 3 million people have left the workforce due to COVID-19 concerns, costing the nation $250 billion in economic output in the first six months of 2022.

- The Conference Board’s index of U.S. consumer confidence hit a three-month low in October.

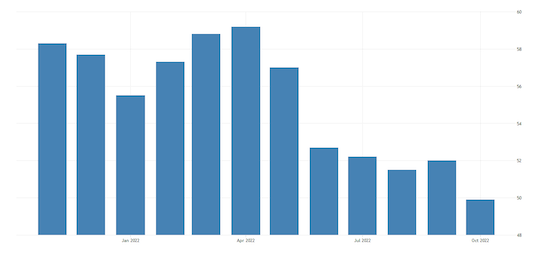

- U.S. manufacturing activity took a sharp turn into contraction territory to start the fourth quarter, according to S&P Global:

- U.S. company borrowing for equipment purchases was 11% higher in September from a year ago, a positive signal of business activity.

- Rising interest rates led to the biggest monthly decline in U.S. home prices in more than a decade in August, according to the Case-Shiller index:

- U.S. apartment demand fell to a 13-year low in the third quarter after rents surged 25% the past two years.

- Average U.S. hotel rates are up 22% from the same time last year as travel activity remains strong heading into the holiday season.

- In the latest news from earnings season:

- Google parent Alphabet posted its fifth quarter of slowing sales growth while Microsoft saw its weakest revenue in over five years, as both firms contended with a stronger U.S. dollar and slumping demand for computers and digital advertising.

- Coca-Cola says it will start using cheaper packaging as it prepares for a global economic downturn.

- General Electric trimmed its full-year outlook on difficulties in its renewables unit.

- Minnesota-based 3M saw quarterly sales fall 3.6% on weakening demand and impacts from the stronger U.S. dollar.

- Visa saw better-than-expected earnings on a 36% surge in cross-border volumes, a result of more Americans traveling abroad.

- Strong demand for leisure travel gave JetBlue its first quarterly profit of the pandemic, even after costs surged 36%.

- Mattel saw a marginal decline in quarterly sales as the toy maker said it would ramp up promotions to get rid of excess inventory.

- Cleveland-Cliffs, the U.S.’s second-largest steelmaker, missed quarterly targets by 50% amid slumping demand and higher input costs.

- Sales fell at Bristol Myers Squibb as generic competition ate into demand for its key cancer drug.

- Logitech saw resilient demand for tech equipment in the third quarter, leading to better-than-expected profit.

- Shares of photocopy maker Xerox plunged 25% Tuesday after it slashed its annual revenue and cash-flow forecasts.

- Aerospace supplier Raytheon saw a 5% bump in quarterly revenue as air travel demand boosted sales of parts and services.

International Markets

- Beijing shut its Universal resort, and the cities of Wuhan and Guangzhou locked down some districts as COVID-19 cases creep higher across China.

- California is poised to overtake Germany as the world’s fourth largest economy.

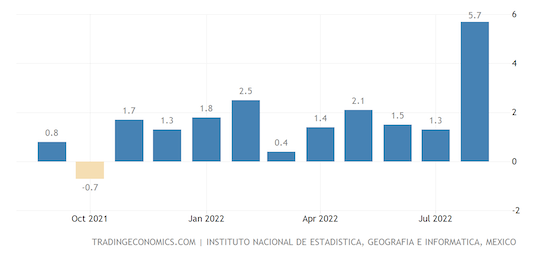

- Mexico’s economic activity rose 5.7% from a year ago in August, topping market expectations:

- Bank lending to eurozone companies quickened in September, extending the biggest private borrowing binge in over a decade as firms scramble for liquidity to cover energy costs.

- Sentiment among German exporters rose slightly in October but was weighed by pessimism from high-energy sectors including chemicals, glassware and metal production.

- Japan will likely end up spending $170 billion in its upcoming economic stimulus package.

- China issued new rules meant to boost bank lending to private businesses, Beijing’s latest attempt to support an economy facing multiple headwinds.

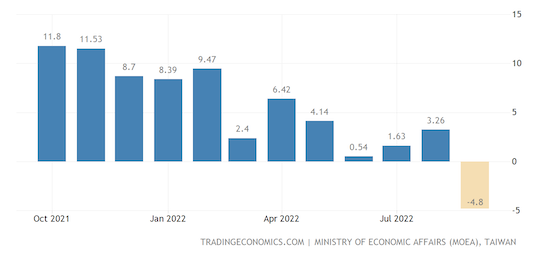

- Taiwan’s industrial output fell 4.8% year over year in September, its first contraction since January 2020 on a sharp decline in manufacturing output:

- Deutsche Bank’s quarterly profit rose sharply after it charged higher interest on loans and traded more currencies in a volatile market.

- British bank Barclays saw muted third-quarter growth after booking large provisions for potentially soured loans.

- Norwegian Air saw its highest revenue of the pandemic and said it will cut capacity by 25% this winter on forecasts of lower travel demand.

- French tire maker Michelin posted a surprise 20.5% gain in quarterly sales but cut its full-year guidance, citing uncertain demand.

- Zara parent Inditex, the world’s biggest textile retailer, announced plans to sell its entire business operations in Russia.

Some sources linked are subscription services.