MH Daily Bulletin: September 8

News relevant to the plastics industry:

At M. Holland

- M. Holland has announced expanded access to 3D printing filaments from Braskem, a global chemical company, providing clients with access to polyethylene (PE) and glass fiber reinforced polypropylene (PP) filaments. Click here to read the full press release.

- M. Holland will be attending the North American Detroit Auto Show on Sept. 14-15. This annual showcase for emerging automotive technologies will be held at Huntington Place in Detroit, Michigan. If you’re attending, please RSVP for M. Holland’s reception or contact Mike Gumbko, Strategic Account Manager, to set up a meeting with our Automotive team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell over 5% Wednesday on downbeat economic data out of China.

- In mid-morning trading today, WTI futures were up 1.1% at $82.85/bbl, Brent was up 0.5% at $88.40/bbl, and U.S. natural gas was up 0.6% at $7.89/MMBtu.

- The American Petroleum Institute reported a surprise 3.65-million-barrel build in crude inventories last week, putting downward pressure on prices. Government data is due today.

- Top oil field firm Schlumberger says North American oil and gas activity is growing faster than expected, with producers more concerned about securing equipment than a sudden drop in prices.

- More oil news related to the war in Europe:

- EU policymakers said Wednesday they will soon propose a system to cap prices on Russian gas. Moscow responded with a threat to completely halt energy deliveries to the bloc.

- Europe has increased gas inventories by a record amount this year but will still need to sharply lower consumption this winter to avoid rationing, officials said.

- EU policymakers are exploring a windfall tax on utilities as well as a cap on electricity generated from non-gas sources including wind, nuclear and coal, as options to lower energy prices. Bloc-wide commitments to support households and businesses through the energy crisis has reached $300 billion and growing.

- Moscow says flows on the Nord Stream 1 pipeline to Germany could resume if “paperwork” issues with equipment are worked out, a claim widely doubted by Western governments.

- The British government will announce dozens of new oil and gas licenses for North Sea production today.

- Shelling has damaged the backup power line at Ukraine’s Zaporizhzhia power plant, bringing Europe’s largest nuclear reactor closer to a meltdown. Ukrainian officials called for an immediate evacuation of the nearby town Wednesday.

- Some German manufacturers are halting production in response to the surge in energy prices caused by Russia’s squeeze on gas supplies.

Supply Chain

- U.S. power consumption will hit a new record this year on rebounding economic activity and hotter weather, according to the administration.

- California declared another weather emergency Wednesday as record-breaking heat puts the state on the brink of forced power outages. A strengthening hurricane approaching Mexico’s Pacific coast could prolong the weather pattern impacting California.

- Diesel demand for backup generators is surging in California, straining supplies already at a three-year low.

- California officials are urging commercial ships not to plug in to shore power in a bid to reduce demand on the state’s heat-strained grid.

- Tropical Storm Earl developed into the Atlantic’s second hurricane of the season and is poised to strengthen into a Category 3 storm as it passes Bermuda today.

- China recorded its highest temperatures and lowest rainfall in six decades this summer, severely impacting crops and power supplies.

- The worst flooding in a half-century continued to batter Bangalore, India, Wednesday, home to offices of major tech companies including JPMorgan Chase, Microsoft, Dell and HP.

- U.S. labor officials are meeting with rail unions and railroads throughout the week to head off potential strikes by more than 100,000 workers who have yet to reach agreement with their employers.

- Tensions continue to mount between FedEx and its ground contract drivers, with a trade group representing some 6,000 contractors calling for a no-confidence vote on FedEx Ground’s CEO.

- Over 115,000 British postal workers are planning more strikes for later this month as a contract dispute lingers on, stacking up losses for Royal Mail.

- The New York Fed’s gauge of global supply pressures eased in August, extending a steady decline since December 2021 on shorter delivery times across the board.

- The Baltic Dry Index, a widely tracked gauge of dry-bulk shipping rates, has fallen 66% since May to its lowest point in over two years.

- Long-term contract container rates are showing signs of peaking.

- Container ship backlogs are rising at German ports, with 19 vessels now waiting to unload at Bremerhaven and Hamburg, up from 17 two weeks ago.

- Container lines are pulling nearly 9% of their capacity from Asia-to-Europe lanes in the coming weeks amid forecasts of falling demand in the fourth quarter.

- Container shipping profits likely totaled $63.7 billion in the second quarter, the seventh record-shattering quarter in a row, according to estimates.

- Hutchison Ports and the terminal investment arm of MSC announced plans to jointly develop a larger container terminal at the Port of Rotterdam.

- Newell Brands scaled back its 2022 sales outlook and said retailers are cutting more consumer-goods orders in an effort to pare back swollen inventories. Some retailers are storing excess merchandise in warehouses to hold for sale later this year or in 2023.

- The Pentagon paused accepting deliveries of Lockheed Martin’s F-35 jets following the discovery of a part that could be in violation of trade rules against China.

- Samsung Electronics, the world’s largest chip maker by revenue, expects a sharp downturn in computer chip sales to extend into 2023.

- U.S. tech firms that get government funding will be banned from building advanced facilities in China for at least a decade as the White House doubles down on efforts to boost domestic computer chip production.

- Amazon’s chief executive says the company is slowing hiring after the pandemic boom led to overexpansion.

- New Jersey logistics firm NFI will roll out autonomous truck-unloading robots, made by Boston Dynamics, at a warehouse in Georgia next year.

- In the latest news from the auto industry:

- Super-premium car sales from Lamborghini, Bentley and Ferrari are up 35.6% this year compared to five years ago.

- Porsche is looking for 80% of its global vehicle sales to be electric by 2030.

- Nissan announced plans to acquire Vehicle Energy Japan, a leading lithium-ion battery maker.

- Toyota is raising the price of automotive steel it sells to parts makers by up to 30%.

- Oklahoma-based Stevens Trucking plans to deploy 500 trucks with self-driving technology from Locomation by the end of 2023.

- Brazilian mining firm Vale says global demand for nickel will rise 44% by 2030 on high demand for electric vehicle batteries.

- A federal court in California lifted an injunction that had blocked the state from enforcing its AB5 “gig economy” employment law in the trucking sector.

- Canada is changing immigration rules to allow speedy entry for truck drivers amid a growing labor shortage in the industry.

- UPS plans to hire 100,000 temporary workers this year, in line with levels from 2021, to handle a surge in package volumes around the holidays.

- Minnesota’s 3M opened a new shipping site in Charleston, South Carolina, to streamline its deliveries to Asia.

- Wheat prices rose 4% Wednesday after Russia threatened to double back on a United Nations-brokered agreement to allow Ukraine to export grain.

- Bird flu has re-emerged in a number of Midwest states, forcing a major poultry farm in Ohio to destroy 3 million birds.

Domestic Markets

- The U.S. reported 74,803 new COVID-19 infections and 336 virus fatalities Tuesday.

- New York lifted a mask requirement for public transit Wednesday, one of the state’s last pandemic mandates.

- The share of U.S. adults who got treatment for mental health grew during the pandemic from 19% to 22%, according to the CDC.

- Over 6,000 teachers and staff went on strike in Seattle Wednesday, delaying the restart of classes in a dispute over wages and conditions.

- The Federal Reserve is poised to raise interest rates another 0.75 percentage points this month, according to analysts. Officials maintain the current inflationary pressures are the worst since the 1980s.

- The Federal Reserve’s latest “Beige Book” suggested U.S. economic activity was flat from July to August, while businesses saw signs of easing labor shortages and price pressures.

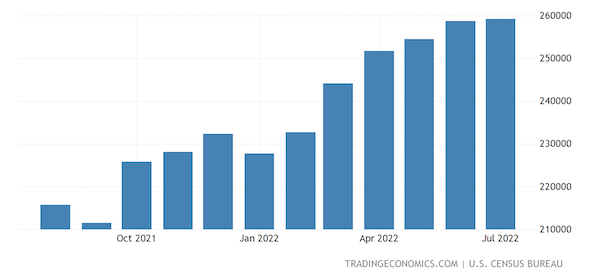

- The U.S. trade deficit narrowed a sharp 12.6% from June to July as import demand lagged. Exports edged up to a record-high $259.3 billion.

- The U.S. dollar surged to 24-year peak against the Japanese yen and a 37-year high against British sterling yesterday.

- U.S. home prices dropped 0.77% from June to July, the first monthly drop in almost three years, according to data firm Black Knight.

- The average U.S. mortgage rate rose to 5.94% last week while mortgage applications dropped 23% below the same time last year.

- Dozens of flights were canceled at Austin-Bergstrom airport Wednesday morning due to a power outage, with disruption likely to last through today.

- United Airlines and American Airlines say there has been no slowdown in post-summer travel bookings.

- Shares of American Eagle Outfitters plunged 14% Wednesday as the apparel retailer missed quarterly profit estimates, paused its dividend and announced plans to freeze hiring and reduce capital spending.

- Struggling retailer Bed Bath & Beyond expects to have burned through more than $800 million in cash through the six months ending in August, a sum greater than its current market capitalization.

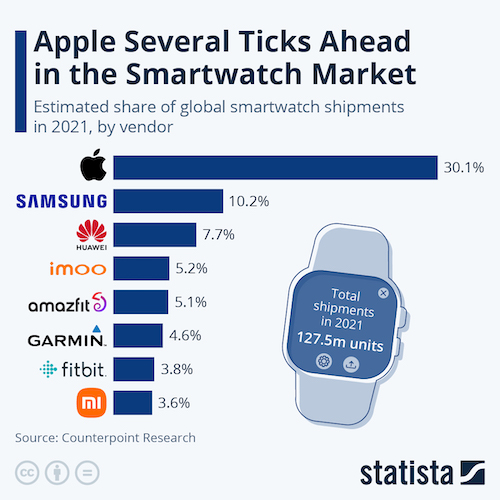

- Apple unveiled its newest lineup of iPhones and smartwatches Wednesday, with sales of iPhones expected to rise 6.7% this year to a record $205 billion. The company surprised many by not raising prices on the new lineup.

- Regal Cinemas’ parent company, the second-largest theater chain in the world, filed for Chapter 11 bankruptcy protection Wednesday after a sluggish pandemic rebound in movie attendance.

- Walmart became the latest big retailer to raise billions of dollars in bond offerings to tap into the debt market before the Federal Reserve hikes rates further.

- Walmart and healthcare giant UnitedHealth Group entered a 10-year partnership to provide preventive care to over-65s and virtual care for all age groups.

International Markets

- China’s Chengdu megacity extended lockdowns for another week after COVID-19 cases rose above 100 Tuesday. Across the country, officials are urging people to stay put for the upcoming holiday weekend.

- Japan’s GDP growth in the second quarter was revised upward from 2.2% to 3.5%.

- Japan more than doubled its daily cap on visitors Wednesday in a bid to revive its languishing tourism industry.

- Goods exports, the main driver of China’s economic engine, sputtered in August, rising a lower-than-expected 7.1% from a year earlier.

- China’s foreign exchange reserves fell for a second month in August as global financial asset prices dropped.

- China’s exports to Russia rose 26.5% in August while its imports from Russia surged almost 60%.

- Canada’s central bank hiked its benchmark interest rate by 0.75 percentage points to a 14-year high on Wednesday while signaling more rate increases to come.

- Canadian exports dropped in July for the first time this year due to lower energy prices. In August, the nation’s economic activity expanded while employment rose at a faster pace, according to surveys.

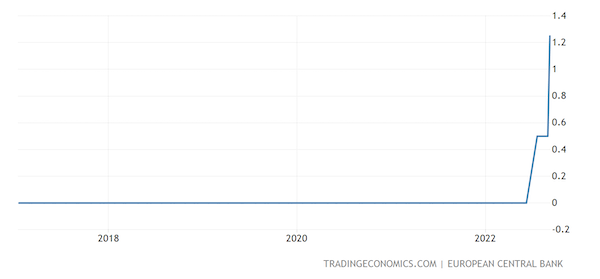

- The European Central Bank raised interest rates by 0.75% today.

- Mexico’s economy is projected to grow 3% in 2023, higher than this year’s 2.4% pace, as inflation cools and oil output picks up, according to government forecasts.

- British homebuyer inquiries fell to their lowest level of the pandemic in August and are expected to stall for much of the next year due to recession fears.

- Global air travel is now about 75% of pre-pandemic levels and gaining momentum, executives say.

- Air Canada expects flight and baggage delays to ease the rest of the year as staffing levels improve.

- Finnish carrier Finnair will start shrinking its fleet as disruption from the closure of Russian airspace hits its profitability.

Some sources linked are subscription services.