MH Daily Bulletin: September 14

News relevant to the plastics industry:

At M. Holland

- M. Holland has announced expanded access to 3D printing filaments from Braskem, a global chemical company, providing clients with access to polyethylene (PE) and glass fiber reinforced polypropylene (PP) filaments. Click here to read the full press release.

- Are you attending the North American Detroit Auto Show this week? We invite you to join our networking reception at the Detroit Athletic Club on Thursday, Sept. 15, at 4 pm. To RSVP for our reception or set up a meeting with our Automotive team, please contact Mike Gumbko, Strategic Account Manager.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- U.S. consumer electricity prices rose 15.8% in August from a year ago, the biggest jump since 1981. Natural gas bills were up 33%.

- The American Petroleum Institute says U.S. crude stocks rose by over 6 million barrels last week compared to forecasts for a draw. Government data will be released today.

- The U.S. is not likely to start refilling emergency crude reserves until prices dip below $80/bbl, according to reports.

- OPEC kept its forecasts unchanged for global oil demand growth this year and next, saying major economies were faring better than expected despite recessionary fears. Lower demand in China, however, could weigh on robust demand elsewhere, the IEA warned.

- OPEC again raised output in August but remained well under target levels for the third month in a row, with steep production declines in Nigeria, Angola and Iraq. Saudi Arabia’s output surpassed 11 million bpd for the first time in two years.

- Saudi Aramco’s chief says cyberattacks are among the greatest risks that the firm currently faces, on par with natural disasters or physical attacks.

- More oil news related to the war in Europe:

- Russia’s energy revenues shrank 13% in August to the lowest in more than a year as the nation was forced to sell discounted crude and squeeze gas flows to the West. Year-to-date, Gazprom has supplied 43% less gas to Europe but raised prices by three-fold on average.

- The European Commission will unveil plans today to cut electricity consumption across the continent and cap revenues for non-gas power plants. Individual nations, including Germany and Poland, are also readying domestic proposals.

- Uniper, Germany’s largest importer of Russian gas, threatened to sue Gazprom in a Swedish court over the firm’s recent gas cuts, which led Uniper to a $12.3 billion first-half loss and forced a bailout by the German government. The German government is considering taking a majority stake and perhaps nationalizing Uniper.

- The restart of a large nuclear reactor in Sweden has been delayed, a further setback to power supply in the Nordic and Baltic region.

- U.S. legislation to update energy-pipeline permitting will be attached to a “stopgap” bill to keep the government from shutting down after Sept. 30, lawmakers said.

- The U.S. Department of Energy says up to 80% of the country’s coal plants could eventually be converted to host small-scale nuclear reactors.

- Energy trader Vitol smashed its previous earnings record with first-half profits of some $4.5 billion, more than in the whole of last year, according to reports.

Supply Chain

- The U.S. government started making emergency plans to ensure shipments of key goods in the event that the U.S. rail system shuts down this Friday, the contract deadline for some 66,000 unionized rail workers. A stoppage could freeze 30% of rail cargo and cost the U.S. economy about $2 billion per day, analysts say.

- Rail and flight traffic was halted in Shanghai and other cities, as China issued its highest cyclone warning with the approach of Typhoon Muifa.

- The Mosquito Fire near Sacramento grew to almost 50,000 acres Tuesday with less than 20% containment, the latest in a string of wildfires caused by last week’s West Coast heatwave.

- U.S. container imports in August, though down from the prior year, were up by double digits from pre-pandemic levels. Container imports are projected to fall 3.1% in the second half of the year from last year’s record levels, according to the Global Port Tracker.

- Growing numbers of container lines are offering discounts to get shippers to maintain contracted volume commitments.

- Maersk is poised to boost its orders for container ships capable of running on methanol.

- Just over 271,650 intermodal loads were carried by U.S. railroads in the first week of September, 2.1% higher than a year ago for the first year-over-year increase since February.

- Old Dominion Freight Line says less-than-truckload shipments were down 2.7% in the first part of the third quarter.

- China’s semiconductor imports fell 12.8% in the first eight months of this year.

- Key Apple supplier Foxconn is partnering with an Indian metals company to build a nearly $20 billion computer chip plant in Gujarat, India.

- Skyrocketing dry ice prices and a shortage of refrigerated containers are adding substantial costs to transporting perishables.

- Corteva, a major American chemical and pesticides company, announced plans to exit 35 countries and lay off 5% of its global workforce as part of an inflation-fueled restructuring.

- In the latest news from the auto industry:

- Tesla aims to build 5,000 cars a week at its new production site in Germany by the first quarter of next year, a fivefold increase from current output.

- Honda is considering taking its electric motorcycle unit public, according to reports.

- Striking workers at a Stellantis plant in Indiana are returning to work after reaching a tentative agreement for a new contract.

- Auto parts supplier Aptiv is taking a majority stake in a unit of Italy’s Intercable, giving the U.S. firm access to technology used in electric vehicles.

- California-based SiFive, a designer of hardware components for computer chips, has launched three new products aimed at the auto market, one of the hottest areas for chip makers amid growing use of electric and autonomous vehicles.

- A Michigan startup claims to have developed a new electric-vehicle battery pack that would slash cell costs by up to 50% while delivering 600 miles of driving range.

- Jaguar Land Rover and South Korean battery giant SK Innovation are putting more than $300 million into Ascend Elements, a startup aiming to be a center of battery production in the Southeastern U.S.

- The U.S. government is partnering with Google’s parent firm to build a new research and production site for advanced computer chips in Bloomington, Minnesota.

- Amazon plans to spend $450 million raising pay and benefits for delivery partners as it gears up for the peak holiday shopping season.

- Robotics companies are offering a wider array of increasingly sophisticated devices aimed at repairing fractured supply chains.

- Sales at industrial parts supplier Fastenal jumped 21% from a year ago in August.

- India-based steel producer JSW will partner with Germany’s SMS group on a $1.26 billion plan to lower carbon emissions at its plants.

- Boeing delivered 35 planes last month after resuming shipments of its 787 Dreamliner for the first time in two years.

- Ethiopian Airlines leased three Boeing 767 freighters in a bid to make its cargo division a standalone profit center with $3 billion in revenue by 2035.

- Pervasive drought in France devastated the nation’s corn production this year, with crop yields falling as much as 25%, according to estimates.

- Brazil is ramping up soybean exports just as American farmers are facing hurdles in reaching overseas markets due to transport backlogs.

Domestic Markets

- The U.S. reported 67,342 new COVID-19 infections and 358 virus fatalities Tuesday. With national reported COVID-19 cases down 24% in the past two weeks, only five states now have rising infection rates: Kentucky, Missouri, New York, South Carolina and Texas.

- With home COVID-19 tests skewing reporting, John Hopkins University is scaling back its COVID-19 data dashboard, a key source of information through the pandemic.

- Just 37% of Americans now report sometimes or always wearing a mask outside the home, sharply down from 71% a year ago and 89% two years ago.

- In inflation news:

- U.S. stocks saw some of their steepest declines of the pandemic Tuesday following news of worse-than-expected 8.3% inflation. The dollar index, meanwhile, saw its biggest single-day gain since March 2020.

- Analysts widely agree that the U.S.’s latest inflation numbers will keep the Federal Reserve on track to raise interest rates by at least 75 basis points next week.

- Cities across the South and Southwest saw double-digit inflation in August, including 13% in Phoenix, the highest in the country.

- U.S. food costs rose 11.4% year over year in August, the biggest jump in 43 years. Rent prices were up 6.3%, the most since 1986.

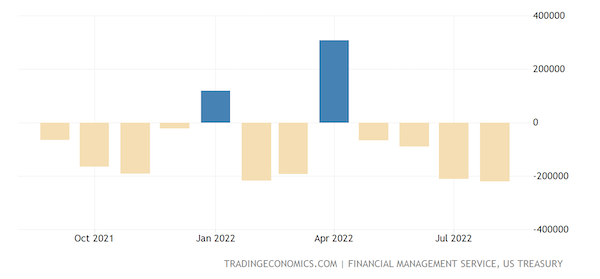

- The U.S. government posted a $220 million budget deficit in August, up 29% from a year ago despite a 13% rise in receipts.

- Citigroup and JPMorgan Chase are warning of a potential 50% hit to investment-banking fees this quarter as recessionary fears spook investors.

- The U.S. median household income was flat last year at $70,800, new data shows, while a key measure of how many Americans lived in poverty fell to a record low thanks in large part to federal pandemic aid.

- The U.S. economy is expected to create jobs at a slower pace over the coming decade while younger Americans are less likely to be part of the labor force, according to government forecasts. More than one-third of Gen Z consumers between 18- and 25-years-old say they have no investments and are short of spare funds, Bank of America says.

- Branded U.S. coffee shop sales rose to 96% of pre-pandemic levels for the 12 months ending in June, new data shows.

International Markets

- About 65 million people in 33 Chinese cities are under partial or full COVID-19 lockdowns, as online complaints over food and medicine shortages rise.

- China’s tourism revenue is plummeting as domestic holiday travel struggles to surpass 60% of pre-pandemic levels due to lockdowns.

- Hong Kong will stop holding COVID-19 infected travelers in government quarantine camps, allowing them to stay in quarantine hotels instead.

- Australia has scrapped its masking requirement for air travel and reduced isolation periods for people infected with COVID-19.

- European factory output dropped by 2.3% in July from a month earlier, the first decline since March, as high energy prices cut operations.

- France lowered its economic growth forecast for the year from 1.4% to 1%, citing volatile energy prices.

- Chinese investment in Mexico jumped from $154 million in 2016 to just under $500 million last year as more manufacturers see the country as a method of evading U.S. tariffs.

- The number of working-age Britons too sick to work has jumped to its highest level since 2005, largely due to long-COVID, economists say.

- Internal Russian documents show the country faces major issues in its research and production of electronics, including low investment attractiveness and severe labor shortages.

- Swiss-based UBS says clients are showing increased caution as they worry about the impacts of inflation and energy prices on the global economy.

- Starbucks raised its profit forecasts in announcing plans to spend up to $3 billion on buildings, labor and technology updates through 2025. The chain also plans to build 3,000 new stores in China, a 56% rise from current levels.

- French aviation regulators are asking airlines to cut flight schedules in half on Sept. 16 due to a planned nationwide strike by air traffic controllers.

- Japan Airlines says its operational capacity is at 65% of pre-pandemic international levels although demand is just 40% due to ongoing COVID-19 restrictions.

Some sources linked are subscription services.