MH Daily Bulletin: September 15

News relevant to the plastics industry:

At M. Holland

- M. Holland has announced expanded access to 3D printing filaments from Braskem, a global chemical company, providing clients with access to polyethylene (PE) and glass fiber reinforced polypropylene (PP) filaments. Click here to read the full press release.

- Are you attending the North American Detroit Auto Show this week? We invite you to join our networking reception at the Detroit Athletic Club today at 4 pm? To RSVP for our reception, please contact Mike Gumbko, Strategic Account Manager.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose 1% Wednesday after the IEA predicted a rise in gas-to-oil switching for heating purposes this winter.

- Energy futures slid today following an announcement that a nationwide rail strike was averted. In mid-morning trading, WTI futures were down 3.0% at $85.80/bbl, Brent was off 3.1% at $93.26/bbl, and U.S. natural gas was down 7.5% at $8.43/MMBtu.

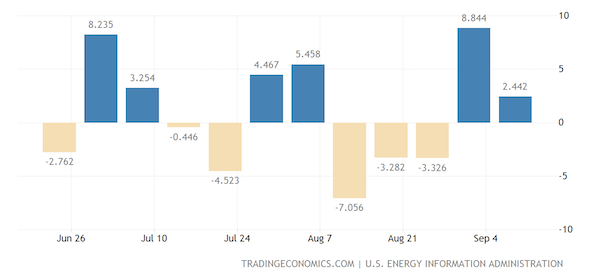

- U.S. crude stocks rose by 2.4 million barrels last week, the second weekly gain in a row fueled by a release from government reserves. Releases are set to end in October.

- U.S. distillate stocks are about 23% below the five-year average for this time of year, government data shows.

- Global oil production rose by 790,000 bpd in August, led by increases from Saudi Arabia and the UAE. The IEA says global oil demand will falter in the fourth quarter before rebounding strongly next year.

- Rental costs for offshore oil and gas platforms have more than doubled the past two years and could soon rise to $500,000 a day, executives say.

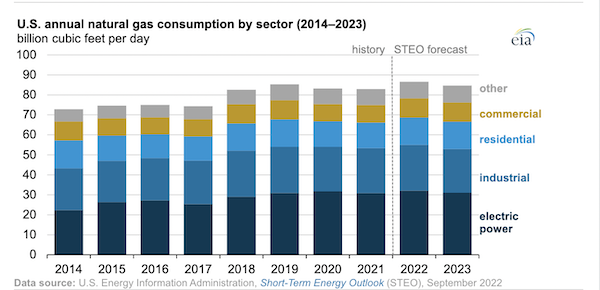

- U.S. natural gas consumption is poised to hit 86.6 billion cubic feet per day next year, an all-time high:

- More oil news related to the war in Europe:

- On Wednesday, the EU’s executive arm unveiled plans to levy $140 billion from energy firm profits to help shield households and businesses from soaring prices. Policymakers also proposed a mandatory target for countries to cut electricity use by 5% during peak hours, while backing away from a Russian gas price cap.

- European gas prices are down 40% in recent weeks as fuel storage levels look healthy heading into winter.

- European businesses have ratcheted down gas use in recent months, with slowing production at chemical plants and closed metals factories now widely expected to tip Europe into a recession.

- Russia’s invasion knocked out 90% of wind power capacity in Ukraine, Europe’s fastest-growing country for wind development.

- France plans to spend $16 billion on capping power price hikes to just 15% next year, a measure partially funded by windfall profits on non-gas producers.

- Japan plans to return seven nuclear reactors to service by the summer of next year amid a shortage of natural gas.

- The U.S. administration awarded $190 million of offshore oil-and-gas leases Wednesday, completing the sale of 1.7 million acres in the Gulf of Mexico that had been held up since last November over environmental concerns.

- Vehicle electrification will not kill the ethanol market, according to oil executives, as demand will continue to exist in countries where electric vehicle adoption is slower, such as Brazil and India.

Supply Chain

- With White House intervention, U.S. railroads and unions representing more than 100,000 workers reached a tentative deal after 20 straight hours of talks on Wednesday. The move averts a potential strike that had already started shutting down a crucial vein of the U.S. economy, including ancillary services such as passenger transit.

- Typhoon Muifa battered China’s east coast on Wednesday in what some forecasters call the strongest cyclone in a decade. Ports in Shanghai and Ningbo shut down oil loading, and air travel was paused.

- Industry experts warn that the growing number of extreme weather events around the world could deepen turmoil in supply chains.

- Crude and LNG tankers are already seeing winter-like rates in late summer, with spot rates for LNG carriers topping $100,000 a day, the highest since last December.

- Maersk halted import bookings into Fort Worth, Texas, due to severe rail congestion.

- MSC is adding more mid-size container ships to its hefty order book of nearly $6 billion this year alone.

- The Port Authority of New York and New Jersey suspended a container dwell fee set to take effect this month.

- Aerospace firm Raytheon trimmed its full-year cash flow estimate by one-third due to rising costs and supply chain snags. The firm also said delivery of some of its Pratt & Whitney commercial engines may slip into the first quarter of 2023.

- In the latest news from the auto industry:

- Honda is cutting car output by up to 40% at two Japanese plants this month due to supply chain issues.

- The White House approved the first $900 million of nearly $5 billion made available in last year’s infrastructure bill to build electric-vehicle charging stations in 35 states.

- The U.S. administration is moving forward with plans to purchase nearly all electric vehicles or plug-in hybrid models for government fleets by 2027.

- Tesla must delay plans to expand its German “Gigafactory” due to local opposition. The automaker has switched its attention to the U.S. for potential battery cell production, according to reports.

- Tesla’s vehicle deliveries from its Shanghai plant were up 74% in August, with more than half the cars targeted for export.

- Ford and Ferrari unveiled two new hallmark internal combustion vehicles on Wednesday, an appeal to drivers not interested in making the switch to electric.

- Following Tesla, Ford released new rules for U.S. dealers that sell electric vehicles, including restrictions on price haggling and required investments in charging ports.

- GM’s autonomous Cruise division is making its own computer chips for production by 2025, a bid to reduce dependence on third-party suppliers.

- Honda denied claims it is seeking to take its electric motorcycle unit public. The company expects the unit to account for 15% of total sales by 2030.

- Volvo began production of three new heavy-duty electric truck models whose gas counterparts make up two-thirds of group sales. The move brings Volvo’s total electric lineup to six truck models.

- Stellantis is exploring producing its own energy for European plants in response to supply insecurity caused by the war in Ukraine.

- The U.S. and Mexico resolved the latest in a series of labor complaints under the USMCA regional trade pact that involved union elections at an auto parts plant in northern Mexico.

- Taiwan’s TSMC, which currently holds about 54% of the global market for contracted computer chips, will likely supply Apple’s next iteration of iPhone and MacBook models.

- Alcoa, the U.S.’s largest aluminum-maker, forecast lower earnings this quarter due to high energy costs and lower prices for the metal.

- Japan’s Nippon Steel will begin selling products that are certified as reducing CO2 emissions from the manufacturing process.

- The United Nations says it is moving closer to bringing more ammonia to the global market from Eastern Europe, a potential breakthrough for shrinking fertilizer supply.

- Australia’s earnings from coal exports tumbled 17% last month and iron ore exports fell almost 15%.

- Union Pacific railroad issued $600 million in green bonds to fund its carbon reduction efforts.

Domestic Markets

- The U.S. reported 60,558 new COVID-19 infections and 350 virus fatalities Wednesday. Cases, hospitalizations and deaths all fell 6%-8% last week.

- New York City is short 176,000 from pre-pandemic employment levels, the slowest recovery of any major U.S. metro area.

- Pfizer is in late-stage testing of a flu vaccine developed using the mRNA technology of its COVID-19 shots, the first flu vaccine of its kind.

- The number of Americans working remotely more than tripled in 2021 from pre-pandemic levels to roughly 17.9% of the workforce, or 27.6 million employees, according to federal data.

- First-time jobless claims fell by 5,000 last week to 213,000, a hopeful sign that an economic soft landing may be achievable.

- Retail sales rose 0.3% last month, better than flat sales expected by economists.

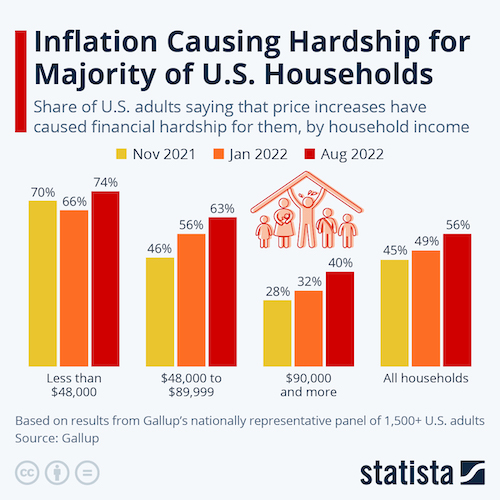

- The majority of U.S. adults now say that inflation is causing financial hardship in the household, with 12% saying the damage is severe:

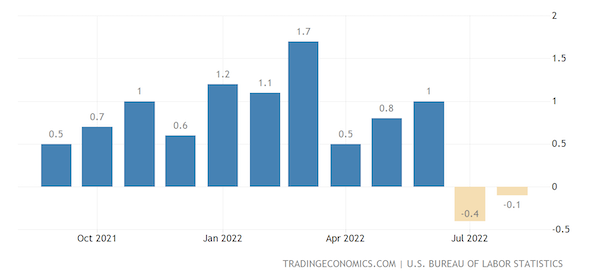

- U.S. producer prices fell 0.1% from July to August, the second monthly decline led by lower fuel costs. Prices are still about 8.7% higher than a year ago:

- More of Americans’ income will be taxed at lower rates next year thanks to a significant inflation adjustment, tax professionals say.

- The average U.S. mortgage rate topped 6% for the first time since 2008 and is now more than double the level of a year ago. Mortgage demand has fallen by nearly one-third since last year.

- Self-checkout technology proliferated during the pandemic as retailers faced severe understaffing. Some chains, including Walmart and Dollar General, are piloting stores that offer only self-checkout lanes.

- Walmart is diving into financial tech as it pilots a new digital checking account program for its 1.6 million employees and some online customers.

- Amazon faces its third unionization vote this year, this time at a warehouse in upstate New York.

- California sued Amazon Wednesday, alleging the e-commerce giant violated antitrust law by blocking third-party sellers from selling at lower prices on competing channels to market.

- Comcast and Johnson & Johnson unveiled buybacks worth billions of dollars Wednesday as they joined a rush of U.S. companies seeking to avoid a new tax on such repurchases.

- Chinese investment in U.S. venture-capital funds is on pace to reach about $880 million this year, the second-highest level in at least a dozen years.

- The U.S. administration tripled its planned spending to $3 billion to cut emissions from farming and forestry, the source of nearly 10% of U.S. emissions.

- The founder of outdoor apparel-maker Patagonia gifted the company to a non-profit trust dedicated to fighting climate change.

International Markets

- The World Health Organization chief says vaccinations have led the world to the final stages of the COVID-19 pandemic, which has killed over 6 million people since 2020.

- China’s Chengdu megacity will lift its two-week lockdown today as a recent COVID-19 outbreak comes under control.

- Japan is poised to waive visa requirements for some tourists and remove a limit on daily arrivals in October as it aims to benefit from a rebound in global tourism.

- Israel will start offering Pfizer’s Omicron-tailored booster vaccines by the end of September.

- South Africa’s Biovac Institute has produced the first batch of African-made COVID-19 shots.

- Canadian factory sales fell 0.9% from June to July, the third monthly decline led by lower prices and volumes in metal industries.

- Inflation in Argentina blew past estimates in August, soaring to nearly 80% from a year ago.

- Slowing economic growth is pushing up global debt levels and could lead to a significant rise in corporate bankruptcies, according to economists.

- Retail has been the worst-performing sector in Europe’s benchmark Stoxx 600 Index this year, down 37%.

- Google yesterday lost a court appeal of the EU’s $4.1 billion fine on the company for anticompetitive practices.

- Technology supplier Bosch announced plans to build a $215 million plant in the central Mexican state of Queretaro to make components for mobile applications.

- Air France will offer bonuses and raise salaries for all its workers ahead of planned wage talks next year.

Some sources linked are subscription services.