MH Daily Bulletin: October 27

News relevant to the plastics industry:

At M. Holland

- A recent Plastics News story highlights business insight from M. Holland’s Plastics Reflections webinar. Click here to read the article, which examines the various challenges facing international resin markets, including the economy, inflation, high inventories, reshoring and more.

- M. Holland is sponsoring the Association of Rotational Molders (ARM) Annual Meeting in Atlanta on Nov. 6-9! Please stop by Booth #19 to meet our team of Rotational Molding experts and learn more about our product offerings and grinding capabilities.

Supply

- Oil rose 3% Wednesday, boosted by rising exports, increased refining activity and the strong U.S. dollar.

- In mid-morning trading today, WTI futures were up 1.4% at $89.17/bbl, Brent was up 1.1% at $96.74/bbl, and U.S. natural gas was down 5.2% at $5.31/MMBtu.

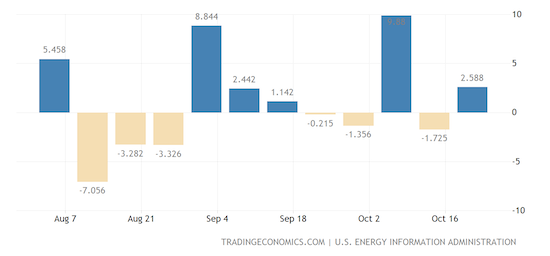

- U.S. crude stocks rose by a larger-than-expected 2.6 million barrels last week, according to the Energy Information Administration (EIA).

- Global fossil fuel demand will peak or plateau by the end of the decade, with demand deterioration accelerated by the war in Ukraine, according to the International Energy Agency (IEA).

- U.S. crude exports rose to 5.1 million bpd last week, an all-time high, which dropped net crude imports to their lowest level on record.

- U.S. refining rates were steady at 89% of capacity last week, the highest for this time of year since 2018.

- Oil-importing nations in Africa, Asia and Latin America will be hit hardest by the global energy crisis, experts say.

- The World Bank predicts energy prices will pull back 11% in 2023 after surging 60% this year.

- More oil news related to the war in Europe:

- Reports suggest the U.S. and EU will agree to a looser cap on Russian oil prices and are likely to settle on a top price for Russian oil in the $60 range when the cap takes effect on Dec. 5.

- A blanket cap on gas prices in Europe this winter has shifted into a last-resort measure.

- Russian seaborne exports fell to their lowest level of the year in September as the IEA projects that demand for Russian oil will fall 25% by the end of the decade and never return to 2021 levels.

- Over half of German firms say they have exhausted tools to cut natural gas use ahead of winter.

- U.S refiner Phillips 66 is cutting staff at several refineries, refined product terminals and offices as part of a restructuring.

- U.S. producer Hess beat quarterly targets on a 32% increase in per-day output and a 38% increase in the average price per barrel.

- Namibia may try to join OPEC if a rash of new oil discoveries proves large enough for commercial development.

- Exxon Mobil made two new discoveries offshore Guyana.

- Britain’s new government plans to reinstate a ban on fracking.

- British wind farms generated a record amount of electricity Wednesday, relieving pressure on gas markets.

- Global hydropower output is down sharply this year as heat waves and droughts shrink rivers.

Supply Chain

- Over 80% of the continental U.S. has unusually dry conditions or full-on drought, the largest percentage in data going back 20 years.

- Representing 6,000 workers, the Brotherhood of Railroad Signalmen union voted against a tentative contract deal with railroads Wednesday, becoming the second union to reject the White House-brokered deal.

- DSV saw its profit rise in the third quarter despite declining air and sea volumes. The Danish freight forwarder also says it is backing away from acquisitions until valuations of target companies come down.

- UPS beat analyst earnings projections in the third quarter and reaffirmed guidance for the year.

- Amazon opened a 2.6 million-square-foot fulfillment center in Ontario, Canada, powered by advanced robotics.

- Some retailers are scaling back warehouse operations amid receding e-commerce demand.

- A U.S. less-than-truckload group has created a common electronic bill of lading, promising to streamline data and give greater visibility to shippers.

- In the latest news from the auto industry:

- Ford swung to a quarterly loss of $827 million after a hefty charge associated with the shutdown of its defunct self-driving venture Argo AI, which Volkswagen also exited.

- Harley-Davidson posted a 60% jump in quarterly profit after raising its prices during the summer.

- Daimler Truck raised its full-year guidance after reporting 159% gain in earnings before interest and taxes in the third quarter.

- Penske reported record quarterly revenue but said profit fell 4.2% on impacts from currency movements and lower used-vehicle sales.

- U.S. auto sales are forecast to rise an annual 12.1% this month on easing supply snags.

- GM’s North America production reached 651,000 vehicles in the third quarter, up 73% from a year ago.

- British car production dropped 6% in September on continued impacts from energy costs and supply issues.

- Volkswagen Group will only produce electric cars in Europe under the VW brand starting in 2033, executives said.

- Toyota is considering boosting production of its first mass-market electric vehicle up to twelvefold by 2025.

- Volvo plans to start building battery modules at its plant in Ghent, Belgium, by 2025.

- Ford on Wednesday quickly followed Mercedes in announcing plans to fully exit Russia.

- The White House unveiled nearly $1 billion in grants to help electrify school-district bus fleets.

- About half of Europe’s aluminum production has been shut down due to surging energy costs this year, prompting Norwegian producer Norsk Hydro to call for U.S. sanctions against Russian aluminum.

- Quarterly profit at Samsung Electronics fell 23.6% as demand for memory chips, its main source of income, slumped.

- Taiwanese chipmaker United Microelectronics cut its capital expenditures by 20% this year due to weak consumer demand.

- Hard-drive-maker Seagate Technology will trim 8% of its global workforce, or 3,000 workers, on forecasts of falling demand.

- The backup of grain-carrying ships at Ukrainian ports now exceeds 150 vessels.

Domestic Markets

- The U.S. reported 69,897 new COVID-19 infections and 1,095 virus fatalities Wednesday.

- Health experts fear rising cases of influenza and respiratory illnesses could trigger a COVID-19 wave heading into winter.

- Most offices in the largest U.S. cities are still less than half full even after employers ramped up campaigns to bring workers back in recent weeks.

- Companies broadly plan to step up college hiring next year as labor conditions remain tight, surveys show.

- U.S. GDP grew a better-than-expected 2.6% last quarter, rebounding from two consecutive quarters of contraction.

- U.S. initial jobless claims rose by 3,000 last week to 217,000, indicating the employment market remains robust.

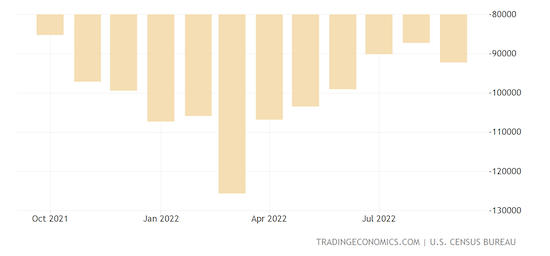

- The U.S. trade deficit in goods widened sharply by 5.7% in September, the first expansion in five months:

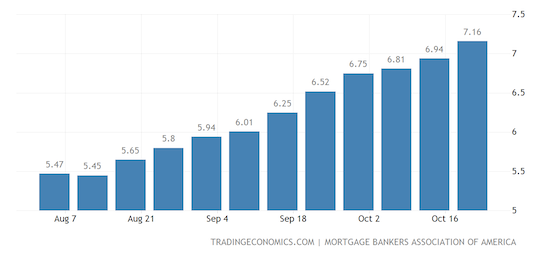

- New U.S. home sales fell 10.9% in September, new data shows, as the average U.S. mortgage rate reaches its highest level since 2001:

- In the latest news from earnings season:

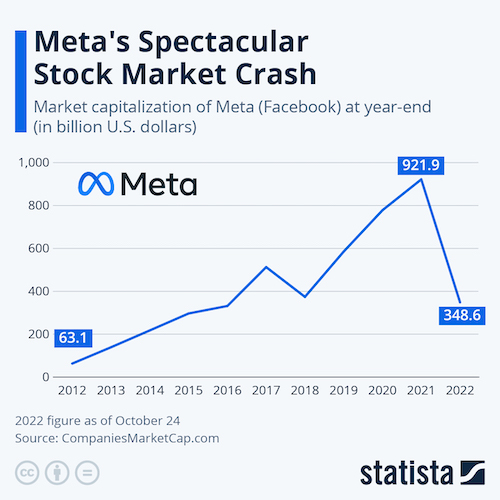

- Shares of Facebook parent Meta plummeted 15% after the tech giant saw a second quarter of revenue decline and warned of near-term sales headwinds.

- Boeing’s quarterly loss widened to $3.3 billion from $132 million a year ago, on a range of issues in its supply chain, defense business and regulatory approvals.

- Kraft Heinz said strong demand in the face of rising inflation led to an 11.6% increase in quarterly sales.

- Same-store sales at paint and coatings manufacturer Sherwin-Williams rose nearly 21% on higher product prices.

- Business-jet-maker General Dynamics saw better-than-expected profit on strong demand for private flying.

- Hilton Worldwide raised its annual profit forecast after travel demand topped forecasts in the third quarter.

- Shopping mall owner Unibail-Rodamco-Westfield raised its guidance for the second time this year after tenant sales for the first nine months of 2022 beat pre-pandemic levels.

- Online real estate firm Zillow will lay off 300 employees as it contends with a slowing housing market.

- Workers at an Amazon warehouse in Moreno Valley, California, withdrew a petition to hold a union election.

- Airfares for leisure travel were up nearly 43% in September from a year earlier.

- Alaska Airlines will buy 52 more 737 MAX jets from Boeing as the carrier phases out Airbus planes from its fleet.

- Aviation regulators are looking to expand the U.S. government’s limitations on 5G services to smaller telecom firms, citing continued danger to air traffic.

International Markets

- China reported more than 1,000 COVID-19 cases for the third consecutive day, prompting a tightening of restrictions and lockdowns in hotspot cities.

- China will ease restrictions on international flights starting Oct. 30, despite keeping overall flights down substantially from pre-pandemic levels.

- China’s year-to-date budget deficit almost tripled from a year ago to a record $980 billion, as COVID-19 outbreaks and a housing market slump hit government finances.

- A recent study of COVID-19 in the first year of the pandemic found that mild sufferers were 2.7 times more likely to suffer blood clots than normal, while those hospitalized were 22 times more likely to develop blood clots.

- Canada’s central bank raised its main interest rate a smaller-than-expected 50 basis points Wednesday, saying it was getting closer to the end of its historic tightening campaign amid forecasts of stalling GDP growth.

- The European Central Bank raised interest rates by 75 basis points when it met today.

- Brazil’s central bank held interest rates at a nearly six-year high for its second policy meeting in a row.

- South Korea saw its slowest GDP growth in a year in the third quarter.

- Singapore is seeing its fastest pace of inflation since 2008.

- Fitch ratings agency downgraded Argentina’s sovereign credit rating from CCC to CCC-, citing deep macroeconomic imbalances and risks over debt repayment.

- Beer brewers Heineken and Carlsberg say global demand for beer could start to slow.

- Quarterly earnings at the world’s largest grain companies are surging after months of crop shortages and global volatility.

- New research suggests global temperatures will increase between 2.1°C and 2.9°C by the end of the century even if global climate promises are kept.

Some sources linked are subscription services.